UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): June 26, 2015

Casella Waste Systems, Inc.

(Exact Name of Registrant as Specified in Charter)

|

|

|

|

|

| Delaware |

|

000-23211 |

|

03-0338873 |

| (State or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

|

|

|

| 25 Greens Hill Lane

Rutland, Vermont |

|

05701 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (802) 775-0325

Not applicable

(Former

Name or Former Address, if Changed Since Last Report)

Check the

appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 1.01. Entry into a Material Definitive Agreement.

On June 26, 2015, Casella Waste Systems, Inc., a Delaware corporation (the “Company”), entered into the First Amendment (the

“Amendment”), to the Loan and Security Agreement, dated as of February 27, 2015 (the “Loan Agreement”), by and among the Company, the Company’s subsidiaries identified therein and Bank of America, N.A., as agent for the

lenders party thereto.

The Amendment modifies the definition of “Change of Control” in the Loan Agreement to delete the

following clause at the end of subsection (b) of such definition: “(excluding, in the case of both clause (ii) and clause (iii), any individual whose initial nomination for, or assumption of office as, a member of that

board or equivalent governing body occurs as a result of an actual or threatened solicitation of proxies or consents for the election or removal of one or more directors by any person or group other than a solicitation for the election of one or

more directors by or on behalf of the board of directors)”. No other terms of the Loan Agreement were changed in connection with the Amendment and all other provisions of the Loan Agreement remain in effect.

The above description of the Amendment is qualified in its entirety by reference to the Amendment, a copy of which is attached as Exhibit 10.1

to this Current Report on Form 8-K and is incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

See Exhibit Index attached hereto.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

CASELLA WASTE SYSTEMS, INC. |

|

|

|

|

| Date: June 26, 2015 |

|

|

|

By: |

|

/s/ Edmond R. Coletta |

|

|

|

|

|

|

|

|

|

|

Edmond R. Coletta |

|

|

|

|

|

|

|

|

|

|

Senior Vice President and Chief Financial Officer |

Exhibit Index

|

|

|

| Exhibit

No. |

|

Description |

|

|

| 10.1 |

|

First Amendment to Loan and Security Agreement, dated as of June 26, 2015, by and among Casella Waste Systems, Inc., its subsidiaries listed on Schedule 1 to the Loan and Security Agreement, dated as of February 27, 2015, the

lenders from time to time party thereto, and Bank of America, N.A., as Agent |

Exhibit 10.1

[EXECUTION VERSION]

FIRST AMENDMENT TO LOAN AND SECURITY AGREEMENT

This FIRST AMENDMENT TO LOAN AND SECURITY AGREEMENT (this “First Amendment”) is made and entered into as of June 26,

2015, by and among CASELLA WASTE SYSTEMS, INC., a Delaware corporation (the “Company”), its Subsidiaries listed on Schedule 1 to the Loan and Security Agreement, dated as of February 27, 2015 (as the same may be

amended and in effect from time to time, the “Loan and Security Agreement”) (together with the Company, collectively, the “Borrowers”), the Lenders from time to time party thereto, and BANK OF AMERICA, N.A.,

as Agent.

WHEREAS, the Borrowers have requested that each of the Lenders agree, and Lenders constituting “Required

Lenders” under the terms of the Loan and Security Agreement are willing to agree, on the terms and subject to the conditions set forth herein, to amend the definition of Change of Control contained in Section 1.1 of the Loan and Security

Agreement.

NOW, THEREFORE, in consideration of the foregoing, and for other good and valuable consideration, the receipt and

sufficiency of which are hereby acknowledged, the parties agree as follows:

1. Definitions; Loan Document. Capitalized terms used

herein without definition shall have the meanings assigned to such terms in the Loan and Security Agreement. This First Amendment shall constitute a Loan Document for all purposes of the Loan and Security Agreement and the other Loan Documents.

