Dollar General, Dollar Tree Post Disappointing Same-Store Sales

August 25 2016 - 9:05AM

Dow Jones News

By Joshua Jamerson and Lisa Beilfuss

Dollar General Corp. reported weaker-than-expected sales growth

in its latest quarter, hurt by declining traffic, signaling that

discount retailers are also vulnerable to the trend of dwindling

consumer spending in brick-and-mortar stores.

Same-store sales increased 0.7%, compared with the 2.6% growth

analysts were expecting, according to the consensus estimate from

Consensus Metrix. Dollar General said an increase in average

transaction amount was offset by declining traffic. Shares skidded

7.4% to $85 in premarket trading.

Dollar General's chief executive, Todd Vasos, said food

deflation, a reduction in food stamp participation rates and

benefit levels and a mild spring hurt the business. Mr. Vasos also

said competition also intensified in some regions.

Like rival Dollar Tree Inc., Dollar General has benefited over

the past year from rising wages among core customers, who in the

second quarter saw their wages increase at the best clip since the

recession. Sales and traffic had been up in the sector, in contrast

to trends across the larger retail space, and both stocks had

benefited.

Also Thursday morning, Dollar Tree's sales results came in below

its expectations. Same-store sales increased 1.2%, compared with a

2.7% increase a year ago. Analysts, on average, expected 2.6%

growth in the latest quarter. Dollar Tree shares fell 6% to $89.16

premarket.

Dollar General has been working to grow its footprint after last

year losing out on a merger between rivals. The company bid to buy

Family Dollar, which ultimately merged with Dollar Tree in a deal

worth about $9 billion. Since then, Dollar General has said it

would boost its store base by about 50%, targeting 20,000 shops by

2020.

As part of that plan, the company bought 41 Walmart Express

shops last month across nearly a dozen states. Those locations, the

company said, would add to a list of about 120 stores that offer

some perishable food. As shoppers continue to move online, Dollar

General has said it would add more fresh foods and health and

beauty products to its aisles -- items that tend to boost

traffic.

In all, Dollar General reported a profit of $306.5 million, or

$1.08 a share, up from 282.3 million, or 95 cents a share, a year

earlier. Revenue rose 5.8% to $5.39 billion in sales. Analysts

projected $1.09 in per-share profit on $5.50 billion in sales,

according to Thomson Reuters.

Meanwhile, Dollar Tree reported a profit of $170.2 million, or

72 cents a share, compared with a year-earlier loss of $98 million,

or 46 cents a share. Revenue increased to $5 billion from $3.01

billion, helped by the acquisition. The company anticipated 66

cents to 72 cents a share in earnings, and revenue between $5.03

billion to $5.12 billion.

Write to Joshua Jamerson at joshua.jamerson@wsj.com and Lisa

Beilfuss at lisa.beilfuss@wsj.com

(END) Dow Jones Newswires

August 25, 2016 08:50 ET (12:50 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

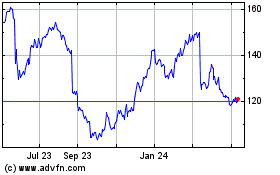

Dollar Tree (NASDAQ:DLTR)

Historical Stock Chart

From Mar 2024 to Apr 2024

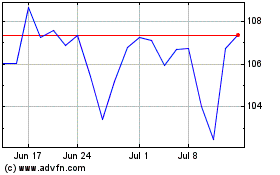

Dollar Tree (NASDAQ:DLTR)

Historical Stock Chart

From Apr 2023 to Apr 2024