Current Report Filing (8-k)

August 03 2016 - 9:01AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

August 3, 2016

(August 2, 2016)

DISH NETWORK CORPORATION

(Exact name of registrant as specified in its charter)

|

NEVADA

|

|

0-26176

|

|

88-0336997

|

|

(State or other jurisdiction of

incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer

Identification No.)

|

|

9601 SOUTH MERIDIAN BLVD.

ENGLEWOOD, COLORADO

|

|

80112

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

(303) 723-1000

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 8.01 Other Events

On August 3, 2016, DISH Network Corporation (“DISH Network”) issued a press release announcing that on August 2, 2016, it priced an offering of $2.5 billion aggregate principal amount of 3.375% Convertible Notes due 2026 (the “Notes”). The Notes will mature on August 15, 2026. Interest on the Notes will be paid on February 15 and August 15 of each year, commencing on February 15, 2017.

The Notes will be convertible under certain circumstances and during certain periods into DISH Network’s Class A Common Stock at an initial conversion rate of 15.3429 shares of DISH Network’s Class A Common Stock per $1,000 principal amount of Notes, equivalent to an initial conversion price of approximately $65.18 per share. Upon any conversion, DISH Network will settle its conversion obligation in cash, shares of its Class A Common Stock or a combination of cash and shares of its Class A Common Stock, at its election. In connection with the offering, DISH Network also granted the initial purchaser of the Notes a 30-day option to purchase up to an additional $500 million in aggregate principal amount of the Notes. In connection with the pricing of the Notes, DISH Network has entered into a convertible note hedge transaction with four financial institutions, including an affiliate of the initial purchaser of the Notes (each, an “option counterparty”). The convertible note hedge transaction is expected generally to reduce potential dilution to holders of DISH Network’s Class A Common Stock attributable to any conversion of the Notes and/or offset any cash payments DISH Network is required to make in excess of the principal amount of converted Notes, as the case may be. DISH Network has also entered into a warrant transaction with each option counterparty. The warrant transaction could separately have a dilutive effect to the extent that the market price per share of DISH Network’s Class A Common Stock exceeds the strike price of the warrants; unless DISH Network elects to settle the warrants in cash. If the initial purchaser exercises its option to purchase additional Notes, DISH Network expects to enter into an additional convertible note hedge transaction and an additional warrant transaction with each option counterparty. The net proceeds of the offering (after payment of the net cost of the contemporaneous convertible note hedge transactions and warrant transactions) are intended to be used for strategic transactions, which may include wireless and spectrum-related strategic transactions, and for other general corporate purposes.

DISH

Network

placed the Notes in a private placement under Rule 144A under the Securities Act of 1933, as amended (the “Securities Act”). The Notes and shares of DISH Network’s Class A Common Stock issuable upon the conversion of the Notes, if any, have not been and will not be registered under the Securities Act or the securities laws of any other jurisdiction and may not be offered or sold in the United States absent registration or an applicable exemption from registration requirements.

Certain statements incorporated by reference in this Current Report on Form 8-K may be forward-looking statements, which may involve a number of risks and uncertainties that could cause actual events or results to differ materially from those described. DISH Network

does not undertake any

obligation to update forward-looking statements.

See Press Release, dated August

3

, 2016, “DISH Network Places Offering of $2.5 Billion in Convertible Notes,” attached hereto as Exhibit 99.1.

Item 9.01 Financial Statements and Exhibits.

(d)

Exhibits.

Exhibit 99.1 Press Release “DISH Network Places Offering of $2.5 Billion in Convertible Notes” dated August 3, 2016

2

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

DISH NETWORK CORPORATION

|

|

|

|

|

|

|

Date: August 3, 2016

|

|

By:

|

/s/R. Stanton Dodge

|

|

|

|

|

R. Stanton Dodge

|

|

|

|

|

Executive Vice President, General Counsel and Secretary

|

3

EXHIBIT INDEX

|

Exhibit 99.1

|

|

Press Release “DISH Network Places Offering of $2.5 Billion in Convertible Notes” dated August 3, 2016

|

4

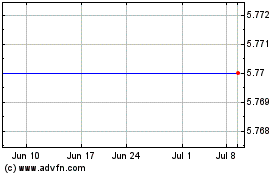

DISH Network (NASDAQ:DISH)

Historical Stock Chart

From Mar 2024 to Apr 2024

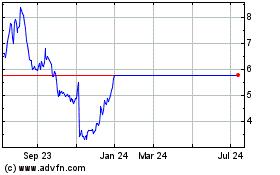

DISH Network (NASDAQ:DISH)

Historical Stock Chart

From Apr 2023 to Apr 2024