As filed with the Securities and Exchange Commission on June 19, 2015 Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________

FORM S-8

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

______________________

CISCO SYSTEMS, INC.

(Exact Name of Registrant as Specified in Its Charter)

|

| | |

California | | 77-0059951 |

(State or Other Jurisdiction

of Incorporation or Organization) | | (I.R.S. Employer

Identification No.) |

170 West Tasman Drive

San Jose, California 95134-1706

(Address of Principal Executive Offices) (Zip Code)

Restricted stock units granted under the Piston Cloud Computing, Inc. 2015 Equity Incentive Plan, and assumed by the Registrant

(Full Title of the Plan)

______________________

John T. Chambers

Chairman and Chief Executive Officer

Cisco Systems, Inc.

300 East Tasman Drive

San Jose, California 95134-1706

(Name and Address of Agent For Service)

(408) 526-4000

(Telephone Number, including area code, of agent for service)

______________________

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

| |

Large accelerated filer x | Accelerated filer o |

Non-accelerated filer o (Do not check if a smaller reporting company) | Smaller reporting company o

|

CALCULATION OF REGISTRATION FEE |

| | | | |

Title of Securities To Be Registered | Amount To Be Registered (1) | Proposed Maximum Offering Price Per Share | Proposed Maximum Aggregate Offering Price | Amount of Registration Fee |

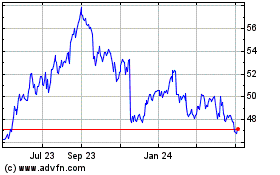

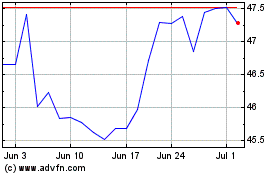

In respect of assumed restricted stock units: Common Stock, $0.001 par value per share (2) | 253,414 (2) | $28.54 (3) | $7,232,435.56 (3) | $840.41(3) |

| |

(1) | This Registration Statement shall also cover any additional shares of the Registrant's common stock that become issuable in respect of the securities identified in the above table by reason of any stock dividend, stock split, recapitalization or other similar transaction effected without the Registrant's receipt of consideration which results in an increase in the number of the outstanding shares of the Registrant's common stock. |

| |

(2) | Represents shares subject to issuance in connection with restricted stock units outstanding under the Piston Cloud Computing, Inc. 2015 Equity Incentive Plan, and assumed by the Registrant on June 12, 2015 pursuant to an Agreement and Plan of Merger by and among the Registrant, Piston Cloud Computing, Inc., Pegasus Acquisition Corp. and the Stockholders’ Agent, dated as of May 29, 2015. |

| |

(3) | Calculated solely for the purposes of this offering under Rule 457(c) and (h) of the Securities Act of 1933, as amended, on the basis of the average of the high and low prices of the Registrant’s common stock as reported on The NASDAQ Global Select Market on June 16, 2015. |

TABLE OF CONTENTS

|

| | |

PART II | | |

Item 3. | | II-1 |

Item 4. | | II-1 |

Item 5. | | II-1 |

Item 6. | | II-1 |

Item 7. | | II-2 |

Item 8. | | II-2 |

Item 9. | | II-3 |

| | |

| | |

EXHIBIT INDEX

EXHIBIT 5.1

EXHIBIT 23.1

EXHIBIT 99.1

EXHIBIT 99.2

PART II

Information Required in the Registration Statement

Item 3. Incorporation of Documents by Reference.

Cisco Systems, Inc. (the “Registrant”) hereby incorporates by reference into this Registration Statement the following documents previously filed with the Securities and Exchange Commission (the “Commission”):

| |

(a) | The Registrant’s Annual Report on Form 10-K for the fiscal year ended July 26, 2014 filed with the Commission on September 9, 2014 pursuant to Section 13 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”); |

| |

(b) | All other reports filed pursuant to Section 13(a) or 15(d) of the Exchange Act since the end of the fiscal year covered by the Registrant’s Annual Report referred to in (a) above; and |

| |

(c) | The description of the Registrant’s Common Stock contained in the Registrant’s Registration Statement on Form 8-A (No. 000-18225) filed with the Commission on January 11, 1990, together with Amendment No. 1 on Form 8-A filed with the Commission on February 15, 1990, and including any other amendments or reports filed for the purpose of updating such description. |

All reports and definitive proxy or information statements filed pursuant to Section 13(a), 13(c), 14 or 15(d) of the Exchange Act subsequent to the filing of this Registration Statement and prior to the filing of a post-effective amendment which indicates that all securities offered hereby have been sold or which de-registers all securities then remaining unsold shall be deemed to be incorporated by reference into this Registration Statement and to be a part hereof from the date of filing such documents, except as to specific sections of such statements as set forth therein. Unless expressly incorporated into this Registration Statement, a report furnished on Form 8-K prior or subsequent to the date hereof shall not be incorporated by reference into this Registration Statement. Any statement contained in a document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded for purposes of this Registration Statement to the extent that a statement contained in any subsequently filed document which also is deemed to be incorporated by reference herein modifies or supersedes such statement.

Item 4. Description of Securities.

Not applicable.

Item 5. Interests of Named Experts and Counsel.

As of the date of this Registration Statement, attorneys of Fenwick & West LLP beneficially own an aggregate of approximately 84,000 shares of the Registrant’s common stock.

Item 6. Indemnification of Directors and Officers.

Section 317 of the California Corporations Code authorizes a court to award or a corporation’s Board of Directors to grant indemnity to directors and officers in terms sufficiently broad to permit indemnification (including reimbursement of expenses incurred) under certain circumstances for liabilities arising under the Securities Act of 1933, as amended (the “Securities Act”). The Registrant’s Restated Articles of Incorporation, as amended, and Amended and Restated Bylaws provide for indemnification of its directors, officers, employees and other agents to the maximum extent permitted by the California Corporations Code. In addition, the Registrant has entered into Indemnification Agreements with each of its directors and officers, and maintains directors’ and officers’ liability insurance under which its directors and officers are insured against loss (as defined in the policy) as a result of certain claims brought against them in such capacities.

