UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON D.C. 20549

FORM 8-K

CURRENT REPORT PURSUANT

TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): November 2, 2015

DOLLAR TREE, INC.

(Exact name of registrant as specified in its charter)

VIRGINIA

(State or Other Jurisdiction of Incorporation)

|

| |

0-25464 | 26-2018846 |

(Commission File Number) | (I.R.S. Employer Identification No.) |

500 Volvo Parkway

Chesapeake, VA 23320

(Address of Principal Executive Offices and Zip Code)

(757) 321-5000

(Registrant’s Telephone Number, Including Area Code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 7.01. Regulation FD Disclosure.

On November 2, 2015, Dollar Tree, Inc. and Sycamore Partners, a private equity firm specializing in consumer and retail investments, issued a joint press release announcing that the transaction pursuant to which Dollar Tree divested 330 Family Dollar stores to Dollar Express LLC, a portfolio company of Sycamore Partners, has been completed. The 330 Family Dollar stores represent approximately $45.5 million of annual operating income. A copy of the press release is attached to this Form 8-K as Exhibit 99.1 and is incorporated herein by this reference.

The information contained in this item is being furnished to the Securities and Exchange Commission. Such information shall not be deemed "filed" for purposes of Section 18 of the Securities and Exchange Act of 1934 or otherwise subject to the liabilities of that Section. The information shall not be deemed incorporated by reference into any registration statement or other document filed pursuant to the Securities Act of 1933, except as expressly set forth by specific reference in such filing.

Forward Looking Statements

Certain statements contained herein are “forward-looking statements” that are subject to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These forward-looking statements and information about Dollar Tree’s current and future prospects and its operations and financial results are based on currently available information. Various risks, uncertainties and other factors could cause actual future results and financial performance to vary significantly from those anticipated in such statements. The forward looking statements contained herein include certain plans, activities or events which Dollar Tree expects will or may occur in the future and relate to, among other things, future financial and operating results of the divested stores.

The forward-looking statements made by Dollar Tree, in this and in other documents or statements are qualified by factors, risks and uncertainties, including, but not limited to, those set forth under the headings titled “A Warning About Forward-Looking Statements” and “Risk Factors” in Dollar Tree’s Annual Report on Form 10-K for the fiscal year ended January 31, 2015 and Dollar Tree’s Quarterly Report on Form 10-Q for the quarter ended August 1, 2015, and other reports filed by Dollar Tree with the SEC, which are available at the SEC’s website http://www.sec.gov.

Please read Dollar Tree’s “Risk Factors” and other cautionary statements contained in its filings. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. Dollar Tree undertakes no obligation to update or revise any forward-looking statements, even if experience or future changes make it clear that projected results expressed or implied in such statements will not be realized, except as may be required by law. As a result of these risks and others, actual results could vary significantly from those anticipated herein, and Dollar Tree’s financial condition and results of operations could be materially adversely affected.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| |

99.1 | Press release dated November 2, 2015 issued by Dollar Tree, Inc. and Sycamore Partners |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

|

| | |

| | |

| DOLLAR TREE, INC. |

| | |

Date: November 2, 2015 | By: | /s/ Kevin S. Wampler |

| Kevin S. Wampler |

| Chief Financial Officer |

EXHIBITS

| |

Exhibit 99.1 - | Press release dated November 2, 2015 issued by Dollar Tree, Inc. and Sycamore Partners |

Exhibit 99.1

Dollar Tree Completes Divestiture of

330 Family Dollar Stores to Dollar Express

CHESAPEAKE, VA and NEW YORK, NY - November 2, 2015 - Dollar Tree, Inc. (NASDAQ: DLTR), the nation’s leading operator of discount variety stores selling everything for $1 or less, and Sycamore Partners, a private equity firm specializing in consumer and retail investments, today announced that they have completed the transaction pursuant to which Dollar Tree divested 330 Family Dollar stores to Dollar Express LLC, a portfolio company of Sycamore Partners. The divestiture satisfied a condition as required by the Federal Trade Commission in connection with Dollar Tree’s recently-completed acquisition of Family Dollar Stores, Inc. The stores will operate under the Dollar Express banner.

“We are pleased to have completed this acquisition, which adds to our growing portfolio of leading retailers and consumer brands,” said Peter Morrow, a Managing Director at Sycamore Partners. “We look forward to operating these 330 stores as Dollar Express, a brand new, nationwide discount retailer that is well-positioned as an innovator in the market. We believe our significant experience with carve-out transactions will be beneficial in supporting the Dollar Express team to serve our loyal customers and create value.”

About Dollar Tree, Inc.

Dollar Tree, Inc., a Fortune 500 Company, operated 13,864 stores in 48 states and five Canadian Provinces as of August 1, 2015, with total retail selling square footage of 108.2 million. To learn more about the Company, visit www.DollarTree.com.

About Sycamore Partners

Sycamore Partners is a private equity firm based in New York specializing in consumer and retail investments. The firm has more than $3.5 billion in capital under management. The firm's strategy is to partner with management teams to improve the operating profitability and strategic value of their businesses. The firm's investment portfolio currently includes Aeropostale, Coldwater Creek, Dollar Express, EMP Merchandising, Hot Topic, the Kasper Group, Kurt Geiger, MGF Sourcing, Nine West Holdings, Pathlight Capital, Talbots, and Torrid.

Investors/Media Contacts:

Dollar Tree:

Randy Guiler

Dollar Tree, Inc.

(757) 321-5284

Sycamore Partners:

Michael Freitag or Arielle Rothstein

Joele Frank, Wilkinson Brimmer Katcher

(212) 355-4449

Forward Looking Statements

Certain statements contained herein are “forward-looking statements” that are subject to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These forward-looking statements and information about Dollar Tree’s current and future prospects and its operations and financial results are based on currently available information. Various risks, uncertainties and other factors could cause actual future results and financial performance to vary significantly from those anticipated in such statements. The forward looking statements contained herein include certain plans, activities or events which Dollar Tree expects will or may occur in the future and relate to, among other things, future financial and operating results of the divested stores.

The forward-looking statements made by Dollar Tree, in this and in other documents or statements are qualified by factors, risks and uncertainties, including, but not limited to, those set forth under the headings titled “A Warning About Forward-Looking Statements” and “Risk Factors” in Dollar Tree’s Annual Report on Form 10-K for the fiscal year ended January 31, 2015 and Dollar Tree’s Quarterly Report on Form 10-Q for the quarter ended August 1, 2015, and other reports filed by Dollar Tree with the SEC, which are available at the SEC’s website http://www.sec.gov.

Please read Dollar Tree’s “Risk Factors” and other cautionary statements contained in its filings. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. Dollar Tree undertakes no obligation to update or revise any forward-looking statements, even if experience or future changes make it clear that projected results expressed or implied in such statements will not be realized, except as may be required by law. As a result of these risks and others, actual results could vary significantly from those anticipated herein, and Dollar Tree’s financial condition and results of operations could be materially adversely affected.

This regulatory filing also includes additional resources:

a8k110215completionofdivesti.pdf

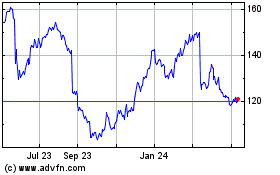

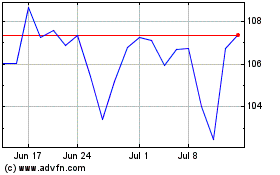

Dollar Tree (NASDAQ:DLTR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Dollar Tree (NASDAQ:DLTR)

Historical Stock Chart

From Apr 2023 to Apr 2024