Casella Waste Systems, Inc. (NASDAQ:CWST), a regional solid waste,

recycling and resource management services company, today reported

its first quarter financial results for the three month period

ended March 31, 2016.

Highlights for the Three Months Ended

March 31, 2016:

- Revenues were $125.4 million for the quarter, up $8.9

million, or 7.6%, from the same period in 2015.

- Adjusted EBITDA* was $19.3 million for the quarter, up

$4.8 million, or 33.1%, from the same period in 2015. Net

Loss was ($7.6) million, an improvement of $0.4 million from the

same period in 2015.

- Adjusted Operating Income* for the quarter was $2.0

million, up $3.8 million from the same period in

2015.

- Overall solid waste pricing for the quarter was up

4.7%, mainly driven by strong collection pricing up

6.7%.

“Our solid results in the first quarter were driven by continued

execution against our key management strategies, a mild winter in

the Northeast, and selective strengthening of the regional

economy,” said John W. Casella, chairman and CEO of Casella Waste

Systems. “I am very pleased with our financial and

operational performance during the quarter, and I believe that we

are well positioned to continue to execute in fiscal year 2016 and

beyond.”

“We continued to expand Adjusted Operating Income margins in the

quarter, up roughly 310 bps year-over-year, as our strong pricing

and operating efficiency programs enabled us to outpace inflation

during the period,” Casella said. "Our efforts to drive

pricing in the collection and disposal lines-of-business continued

to gain strength through the first quarter. Overall solid

waste pricing was up 4.7%, with particular strength in the

collection line-of-business, where we experienced our highest

pricing growth in over 10 years at 6.7%. Adding to this

success, we advanced disposal pricing 2.8% in our Eastern Region as

we further capitalized on the tightening disposal markets across

this market area. These strong pricing gains were

complemented by improvements from our operating efficiency programs

with our fleet and routing programs driving lower costs.”

“Beyond our strategic execution, our results during the quarter

benefited from a mild winter as compared to the historically snowy

and cold winter that we experienced in the first quarter of 2015,”

Casella said. “It is too early in the year to estimate how

much of the typical spring ramp-up was pulled forward into the

winter months versus the benefits from the tightening disposal

markets and economic growth in the Northeast. During the

first quarter, our landfill volumes were up 152,000 tons

year-over-year, or up 19.7%, with over 55% of this growth coming

from higher construction & demolition volumes across most of

our market areas. These strong trends have begun to moderate

into the second quarter.”

“Over the last year, we have worked diligently to reshape our

recycling sales model in the face of rapidly declining recycling

commodity prices, and the changes that we made are working

extremely well,” Casella said. “In fact, during the first

quarter we improved operating income by $1.1 million year-over-year

in our recycling business, despite a 20% drop in our average

commodity revenue per ton. We overcame lower recycling

commodity prices and achieved this improvement through a

combination of our Sustainability Recycling Adjustment (“SRA”) fee

applied to residential and commercial hauling customers, lower

rebates or higher tipping fees to recycling processing customers,

and efforts to reduce operating costs at our materials processing

facilities.”

“During the first quarter, we repurchased and permanently

retired $4.2 million of our 7.75% Senior Subordinated Notes due

2019, demonstrating our continued commitment to reduce leverage and

accelerate free cash flow generation by retiring our highest cost

debt,” Casella said. “Through our continued cash flow growth

and debt repayment, we reduced our consolidated leverage ratio as

defined by our ABL Revolver from 5.43x on March 31, 2015 to 4.64x

on March 31, 2016.”

For the quarter, revenues were $125.4 million, up $8.9 million,

or 7.6%, from the same period in 2015, with revenue growth mainly

driven by robust collection and disposal pricing and continued

growth in solid waste and recycling volumes, partially offset by

lower recycling commodity pricing, lower energy pricing and

divestitures.

Adjusted EBITDA was $19.3 million for the quarter, up $4.8

million, or 33.1%, from the same period in 2015, with growth mainly

driven by improved performance in the collection, disposal and

recycling lines-of-business.

Operating income was $2.0 million for the quarter, down $1.1

million from the same period in 2015, whereas Adjusted Operating

Income was $2.0 million for the quarter, up $3.8 million from the

same period in 2015. The current quarter did not include any

adjustments, while the same period in 2015 included a $4.9 million

gain related to the dissolution of CARES and a reversal of excess

costs related to the Maine Energy divestiture.

