Viacom, Dish Network Agree on Carriage Contract--Update

April 21 2016 - 12:11PM

Dow Jones News

By Keach Hagey and Shalini Ramachandran

Viacom Inc.'s channels will remain on satellite-television

provider Dish Network Corp.'s service after the companies agreed to

a multiyear carriage contract.

Terms of the deal weren't disclosed, although the companies said

the agreement would allow Dish subscribers to access Viacom content

-- including Comedy Central and MTV -- on Dish's Sling TV streaming

service.

The agreement comes as the traditional pay-tv business faces

increasing pressures because of shrinking profits for distributors,

rising costs of content and the proliferation of choices for

consumers beyond the bundle.

In addition, Viacom -- which operates Nickelodeon, MTV and

Comedy Central, among other channels -- is viewed as especially

vulnerable by some on Wall Street. The young audience for its

channels has been the first to abandon or avoid signing up for

expensive pay-TV packages in favor of cheaper, ad-free subscription

services like Netflix or free, ad-supported streaming sites like

YouTube and Snapchat.

The Dish agreement applies to 18 Viacom channels, including

Nickelodeon, Comedy Central, MTV, VH1, Spike, BET, CMT, TV Land,

Nick Jr. and Nicktoons.

Todd Juenger, an analyst at Sanford C. Bernstein, has long

argued Viacom is "uniquely vulnerable" to being the first place

where major readjustments to the pay-TV bundle will be made. He

became more convinced of that, he wrote this week, after reviewing

the growing pressure on distributors' businesses as cord-cutting

proliferates.

"If the current trajectories of ARPU [average revenue per user]

and affiliate fees continue at current rates, the average [pay-tv

distributor] would earn $0 on video subs by the year 2023," he

wrote. "So obviously something has to change. We believe Viacom is

the obvious place for [pay-tv distributors] to start."

Viacom's channel's ratings have fallen markedly since 2009, the

last time it signed a distribution deal with Dish, said Rich

Greenfield, an analyst at BTIG Research.

While the deal's financial terms weren't revealed, Viacom likely

was under pressure not to accept a significantly lower rate, Mr.

Greenfield said, because it has "most favored nation" clauses in

its contracts with other big distributors like Comcast Corp. that

would mean they had the right to those same low rates.

Wednesday, a Viacom spokesman said that so far this year, "our

networks represent nearly one fifth of cable viewership on Dish,

which gives Dish enormous incentive to renew our agreement."

Write to Keach Hagey at keach.hagey@wsj.com and Shalini

Ramachandran at shalini.ramachandran@wsj.com

Corrections & Amplifications

An earlier headline to this story's summary on the wsj.com home

page incorrectly said Viacom's channels had gone dark on Dish

Network. Instead, the channels remained on the satellite-television

provider as negotiations continued past the deadline.

(END) Dow Jones Newswires

April 21, 2016 11:56 ET (15:56 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

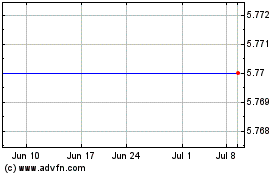

DISH Network (NASDAQ:DISH)

Historical Stock Chart

From Mar 2024 to Apr 2024

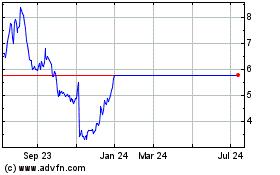

DISH Network (NASDAQ:DISH)

Historical Stock Chart

From Apr 2023 to Apr 2024