Item 7. Exemption from Registration Claimed.

Not applicable.

Item 8. Exhibits.

|

| | | | | | |

Exhibit |

| Incorporated by Reference | Filed |

Number | Exhibit Description | Form | File No. | Exhibit | Filing Date | Herewith |

|

|

|

|

|

|

|

4.1 | Restated Articles of Incorporation of Cisco Systems, Inc., as currently in effect. | S-3 | 333-56004 | 4.1 | February 21, 2001 |

|

|

|

|

|

|

|

|

4.2 | Amended and Restated Bylaws of Cisco Systems, Inc., as currently in effect. | 8-K | 000-18225 | 3.1 | October 4, 2012 |

|

|

|

|

|

|

|

|

5.1 | Opinion and Consent of Fenwick & West LLP. |

|

|

|

| X |

|

|

|

|

|

|

|

23.1 | Consent of Independent Registered Public Accounting Firm. |

|

|

|

| X |

|

|

|

|

|

|

|

23.2 | Consent of Fenwick & West LLP (contained in Exhibit 5.1). |

|

|

|

| X |

|

|

|

|

|

|

|

24 | Power of Attorney (incorporated by reference to Page II‑4 of this Registration Statement). |

|

|

|

| X |

|

|

|

|

|

|

|

99.1 | Piston Cloud Computing, Inc. 2015 Equity Incentive Plan. |

|

|

|

| X |

|

|

|

|

|

|

|

99.2 | Forms of Cisco Systems, Inc. Restricted Stock Unit Assumption Agreement. |

|

|

|

| X |

Item 9. Undertakings.

A. The undersigned Registrant hereby undertakes: (1) to file, during any period in which offers or sales are being made, a post-effective amendment to this Registration Statement: (i) to include any prospectus required by Section 10(a)(3) of the Securities Act; (ii) to reflect in the prospectus any facts or events arising after the effective date of the Registration Statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in this Registration Statement — notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than a 20 percent change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective Registration Statement; and (iii) to include any material information with respect to the plan of distribution not previously disclosed in the Registration Statement or any material change to such information in the Registration Statement; provided, however, that clauses (1)(i) and (1)(ii) shall not apply if the information required to be included in a post-effective amendment by those clauses is contained in periodic reports filed with or furnished to the Commission by the Registrant pursuant to Section 13 or Section 15(d) of the Exchange Act that are incorporated by reference in this Registration Statement; (2) that, for the purpose of determining any liability under the Securities Act, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof; and (3) to remove from registration by means of a post-effective amendment any of the securities being registered that remain unsold at the termination of the offering.

B. The undersigned Registrant hereby undertakes that, for purposes of determining any liability under the Securities Act, each filing of the Registrant’s annual report pursuant to Section 13(a) or Section 15(d) of the Exchange Act that is incorporated by reference into this Registration Statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

C. Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons of the Registrant pursuant to the indemnification provisions summarized in Item 6, or otherwise, the Registrant has been advised that in the opinion of the Commission such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the Registrant of expenses incurred or paid by a director, officer or controlling person of the Registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the Registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the Registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-8 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of San Jose, State of California, on June 19, 2015.

|

|

Cisco Systems, Inc. |

|

By: /s/ John T. Chambers |

John T. Chambers, |

Chairman and Chief Executive Officer |

|

POWER OF ATTORNEY

KNOW ALL PERSONS BY THESE PRESENTS, that each person whose signature appears below does hereby constitute and appoint John T. Chambers, Charles H. Robbins, Kelly A. Kramer and Mark Chandler, and each of them, with full power of substitution, such person’s true and lawful attorneys-in-fact and agents for such person, with full power and authority to do any and all acts and things and to execute any and all instruments which said attorneys and agents, and any one of them, determine may be necessary or advisable or required to enable said corporation to comply with the Securities Act of 1933, as amended, and any rules or regulations or requirements of the Securities and Exchange Commission in connection with this Registration Statement. Without limiting the generality of the foregoing power and authority, the powers granted include the power and authority to sign the names of the undersigned officers and directors in the capacities indicated below to this Registration Statement, to any and all amendments, both pre-effective and post-effective, and supplements to this Registration Statement, and to any and all instruments or documents filed as part of or in conjunction with this Registration Statement or amendments or supplements thereof, and each of the undersigned hereby ratifies and confirms that all said attorneys and agents, or any one of them, shall do or cause to be done by virtue hereof. This Power of Attorney may be signed in several counterparts.

Pursuant to the requirements of the Securities Act of 1933, as amended, this Registration Statement has been signed by the following persons on behalf of the Registrant in the capacities and on the dates indicated.

|

| | |

Signature | Title | Date |

| | |

/s/ John T. Chambers | Chairman and Chief Executive Officer | June 19, 2015 |

John T. Chambers | (Principal Executive Officer) | |

| | |

/s/ Kelly A. Kramer | Executive Vice President and Chief Financial Officer | June 19, 2015 |

Kelly A. Kramer | (Principal Financial Officer) | |

| | |

/s/ Prat S. Bhatt | Senior Vice President, Corporate Controller and Chief Accounting Officer | June 19, 2015 |