Net loss attributable to common stockholders was ($7.6) million,

or ($0.19) per common share for the quarter, compared to a net loss

attributable to common stockholders of ($9.3) million, or ($0.23)

per common share for the same period in 2015. The current

quarter included a less than $0.1 million gain on debt

extinguishment, while the same quarter last year included, in

addition to the items identified above, a $0.5 million loss on debt

extinguishment related to refinancing of the company's Senior

Credit Facility.

Net cash provided by operating activities was $1.7 million in

the quarter, up $7.4 million from the same period in 2015.

Free Cash Flow* was ($8.3) million in the quarter, as

compared to ($7.5) million for the same period in 2015.

Normalized Free Cash Flow* was ($8.3) million in the quarter, up

$2.0 million from the same period in 2015. The current

quarter did not include any adjustments, while the same period in

2015 included a $3.1 million adjustment for the net cash proceeds

from the CARES dissolution and a $0.2 million adjustment for the

cash outlays associated with the Worcester landfill

capping.

As expected, given the operational and working capital

seasonality of the Company’s business, Free Cash Flow was negative

in the first quarter, and we project Free Cash Flow to be positive

for the remainder of our fiscal year.

Outlook

The company reaffirmed its 2016 guidance for the year ending

December 31, 2016 by estimating results in the following

ranges:

- Revenues between $550 million and $560 million;

- Adjusted EBITDA* between $111 million and $115 million;

and

- Free Cash Flow* between $20 million and $24 million.

Conference call to discuss quarter

The company will host a conference call to discuss these results

on Thursday, May 5, 2016 at 10:00 a.m. Eastern Time.

Individuals interested in participating in the call should dial

(877) 838-4153 or for international participants (720) 545-0037 at

least 10 minutes before start time. The call will also be

webcast; to listen, participants should visit Casella Waste

Systems’ website at http://ir.casella.com and follow the

appropriate link to the webcast.

A replay of the call will be available on the company’s website,

or by calling (855) 859-2056 or (404) 537-3406 (Conference ID

88359103) until 1:00 p.m. ET on Thursday, May 12, 2016.

About Casella Waste Systems, Inc.

Casella Waste Systems, Inc., headquartered in Rutland, Vermont,

provides solid waste management services consisting of collection,

transfer, disposal, and recycling services in the northeastern

United States. For further information, investors contact Ned

Coletta, Chief Financial Officer at (802) 772-2239; media contact

Joseph Fusco, Vice President at (802) 772-2247; or visit the

company’s website at http://www.casella.com.

*Non-GAAP Financial Measures

In addition to disclosing financial results prepared in

accordance with Generally Accepted Accounting Principles in the

United States (“GAAP”), the company also discloses earnings before

interest, taxes, and depreciation and amortization, adjusted for

accretion, depletion of landfill operating lease obligations, gains

on asset sales, development project charge write-offs, contract

settlement charges, legal settlement costs, tax settlement costs,

bargain purchase gains, asset impairment charges, environmental

remediation charges, severance and reorganization costs, expenses

from divestiture, acquisition and financing costs, gains on the

settlement of acquisition related contingent consideration, fiscal

year-end transition costs, proxy contest costs, as well as impacts

from divestiture transactions (“Adjusted EBITDA”), which is a

non-GAAP measure.

The company also discloses earnings before interest and taxes,

adjusted for gains on asset sales, development project charge

write-offs, contract settlement charges, legal settlement costs,

tax settlement costs, bargain purchase gains, asset impairment

charges, environmental remediation charges, severance and

reorganization costs, expenses from divestiture, acquisition and

financing costs, gains on the settlement of acquisition related

contingent consideration, fiscal year-end transition costs, proxy

contest costs, as well as impacts from divestiture transactions

(“Adjusted Operating Income”), which is a non-GAAP

measure.

The company also discloses net cash provided by operating

activities, less capital expenditures (excluding acquisition

related capital expenditures), less payments on landfill operating

lease contracts, plus proceeds from divestiture transactions, plus

proceeds from the sale of property and equipment, plus proceeds

from property insurance settlement, less contributions from

(distributions to) noncontrolling interest holders (“Free Cash

Flow”), which is a non-GAAP measure.

And lastly, the company discloses Free Cash Flow plus certain

cash outflows associated with landfill closure, site improvement

and remediation expenditures, plus certain cash outflows associated

with new contract and project capital expenditures, plus cash

(inflows) outflows associated with certain business dissolutions

(“Normalized Free Cash Flow”), which is a non-GAAP measure.

