Comcast Revenue Tops Estimates as Video Subscriber Losses Improve

July 27 2016 - 7:40AM

Dow Jones News

Comcast Corp. reported better-than-expected financial results in

the most recent quarter and limited the loss of cable customers,

despite the pressure on the pay-TV business from cord-cutting and

cheaper streaming options.

Net income in the second quarter fell to $2.03 billion, or 83

cents a share, compared with $2.14 billion, or 84 cents a share, a

year ago, dragged down by a weaker performance at the film studio

without a major blockbuster release in the period.

Revenue grew 2.8% to $19.27 billion. Both figures exceeded

estimates from analysts, who were projecting earnings of 81 cents a

share on about $19 billion in revenue, according to Thomson

Reuters.

Comcast lost 4,000 video customers in the seasonally weak second

quarter when many families move or customers cancel cable-TV

service during the summer months. It was an improvement from the

69,000 subscribers lost in the year-ago period and its best

second-quarter performance in a decade.

Cable companies are benefiting from investing more in their

cable-TV products and bundling them alongside fast broadband, as

well as offering cheaper, slimmed-down bundles of programming for

more cost-conscious consumers.

Comcast, in particular, is beginning to benefit from the rollout

of its next-generation X1 internet-connected set-top box and guide,

which the company has said increases the time customers spend

watching TV and makes them more likely to stick with Comcast. As of

the second quarter, 40% of customers now have X1 boxes. Earlier

this month, Comcast said it plans to integrate Netflix's service

into its X1 box after years of holding out from striking such a

deal.

Comcast also likely benefited from weakness at its rivals, as

AT&T focused on integrating DirecTV and Dish Network Corp.

faced blackouts amid carriage disputes, Wells Fargo analyst Marci

Ryvicker said in a research note earlier this month.

The company's broadband and business services divisions reported

sales growth in the second quarter, boosting overall revenue at the

cable business. The cable unit, which accounts for the bulk of the

company's revenue, posted 6% sales growth to $12.44 billion.

Broadband revenue increased 8.6% to $3.37 billion, as the

company added 220,000 broadband customers in the quarter compared

with 180,000 a year earlier.

Video revenue grew 2.8% to $5.58 billion, while

business-services revenue jumped 17% to $1.36 billion. Voice

revenue fell 1.1% to $893 million.

At NBCUniversal, revenue fell 1.8% to $7.10 billion, as declines

in filmed entertainment offset growth at its television networks

and theme parks. Operating cash flow at NBCUniversal was relatively

flat at $1.69 billion.

Filmed entertainment posted a 40% drop in revenue and 87%

decline in operating cash flow as Universal Pictures lacked a major

blockbuster release in the second quarter. A year ago, the studio

had box-office hits including "Furious 7" and "Jurassic World."

In April, Comcast agreed to buy DreamWorks Animations SKG Inc.

for $3.8 billion in a deal that will add the "Shrek," "Kung Fu

Panda," and "Madagascar" franchises to its film lineup and help it

challenge Walt Disney Co. in family entertainment. The deal is

expected to close by the end of the year.

Revenue grew 4.7% to $2.57 billion at the unit that includes

Comcast's cable TV networks including Bravo, USA Network and Syfy,

and operating cash flow grew 8.3% to $944 million. Revenue at the

broadcast-TV segment, which includes the flagship NBC network,

increased 17% to $2.13 billion.

Revenue at NBCU's theme parks segment grew 47% to $1.14 billion,

thanks to the inclusion of Universal Studios Japan, which Comcast

bought control of last September, as well as Universal Studios

Hollywood's opening of the Wizarding World of Harry Potter.

Write to Cassandra Jaramillo at cassandra.jaramillo@wsj.com and

Shalini Ramachandran at shalini.ramachandran@wsj.com

(END) Dow Jones Newswires

July 27, 2016 07:25 ET (11:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

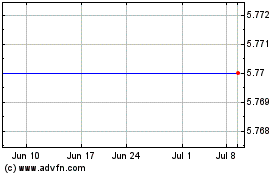

DISH Network (NASDAQ:DISH)

Historical Stock Chart

From Mar 2024 to Apr 2024

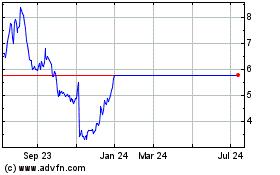

DISH Network (NASDAQ:DISH)

Historical Stock Chart

From Apr 2023 to Apr 2024