Cisco Tops Expectations As Firm Branches Out -- WSJ

May 19 2016 - 3:04AM

Dow Jones News

By Don Clark and Nathan Becker

Cisco Systems Inc. continued to battle weak technology spending

in its latest quarter, but the Silicon Valley company's numbers

showed progress in building businesses beyond networking gear.

The company said third-quarter net income declined nearly 4%

while revenue slid 1% for the period ended in April. But Cisco's

results came in better than analysts expected, as did its financial

projections for the current quarter.

Cisco shares rose 6% in after-hours trading. As of Wednesday's

close, the stock had fallen 5.2% in the past month.

The San Jose, Calif., company's results often reflect changes in

technology spending patterns ahead of peers. Cisco said last

quarter that customers appeared to be spooked by the stock market

selloff in January.

In the latest quarter, Cisco's biggest businesses -- switching

and routing systems -- continued to show the signs of tepid demand.

Switching revenue fell 3%, while revenue in the company's routing

business fell 5%.

Chuck Robbins, Cisco's chief executive, said customers tend to

be spending mainly where the need for new hardware is urgent -- not

upgrading gear that is working satisfactorily.

"We see customers spending where they need to spend," he said

during a conference call. "There is still a fair amount of caution

in the market."

But Cisco has moved into many other software and services

businesses -- largely through acquisitions -- that help smooth out

swings in corporate demand and generate recurring revenue that is a

key corporate goal. Contributors include Cisco's business in

videoconferencing and other collaboration offerings, its

third-biggest revenue stream, where revenue climbed 10%. Revenue

from security products and services rose 17%.

Dave Heger, an analyst at Edward Jones, said the decline in

revenue from switching and routing was greater than expected and "a

little bit concerning." But he said Cisco's overall results

counteracted a recent sense of pessimism about the

enterprise-technology sector.

"There may a sense of relief," Mr. Heger said.

Cisco, whose business in China endured a long slide that ended

recently, said orders from the country increased 22%.

Overall for the third quarter ended April 30, Cisco reported

earnings of $2.35 billion, or 46 cents a share, down from $2.44

billion, or 47 cents a share. Revenue declined to $12 billion from

$12.14 billion, though it rose 3% excluding a business in home

cable TV hardware sold last year.

Excluding items such as stock-based compensation, the company

said per-share earnings came to 57 cents. Analysts on that basis

had predicted 55 cents a share on revenue of $11.97 billion,

according to Thomson Reuters.

For the fourth quarter, Cisco predicted adjusted per-share

earnings of 59 cents to 61 cents. It said revenue excluding the

former cable-related business would be flat to up 3%, a range with

an indicated midpoint of $12.5 billion. Analysts had projected

earnings per share on that basis of 58 cents on revenue of $12.42

billion.

Write to Nathan Becker at nathan.becker@wsj.com

(END) Dow Jones Newswires

May 19, 2016 02:49 ET (06:49 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

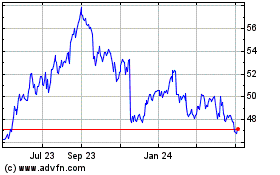

Cisco Systems (NASDAQ:CSCO)

Historical Stock Chart

From Mar 2024 to Apr 2024

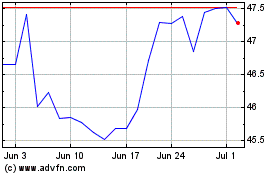

Cisco Systems (NASDAQ:CSCO)

Historical Stock Chart

From Apr 2023 to Apr 2024