Adjusted EBITDA and Adjusted Operating Income are reconciled to

net loss, while Free Cash Flow and Normalized Free Cash Flow are

reconciled to net cash provided by operating activities. The

Company does not provide reconciling information for

forward-looking periods because such information is not available

without an unreasonable effort. The Company believes that

such information is not significant to an understanding of its

non-GAAP measures for forward-looking periods because its

methodology for calculating such non-GAAP measures is based on

sensitivity analysis at the business unit level rather than on

differences from GAAP financial measures.

The company presents Adjusted EBITDA, Adjusted Operating Income,

Free Cash Flow, and Normalized Free Cash Flow because it considers

them important supplemental measures of its performance and

believes they are frequently used by securities analysts, investors

and other interested parties in the evaluation of the company’s

results. Management uses these non-GAAP measures to further

understand the company’s “core operating performance.” The company

believes its “core operating performance” is helpful in

understanding its ongoing performance in the ordinary course of

operations. The company believes that providing Adjusted EBITDA,

Adjusted Operating Income, Free Cash Flow, and Normalized Free Cash

Flow to investors, in addition to corresponding income statement

and cash flow statement measures, affords investors the benefit of

viewing its performance using the same financial metrics that the

management team uses in making many key decisions and understanding

how the core business and its results of operations has performed.

The company further believes that providing this information allows

its investors greater transparency and a better understanding of

its core financial performance. In addition, the instruments

governing the company’s indebtedness use EBITDA (with additional

adjustments) to measure its compliance with covenants.

Non-GAAP financial measures are not in accordance with or an

alternative for GAAP. Adjusted EBITDA, Adjusted Operating

Income, Free Cash Flow, and Normalized Free Cash Flow should not be

considered in isolation from or as a substitute for financial

information presented in accordance with GAAP, and may be different

from Adjusted EBITDA, Adjusted Operating Income, Free Cash Flow, or

Normalized Free Cash Flow presented by other companies.

Safe Harbor Statement

Certain matters discussed in this press release, including, but

not limited to, the statements regarding financial results and

guidance, are "forward-looking statements" intended to qualify for

the safe harbors from liability established by the Private

Securities Litigation Reform Act of 1995. These forward-looking

statements can generally be identified as such by the context of

the statements, including words such as “believe,” “expect,”

“anticipate,” “plan,” “may,” “would,” “intend,” “estimate,”

“guidance” and other similar expressions, whether in the negative

or affirmative. These forward-looking statements are based on

current expectations, estimates, forecasts and projections about

the industry and markets in which we operate and management’s

beliefs and assumptions. We cannot guarantee that we actually will

achieve the financial results, plans, intentions, expectations or

guidance disclosed in the forward-looking statements made. Such

forward-looking statements, and all phases of our operations,

involve a number of risks and uncertainties, any one or more of

which could cause actual results to differ materially from those

described in our forward-looking statements. Such risks and

uncertainties include or relate to, among other things: adverse

weather conditions that have negatively impacted and may continue

to negatively impact our revenues and our operating margin; current

economic conditions that have adversely affected and may continue

to adversely affect our revenues and our operating margin; we may

be unable to increase volumes at our landfills or improve our route

profitability; our need to service our indebtedness may limit our

ability to invest in our business; we may be unable to reduce costs

or increase pricing or volumes sufficiently to achieve estimated

Adjusted EBITDA and other targets; landfill operations and permit

status may be affected by factors outside our control; groundwater

contamination discovered near our Southbridge landfill may delay

our permitting activities at that landfill and result in costs and

liabilities as well as impacting our disposal revenues at that

site, each of which could impact our results of operations; we may

be required to incur capital expenditures in excess of our

estimates; fluctuations in energy pricing or the commodity pricing

of our recyclables may make it more difficult for us to predict our

results of operations or meet our estimates; we may incur

environmental charges or asset impairments in the future; and

actions of activist investors and the cost and disruption of

responding to those actions. There are a number of other important

risks and uncertainties that could cause our actual results to

differ materially from those indicated by such forward-looking

statements. These additional risks and uncertainties include,

without limitation, those detailed in Item 1A, “Risk Factors” in

our Form 10-K for the fiscal year ended December 31, 2015.

