Cisco to Buy AppDynamics for $3.7 Billion -- 2nd Update

January 24 2017 - 10:13PM

Dow Jones News

By Rachael King and Dana Cimilluca

Cisco Systems Inc. is buying software company AppDynamics Inc.

for $3.7 billion, plucking the startup from IPO registration at a

big premium in an effort to bolster its software offerings to large

enterprise customers.

AppDynamics, whose software helps companies including Cisco

monitor the performance of their applications, was gearing up to be

the first tech company to go public this year. The company was

expected to price Wednesday night, and earlier Tuesday bankers

increased the IPO's estimated price that would have valued

AppDynamics at as high as about $2 billion.

Cisco agreed to pay about $26 a share, according to a person

familiar with the matter, well above the company's original price

range of $10 to $12 a share.

Under CEO Chuck Robbins, Cisco has placed increasing importance

on software. The company has long held a dominant share of sales of

the routing and switching equipment used to funnel data over the

internet and between computers in data centers. As competitors

enter the market with less expensive options, Cisco has focused on

other business lines such as security, collaboration and the

"Internet of Things."

Cisco's price nearly doubles the $1.9 billion valuation that

AppDynamics' investors placed on the company in late 2015. Those

backers include venture firms Greylock Partners and Lightspeed

Venture Partners, which each owned 20.8% of AppDynamics valued in

the deal at over a half-billion dollars.

AppDynamics had originally planned its debut for December but

postponed the offering due to uncertainty following the U.S.

presidential election. The company was set to lead an expected

charge of IPOs after one of the slowest years for new U.S. listings

in more than a decade.

The startup was founded in 2008 by veteran startup engineer

Jyoti Bansal, who saw that companies were becoming more reliant on

increasingly complex software. Customers such as airlines, banks

and retailers use the software to monitor the performance of their

applications to ensure they are running smoothly.

One of the benefits of AppDynamics's software is that it lets

companies monitor applications and fix problems across different

cloud services from companies like Alphabet Inc.'s Google and

International Business Machines Inc. This will become increasingly

important as companies shift their applications to run in data

centers from multiple providers.

"In a multi-cloud world, your ability to maintain quality of

service and visibility can become obfuscated," said Hilton

Romanski, chief strategy officer at Cisco, in an interview.

He said Cisco has been an AppDynamics customer for more than two

years. Cisco put a premium on the IPO price partially because of

the company's high revenue growth. In the first nine months of

2016, AppDynamics lost about $95 million on revenue of $158

million, up about 54% from a year earlier.

AppDynamics, which will continue to be led by CEO David

Wadhwani, will become a new unit in Cisco's Internet of Things and

Applications business. Cisco has long promoted the shift to the

"Internet of Things" -- a concept describing the myriad of

network-connected devices -- as the next major phase in the

evolution of the internet. Last year, Cisco bought Internet of

Things platform maker Jasper Technologies for $1.4 billion.

Beyond the Internet of Things, Mr. Romanski expects to spread

AppDynamics's technology across a number of businesses including

core networking, security and network analytics.

Write to Rachael King at rachael.king@wsj.com and Dana Cimilluca

at dana.cimilluca@wsj.com

(END) Dow Jones Newswires

January 24, 2017 21:58 ET (02:58 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

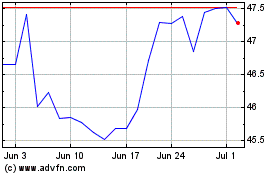

Cisco Systems (NASDAQ:CSCO)

Historical Stock Chart

From Mar 2024 to Apr 2024

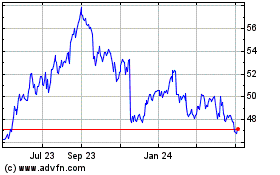

Cisco Systems (NASDAQ:CSCO)

Historical Stock Chart

From Apr 2023 to Apr 2024