Dollar General Profit Rises on Higher Sales

August 27 2015 - 2:10PM

Dow Jones News

By Paul Ziobro

Dollar General Corp.'s second-quarter profit rose 12.3% on

higher sales across all categories as the discounter's low prices

continue to attract more shoppers looking for quick shopping

trips.

The Goodlettsville, Tenn.-based retailer's sales rose 7.9% to

$5.1 billion, helped by hundreds of more stores and a 2.8% sales

increase at existing locations. All categories posted growth, with

the largest increases in area such as candy and snacks, tobacco

products, perishables and seasonal items.

Six years after the Great Recession, Dollar General still finds

itself picking up more customers drawn to lower prices for smaller

sized items that are sold closer to their homes. Dollar General is

continuing adding more items selling for $1 and $5, and says that

half of shoppers are putting at least one $1 item into their

shopping baskets on each trip.

Dollar General Chief Executive Todd Vasos, who replaced longtime

CEO Rick Dreiling in June, said the chain's core of low-income

shoppers is feeling a little better now, bolstered by an improving

job market and lower gas prices. But those shoppers are still

aren't spending more freely.

"It takes a little bit more time for her to let go of the purse

strings a little bit more," Mr. Vasos said on Thursday's earnings

call.

Still, Dollar General is experimenting with a new model in which

it spends more on wages to better stock shelves while also reducing

travel for some district managers so they can have more time with

store managers. Early results of the test are promising and Dollar

General plans to roll out the new labor model to about a third of

the chain's more than 12,000 stores by the end of the fiscal year,

which ends in January.

The investments come as Wal-Mart Stores Inc. and Target Corp.

both have put a priority on improving in-stock levels at their

stores, and are investing more on higher wages. Meanwhile, Dollar

General may also see more competition in the dollar store space as

two of its rivals, Dollar Tree Inc. and Family Dollar Stores Inc.,

have merged, creating a more formidable competitor.

Overall, Dollar General posted a profit of $282.3 million, up

from $251.3 million a year earlier. Gross margin rose to 31.2% from

30.8% a year earlier amid higher inventory markups and lower

transportation costs.

Dollar General backed its financial forecasts for the year,

though said it now expects same-store sales growth to be closer to

the lower end of its range of 3% to 3.5%. Shares fell 3.6% in

recent trading to $73.94, trimming year-to-date gains to just

4.6%.

Chelsey Dulaney contributed to this article.

Write to Paul Ziobro at Paul.Ziobro@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

August 27, 2015 13:55 ET (17:55 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

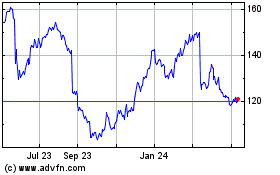

Dollar Tree (NASDAQ:DLTR)

Historical Stock Chart

From Mar 2024 to Apr 2024

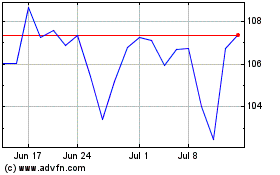

Dollar Tree (NASDAQ:DLTR)

Historical Stock Chart

From Apr 2023 to Apr 2024