We undertake no obligation to update publicly any

forward-looking statements whether as a result of new information,

future events or otherwise, except as required by law.

| CASELLA WASTE SYSTEMS, INC. AND

SUBSIDIARIES |

| CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS |

| (Unaudited) |

| (In thousands, except amounts per

share) |

| |

|

|

|

| |

|

Three Months

Ended March

31, |

|

| |

|

2016 |

|

2015 |

|

| |

|

|

|

|

|

| |

|

|

|

|

|

| Revenues |

|

$ |

125,432 |

|

|

$ |

116,577 |

|

|

| |

|

|

|

|

|

| Operating

expenses: |

|

|

|

|

|

| Cost of

operations |

|

|

90,418 |

|

|

|

87,833 |

|

|

| General

and administration |

|

|

18,587 |

|

|

|

16,805 |

|

|

|

Depreciation and amortization |

|

|

14,453 |

|

|

|

13,748 |

|

|

|

Divestiture transactions |

|

|

- |

|

|

|

(4,935 |

) |

|

|

|

|

|

123,458 |

|

|

|

113,451 |

|

|

| |

|

|

|

|

|

| Operating income |

|

|

1,974 |

|

|

|

3,126 |

|

|

| |

|

|

|

|

|

| Other expense

(income): |

|

|

|

|

|

| Interest

expense, net |

|

|

9,926 |

|

|

|

9,985 |

|

|

| (Gain)

