UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON D.C. 20549

FORM 8-K

CURRENT REPORT PURSUANT

TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): August 25, 2016

DOLLAR TREE, INC.

(Exact name of registrant as specified in its charter)

VIRGINIA

(State or Other Jurisdiction of Incorporation)

|

| |

0-25464 | 26-2018846 |

(Commission File Number) | (I.R.S. Employer Identification No.) |

500 Volvo Parkway

Chesapeake, VA 23320

(Address of Principal Executive Offices and Zip Code)

(757) 321-5000

(Registrant’s Telephone Number, Including Area Code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.02. Results of Operations and Financial Condition.

Today, August 25, 2016, Dollar Tree, Inc. issued a press release reporting its fiscal 2016 second quarter sales and earnings results and announcing that it will hold a publicly available telephone conference call to discuss these results. A copy of the press release is attached to this Form 8-K as Exhibit 99.1 and is incorporated herein by this reference.

The information contained in items 2.02 and 7.01, including that incorporated by reference, is being furnished to the Securities and Exchange Commission. Such information shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934 or otherwise subject to the liabilities of that Section. The information shall not be deemed incorporated by reference into any registration statement or other document filed pursuant to the Securities Act of 1933, except as expressly set forth by specific reference in such filing.

Item 7.01. Regulation FD Disclosure.

The information (including disclaimer) presented under Item 2.02 is incorporated by reference into this Item 7.01.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

99.1 Press Release dated August 25, 2016 issued by Dollar Tree, Inc.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

|

| | |

| | |

| DOLLAR TREE, INC. |

| | |

Date: August 25, 2016 | By: | /s/ Kevin S. Wampler |

| Kevin S. Wampler |

| Chief Financial Officer |

EXHIBITS

Exhibit 99.1 - Press release dated August 25, 2016 issued by Dollar Tree, Inc.

Exhibit 99.1

DOLLAR TREE, INC. REPORTS RESULTS FOR THE SECOND QUARTER FISCAL 2016

~ Sales increased 65.9% to $5.00 Billion and Same-Store Sales Increased 1.2% ~

~ Diluted Earnings per Share Increased to $0.72 ~

CHESAPEAKE, Va. - August 25, 2016 - Dollar Tree, Inc. (NASDAQ: DLTR), North America's leading operator of discount variety stores, today reported results for its second fiscal quarter ended July 30, 2016.

Second Quarter Results

Second quarter fiscal 2016 results include nine additional weeks of operations for the Family Dollar segment when compared to the second quarter of fiscal 2015, which included four weeks of operations following the acquisition on July 6, 2015.

Net sales increased 65.9% to $5.00 billion from $3.01 billion in the prior year’s second quarter. The $1.99 billion increase was the result of an incremental $1.80 billion in net sales from Family Dollar stores, sales from new Dollar Tree stores, and a 1.2% same-store sales increase, on a constant currency basis. Same-store sales increased 2.7%, on a constant currency basis, in the prior-year period. Adjusted for the impact of Canadian currency fluctuations, the same-store sales increase was 1.1%. The positive same-store sales growth was driven by increases in customer count and average ticket.

Gross profit increased by $657.2 million, or 76.8%, to $1.51 billion in the second quarter compared to $855.2 million in the prior year’s second quarter. The increase included an incremental $588.4 million of gross profit for Family Dollar and a 9.2% increase in Dollar Tree’s gross profit for the quarter. As a percent of sales, gross margin increased to 30.3% compared to 28.4% in the prior year. The prior year’s second quarter included $60.0 million of markdown expense related to product assortment rationalization and planned liquidations at Family Dollar.

Selling, general and administrative expenses were 23.1% of sales compared to 24.3% of sales in the prior year's second quarter. Excluding $17.7 million of acquisition-related costs from the prior year’s period, selling, general a+nd administrative expenses, as a percent of sales, improved to 23.1% from 23.7%. This 60 basis point improvement was the result of lower payroll and operating and corporate expenses, as a percent of sales, partially offset by higher store repairs and maintenance expenses and depreciation expense.

Operating income increased 189.5% to $357.2 million compared with $123.4 million in the same period last year. Operating income margin increased to 7.1% in the current quarter from 4.1% in last year’s quarter. This increase in operating income is the result of an incremental $189.7 million of operating income in the Family Dollar segment, and a $44.1 million increase in operating income in the Dollar Tree segment.

