Dollar General Earnings Edge Above Expectations, But Sales Miss

August 27 2015 - 7:52AM

Dow Jones News

By Chelsey Dulaney

Dollar General Corp.'s profit edged above expectations for its

second quarter, though revenue growth missed views despite

continued gains in store traffic and transaction value.

Dollar General is seeing more people visit its stores and growth

in profitable categories as its core customers benefit from things

such as wage growth, lower unemployment and cheap gas.

Meanwhile, the company is bracing for heightened competition as

rivals Dollar Tree Inc. and Family Dollar Stores Inc. merge and is

ramping up spending on labor this year. Dollar General has said it

plans to increase the hours allocated to employees to help improve

the quality of stores and draw in traffic as big-box retailers like

Target Corp. pick up traffic.

In the latest quarter, Dollar General's sales at existing

locations grew 2.8%. The company said items such as candy and

snacks, tobacco products and seasonal items also saw growth.

Analysts, however, had expected same-store sales to increase by

3.6%, according to Consensus Metrix.

Gross margin ticked up to 31.2% from 30.8% a year earlier amid

higher inventory markups and lower transportation costs.

Overall, Dollar General posted a profit of $282.3 million, or 95

cents a share, up from $251.3 million, or 83 cents a share, a year

earlier.

Sales grew 7.9% to $5.1 billion.

Analysts polled by Thomson Reuters had projected earnings of 94

cents a share and revenue of $5.14 billion.

The company backed its outlook for the year.

Write to Chelsey Dulaney at Chelsey.Dulaney@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

August 27, 2015 07:37 ET (11:37 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

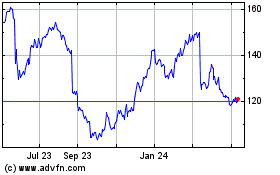

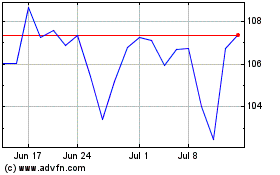

Dollar Tree (NASDAQ:DLTR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Dollar Tree (NASDAQ:DLTR)

Historical Stock Chart

From Apr 2023 to Apr 2024