loss on debt extinguishment |

|

|

(48 |

) |

|

|

521 |

|

|

| Loss on

derivative instruments |

|

|

- |

|

|

|

151 |

|

|

| Other

income |

|

|

(141 |

) |

|

|

(164 |

) |

|

| Other expense, net |

|

|

9,737 |

|

|

|

10,493 |

|

|

| |

|

|

|

|

|

| Loss before income

taxes |

|

|

(7,763 |

) |

|

|

(7,367 |

) |

|

| (Benefit) provision for

income taxes |

|

|

(149 |

) |

|

|

596 |

|

|

|

|

|

|

|

|

|

| Net loss |

|

|

(7,614 |

) |

|

|

(7,963 |

) |

|

| |

|

|

|

|

|

| Less: Net

(loss) income attributable to noncontrolling interests |

|

|

(6 |

) |

|

|

1,308 |

|

|

|

|

|

|

|

|

|

| Net loss attributable

to common stockholders |

|

$ |

(7,608 |

) |

|

$ |

(9,271 |

) |

|

|

|

|

|

|

|

|

| Basic

and diluted weighted average common shares outstanding |

|

|

40,996 |

|

|

|

40,417 |

|

|

| |

|

|

|

|

|

| Basic

and diluted earnings per common share |

|

$ |

(0.19 |

) |

|

$ |

(0.23 |

) |

|

|

|

|

|

|

|

|

| Adjusted

EBITDA |

|

$ |

19,263 |

|

|

$ |

14,477 |

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

| CASELLA WASTE SYSTEMS, INC. AND

SUBSIDIARIES |

|

| CONDENSED CONSOLIDATED BALANCE

SHEETS |

|

| (In thousands) |

|

| |

|

|

|

|

|

|

ASSETS |

|

March 31,

2016 |

|

December 31,

2015 |

|

| |

|

(Unaudited) |

|

|

|

| CURRENT ASSETS: |

|

|

|

|

|

| Cash and

cash equivalents |

|

$ |

1,648 |

|

|

$ |

2,312 |

|

|

|

Restricted cash |

|

|

|

|

|

| Accounts

receivable - trade, net of allowance for doubtful accounts |

|

|

53,034 |

|

|

|

60,167 |

|

|

| Other

current assets |

|

|

16,050 |

|

|

|

14,189 |

|

|

| Total current

assets |

|

|

70,732 |

|

|

|

76,668 |

|

|

| |

|

|

|

|

|

| Property, plant and

equipment, net of accumulated depreciation and amortization |

|

|

397,107 |

|

|

|

402,252 |

|

|

| Goodwill |

|

|

118,976 |

|

|

|

118,976 |

|

|

| Intangible assets,

net |

|

|

8,728 |

|

|

|

9,252 |

|

|

| Restricted assets |

|

|

871 |

|

|

|

2,251 |

|

|

| Cost method

investments |

|

|

12,333 |

|

|

|

12,333 |

|

|

| Other non-current

assets |

|

|

11,659 |

|

|

|

11,937 |

|

|

| |

|

|

|

|

|

| Total

assets |

|

$ |

620,406 |

|

|

$ |

633,669 |

|

|

| |

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS' DEFICIT |

|

|

|

|

|

| |

|

|

|

|

|

| CURRENT

LIABILITIES: |

|

|

|

|

|

| Current

maturities of long-term debt and capital leases |

|

$ |

1,458 |

|

|

$ |

1,448 |

|

|

| Accounts

payable |

|

|

38,809 |

|

|

|

44,921 |

|

|

| Other

accrued liabilities |

|

|

30,118 |

|

|

|

38,977 |

|

|

| Total current

liabilities |

|

|

70,385 |

|

|

|

85,346 |

|

|

| |

|

|

|

|

|

| Long-term debt and

capital leases, less current maturities |

|

|

513,220 |

|

|

|

505,985 |

|

|

| Other long-term

liabilities |

|

|

65,317 |

|

|

|

63,935 |

|

|

| |

|

|

|

|

|

| Total stockholders'

deficit |

|

|

(28,516 |

) |

|

|

(21,597 |

) |

|

| |

|

|

|

|

|

| Total

liabilities and stockholders' deficit |

|

$ |

620,406 |

|

|

$ |

633,669 |

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

| CASELLA WASTE SYSTEMS, INC. AND

SUBSIDIARIES |

|

| CONDENSED CONSOLIDATED STATEMENTS OF CASH

FLOWS |

|

| (Unaudited) |

|

| (In thousands) |

|

|

|

|

|

|

|

|

|

Three Months Ended March

31, |

|

|

|

|

2016 |

|

2015 |

|

|

|

|

|

|

|

|

| Cash Flows from

Operating Activities: |

|

|

|

|

|

| Net loss |

|

$ |

(7,614 |

) |

|

$ |

(7,963 |

) |

|

| Adjustments to

reconcile net loss to net cash provided by (used in) operating

activities - |

|

|

|

|

|

|

Depreciation and amortization |

|

|

14,453 |

|

|

|

13,748 |

|

|

| Depletion

of landfill operating lease obligations |

|

|

1,950 |

|

|

|

1,690 |

|

|

| Interest

accretion on landfill and environmental remediation

liabilities |

|

|

886 |

|

|

|

848 |

|

|

|

Amortization of debt issuance costs and discount on long-term

debt |

|

|

1,040 |

|

|

|

938 |

|

|

|

Stock-based compensation expense |

|

|

722 |

|

|

|

660 |

|

|

| Gain on

sale of property and equipment |

|

|

(203 |

) |

|

|

(46 |

) |

|

|

Divestiture transactions |

|

|

- |

|

|

|

(4,935 |

) |

|

| (Gain)