Prat S. Bhatt | (Principal Accounting Officer) | |

| | |

| | |

| | |

|

| | |

Signature | Title | Date |

| | |

| | |

| | |

/s/ Carol A. Bartz | Lead Independent Director | June 19, 2015 |

Carol A. Bartz | | |

| | |

/s/ M. Michele Burns | Director | June 19, 2015 |

M. Michele Burns | | |

| | |

| Director | |

Michael D. Capellas | | |

| | |

/s/ Brian L. Halla | Director | June 19, 2015 |

Brian L. Halla | | |

| | |

| Director | |

Dr. John L. Hennessy | | |

| | |

/s/ Kristina M. Johnson | Director | June 19, 2015 |

Dr. Kristina M. Johnson | | |

| | |

/s/ Roderick C. McGeary | Director | June 19, 2015 |

Roderick C. McGeary | | |

| | |

/s/ Charles H. Robbins | Director | June 19, 2015 |

Charles H. Robbins | | |

| | |

/s/ Arun Sarin | Director | June 19, 2015 |

Arun Sarin | | |

| | |

/s/ Steven M. West | Director | June 19, 2015 |

Steven M. West | | |

EXHIBIT INDEX

|

| | | | | | |

Exhibit |

| Incorporated by Reference | Filed |

Number | Exhibit Description | Form | File No. | Exhibit | Filing Date | Herewith |

| | | | | | |

4.1 | Restated Articles of Incorporation of Cisco Systems, Inc., as currently in effect. | S-3 | 333-56004 | 4.1 | February 21, 2001 |

|

| | | | | | |

4.2 | Amended and Restated Bylaws of Cisco Systems, Inc., as currently in effect. | 8-K | 000-18225 | 3.1 | October 4, 2012 |

|

| | | | | | |

5.1 | Opinion and Consent of Fenwick & West LLP. |

|

|

|

| X |

| | | | | | |

23.1 | Consent of Independent Registered Public Accounting Firm. |

|

|

|

| X |

| | | | | | |

23.2 | Consent of Fenwick & West LLP (contained in Exhibit 5.1). |

|

|

|

| X |

| | | | | | |

24 | Power of Attorney (incorporated by reference to Page II‑4 of this Registration Statement). |

|

|

|

| X |

| | | | | | |

99.1 | Piston Cloud Computing, Inc. 2015 Equity Incentive Plan. |

|

|

|

| X |

| | | | | | |

99.2 | Forms of Cisco Systems, Inc. Restricted Stock Unit Assumption Agreement. |

|

|

|

| X |

Exhibit 5.1

June 19, 2015

Cisco Systems, Inc.

170 West Tasman Drive

San Jose, CA 95134-1706

Dear Gentlemen/Ladies:

At your request, we have examined the Registration Statement on Form S-8 (the “Registration Statement”) to be filed by Cisco Systems, Inc., a California corporation (“Cisco” or the “Company”), with the Securities and Exchange Commission (the “Commission”) on or about June 19, 2015 in connection with the registration under the Securities Act of 1933, as amended, of an aggregate of 253,414 shares of Cisco’s Common Stock (the “Shares”) subject to issuance by Cisco upon the settlement of Restricted Stock Units (the “RSUs”) granted under the Piston Cloud Computing, Inc. 2015 Equity Incentive Plan (the “Plan”) and assumed by Cisco in accordance with the terms of an Agreement and Plan of Merger, dated as of May 29, 2015 (the “Merger Agreement”) by and among Cisco, Pegasus Acquisition Corp., a Delaware corporation and a wholly-owned subsidiary of Cisco, Piston Cloud Computing, Inc., a Delaware corporation and the Stockholders’ Agent (as that term is defined in the Merger Agreement). In rendering this opinion, we have examined such matters of law and fact as we have deemed necessary in order to render the opinions set forth herein, which included examination of the following:

| |

(1) | the Company’s Restated Articles of Incorporation, filed with the California Secretary of State on January 18, 2001 and certified by the California Secretary of State on May 26, 2015, as filed with the Commission as an exhibit to the Form S-3 registration statement filed by the Company with the Commission on February 21, 2001 (the “Restated Articles”); |

| |

(2) | the Company’s Amended and Restated Bylaws, as filed with the Commission as an exhibit to the Form 8-K filed by the Company with the Commission on October 4, 2012 (the “Restated Bylaws”); |

| |

(3) | the Registration Statement, together with the Exhibits filed as a part thereof or incorporated therein by reference; |

| |

(4) | the Prospectus prepared in connection with the Registration Statement; |

| |

(5) | the minutes of meetings and actions by written consent of the Company’s Board of Directors at which, or pursuant to which, the Restated Articles and Restated Bylaws were approved and resolutions that a representative of the Company has represented to us were adopted at a meeting of the Compensation and Management Development Committee of the Company’s Board of Directors assuming the RSUs; |

| |

(6) | the stock records that the Company has provided to us (consisting of (i) a report from the Company’s transfer agent as to the outstanding shares of the Company’s capital stock as of June 17, 2015 and a verbal confirmation from the Company’s transfer agent as to the outstanding shares of the Company’s capital stock on June 19, 2015; and (ii) a summary report from the Company as of June 17, 2015 of outstanding restricted stock units, options and warrants to purchase the Company’s capital stock and stock reserved for issuance thereunder upon the exercise or settlement of restricted stock units, options and warrants to be granted in the future); |

| |

(7) | the Merger Agreement and all exhibits thereto, as well as the Certificate of Merger filed with the Delaware Secretary of State with respect to the merger provided for in the Merger Agreement on June 12, 2015; |

| |

(8) | the Plan, and the forms of agreements used thereunder for the RSUs furnished to us by the Company (such forms of agreements, the “Plan Agreements”); |

| |

(9) | the forms of Cisco’s Restricted Stock Unit Assumption Agreements (the “RSU Assumption Agreements”) to be used by the Company to assume the RSUs originally issued under the Plan and assumed by the Company under the Merger Agreement, as filed by the Company with the Commission as exhibits to the Registration Statement; |

| |

(10) | a Certificate of Status issued by the office of the California Secretary of State on June 16, 2015, stating that the Company is a California corporation, in good standing (together with the certificate of good standing described in item 11 below, the “Certificates of Good Standing”); and |

| |

(11) | a Certificate of Good Standing from the California Franchise Tax Board, dated June 17, 2015, stating that the Company is in good standing with that agency. |

In our examination of documents for purposes of this opinion, we have assumed, and express no opinion as to, the genuineness of all signatures on original documents, the authenticity and completeness of all documents submitted to us as originals, the conformity to originals and completeness of all documents submitted to us as copies, the legal capacity of all persons or entities executing the same, the lack of any undisclosed termination, modification, waiver or amendment to any such document and the due authorization, execution and delivery of all such documents where due authorization, execution and delivery are prerequisites to the effectiveness thereof. We

have also assumed that the certificates representing the Shares have been, or will be, when issued, properly signed by authorized officers of the Company or their agents.

