Sling TV Targets Cord-Cutters With New Ad Campaign

August 30 2016 - 9:29AM

Dow Jones News

By Shalini Ramachandran

Sling TV is making it official: the streaming service is going

after cord-cutters.

Until now, executives at Dish Network Corp., the satellite TV

provider that owns Sling TV, have largely insisted that the

$20-a-month streaming service targets "cord-nevers" -- younger

consumers who have never signed up for a pay TV subscription.

That message was aimed at reassuring big TV companies who were

nervous about licensing just a few of their channels to Sling TV,

rather than their full suite of networks. Part of the concern was

that supporting Sling TV's slimmed-down, cheaper streaming bundle

would encourage more people to "cut the cord," meaning cancel their

traditional pay TV subscriptions, which are still the backbone of

the TV ecosystem.

Now Sling TV executives say they are pulling out all the stops

in a multimillion-dollar campaign aimed at attracting those

cord-cutters.

The nationwide ad campaign, which will run across TV, digital,

print, and social channels, features "Machete" star Danny Trejo

growling about how "evil" and "scary" cable TV companies are, with

their long-term contracts and pricing lures that make you end up

paying more than $100 a month.

In the ad, Sling TV compares those pain points with its low

price, no hidden fees and no long-term contracts -- effectively

encouraging disgruntled cable subscribers to cut the cord and sign

up.

Sling TV Chief Executive Roger Lynch's pitch is that the

streaming service will give a place for fed-up cable customers to

go where they can still pay to watch a selection of TV channels, as

opposed to leave the ecosystem entirely.

"We're not creating sentiment; we're reflecting that it is the

growing percentage of the market," said Sling TV Chief Marketing

Officer Glenn Eisen. The idea with the campaign is to "ratchet up

the tone" against traditional pay TV, he said.

Sling TV's biggest programming partners, including ESPN's

majority-owner Walt Disney Co., have been under pressure from

investors due to increased worries about subscriber losses as more

consumers downgrade to skinnier bundles of channels.

In the past few months, Sling TV has grown its content

offerings, signing up programmers like the NFL Network,

NBCUniversal and 21st Century Fox, and has begun offering a

$25-a-month tier allowing people to watch multiple streams

simultaneously, an upgrade from its original single-stream service.

Mr. Lynch said recent moves from wireless carriers like Sprint and

T-Mobile to drum up unlimited data plans were another encouraging

factor, given that one-third of Sling TV's unique viewers a week

watch using a mobile phone.

The campaign may also be a move of necessity. Dish doesn't break

out Sling TV customers from its traditional satellite TV

subscribers. But even with the benefit of Sling TV growth, Dish

lost 304,000 subscribers in the first half of this year, compared

with a loss of 46,000 during the same period a year ago.

When Sling TV launched in early 2015, Mr. Lynch said, the

addressable market was 21 million homes -- 16 million cord-nevers

and 5 million people who had cut the cord over the prior few years.

He said both groups are "certainly growing."

"Millennials watch fewer hours of traditional TV a day," Mr.

Lynch said. "We expect that to continue."

Write to Shalini Ramachandran at

shalini.ramachandran@wsj.com

(END) Dow Jones Newswires

August 30, 2016 09:14 ET (13:14 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

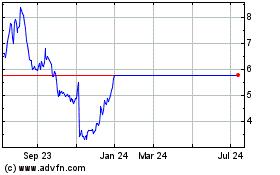

DISH Network (NASDAQ:DISH)

Historical Stock Chart

From Mar 2024 to Apr 2024

DISH Network (NASDAQ:DISH)

Historical Stock Chart

From Apr 2023 to Apr 2024