loss on debt extinguishment |

|

|

(48 |

) |

|

|

521 |

|

|

| Loss on

derivative instruments |

|

|

- |

|

|

|

151 |

|

|

| Deferred

income taxes |

|

|

100 |

|

|

|

(49 |

) |

|

| Changes

in assets and liabilities, net of effects of acquisitions and

divestitures |

|

|

(9,562 |

) |

|

|

(11,258 |

) |

|

| Net Cash

Provided By (Used In) Operating Activities |

|

|

1,724 |

|

|

|

(5,695 |

) |

|

| Cash Flows from

Investing Activities: |

|

|

|

|

|

| Additions

to property, plant and equipment |

|

|

(9,848 |

) |

|

|

(4,444 |

) |

|

| Payments

on landfill operating lease contracts |

|

|

(500 |

) |

|

|

(478 |

) |

|

| Proceeds

from divestiture transactions |

|

|

- |

|

|

|

4,550 |

|

|

| Proceeds

from sale of property and equipment |

|

|

359 |

|

|

|

89 |

|

|

| Net Cash

Used In Investing Activities |

|

|

(9,989 |

) |

|

|

(283 |

) |

|

| Cash Flows

from Financing Activities: |

|

|

|

|

|

| Proceeds

from long-term borrowings |

|

|

64,300 |

|

|

|

197,591 |

|

|

| Principal

payments on long-term debt |

|

|

(57,948 |

) |

|

|

(186,500 |

) |

|

| Payments

of debt issuance costs |

|

|

(99 |

) |

|

|

(6,852 |

) |

|

| Change in

restricted cash |

|

|

1,348 |

|

|

|

4,086 |

|

|

|

Distribution to noncontrolling interest holder |

|

|

- |

|

|

|

(1,495 |

) |

|

| Net Cash

Provided By Financing Activities |

|

|

7,601 |

|

|

|

6,830 |

|

|

| Net

(decrease) increase in cash and cash equivalents |

|

|

(664 |

) |

|

|

852 |

|

|

| Cash and

cash equivalents, beginning of period |

|

|

2,312 |

|

|

|

2,205 |

|

|

| Cash and

cash equivalents, end of period |

|

$ |

1,648 |

|

|

$ |

3,057 |

|

|

|

|

|

|

|

|

|

|

Supplemental Disclosures of Cash Flow Information: |

|

|

|

|

|

| Cash

interest |

|

$ |

16,122 |

|

|

$ |

15,336 |

|

|

| Cash

income taxes, net of refunds |

|

$ |

101 |

|

|

$ |

30 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| CASELLA WASTE SYSTEMS, INC. AND

SUBSIDIARIES |

| RECONCILIATION OF CERTAIN NON-GAAP

MEASURES |

| (Unaudited) |

| (In thousands) |

| |

|

|

|

|

|

| Following is a reconciliation of Adjusted EBITDA and

Adjusted Operating Income (Loss) to Net Loss: |

| |

|

|

|

|

|

| |

|

Three Months

Ended March

31, |

|

| |

|

2016 |

|

2015 |

|

| |

|

|

|

|

|

|

Net Loss |

|

$ |

(7,614 |

) |

|

$ |

(7,963 |

) |

|

| (Benefit)

provision for income taxes |

|

|

(149 |

) |

|

|

596 |

|

|

| Other

(income) expense, net |

|

|

(189 |

) |

|

|

508 |

|

|

| Interest

expense, net |

|

|

9,926 |

|

|

|

9,985 |

|

|

|

Divestiture transactions |

|

|

- |

|

|

|

(4,935 |

) |

|

|

Depreciation and amortization |

|

|

14,453 |

|

|

|

13,748 |

|

|

| Depletion

of landfill operating lease obligations |

|

|

1,950 |

|

|

|

1,690 |

|

|

| Interest

accretion on landfill and environmental remediation

liabilities |

|

|

886 |

|

|

|

848 |

|

|

|

Adjusted EBITDA |

|

$ |

19,263 |

|

|

$ |

14,477 |

|

|

|

Depreciation and amortization |

|

|

(14,453 |

) |

|

|

(13,748 |

) |

|

| Depletion

of landfill operating lease obligations |

|

|

(1,950 |

) |

|

|

(1,690 |

) |

|

| Interest

accretion on landfill and environmental remediation

liabilities |

|

|

(886 |

) |

|

|

(848 |

) |

|

|

Adjusted Operating Income (Loss) |

|

$ |

1,974 |

|

|

$ |

(1,809 |

) |

|

|

|

|

|

|

|

|

| |

| Following is a reconciliation of Free Cash Flow and

Normalized Free Cash Flow to Net Cash Provided By (Used In)

Operating Activities: |

| |

| |

|

Three Months Ended March

31, |

|

| |

|

2016 |

|

2015 |

|

|

Net Cash Provided By (Used In) Operating

Activities |

|

$ |

1,724 |

|

|

$ |

(5,695 |

) |

|

| Capital

expenditures |

|

|

(9,848 |

) |

|

|

(4,444 |

) |

|

| Payments on landfill

operating lease contracts |

|

|

(500 |

) |

|

|

(478 |

) |

|

| Proceeds from sale of

property and equipment |

|

|

359 |

|

|

|

89 |

|

|

| Proceeds from

divestiture transactions |

|

|

- |

|

|

|

4,550 |

|

|

| Distribution to

noncontrolling interest holder |

|

|

- |

|

|

|

(1,495 |

) |

|

| Free Cash

Flow |

|

$ |

(8,265 |

) |

|

$ |

(7,473 |

) |

|

| Landfill

closure, site improvement and remediation expenditures

(i) |

|

|

- |

|

|

|

234 |

|

|

| Net cash

proceeds from CARES dissolution (ii) |

|

|

- |

|

|

|

(3,055 |

) |

|

|

Normalized Free Cash

Flow |

|

$ |

(8,265 |

) |

|

$ |

(10,294 |

) |

|

|

|

|

|

|

|

|

| (i) Includes cash outlays associated with Worcester landfill

capping. |

| (ii) Includes cash proceeds and cash distribution associated

with the dissolution of CARES. |

|

|

|

|

|

|

|

| CASELLA WASTE SYSTEMS, INC. AND

SUBSIDIARIES |

|

| SUPPLEMENTAL DATA TABLES |

|

| (Unaudited) |

|

| (In thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Amounts of our total revenues attributable to services