The Company's effective tax rate for the quarter was 36.9% compared to a benefit of 31.1% in the prior year period. The increase is primarily attributable to a pre-tax loss in the second quarter of 2015.

Net income compared to the prior year's second quarter increased $268.2 million to $170.2 million, and diluted earnings per share increased to $0.72.

Bob Sasser, Chief Executive Officer, stated, "I am very pleased with the Company's overall performance in our second quarter. Through what continues to be a challenging retail sales environment, we delivered gross margin improvement and managed expenses effectively to deliver earnings at the top end of our guidance range. In our Dollar Tree segment, we improved our operating margin and delivered our 34th consecutive quarter of positive same-store sales."

Sasser added, "Just over a year ago, we completed our acquisition of Family Dollar and our integration continues to progress as planned. The stores are cleaner, the values are greater and our merchandise assortments are improving. Additionally, we are taking the necessary steps to develop our shared services support model, and are continuing our focus on cost-related synergy capture. As a combined organization, we are well-positioned to better serve more customers, generate significant cash flows and deliver long-term value to our shareholders.”

During the quarter, the Company opened 156 stores, expanded or relocated 52 stores, and closed 17 stores. Additionally, as part of its re-banner initiative, the Company opened 47 former Family Dollar store locations as new Dollar Tree stores. The Company also converted the remaining 32 Deals stores to Dollar Tree stores. Retail selling square footage at the end of the quarter was approximately 110.8 million square feet.

First Six Months Results

Consolidated net sales increased 94.3% to $10.08 billion from $5.19 billion in the first six months of 2015. The $4.89 billion increase was the result of $4.50 billion in incremental net sales from Family Dollar stores, sales from new Dollar Tree stores, and a 1.7% same-store sales increase, on a constant currency basis. Adjusted for the impact of Canadian currency fluctuations, the same-store sales increase was 1.6%.

Gross profit increased $1.46 billion, or 91.2%, to $3.07 billion from $1.60 billion in the first six months of 2015. As a percent of sales, gross margin decreased by 50 basis points to 30.4% compared to the prior year period.

Selling, general and administrative expenses were 22.7% of sales compared to 24.1% of sales in the first six months of 2015. Excluding $28.1 million of acquisition-related costs from the first six months of 2015, selling, general and administrative expenses, as a percent of sales, improved to 22.7% from 23.5%.

Net income increased $431.3 million compared to the prior year's first six months, resulting in net income of $1.70 per diluted share.

Company Outlook

The Company estimates consolidated net sales for the third quarter of 2016 to range from $5.02 billion to $5.10 billion, based on a low single-digit increase in same-store sales. Diluted earnings per share are estimated to be in the range of $0.76 to $0.82.

Consolidated net sales for full-year 2016 are now expected to range between $20.69 billion and $20.87 billion compared to the Company’s previously expected range of $20.79 billion to $21.08 billion. This estimate is based on a low single-digit increase in same-store sales, and 4.0% square footage growth. The Company now anticipates net income per diluted share for full-year 2016 will range between $3.67 and $3.82. This compares to its previous EPS guidance range of $3.58 to $3.80.

Conference Call Information

On Thursday, August 25, 2016, the Company will host a conference call to discuss its earnings results at 9:00 a.m. Eastern Time. The telephone number for the call is 888-427-9376. A recorded version of the call will be available until midnight Thursday, September 1, 2016 and may be accessed by dialing 888-203-1112. The access code is 1772942. A webcast of the call is accessible through Dollar Tree's website, and will remain online until Thursday, September 1, 2016.

Dollar Tree, a Fortune 200 Company, operated 14,129 stores across 48 states and five Canadian provinces as of July 30, 2016. Stores operate under the brands of Dollar Tree, Family Dollar, and Dollar Tree Canada. To learn more about the Company, visit www.DollarTree.com.