As to matters of fact relevant to this opinion, we have relied solely upon our examination of the documents referred to above and representations made to us by representatives of the Company and have assumed the current accuracy and completeness of the information obtained from such documents and representations. We have made no independent investigation or other attempt to verify the accuracy of any of such information or to determine the existence or non-existence of any other factual matters.

With respect to our opinion expressed in paragraph (1) below as to the valid existence and good standing of the Company with the State of California, we have relied solely upon the Certificates of Good Standing and representations made to us by the Company.

We are admitted to practice law in the State of California, and we render this opinion only with respect to, and express no opinion herein concerning the application or effect of the laws of any jurisdiction other than, the existing laws of the United States of America and of the State of California.

This opinion is based upon the customary practice of lawyers who regularly give, and lawyers who regularly advise opinion recipients regarding, opinions of the kind set forth in this opinion letter, including customary practice as described in bar association reports.

Based upon the foregoing, it is our opinion that:

(1) The Company is a corporation validly existing, in good standing, under the laws of the State of California; and

(2) The 253,414 Shares that may be issued and sold by the Company upon the settlement of the RSUs, when issued, sold and delivered in accordance with the Plan, the applicable Plan Agreements governing the RSUs, notices of restricted stock unit agreements and RSU Assumption Agreements entered into thereunder, and in the manner and for the consideration stated in the Registration Statement and the Prospectus, will be validly issued, fully paid and nonassessable.

We consent to the use of this opinion as an exhibit to the Registration Statement and further consent to all references to us, if any, in the Registration Statement, the Prospectus constituting a part thereof and any amendments thereto. This opinion is intended solely for use in connection with issuance and sale of the Shares subject to the Registration Statement and is not to be relied upon for any other purpose. In rendering the opinions below, we are opining only as to the specific legal issues expressly set forth therein, and no opinion shall be inferred as to any other matter or matters. This opinion is rendered on, and speaks only as of, the date first written above and is based solely on our understanding of facts in existence as of such date after the aforementioned examination. We assume no obligation to advise you of any fact, circumstance, event or change in

the law or the facts that may hereafter be brought to our attention whether or not such occurrence would affect or modify any of the opinions expressed herein.

|

| |

| Yours truly, FENWICK & WEST LLP By: /s/ Daniel J. Winnike Daniel J. Winnike, a Partner |

| |

Exhibit 23.1

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

We hereby consent to the incorporation by reference in this Registration Statement on Form S-8 of our report dated September 9, 2014 relating to the consolidated financial statements, financial statement schedule and the effectiveness of internal control over financial reporting, which appears in Cisco Systems, Inc.’s Annual Report on Form 10-K for the year ended July 26, 2014.

/s/ PricewaterhouseCoopers LLP

San Jose, California

June 19, 2015

Exhibit 99.1

PISTON CLOUD COMPUTING, INC.

2015 EQUITY INCENTIVE PLAN

SECTION 1. INTRODUCTION.

The Piston Cloud Computing, Inc. 2015 Equity Incentive Plan became effective upon its adoption by the Company’s Board of Directors on the Effective Date, and must be approved by the stockholders of the Company, when required by applicable laws, within twelve (12) months following such date. If the Company’s stockholders do not approve this Plan, no Awards will be granted under this Plan.

The purpose of the Plan is to promote the long-term success of the Company and the creation of stockholder value by offering designated Employees and Consultants an opportunity to share in such long- term success by acquiring a proprietary interest in the Company. The Plan seeks to achieve this purpose by providing for discretionary long-term incentive awards in the form of Awards.

The Plan shall be governed by, and construed in accordance with, the laws of the State of California (except its choice-of-law provisions). Capitalized terms shall have the meaning provided in Section 2 unless otherwise provided in this Plan or any related Stock Option Agreement or Stock Unit Agreement.

SECTION 2. DEFINITIONS.

(a) “Affiliate” means any entity other than a Subsidiary, if the Company and/or one or more Subsidiaries own not less than 50% of such entity.

(b) “Award” means any award of an Option or Stock Unit under the Plan.

(c) “Board” means the Board of Directors of the Company, as constituted from time to time.

(d) “Cashless Exercise” means, to the extent that a Stock Option Agreement so provides and as permitted by applicable law, a program approved by the Committee in which payment may be made all or in part by delivery (on a form prescribed by the Committee) of an irrevocable direction to a securities broker to sell Shares and to deliver all or part of the sale proceeds to the Company in payment of the aggregate Exercise Price and, if applicable, the amount necessary to satisfy the Company’s withholding obligations at the minimum statutory withholding rates, including, but not limited to, U.S. federal and state income taxes, payroll taxes, and foreign taxes, if applicable.

(e) “Cause” means, except as may otherwise be provided in a Participant’s employment agreement or Award agreement, a conviction of a Participant for a felony crime or the failure of a Participant to contest prosecution for a felony crime, or a Participant’s misconduct, fraud or dishonesty (as such terms are defined by the Committee in its sole discretion), or any unauthorized use or disclosure of confidential information or trade secrets, in each case as determined by the Committee, and the Committee’s determination shall be conclusive and binding.

