Brocade Strikes $1.2 Billion Deal for Ruckus Wireless -- Update

April 04 2016 - 4:06PM

Dow Jones News

By Don Clark and Joshua Jamerson

Brocade Communications Systems Inc. agreed to buy Ruckus

Wireless for about $1.2 billion, the latest in a series of moves by

network-equipment companies to expand their Wi-Fi offerings.

The deal, which values Ruckus at $14.43 a share, caused that

company's stock to jump 32% to $13.20 a share. Brocade's stock fell

14% to $9.15.

Brocade, based in Sunnyvale, Calif., was originally known for

networking hardware used in data storage applications. But the

company has branched into other networking segments, including

routers and switches sold in competition with the likes of Cisco

Systems Inc.

Ruckus, also based in Sunnyvale, specializes in Wi-Fi gear used

by companies and public venues. Its chief executive, Selina Lo, is

one of a small number of female CEOs of publicly held tech

companies.

The growing popularity of Wi-Fi has triggered other deals in the

sector. Cisco, for example, in 2012 agreed to buy Meraki Inc. for

$1.2 billion. Hewlett-Packard Co. in March 2015 announced a deal to

buy Aruba Networks Inc. for about $3 billion; that business is now

part of Hewlett Packard Enterprise Co. since the H-P breakup.

Lloyd Carney, Brocade's chief executive, said those two deals --

and the prospect of competing against companies with expanded

product lines -- helped prompt the decision to buy Ruckus. He said

the acquisition will help Brocade compete with the two larger

companies without worrying partners that sell computing and storage

products in competition with them, like International Business

Machines Corp. and Dell Inc.

"Our larger partners like the fact that they know we're never

going to be in their business," he said. "They know where our swim

lanes are."

Ruckus went public in 2012 at a price of $15 a share. After an

initial run-up, the stock has traded considerably below that.

Dan Rabinovitsj, its chief operating officer, said his company

wasn't looking to be acquired. But he said the company's board

responded favorably to the price Brocade offered.

In the combined company, Ms. Lo will lead the Ruckus

organization and report directly to Mr. Carney.

The companies expect the transaction to close in Brocade's third

fiscal quarter of 2016.

Brocade will pay about $1.5 billion in total, before deducting

cash and investments held by Ruckus. That company's stockholders

will receive $6.45 in cash and 0.75 shares of Brocade for each

share. The transaction price may fluctuate until close, the

companies said.

Ruckus on Monday raised the lower end of its profit and revenue

forecasts for the first quarter. The company said it now expects

adjusted profit of 9 cents to 10 cents a share on revenue in the

range of $98 million to $101 million.

In February, the company had issued guidance for first-quarter

profit of 8 cents to 10 cents a share on revenue of $96 million to

$101 million, according to FactSet.

The company also now expects adjusted-operating margin in the

range of 9% to 11%, compared with prior guidance of 8.5% to

11%.

Brocade said it had increased its stock-repurchase program by

$800 million, bringing the total remaining amount authorized under

the program to about $1.7 billion. That move was meant to

facilitate the repurchase of all shares issued in conjunction with

the Ruckus acquisition

--Ryan Knutson contributed to this article.

Write to Don Clark at don.clark@wsj.com and Joshua Jamerson at

joshua.jamerson@wsj.com

(END) Dow Jones Newswires

April 04, 2016 15:51 ET (19:51 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

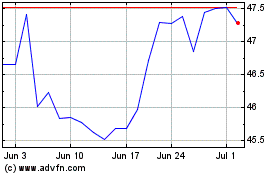

Cisco Systems (NASDAQ:CSCO)

Historical Stock Chart

From Mar 2024 to Apr 2024

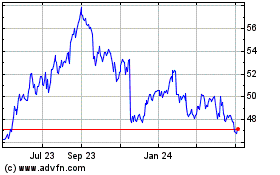

Cisco Systems (NASDAQ:CSCO)

Historical Stock Chart

From Apr 2023 to Apr 2024