Dollar-Store Chains Offer Glum Outlook -- WSJ

August 26 2016 - 3:03AM

Dow Jones News

By Sarah Nassauer

The nation's two biggest dollar-store chains gave a downbeat

assessment of the health of the nation's poorest shoppers, who are

being squeezed by rising rents and health-care bills.

"I know that when we look at globally the overall U.S.

population, it seems like things are getting better," Dollar

General Chief Executive Todd Vasos said on a conference call. But

for the chain's core shopper, "things have not gotten any better

for her. And arguably they are worse."

Dollar General Corp. said sales growth in existing stores slowed

to 0.7% in the second quarter from 2.2% in the preceding quarter.

Mr. Vasos said changes to food-stamp programs in around 20 states

this April that cut off benefits for hundred of thousands of people

hurt sales, as did falling food prices and the need to compete with

rivals on pricing.

At Dollar Tree Inc., same-store sales increased 1.2%, slower

than the prior quarter and below analysts' forecasts. Dollar Tree

CEO Bob Sasser said the consumer is facing rising costs such as

rent and food. "We see them as still being under pressure," Mr.

Sasser said. "I think that's the No. 1 issue that we see out

there."

The rare disappointment in the two chains' financial results

took a toll on their stocks. Shares of Dollar General fell 16% to

$77.40, while Dollar Tree shares declined 9.4% to $86.

Dollar stores have been a relative bright spot in a troubled

retail sector as recession-weary shoppers flocked to their low

prices and convenient locations near residential areas. The two

chains have been growing rapidly as others retrench. Dollar Tree

acquired rival Family Dollar last year for about $9 billion. Dollar

General is adding thousands of stores, aiming to have 20,000 shops

by 2020, up from 13,000.

But improving operations at Wal-Mart Stores Inc. are likely

putting pressure on the retailers. Last week Wal-Mart reported its

eighth straight quarter of sales growth in existing stores, with a

1.6% gain. Executives have said the world's largest retailer by

revenue is beginning to invest billions to lower prices on some

products, forcing smaller players to do the same.

"I believe everyone knows some of the retailers that are working

price right now," Dollar General's Mr. Vasos said without naming

Wal-Mart. To fight back, the dollar chain has lowered prices by an

average of 10% on hundreds of best-selling products in 2,200 of its

stores. "For our core consumer, price is everything."

Both chains have been seeking ways to drive traffic and fend off

competition from online retailers or massive Wal-Mart stores often

on the outskirts of town. Dollar General has said it would add more

fresh foods and health and beauty products to its aisles. Dollar

Tree has highlighted more seasonal items like decorations and

gifts. Both are rapidly expanding.

But declining food prices hit Dollar General. The retailer said

prices for everything from milk and eggs to sugar and coffee hit

its sales growth, a trend executives forecast will continue through

the end of the year. "As we all know, the consumers don't consume

that much more just because the price is a little less expensive,"

said Mr. Vasos.

In all, Dollar General reported a profit increase of 8.5% to

$306.5 million, while revenue rose 5.8% to $5.39 billion.

Meanwhile, Dollar Tree reported a profit of $170.2 million,

compared with a year-earlier loss of $98 million, helped by the

Family Dollar acquisition. Revenue increased to $5 billion from

$3.01 billion.

--Joshua Jamerson and Lisa Beilfuss contributed to this

article.

Write to Sarah Nassauer at sarah.nassauer@wsj.com

(END) Dow Jones Newswires

August 26, 2016 02:48 ET (06:48 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

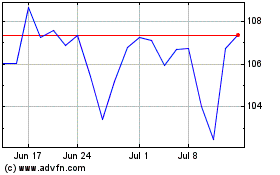

Dollar Tree (NASDAQ:DLTR)

Historical Stock Chart

From Mar 2024 to Apr 2024

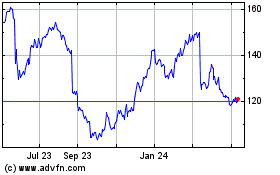

Dollar Tree (NASDAQ:DLTR)

Historical Stock Chart

From Apr 2023 to Apr 2024