A WARNING ABOUT FORWARD-LOOKING STATEMENTS: Our press release contains "forward-looking statements" as that term is used in the Private Securities Litigation Reform Act of 1995. Forward-looking statements address future events, developments or results and typically use words such as believe, anticipate, expect, intend, plan, forecast, or estimate. For example, our forward-looking statements include statements regarding third quarter 2016 and full-year 2016 net sales and same-store sales, third quarter 2016 and full-year 2016 diluted earnings per share, square footage growth, the benefits, results, and effects of the merger including synergies, and future financial and operating results and shareholder value. For a discussion of the risks, uncertainties and assumptions that could affect our future events, developments or results, you should carefully review the "Risk Factors," "Business" and "Management's Discussion and Analysis of Financial Condition and Results of Operations" sections in our Annual Report on Form 10-K filed March 28, 2016 and other filings with the Securities and Exchange Commission. We are not obligated to release publicly any revisions to any forward- looking statements contained in this press release to reflect events or circumstances occurring after the date of this report and you should not expect us to do so.

CONTACT: Dollar Tree, Inc.

Randy Guiler, 757-321-5284

Vice President, Investor Relations

www.DollarTree.com

|

| | | | | | | | | | | | | | | | | |

DOLLAR TREE, INC. |

Condensed Consolidated Statements of Operations |

(In millions, except per share data) |

(Unaudited) |

| | | | | | |

| | 13 Weeks Ended | | | 26 Weeks Ended |

| | July 30, 2016 | | August 1, 2015 (1) | | | July 30, 2016 | | August 1, 2015 (1) |

| | | | | | | | | |

Net sales | | $ | 4,996.3 |

| | $ | 3,011.2 |

| | | $ | 10,082.1 |

| | $ | 5,187.8 |

|

| | | | | | | | | |

Cost of sales | | 3,483.9 |

| | 2,156.0 |

| | | 7,015.2 |

| | 3,583.7 |

|

| | | | | | | | | |

Gross profit | | 1,512.4 |

| | 855.2 |

| | | 3,066.9 |

| | 1,604.1 |

|

| | 30.3% |

| | 28.4% |

| | | 30.4% |

| | 30.9% |

|

| | | | | | | | | |

Selling, general & administrative expenses | 1,155.2 |

| | 731.8 |

| | | 2,291.0 |

| | 1,247.8 |

|

| | 23.1% |

| | 24.3% |

| | | 22.7% |

| | 24.1% |

|

| | | | | | | | | |

Operating income | | 357.2 |

| | 123.4 |

| | | 775.9 |

| | 356.3 |

|

| | 7.1% |

| | 4.1% |

| | | 7.7% |

| | 6.9% |

|

| | | | | | | | | |

Interest expense, net | | 87.3 |

| | 263.9 |

| | | 174.6 |

| | 386.2 |

|

Other (income) expense, net | | — |

| | 1.7 |

| | | (0.2 | ) | | (0.9 | ) |

| | | | | | | | | |

Income (loss) before income taxes | | 269.9 |

| | (142.2 | ) | | | 601.5 |

| | (29.0 | ) |

| | 5.4% |

| | (4.7%) |

| | | 6.0% |

| | (0.6%) |

|

| | | | | | | | | |

Income tax expense (benefit) | | 99.7 |

| | (44.2 | ) | | | 198.7 |

| | (0.5 | ) |

Income tax rate | | 36.9% |

| | 31.1% |

| | | 33.0% |

| | 1.7% |

|

| | | | | | | | | |

Net income (loss) | | $ | 170.2 |

| | $ | (98.0 | ) | | | $ | 402.8 |

| | $ | (28.5 | ) |

| | 3.4% |

| | (3.3%) |

| | | 4.0% |

| | (0.5%) |

|

| | | | | | | | | |

Net earnings (loss) per share: | | | | | | | | | |

Basic | | $ | 0.72 |

| | $ | (0.46 | ) | | | $ | 1.71 |

| | $ | (0.14 | ) |

Weighted average number of shares | | 235.6 |

| | 214.3 |

| | | 235.5 |

| | 210.3 |

|

| | | | | | | | | |

Diluted | | $ | 0.72 |

| | $ | (0.46 | ) | | | $ | 1.70 |

| | $ | (0.14 | ) |

Weighted average number of shares | | 236.7 |

| | 214.3 |

| | | 236.6 |

| | 210.3 |

|

| | | | | | | | | |

(1) For the 13 and 26 weeks ended August 1, 2015, Selling, general & administrative expenses includes merger expenses of $17.7 million and $28.1 million, respectively, related to the acquisition of Family Dollar Stores, Inc. on July 6, 2015, and Interest expense, net includes incremental costs incurred to the July 6, 2015 acquisition date in connection with the repayment of pre-existing debt of $227.6 million and $343.2 million, respectively. Excluding these acquisition-related expenses, Net income (loss) and Diluted earnings (loss) per share for the 13 and 26 weeks ended August 1, 2015 were $53.5 million and $0.25, and $200.8 million and $0.95, respectively. |