2. Amendment to Section 1.1 (Defined Terms) of the Loan and Security Agreement. The definition of Change of Control set forth in

Section 1.1 of the Loan and Security Agreement is hereby amended and restated in its entirety as follows:

“Change of

Control: an event or series of events by which:

(a) any “person” or “group” (as such terms are

used in Sections 13(d) and 14(d) of the Exchange Act) becomes the “beneficial owner” (as defined in Rules 13d-3 and 13d-5 under the Exchange Act, except that a person or group shall be deemed to have “beneficial ownership” of all

securities that such person or group has the right to acquire, whether such right is exercisable immediately or only after the passage of time (such right, an “option right”)), directly or indirectly, of securities representing the

Applicable Control Percentage or more of the voting power of the equity securities of the Company entitled to vote (without regard to the occurrence of any contingency with respect to such vote or voting power) for members of the board of directors

or equivalent governing body of the Company; or

(b) during any period of 12 consecutive months, a majority of the members

of the board of directors or other equivalent governing body of the Company cease to be composed of individuals (i) who were members of that board or equivalent governing body on the first day of such period, (ii) whose

1

election or nomination to that board or equivalent governing body was approved by individuals referred to in clause (i) above constituting at the time of such election or nomination

at least a majority of that board or equivalent governing body, or (iii) whose election or nomination to that board or other equivalent governing body was approved by individuals referred to in clauses (i) and (ii) above

constituting at the time of such election or nomination at least a majority of that board or equivalent governing body; or

(c) any Person or two or more Persons acting in concert shall have entered into a contract or agreement with the Company (or

Affiliate of the Company) that, upon consummation thereof, will result in its or their acquisition of 49% or more of the voting power of the equity securities of the Company entitled to vote (without regard to the occurrence of any contingency with

respect to such vote or voting power) for members of the board of directors or equivalent governing body of the Company (and taking into account all such securities that such Person or Persons have the right to acquire pursuant to any option right)

if such contract or agreement does not provide for Full Payment of the Obligations simultaneously with the consummation of the transactions contemplated by such contract or agreement; or

(d) (i) a “change of control” or any comparable term under, and as defined in, any Subordinated Debt or the Senior

Subordinated Debt Documents (or any replacements or refinancings of any thereof) shall have occurred or (ii) a Deemed Liquidation Event under the terms of any Preferred Stock of the Company shall have occurred.”

3. No Waiver. Nothing contained herein shall be deemed to (i) constitute a waiver of any Default or Event of Default that may

heretofore or hereafter occur or have occurred and be continuing or, except as expressly set forth herein, to otherwise modify any provision of the Loan and Security Agreement or any other Loan Document, or (ii) give rise to any defenses or

counterclaims to the Agent’s or any of the Lenders’ right to compel payment of the Obligations when due or to otherwise enforce their respective rights and remedies under the Loan and Security Agreement and the other Loan Documents.

4. Conditions to Effectiveness. This First Amendment shall become effective as of the date when each of the following conditions is

satisfied:

(a) The Agent’s receipt of the following, each of which shall be originals, electronic pdfs or faxes unless otherwise

specified, each dated as of the date hereof and each in form and substance satisfactory to the Agent unless otherwise specified (it being agreed by the parties hereto that any electronic pdf or faxed copies will be followed promptly by originals):

(i) counterparts of this First Amendment, duly and properly authorized, executed and delivered by a Senior Officer of each

of the Borrowers, and by the Required Lenders;

2

(ii) such certificates of resolutions or other action, incumbency certificates

and/or other certificates of Senior Officers of each Borrower as the Agent may reasonably require evidencing the identity, authority and capacity of each Senior Officer thereof authorized to act as a Senior Officer in connection with this First

Amendment; and

(iii) such other assurances, certificates, documents, consents or opinions as the Agent reasonably may

require.

(b) The Borrowers shall have paid all fees, charges and disbursements of counsel (including any local counsel) to the Agent

(directly to such counsel if requested by the Agent) to the extent invoiced prior to or on the date hereof.

5. Representations and

Warranties. The Borrowers jointly and severally represent and warrant to the Agent and the Lenders that, on and as of the date of this First Amendment:

(a) The execution, delivery and performance of this First Amendment and the transactions contemplated hereby (i) are within the corporate

(or the equivalent company or partnership) authority of each of the Borrowers, (ii) have been duly authorized by all necessary corporate (or other) proceedings, (iii) do not conflict with or result in any material breach or contravention

of any provision of any Applicable Law to which any of the Borrowers is subject or any judgment, order, writ, injunction, license or permit applicable to any of the Borrowers so as to materially adversely affect the assets, business or any activity

of the Borrowers, and (iv) do not conflict with any provision of the corporate charter, articles or bylaws (or equivalent other entity or partnership documents) of the Borrowers or any material agreement or other material instrument binding

upon the Borrowers, including, without limitation, any Senior Subordinated Notes Document.