(f) “Change In Control” means, except as may otherwise be provided in a Participant’s employment agreement, Stock Option Agreement or Stock Unit Agreement, the occurrence of any of the following:

(i) A change in the composition of the Board over a period of thirty-six consecutive months or less such that a majority of the Board members ceases, by reason of one or more contested elections for Board membership, to be comprised of individuals who either (A) have been Board members continuously since the beginning of such period or (B) have been elected or nominated for election as Board members during such period by at least a majority of the Board members described in clause (A) who were still in office at the time the Board approved such election or nomination; or

(ii) The acquisition, directly or indirectly, by any person or related group of persons (other than the

Company or a person that directly or indirectly controls, is controlled by, or is under common control with, the Company) of beneficial ownership (within the meaning of Rule 13d-3 under the Exchange Act) of securities of the Company representing more than 35% of the total combined voting power of the Company’s then outstanding securities pursuant to a tender or exchange offer made directly to the Company’s shareholders which the Board does not recommend such shareholders accept.

(g) “Code” means the Internal Revenue Code of 1986, as amended, and the regulations and interpretations promulgated thereunder.

(h) “Committee” means a committee described in Section 3.

(i) “Common Stock” means the Company’s common stock.

(j) “Company” means Piston Cloud Computing, Inc., a Delaware corporation.

(k) “Consultant” means an individual who performs bona fide services to the Company, a Parent, a Subsidiary or an Affiliate, other than as an Employee or Director or Non-Employee Director.

(l) “Corporate Transaction” means, except as may otherwise be provided in a Participant’s employment agreement or Award agreement, the occurrence of any of the following shareholder approved transactions:

(i) The consummation of a merger or consolidation of the Company with or into another entity or any other corporate reorganization, if more than 50% of the combined voting power of the continuing or surviving entity’s securities outstanding immediately after such merger, consolidation or other reorganization is owned by persons who were not shareholders of the Company immediately prior to such merger, consolidation or other reorganization; or

(ii) The sale, transfer or other disposition of all or substantially all of the Company’s assets.

A transaction shall not constitute a Corporate Transaction if its sole purpose is to change the state of the Company's incorporation or to create a holding company that will be owned in substantially the same proportions by the persons who held the Company's securities immediately before such transactions.

(m) “Director” means a member of the Board who is also an Employee.

(n) “Disability” means that the Participant is classified as disabled under a long-term disability policy of the Company or, if no such policy applies, the Participant is unable to engage in any substantial gainful activity by reason of any medically determinable physical or mental impairment which can be expected to result in death or which has lasted or can be expected to last for a continuous period of not less than 12 months.

(o) “Effective Date” means May 26, 2015, the date the Plan was adopted by the Company Board of Directors.

(p) “Employee” means any individual who is a common-law employee of the Company, a Parent, a Subsidiary or an Affiliate.

(q) “Exchange Act” means the Securities Exchange Act of 1934, as amended.

(r) “Exercise Price” means, in the case of an Option, the amount for which a Share may be purchased upon exercise of such Option, as specified in the applicable Stock Option Agreement.

(s) “Fair Market Value” means the market price of a Share as determined in good faith by the Committee. The Fair Market Value shall be determined by the following:

(i) If the Shares were traded over-the-counter or listed with NASDAQ on the date in question, then

the Fair Market Value shall be equal to the last transaction price quoted by the NASDAQ system for the date in question; or

(ii) if the Common Stock is listed on the New York Stock Exchange or the American Stock Exchange on the date in question, the Fair Market Value is the closing selling price for the Common Stock as such price is officially quoted in the composite tape of transactions on the exchange determined by the Committee to be the primary market for the Common Stock for the date in question; provided, however, that if there is no such reported price for the Common Stock for the date in question under (i) or (ii), then if available such price on the last preceding date for which such price exists shall be determinative of Fair Market Value.

If neither (i) or (ii) are applicable, then the Fair Market Value shall be determined by the Committee in good faith on such basis as it deems appropriate.

Whenever possible, the determination of Fair Market Value by the Committee shall be based on the prices reported in the Western Edition of The Wall Street Journal. Such determination shall be conclusive and binding on all persons.

(t) “Grant” means any grant of an Award under the Plan.

(u) “Incentive Stock Option” or “ISO” means an incentive stock option described in Code 422.

(v) “Non-Employee Director” means a member of the Board who is not an Employee.

(w) “Nonstatuatory Stock Option” or “NSO” means a stock option that is not an ISO.

(x) “Option” means a stock option granted under the Plan entitling the Optionee to purchase Shares.

(y) “Optionee” means an individual, estate or other entity that holds an Option.

(z) “Parent” means any corporation (other than the Company) in an unbroken chain of corporations ending with the Company, if each of the corporations other than the Company owns stock possessing 50% or more of the total combined voting power of all classes of stock in one of the other corporations in such chain. A corporation that attains the status of a Parent on a date after the adoption of the Plan shall be considered a Parent commencing as of such date.

(aa) “Participant” means an individual or estate or other entity that holds an Award.

(bb) “Plan” means this Piston Cloud Computing, Inc. 2015 Equity Incentive Plan, as it may be amended from time to time.

(cc) “SEC” means the Securities and Exchange Commission.

(dd) “Securities Act” means the Securities Act of 1933, as amended.

(ee) “Service” means service as an Employee, Director, Non-Employee Director or Consultant. A Participant’s Service does not terminate when continued service crediting is required by applicable law. Service terminates in any event when an approved leave ends, unless such Employee immediately returns to active work. The Committee determines which leaves count toward Service, and when Service terminates for all purposes under the Plan. Further, unless otherwise determined by the Committee, a Participant’s Service shall not be deemed to have terminated merely because of a change in the capacity in which the Participant provides service to the Company, a Parent, Subsidiary or Affiliate, or a transfer between entities (the Company or any Parent, Subsidiary, or Affiliate); provided that there is no interruption or other termination of Service.

(ff) “Share” means one share of Common Stock, as adjusted pursuant to Sections 8 and 9, and any successor security.

(gg) “Specified Employee” means an Employee, Director, Non-Employee Director or Consultant who has been selected by the Committee to receive a Stock Unit under the Plan.

(hh) “Stock Option Agreement” means the agreement described in Section 6 evidencing each award of an Option.