| | | | | | | | | |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

DOLLAR TREE, INC. |

Segment Information |

(In millions, except store count) |

(Unaudited) |

| | | | | | | | | | | | | | | | |

| | 13 Weeks Ended | | 26 Weeks Ended |

| | July 30, 2016 | | August 1, 2015 (a) | | July 30, 2016 | | August 1, 2015 (a) |

| | | | | | | | | | | | | | | | |

Net sales: | | | | | | | | | | | | | | | | |

Dollar Tree | | | $ | 2,387.5 |

| | | | $ | 2,199.6 |

| | | | $ | 4,772.0 |

| | | | $ | 4,376.2 |

| |

Family Dollar | | | 2,608.8 |

| | | | 811.6 |

| | | | 5,310.1 |

| | | | 811.6 |

| |

Total net sales | | | $ | 4,996.3 |

| | | | $ | 3,011.2 |

| | | | $ | 10,082.1 |

| | | | $ | 5,187.8 |

| |

| | | | | | | | | | | | | | | | |

Gross profit: | | | | | | | | | | | | | | | | |

Dollar Tree | | | $ | 818.1 |

| | | | $ | 749.3 |

| | | | $ | 1,638.8 |

| | | | $ | 1,498.2 |

| |

Family Dollar | | | 694.3 |

| | | | 105.9 |

| | | | 1,428.1 |

| | | | 105.9 |

| |

Total gross profit | | | $ | 1,512.4 |

| | | | $ | 855.2 |

| | | | $ | 3,066.9 |

| | | | $ | 1,604.1 |

| |

| | | | | | | | | | | | | | | | |

Operating income (loss): | | | | | | | | | | | | | | | | |

Dollar Tree (b) | | | $ | 262.5 |

| | | | $ | 218.4 |

| | | | $ | 543.1 |

| | | | $ | 451.3 |

| |

Family Dollar (b) | | | 94.7 |

| | | | (95 | ) | | | | 232.8 |

| | | | (95 | ) | |

Total operating income (b) | | | $ | 357.2 |

| | | | $ | 123.4 |

| | | | $ | 775.9 |

| | | | $ | 356.3 |

| |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | 13 Weeks Ended | | 26 Weeks Ended |

| | July 30, | | August 1, | | July 30, | | August 1, |

| | 2016 | | 2015 | | 2016 | | 2015 |

| | Dollar Tree | Family Dollar | Total | | Dollar Tree | Family Dollar | Total | | Dollar Tree | Family Dollar | Total | | Dollar Tree | Family Dollar | Total |