(b) The execution, delivery and performance of

this First Amendment will result in valid and legally binding obligations of the Borrowers enforceable against each in accordance with the respective terms and provisions hereof and thereof, except as enforceability is limited by bankruptcy,

insolvency, reorganization, moratorium or other Applicable Laws relating to or affecting generally the enforcement of creditors’ rights and except to the extent that availability of the remedy of specific performance or injunctive relief or

other equitable remedy is subject to the discretion of the court before which any proceeding therefor may be brought.

(c) The execution,

delivery and performance by the Borrowers of this First Amendment and the transactions contemplated hereby do not require any approval or consent of, or filing with, any Governmental Authority other than those already obtained in writing (copies of

which have been delivered to the Agent), if any.

(d) The representations and warranties contained in Section 9 of the Loan and

Security Agreement are true and correct in all material respects as of the date hereof as though made on and as of the date hereof, except to the extent that such representations and warranties specifically refer to an earlier date, in which case

they shall be true and correct as of such earlier date and except to the extent of changes resulting from transactions contemplated or permitted by

3

the Loan and Security Agreement as amended by the First Amendment and changes occurring in the ordinary course of business which do not have a Material Adverse Effect. For purposes of this

Paragraph 5(d), the representations and warranties contained in Section 9.5.1 of the Loan and Security Agreement shall be deemed to refer to the most recent statements furnished pursuant to Section 10.1.2(a) of the Loan and Security

Agreement.

(e) Both before and after giving effect to this First Amendment and the transactions contemplated hereby, no Default or Event

of Default under the Loan and Security Agreement has occurred and is continuing.

6. Ratification, etc. Except as expressly amended

hereby, the Loan and Security Agreement, the other Loan Documents and all documents, instruments and agreements related thereto are hereby ratified and confirmed in all respects and shall continue in full force and effect. This First Amendment and

the Loan and Security Agreement shall hereafter be read and construed together as a single document, and all references in the Loan and Security Agreement, any other Loan Document or any agreement or instrument related to the Loan and Security

Agreement shall hereafter refer to the Loan and Security Agreement as amended by this First Amendment.

7. GOVERNING LAW. THIS FIRST

AMENDMENT SHALL BE GOVERNED BY AND CONSTRUED IN ACCORDANCE WITH THE LAWS OF THE STATE OF NEW YORK.

8. Counterparts. This First

Amendment may be executed in any number of counterparts and by different parties hereto on separate counterparts, each of which when so executed and delivered shall be an original, but all of which counterparts taken together shall be deemed to

constitute one and the same instrument. Delivery of an executed counterpart of a signature page of this First Amendment by facsimile or other electronic transmission shall be as effective as delivery of an original executed counterpart of this First

Amendment.

[REMAINDER OF PAGE INTENTIONALLY LEFT BLANK]

4

IN WITNESS WHEREOF, each of the undersigned has duly executed this First Amendment to Loan

and Security Agreement as a sealed instrument as of the date first set forth above.