(ii) “Stock Unit” means a bookkeeping entry representing the equivalent of one Share, as awarded under the Plan.

(jj) “Stock Unit Agreement” means the agreement described in Section 8 evidencing each Award of a Stock Unit.

(kk) “Subsidiary” means any corporation (other than the Company) in an unbroken chain of corporations beginning with the Company, if each of the corporations other than the last corporation in the unbroken chain owns stock possessing 50% or more of the total combined voting power of all classes of stock in one of the other corporations in such chain. A corporation that attains the status of a Subsidiary on a date after the adoption of the Plan shall be considered a Subsidiary commencing as of such date.

SECTION 3. ADMINISTRATION.

(a) General. The Board or a Committee appointed by the Board shall administer the Plan. Members of the Committee shall serve for such period of time as the Board may determine and shall be subject to removal by the Board at any time. The Board may also at any time terminate the functions of the Committee and reassume all powers and authority previously delegated to the Committee.

(b) Authority of the Committee. Subject to the provisions of the Plan, the Committee shall have full authority and sole discretion to take any actions it deems necessary or advisable for the administration of the Plan. Such actions shall include:

(i) selecting Participants who are to receive Options under the Plan;

(ii) determining the type, number, vesting requirements and other features and conditions of such Options and amending such Options;

(iii) selecting Specified Employees who are to receive Stock Units under the Plan;

(iv) determining the type, number, vesting requirements and other features and conditions of such Stock Units and amending such Stock Units;

(v) correcting any defect, supplying any omission, or reconciling any inconsistency in the Plan or any Award agreement;

(vi) accelerating the vesting, or extending the post-termination exercise term, of Awards at any time and under such terms and conditions as it deems appropriate;

(vii) interpreting the Plan;

(viii) making all other decisions relating to the operation of the Plan; and

(ix) adopting such plans or subplans as may be deemed necessary or appropriate to provide for the participation by Participants of the Company and its Subsidiaries and Affiliates who reside outside the U.S., which plans and/or subplans shall be attached hereto as Appendices.

The Committee may adopt such rules or guidelines as it deems appropriate to implement the Plan. The Committee’s determinations under the Plan shall be final and binding on all persons.

(c) Indemnification. To the maximum extent permitted by applicable law, each member of the Committee, or of the Board, shall be indemnified and held harmless by the Company against and from

(i) any loss, cost, liability, or expense that may be imposed upon or reasonably incurred by him or her in connection with or resulting from any claim, action, suit, or proceeding to which he or she may be a party or in which he or she may be involved by reason of any action taken or failure to act under the Plan or any Stock Option Agreement or Stock Unit Agreement, and (ii) from any and all amounts paid by him or her in settlement

thereof, with the Company’s approval, or paid by him or her in satisfaction of any judgment in any such claim, action, suit, or proceeding against him or her, provided he or she shall give the Company an opportunity, at its own expense, to handle and defend the same before he or she undertakes to handle and defend it on his or her own behalf. The foregoing right of indemnification shall not be exclusive of any other rights of indemnification to which such persons may be entitled under the Company’s Certificate of Incorporation or Bylaws, by contract, as a matter of law, or otherwise, or under any power that the Company may have to indemnify them or hold them harmless.

SECTION 4. GENERAL.

(a) General Eligibility. Only Employees, Directors, Non-Employee Directors and Consultants shall be eligible to receive Options or Stock Units under the Plan.

(b) Stock Options. No person shall be eligible for the grant of an Option so long as Section 260.140.41(b) of Title 10 of the California Code of Regulations applies unless the requirements of such regulation are satisfied. No Option granted under the Plan is intended to qualify for the treatment afforded under Sections 421 and 422 of the Code.

(c) Restrictions on Shares. Any Shares issued pursuant to an Award shall be subject to such rights of repurchase, rights of first refusal and other transfer restrictions as the Committee may determine, in its sole discretion. Such restrictions shall apply in addition to any restrictions that may apply to holders of Shares generally and shall also comply to the extent necessary with applicable law. In no event shall the Company issue fractional Shares under this Plan.

(d) Beneficiaries. Unless stated otherwise in an Award agreement, a Participant may designate one or more beneficiaries with respect to an Award by timely filing the prescribed form with the Company. A beneficiary designation may be changed by filing the prescribed form with the Company at any time before the Participant’s death. If no beneficiary was designated or if no designated beneficiary survives the Participant, then after a Participant’s death any vested Award(s) shall be transferred or distributed to the Participant’s estate.

(e) No Rights as a Stockholder. A Participant, or a transferee of a Participant, shall have no rights as a stockholder with respect to any Common Stock covered by an Award until such person has satisfied all of the terms and conditions to receive such Common Stock, has satisfied any applicable withholding or tax obligations relating to the Award and the Shares have been issued (as evidenced by an appropriate entry on the books of the Company or a duly authorized transfer agent of the Company).

(f) Termination of Service. Unless the applicable Award agreement or, with respect to Participants who reside in the U.S., the applicable employment agreement provides otherwise, the following rules shall govern the vesting, exercisability and term of outstanding Awards held by a Participant in the event of termination of such Participant’s Service (in all cases subject to the term of the Award): (i) upon termination of Service for any reason, all unvested portions of any outstanding Awards shall be immediately forfeited without consideration and the vested portions of any outstanding Stock Units shall be settled upon termination; (ii) if the Service of a Participant is terminated for Cause, then all unexercised Options, and unvested portions of Stock Units, shall terminate and be forfeited immediately without consideration; (iii) if the Service of Participant is terminated for any reason other than for Cause, death, or Disability, then the vested portion of his/her then-outstanding Options may be exercised by such Participant or his or her personal representative within three months after the date of such termination; or (iv) if the Service of a Participant is terminated due to death or Disability, the vested portion of his/her then- outstanding Options may be exercised within eighteen months after the date of termination of Service.

