SEC Suspends Trading in OTC Stock After Value Soars to $35 Billion

August 15 2016 - 9:40PM

Dow Jones News

The U.S. Securities and Exchange Commission on Monday suspended

trading in the shares of Neuromama Ltd., saying it was concerned

that manipulation had inflated the value of the unlisted company to

$35 billion.

In an order published Monday, the SEC said it halted trading in

the firm's shares until Aug. 26 out of concern that false

information, including a claim that the company would have it

shares listed on the Nasdaq Stock Market, was driving demand for

its stock. Its value had quadrupled in the past four months, rising

as high as $56.25 a share in over the counter trading.

The company's website claims that Neuromama.com is a "leader in

technology, innovation & research" and urges investors to

"learn how we're changing the world." The site says the company has

partnered on projects with Mexico's Department of Culture, has

developed a search engine and social network, and is seeking

financing to build a casino and resort in Ensenada, a coastal city

on the Baja California peninsula.

Neuromama hasn't disclosed annual financial results since April

2013, when it reported having total assets worth just $4,721 and

was known as Trance Global Entertainment Group Corp. In a quarterly

filing made nine months later, the company valued its assets at

$18.2 million, most of which it attributed to a "library of

entertainment assets" that it acquired in September. In separate

correspondence with the SEC, the company said the entertainment

assets included 65 Jazz Network TV shows "as well as a syndication

agreement that includes Direct TV and Dish Network among other

distribution channels."

The website says the company's advisory board is chaired by

Steven Schwartzbard, who also goes by the name Vladislav Steven

Zubkis. In an email, Mr. Zubkis blamed the SEC's action on "the

pressure from short sellers" and said his attorneys were in contact

with the SEC. He said Neuromama's stock price had surged because

tech companies "carry high valuation."

"We are looking to cooperate and make sure thing is resolved,"

Mr. Zubkis said in a phone interview.

The SEC in 1997 previously sued Mr. Zubkis over claims that he

illegally sold $10 million worth of shares in International Brands

Inc. to investors and made fraudulent statements about the

company's revenue and future stock price. A disclosure on

Neuromama's website says he later spent five years in federal

prison. News accounts show that prosecutors accused him of

defrauding investors of more than $1.8 million related to a Las

Vegas casino purchase and development of a storage facility.

Write to Dave Michaels at dave.michaels@wsj.com

(END) Dow Jones Newswires

August 15, 2016 21:25 ET (01:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

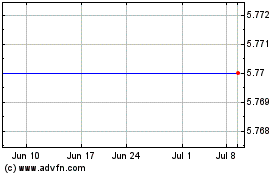

DISH Network (NASDAQ:DISH)

Historical Stock Chart

From Mar 2024 to Apr 2024

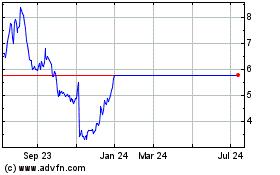

DISH Network (NASDAQ:DISH)

Historical Stock Chart

From Apr 2023 to Apr 2024