|

|

|

| BORROWERS: |

|

| CASELLA WASTE SYSTEMS, INC. |

|

|

| By: |

|

/s/ Edmond R. Coletta |

| Name: |

|

Edmond R. Coletta |

| Title: |

|

Senior Vice President and Chief Financial Officer |

|

| ALL CYCLE WASTE, INC. |

| ATLANTIC COAST FIBERS, INC. |

| BLOW BROS. |

| BRISTOL WASTE MANAGEMENT, INC. |

| C.V. LANDFILL, INC. |

| CASELLA MAJOR ACCOUNT SERVICES, LLC |

| CASELLA RECYCLING, LLC |

| CASELLA RENEWABLE SYSTEMS, LLC |

| CASELLA TRANSPORTATION, INC. |

| CASELLA WASTE MANAGEMENT OF MASSACHUSETTS, INC. |

| CASELLA WASTE MANAGEMENT OF N.Y., INC. |

| CASELLA WASTE MANAGEMENT OF PENNSYLVANIA, INC. |

| CASELLA WASTE MANAGEMENT, INC. |

| CASELLA WASTE SERVICES OF ONTARIO LLC |

| CHEMUNG LANDFILL LLC |

| COLEBROOK LANDFILL LLC |

| FOREST ACQUISITIONS, INC. |

| GRASSLANDS INC. |

| GROUNDCO LLC |

| HAKES C&D DISPOSAL, INC. |

| HARDWICK LANDFILL, INC. |

| HIRAM HOLLOW REGENERATION CORP. |

| KTI BIO FUELS, INC. |

| KTI ENVIRONMENTAL GROUP, INC. |

| KTI NEW JERSEY FIBERS, INC. |

| KTI OPERATIONS, INC. |

| KTI SPECIALTY WASTE SERVICES, INC. |

| KTI, INC. |

|

|

| By: |

|

/s/ Edmond R. Coletta |

| Name: |

|

Edmond R. Coletta |

| Title: |

|

Vice President and Treasurer |

Signature Page to

First Amendment

|

|

|

| MAINE ENERGY RECOVERY COMPANY, LIMITED PARTNERSHIP |

| NEW ENGLAND WASTE SERVICES OF ME, INC. |

| NEW ENGLAND WASTE SERVICES OF N.Y., INC. |

| NEW ENGLAND WASTE SERVICES OF VERMONT, INC. |

| NEW ENGLAND WASTE SERVICES, INC. |

| NEWBURY WASTE MANAGEMENT, INC. |

| NEWS OF WORCESTER LLC |

| NEWSME LANDFILL OPERATIONS LLC |

| NORTH COUNTRY ENVIRONMENTAL SERVICES, INC. |

| NORTHERN PROPERTIES CORPORATION OF PLATTSBURGH |

| OXFORD TRANSFER STATION, LLC |

| PINE TREE WASTE, INC. |

| SCHULTZ LANDFILL, INC. |

| SOUTHBRIDGE RECYCLING & DISPOSAL PARK, INC. |

| SUNDERLAND WASTE MANAGEMENT, INC. |

| THE HYLAND FACILITY ASSOCIATES |

| TOMPKINS COUNTY RECYCLING LLC |

| WASTE-STREAM INC. |

|

|

| By: |

|

/s/ Edmond R. Coletta |

| Name: |

|

Edmond R. Coletta |

| Title: |

|

Vice President and Treasurer |

Signature Page to

First Amendment

|

|

|

| BANK OF AMERICA, N.A., |

| as Agent and a Lender |

|

|

| By: |

|

/s/ Christopher M. O’Halloran |

| Name: |

|

Christopher M. O’Halloran |

| Title: |

|

Senior Vice President |

Signature Page to

First Amendment

|

|

|

| COMERICA BANK, |

| as a Lender |

|

|

| By: |

|

/s/ Tony G. Rice |

| Name: |

|

Tony G. Rice |

| Title: |

|

Vice President |

Signature Page to

First Amendment

|

|

|

| JPMORGAN CHASE BANK, N.A., |

| as a Lender |

|

|

| By: |

|

/s/ Thomas G. Williams |

| Name: |

|

Thomas G. Williams |

| Title: |

|

Authorized Officer |

Signature Page to

First Amendment

|

|

|

| TD BANK, N.A., |

| as a Lender |

|

|

| By: |

|

/s/ Christopher J. Hackett |

| Name: |

|

Christopher J. Hackett |

| Title: |

|

Vice President |

Signature Page to

First Amendment

|

|

|

| WELLS FARGO BANK, N.A., |

| as a Lender |

|

|

| By: |

|

/s/ Todd Nakamoto |

| Name: |

|

Todd Nakamoto |

| Title: |

|

Duly Authorized Signer |

Signature Page to

First Amendment

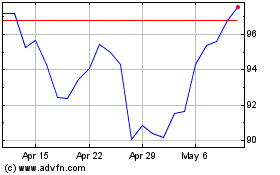

Casella Waste Systems (NASDAQ:CWST)

Historical Stock Chart

From Mar 2024 to Apr 2024

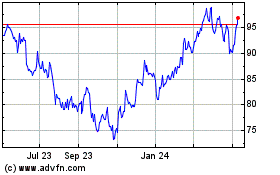

Casella Waste Systems (NASDAQ:CWST)

Historical Stock Chart

From Apr 2023 to Apr 2024