Cisco Results Hurt by Weaker Market for Networking Devices

February 15 2017 - 5:00PM

Dow Jones News

By Rachael King

Even as Cisco Systems Inc. makes some gains in new strategic

areas such as security, the company continues to battle weak

customer spending in its core market for networking gear.

The Silicon Valley company said Wednesday second-quarter revenue

fell 2.9% due to weak spending among service providers for

switching systems that help move network traffic. The company has

now posted revenue declines for five straight quarters.

Shares of Cisco fell 1% after hours.

Cisco said its profit for the quarter ended Jan. 28 fell 25% to

$2.35 billion, or 47 cents a share. Excluding charges, adjusted

earnings per share were 57 cents, compared with an analysts'

consensus estimate of 56 cents a share, according to a Thomson

Reuters poll of analysts.

The San Jose, Calif., company's results often reflect changes in

technology spending patterns ahead of peers.

Cisco's switching revenue fell 5%, and routing revenue dropped

10%. Meanwhile, wireless revenue rose 3%, collaboration revenue

climbed 4% and security revenue jumped 14%.

Cisco Chief Executive Chuck Robbins said in prepared remarks

that he was pleased with "continued customer momentum as we help

them drive security, automation and intelligence across the network

and into the cloud."

Mr. Robbins, who became CEO in 2015, is trying to chart a future

for Cisco in software for security and collaboration as the

company's main hardware business has come under pressure from

competitors over the past few years.

To that end, Cisco said in January it would purchase software

firm AppDynamics Inc. for $3.7 billion. That deal, which help

bolster Cisco's software offerings for large business customers, is

expected to close during the third quarter.

Even as the company continues to see healthy growth in security

software revenue, it is facing increasing competition in its core

switching business. In particular some large customers are turning

to competitors such as Arista Networks Inc. or inexpensive

commodity-style switching systems from vendors such as Taiwan's

Quanta Computer Inc.

In particular, the highest-growth segment in the switching

market is the nearly $8 billion that cloud providers and telecom

service providers spend annually on network switching gear, said

Rohit Mehra, an analyst who leads IDC's networking practice.

In many cases, larger cloud providers and telecom service

providers are looking for hardware that can be easily customized,

automated and managed remotely, Mr. Mehra said. "This is where

Cisco is having challenges competing," he said, adding that Cisco

has made progress in adapting its products.

Write to Rachael King at rachael.king@wsj.com

(END) Dow Jones Newswires

February 15, 2017 16:45 ET (21:45 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

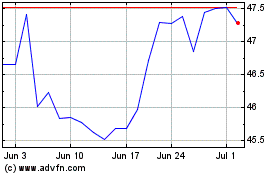

Cisco Systems (NASDAQ:CSCO)

Historical Stock Chart

From Mar 2024 to Apr 2024

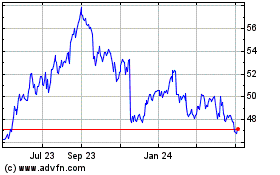

Cisco Systems (NASDAQ:CSCO)

Historical Stock Chart

From Apr 2023 to Apr 2024