Store Count: | | | | | | | | | | | | | | | | |

Beginning | | 6,049 |

| 7,948 |

| 13,997 |

| | 5,454 |

| 8,284 |

| 13,738 |

| | 5,954 |

| 7,897 |

| 13,851 |

| | 5,367 |

| 8,284 |

| 13,651 |

|

New | | 99 |

| 57 |

| 156 |

| | 126 |

| 15 |

| 141 |

| | 211 |

| 116 |

| 327 |

| | 219 |

| 15 |

| 234 |

|

Rebanner (c) | | 47 |

| (54 | ) | (7 | ) | | 4 |

| (18 | ) | (14 | ) | | 41 |

| (54 | ) | (13 | ) | | 4 |

| (18 | ) | (14 | ) |

Closings | | (11 | ) | (6 | ) | (17 | ) | | (1 | ) | — |

| (1 | ) | | (22 | ) | (14 | ) | (36 | ) | | (7 | ) | — |

| (7 | ) |

Ending | | 6,184 |

| 7,945 |

| 14,129 |

| | 5,583 |

| 8,281 |

| 13,864 |

| | 6,184 |

| 7,945 |

| 14,129 |

| | 5,583 |

| 8,281 |

| 13,864 |

|

Selling Square Footage (in millions) | 53.3 |

| 57.5 |

| 110.8 |

| | 48.3 |

| 59.9 |

| 108.2 |

| | 53.3 |

| 57.5 |

| 110.8 |

| | 48.3 |

| 59.9 |

| 108.2 |

|

Growth Rate (Square Footage) | | 10.4% |

| -4.0% |

| 2.4% |

| | 7.8% |

| 100.0% |

| 141.5% |

| | 10.4% |

| -4.0% |

| 2.4% |

| | 7.8% |

| 100.0% |

| 141.5% |

|

| | | | | | | | | | | | | | | | |

(a) The results of Family Dollar's operations are included from the July 6, 2015 acquisition date. |

(b) For the 13 and 26 weeks ended August 1, 2015, Selling, general & administrative expenses includes merger expenses of $16.5 million and $26.9 million, respectively, for the Dollar Tree segment and $1.2 million for the Family Dollar segment related to the acquisition of Family Dollar Stores, Inc. on July 6, 2015. Excluding these acquisition-related expenses, Operating income (loss) for the 13 and 26 weeks ended August 1, 2015 was $234.9 million and $478.2 million, respectively, for the Dollar Tree segment and $(93.8) million for the Family Dollar segment. |

(c) Stores are included as rebanners when they close or open, respectively. |

| | | | | | | | | | | | | | | | |

|

| | | | | | | | | | | | |

DOLLAR TREE, INC. |

Condensed Consolidated Balance Sheets |

(In millions) |

(Unaudited) |

| | | | | | |

| | July 30, | | January 30, | | August 1, |

| | 2016 | | 2016 | | 2015 |

| | | | | | |

Cash and cash equivalents | | $ | 1,093.2 |

| | $ | 736.1 |

| | $ | 1,302.5 |

|

Short-term investments | | 4.0 |

| | 4.0 |

| | 4.0 |

|

Merchandise inventories, net | | 2,975.1 |

| | 2,885.5 |

| | 2,825.1 |

|

Current deferred tax assets, net | | — |

| | — |

| | 85.5 |

|

Other current assets | | 377.1 |

| | 310.3 |

| | 307.6 |

|

Total current assets | | 4,449.4 |

| | 3,935.9 |

| | 4,524.7 |

|

| | | | | | |

Property and equipment, net | | 3,174.2 |

| | 3,125.5 |

| | 3,151.9 |

|

Assets available for sale | | 13.5 |

| | 12.1 |

| | — |

|

Goodwill | | 5,023.8 |

| | 5,021.7 |

| | 4,982.8 |

|

Favorable lease rights, net | | 518.8 |

| | 569.4 |

| | 620.8 |

|

Tradename intangible asset | | 3,100.0 |

| | 3,100.0 |

| | 3,100.0 |

|

Other intangible assets, net | | 5.4 |

| | 5.8 |

| | 6.3 |

|

Other assets | | 44.3 |

| | 130.8 |

| | 178.6 |

|

| | | | | | |

Total assets | | $ | 16,329.4 |

| | $ | 15,901.2 |

| | $ | 16,565.1 |

|

| | | | | | |

| | | | | | |

Current portion of long-term debt | | $ | 145.5 |

| | $ | 108.0 |

| | $ | 83.0 |

|

Accounts payable | | 1,351.5 |

| | 1,251.9 |

| | 1,152.5 |

|

Other current liabilities | | 683.0 |

| | 722.6 |

| | 837.8 |

|

Income taxes payable | | — |

| | 12.9 |

| | — |

|

Total current liabilities | | 2,180.0 |

| | 2,095.4 |

| | 2,073.3 |

|

| | | | | | |

Long-term debt, net, excluding current portion | | 7,155.7 |

| | 7,238.4 |

| | 8,265.5 |

|

Unfavorable lease rights, net | | 136.6 |

| | 149.3 |

| | 162.4 |

|

Deferred tax liabilities, net | | 1,556.0 |

| | 1,586.6 |

| | 1,655.1 |

|

Income taxes payable, long-term | | 73.6 |

| | 71.4 |

| | 34.4 |

|

Other liabilities | | 370.6 |

| | 353.2 |

| | 327.4 |

|

| | | | | | |

Total liabilities | | 11,472.5 |

| | 11,494.3 |

| | 12,518.1 |

|

| | | | | | |

Shareholders' equity | | 4,856.9 |

| | 4,406.9 |

| | 4,047.0 |

|

| | | | | | |

Total liabilities and shareholders' equity | | $ | 16,329.4 |

| | $ | 15,901.2 |

| | $ | 16,565.1 |

|

| | | | | | |

| | | | | | |

The January 30, 2016 information was derived from the audited consolidated financial statements as of that date. |