(g) Information Delivery. When required to comply with Section 260.140.41(h) of Title 10 of the California Code of Regulations, the security holders to whom such information is required to be provided shall be provided the information required by Section 260.140.46 of Title 10 of the California Code of Regulations not less frequently than annually.

SECTION 5. SHARES SUBJECT TO PLAN AND SHARE LIMITS.

(a) Basic Limitation. The stock issuable under the Plan shall be authorized but unissued Shares. The aggregate number of Shares reserved for Awards under the Plan shall not exceed 300,000 Shares, subject to adjustment pursuant to Section 9 and, when required, compliance with the shareholder approval requirements of Section 260.140.45 of Title 10 of the California Code of Regulations.

(b) Additional Shares. If Awards are forfeited or are terminated for any other reason before being exercised or settled, then the Shares underlying such Awards shall again become available for Awards under the Plan.

SECTION 6. TERMS AND CONDITIONS OF OPTIONS.

(a) Stock Option Agreement. Each grant of an Option under the Plan shall be evidenced and governed exclusively by a Stock Option Agreement between the Optionee and the Company. Such Option shall be subject to all applicable terms and conditions of the Plan and may be subject to any other terms and conditions that are not inconsistent with the Plan and that the Committee deems appropriate for inclusion in a Stock Option Agreement (including without limitation any performance conditions). The provisions of the various Stock Option Agreements entered into under the Plan need not be identical.

(b) Number of Shares. Each Stock Option Agreement shall specify the number of Shares that are subject to the Option and shall be subject to adjustment of such number in accordance with Section 9.

(c) Exercise Price. An Option’s Exercise Price shall be established by the Committee and set forth in a Stock Option Agreement.

(d) Exercisability and Term. Each Stock Option Agreement shall specify the date when all or any installment of the Option is to become exercisable. The Stock Option Agreement shall also specify the term of the Option; provided that the term of an Option shall in no event exceed nine years from the date of grant. Unless the applicable Stock Option Agreement provides otherwise, each Option shall vest and become exercisable with respect to 20% of the Shares subject to the Option upon completion of one year of Service measured from the vesting commencement date, the balance of the Shares subject to the Option shall vest and become exercisable in forty-eight equal installments upon completion of each month of Service thereafter, and the term of the Option shall be nine years from the date of grant. A Stock Option Agreement may provide for accelerated vesting in the event of the Participant’s death, Disability, or other events. Notwithstanding any other provision of the Plan, no Option can be exercised after the expiration date provided in the applicable Stock Option Agreement and no Option may provide that, upon exercise of the Option, a new Option will automatically be granted.

(e) Modifications of Options. Within the limitations of the Plan, the Committee may modify outstanding Options provided that no modification of an Option shall, without the consent of the Optionee, impair his or her rights under such Option.

(f) Assignment or Transfer of Options. Except as otherwise provided in the applicable Stock Option Agreement and then only to the extent permitted by applicable law, no Option shall be transferable by the Optionee other than by will or by the laws of descent and distribution. Except as otherwise provided in the applicable Stock Option Agreement, an Option may be exercised during the lifetime of the Optionee only by the Optionee or by the guardian or legal representative of the Optionee. No Option or interest therein may be assigned, pledged or hypothecated by the Optionee during his or her lifetime, whether by operation of law or otherwise, or be made subject to execution, attachment or similar process.

SECTION 7. PAYMENT FOR OPTION SHARES.

The entire Exercise Price of Shares issued upon exercise of Options shall be payable in cash at the time when

such Shares are purchased, except as follows and only if so provided for in an applicable Stock Option Agreement:

(i) Surrender of Stock. Payment for all or any part of the Exercise Price may be made with Shares which have already been owned by the Optionee; provided that the Committee may, in its sole discretion, require that Shares tendered for payment be previously held by the Optionee for a minimum duration. Such Shares shall be valued at their Fair Market Value.

(ii) Cashless Exercise. Payment for all or any part of the Exercise Price may be made through Cashless Exercise.

(iii) Other Forms of Payment. Payment for all or any part of the Exercise Price may be made in any other form that is consistent with applicable laws, regulations and rules and approved by the Committee.

The Stock Option Agreement may specify that payment may be made in any form(s) described in this Section 7.

SECTION 8. TERMS AND CONDITIONS OF STOCK UNITS.

(a) Stock Unit Agreement. Each grant of Stock Units under the Plan shall be evidenced and governed exclusively by a Stock Unit Agreement between the Specified Employee and the Company. Such Stock Units shall be subject to all applicable terms and conditions of the Plan and may be subject to any other terms and conditions that are not inconsistent with the Plan and that the Committee deems appropriate for inclusion in the applicable Stock Unit Agreement (including without limitation any performance conditions). The provisions of the various Stock Unit Agreements entered into under the Plan need not be identical. Stock Units may be granted in consideration of a reduction in the Specified Employee’s other compensation.

(b) Number of Shares. Each Stock Unit Agreement shall specify the number of Shares to which the Stock Unit Grant pertains and shall be subject to adjustment of such number in accordance with Section 9.

(c) Payment for Stock Units. Stock Units shall be issued without consideration.

(d) Vesting Conditions. Unless the applicable Stock Unit Agreement provides otherwise, each Stock Unit shall vest with respect to 25% of the Shares subject to the Stock Unit upon completion of each year of Service on each of the first through fourth annual anniversaries of the vesting commencement date.

(e) Voting Rights. The holders of Stock Units shall have no voting rights.

(f) Form and Time of Settlement. Settlement of vested Stock Units may be made in the form of (i) cash,

(ii) Shares or (iii) any combination of both, as determined by the Committee at the time of grant of the Stock Units, in its sole discretion. Methods of converting Stock Units into cash may include (without limitation) a method based on the average Fair Market Value of Shares over a series of trading days. Vested Stock Units may be settled in a lump sum or in installments, provided, however, that any settlement of Vested Stock Units in installments shall be exempt from or otherwise comply with the provisions regarding deferred compensation set forth in Section 409A of the Code. The distribution may occur or commence when the vesting conditions applicable to the Stock Units have been satisfied or have lapsed, in accordance with applicable law, to any later date. Until an Award of Stock Units is settled, the number of such Stock Units shall be subject to adjustment pursuant to Section 9.