provided for the three months ended March 31, 2016 and 2015 are as

follows: |

|

| |

|

|

|

|

|

|

|

|

|

|

| |

|

|

Three Months Ended March 31, |

|

| |

|

|

2016 |

|

% of Total Revenue |

|

2015 |

|

% of Total Revenue |

|

| |

Collection |

|

$ |

57,851 |

|

|

|

46.1 |

% |

|

$ |

53,326 |

|

|

|

45.7 |

% |

|

| |

Disposal |

|

|

32,253 |

|

|

|

25.7 |

% |

|

|

27,767 |

|

|

|

23.9 |

% |

|

| |

Power generation |

|

|

1,707 |

|

|

|

1.4 |

% |

|

|

2,047 |

|

|

|

1.8 |

% |

|

| |

Processing |

|

|

973 |

|

|

|

0.8 |

% |

|

|

1,121 |

|

|

|

0.9 |

% |

|

| |

Solid waste operations |

|

|

92,784 |

|

|

|

74.0 |

% |

|

|

84,261 |

|

|

|

72.3 |

% |

|

| |

Organics |

|

|

8,935 |

|

|

|

7.1 |

% |

|

|

9,020 |

|

|

|

7.7 |

% |

|

| |

Customer solutions |

|

|

13,075 |

|

|

|

10.4 |

% |

|

|

13,002 |

|

|

|

11.2 |

% |

|

| |

Recycling |

|

|

10,638 |

|

|

|

8.5 |

% |

|

|

10,294 |

|

|

|

8.8 |

% |

|

| |

Total

revenues |

|

$ |

125,432 |

|

|

|

100.0 |

% |

|

$ |

116,577 |

|

|

|

100.0 |

% |

|

| |

|

|

|

|

|

|

|

|

|

|

| |

Components of revenue growth for the three months

ended March 31, 2016 compared to the three months ended March 31,

2015 are as follows: |

|

| |

|

|

|

|

|

|

|

|

|

|

| |

|

|

Amount |

|

% of Related Business |

|

% of Solid Waste Operations |

|

% of Total Company |

|

| |

Solid Waste

Operations: |

|

|

|

|

|

|

|

|

|

| |

Collection |

|

$ |

3,599 |

|

|

|

6.7 |

% |

|

|

4.3 |

% |

|

|

3.1 |

% |

|

| |

Disposal |

|

|

372 |

|

|

|

1.3 |

% |

|

|

0.4 |

% |

|

|

0.3 |

% |

|

| |

Solid Waste

Price |

|

|

3,971 |

|

|

|

|

|

4.7 |

% |

|

|

3.4 |

% |

|

| |

|

|

|

|

|

|

|

|

|

|

| |

Collection |

|

|

1,239 |

|

|

|

|

|

1.5 |

% |

|

|

1.1 |

% |

|

| |

Disposal |

|

|

4,121 |

|

|

|

|

|

4.9 |

% |

|

|

3.5 |

% |

|

| |

Processing |

|

|

(89 |

) |

|

|

|

|

-0.1 |

% |

|

|

-0.1 |

% |

|

| |

Solid Waste

Volume |

|

|

5,271 |

|

|

|

|

|

6.3 |

% |

|

|

4.5 |

% |

|

| |

|

|

|

|

|

|

|

|

|

|

| |

Fuel surcharge |

|

|

(33 |

) |

|

|

|

|

0.0 |

% |

|

|

0.0 |

% |

|

| |

Commodity price &

volume |

|

|

(398 |

) |

|

|

|

|

-0.6 |

% |

|

|

-0.4 |

% |

|

| |

Acquisitions, net

divestitures |

|

|

(288 |

) |

|

|

|

|

-0.3 |

% |

|

|

-0.2 |

% |

|

| |

Total Solid

Waste |

|

|

8,523 |

|

|

|

|

|

10.1 |

% |

|

|

7.3 |

% |

|

| |

|

|

|

|

|

|

|

|

|

|

| |

Organics |

|

|

(85 |

) |

|

|

|

|

|

|

-0.1 |

% |

|

| |

|

|

|

|

|

|

|

|

|

|

| |

Customer

Solutions |

|

|

73 |

|

|

|

|

|

|

|

0.1 |

% |

|

| |

|

|

|

|

|

|

|

|

|

|

| |

Recycling

Operations: |

|

|

|

|

|

% of Recycling Operations |

|

|

|

| |

Price |

|

|

(498 |

) |

|

|

|

|

-4.9 |

% |

|

|

-0.4 |

% |

|

| |

Volume |

|

|

842 |

|

|

|

|

|

8.2 |

% |

|

|

0.7 |

% |

|

| |

Total

Recycling |

|

|

344 |

|

|

|

|

|

3.3 |

% |

|

|

0.3 |