|

| | | | | | | | | | | | |

DOLLAR TREE, INC. |

Condensed Consolidated Statements of Cash Flows |

(In millions) |

(Unaudited) |

| | | | | | 26 Weeks Ended |

| | | | | | July 30, | | August 1, |

| | | | | | 2016 | | 2015 |

| | | | | | | | |

| | | | | | | | |

Cash flows from operating activities: | | | | |

| Net income (loss) | | $ | 402.8 |

| | $ | (28.5 | ) |

| Adjustments to reconcile net income (loss) to net cash provided by (used in) operating activities: | | | | |

| | Depreciation and amortization | | 324.2 |

| | 137.6 |

|

| | Provision for deferred taxes | | (31.1 | ) | | (17.6 | ) |

| | Amortization of debt discount and debt-issuance costs | | 9.5 |

| | 4.7 |

|

| | Other non-cash adjustments to net income (loss) | | 43.1 |

| | 57.5 |

|

| | Changes in operating assets and liabilities | | (68.2 | ) | | (178.1 | ) |

| | | Total adjustments | | 277.5 |

| | 4.1 |

|

| | | | Net cash provided by (used in) operating activities | | 680.3 |

| | (24.4 | ) |

| | | | | | | | |

Cash flows from investing activities: | | | | |

| Capital expenditures | | (355.9 | ) | | (167.0 | ) |

| Increase in restricted cash | | — |

| | (12.0 | ) |

| Acquisition of Family Dollar, net of common stock issued, equity compensation and cash acquired | | — |

| | (6,525.6 | ) |

| Purchase of restricted investments | | (36.1 | ) | | — |

|

| Proceeds from sale of restricted investments | | 118.1 |

| | — |

|

| Proceeds from (payments for) fixed asset disposition | | 1.5 |

| | (0.3 | ) |

| | | | Net cash used in investing activities | | (272.4 | ) | | (6,704.9 | ) |

| | | | | | | | |

Cash flows from financing activities: | | | | |

| Principal payments for long-term debt | | (54.0 | ) | | (935.2 | ) |

| Proceeds from long-term debt, net of discount | | — |

| | 8,200.0 |

|

| Debt-issuance costs | | (0.7 | ) | | (88.9 | ) |

| Proceeds from stock issued pursuant to stock-based compensation plans | | 22.7 |

| | 3.9 |

|

| Cash paid for taxes on exercises/vesting of stock-based compensation | | (19.9 | ) | | (21.3 | ) |

| Tax benefit of exercises/vesting of stock-based compensation | | — |

| | 10.0 |

|

| | | | Net cash provided by (used in) financing activities | | (51.9 | ) | | 7,168.5 |

|

Effect of exchange rate changes on cash and cash equivalents | | 1.1 |

| | (0.8 | ) |

Net increase in cash and cash equivalents | | 357.1 |

| | 438.4 |

|

Cash and cash equivalents at beginning of period | | 736.1 |

| | 864.1 |

|

Cash and cash equivalents at end of period | | $ | 1,093.2 |

| | $ | 1,302.5 |

|

| | | | | | | | |

This regulatory filing also includes additional resources:

a082516q216earningsrelease.pdf

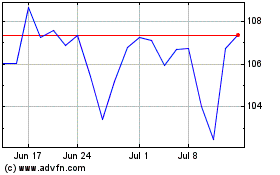

Dollar Tree (NASDAQ:DLTR)

Historical Stock Chart

From Mar 2024 to Apr 2024

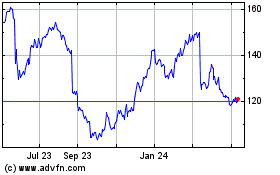

Dollar Tree (NASDAQ:DLTR)

Historical Stock Chart

From Apr 2023 to Apr 2024