% |

|

| |

|

|

|

|

|

|

|

|

|

|

| |

Total

Company |

|

$ |

8,855 |

|

|

|

|

|

|

|

7.6 |

% |

|

| |

|

|

|

|

|

|

|

|

|

|

| |

Solid Waste Internalization Rates by Region for the three

months ended March 31, 2016 and 2015 are as follows: |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

Three Months Ended March 31, |

|

| |

|

|

|

|

|

|

2016 |

|

2015 |

|

| |

Eastern region |

|

|

|

|

|

|

44.7 |

% |

|

|

44.2 |

% |

|

| |

Western region |

|

|

|

|

|

|

72.6 |

% |

|

|

71.7 |

% |

|

| |

Solid waste

internalization |

|

|

|

|

|

|

57.5 |

% |

|

|

57.3 |

% |

|

| |

|

| |

Components of Capital Expenditures for the three

months ended March 31, 2016 and 2015 are as follows

(iv): |

|

| |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

Three Months Ended March 31, |

|

| |

|

|

|

|

|

|

2016 |

|

2015 |

|

| |

Total Growth

Capital Expenditures |

|

|

|

|

|

$ |

1,346 |

|

|

$ |

738 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

| |

Replacement Capital Expenditures: |

|

|

|

|

|

|

|

|

|

| |

Landfill

development |

|

|

|

|

|

$ |

3,787 |

|

|

$ |

1,238 |

|

|

| |

Vehicles, machinery, equipment and containers |

|

|

|

|

|

4,194 |

|

|

|

1,713 |

|

|

| |

Facilities |

|

|

|

|

|

|

154 |

|

|

|

169 |

|

|

| |

Other |

|

|

|

|

|

|

367 |

|

|

|

586 |

|

|

| |

Total

Replacement Capital Expenditures |

|

|

|

|

|

$ |

8,502 |

|

|

$ |

3,706 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

| |

Total Growth and Replacement Capital

Expenditures |

|

|

|

|

$ |

9,848 |

|

|

$ |

4,444 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

| |

(iv) Our capital expenditures are broadly defined as

pertaining to either growth, replacement or acquisition activities.

Growth capital expenditures are defined as costs related to

development of new airspace, permit expansions, and new recycling

contracts along with incremental costs of equipment and

infrastructure added to further such activities. Growth capital

expenditures include the cost of equipment added directly as a

result of organic business growth as well as expenditures

associated with adding infrastructure to increase throughput at

transfer stations and recycling facilities. Replacement capital

expenditures are defined as landfill cell construction costs not

related to expansion airspace, costs for normal permit renewals,

and replacement costs for equipment due to age or obsolescence.

Acquisition capital expenditures, which are not included in the

table above, are defined as costs of equipment added directly as a

result of new business growth related to an acquisition. |

|

Investors:

Ned Coletta

Chief Financial Officer

(802) 772-2239

Media:

Joseph Fusco

Vice President

(802) 772-2247

http://www.casella.com

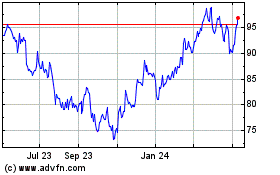

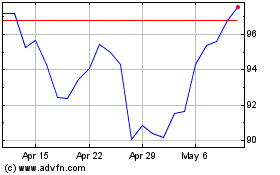

Casella Waste Systems (NASDAQ:CWST)

Historical Stock Chart

From Mar 2024 to Apr 2024

Casella Waste Systems (NASDAQ:CWST)

Historical Stock Chart

From Apr 2023 to Apr 2024