(g) Creditors’ Rights. A holder of Stock Units shall have no rights other than those of a general creditor of the Company. Stock Units represent an unfunded and unsecured obligation of the Company, subject to the terms and conditions of the applicable Stock Unit Agreement.

(h) Modifications or Assumption of Stock Units. Within the limitations of the Plan, the Committee may modify or assume outstanding Stock Units or may accept the cancellation of outstanding Stock Units (including

stock units granted by another issuer) in return for the grant of new Stock Units for the same or a different number of Shares and with the same or different vesting provisions. Notwithstanding the preceding sentence or anything to the contrary herein, no modification of a Stock Unit shall, without the consent of the Specified Employee, impair his or her rights or obligations under such Stock Unit.

(i) Assignment or Transfer of Stock Units. Except as otherwise provided in the applicable Stock Unit Agreement and then only to the extent permitted by applicable law, Stock Units shall not be anticipated, assigned, attached garnished, optioned, transferred or made subject to any creditor’s process, whether voluntarily, involuntarily or by operation of law. Any act in violation of this Section 8(i) shall be void. However, this Section 8(i) shall not preclude a Specified Employee from designating a beneficiary who will receive any outstanding vested Stock Units in the event of the Specified Employee’s death, nor shall it preclude a transfer of vested Stock Units by will or by the laws of descent and distribution.

SECTION 9. PROTECTION AGAINST DILUTION.

(a) Adjustments. In the event of a subdivision of the outstanding Shares, a declaration of a dividend payable in Shares, a declaration of a dividend payable in a form other than Shares in an amount that has a material effect on the price of Shares, a combination or consolidation of the outstanding Shares (by reclassification or otherwise) into a lesser number of Shares, a recapitalization, a spin-off or a similar occurrence, the Committee shall make appropriate adjustments to the following:

(i) the number of Shares and the kind of shares or securities available for future Awards under Section 5;

(ii) the number of Shares and the kind of shares or securities covered by each outstanding Award; or

| |

(iii) | the Exercise Price under each outstanding Option. |

(b) Participant Rights. Except as provided in this Section 9, a Participant shall have no rights by reason of any issue by the Company of stock of any class or securities convertible into stock of any class, any subdivision or consolidation of shares of stock of any class, the payment of any stock dividend or any other increase or decrease in the number of shares of stock of any class. If by reason of an adjustment pursuant to this Section 9 a Participant’s Award covers additional or different shares of stock or securities, then such additional or different shares and the Award in respect thereof shall be subject to all of the terms, conditions and restrictions which were applicable to the Award and the Shares subject to the Award prior to such adjustment.

(c) Fractional Shares. Any adjustment of Shares pursuant to this Section 9 shall be rounded down to the nearest whole number of Shares. Under no circumstances shall the Company (i) be required to authorize or (ii) issue, in either case, fractional shares and no consideration shall be provided as a result of any fractional shares not being issued or authorized.

SECTION 10. EFFECT OF A CORPORATE TRANSACTION.

(a) Corporate Transaction. In the event that the Company is a party to a Corporate Transaction, outstanding Awards shall be subject to the applicable agreement of merger, reorganization, or sale of assets. Such agreement may provide, without limitation, for the assumption or substitution of outstanding Options or Stock Units by the surviving corporation or its parent, for the replacement of outstanding Options and Stock Units with a cash incentive program of the surviving corporation which preserves the spread existing on the unvested portions of such outstanding Awards at the time of the transaction and provides for subsequent payout in accordance with the same vesting provisions applicable to those Awards, or for the cancellation of outstanding Options and/or Stock Units, with or without consideration, in all cases without the consent of the Participant.

(b) Acceleration. The Committee may determine, at the time of grant of an Award or thereafter, that such

Award shall become fully vested as to all Shares subject to such Award in the event that a Corporate Transaction or a Change in Control occurs. Unless otherwise provided in the applicable Award agreement, in the event that a Corporate Transaction occurs and any outstanding Options or Stock Units are not assumed, substituted, or replaced with a cash incentive program pursuant to Section 10(a), then such Options or Stock Units shall terminate and cease to be outstanding.

(c) Dissolution. To the extent not previously exercised or settled, Options or Stock Units shall terminate immediately prior to the dissolution or liquidation of the Company.

SECTION 11. LIMITATIONS ON RIGHTS.

(a) No Entitlements. A Participant’s rights, if any, in respect of or in connection with any Award is derived solely from the discretionary decision of the Company to permit the individual to participate in the Plan and to benefit from a discretionary Award. By accepting an Award under the Plan, a Participant expressly acknowledges that there is no obligation on the part of the Company to continue the Plan and/or grant any additional Awards. Any Award granted hereunder is not intended to be compensation of a continuing or recurring nature, or part of a Participant’s normal or expected compensation, and in no way represents any portion of a Participant’s salary, compensation, or other remuneration for purposes of pension benefits, severance, redundancy, resignation or any other purpose.

Neither the Plan nor any Award granted under the Plan shall be deemed to give any individual a right to remain an employee, consultant or director of the Company, a Parent, a Subsidiary or an Affiliate. The Company and its Parents and Subsidiaries and Affiliates reserve the right to terminate the Service of any person at any time, and for any reason, subject to applicable laws, the Company’s Certificate of Incorporation and Bylaws and a written employment agreement (if any), and such terminated person shall be deemed irrevocably to have waived any claim to damages or specific performance for breach of contract or dismissal, compensation for loss of office, tort or otherwise with respect to the Plan or any outstanding Award that is forfeited and/or is terminated by its terms or to any future Award.

(b) Stockholders’ Rights. A Participant shall have no dividend rights, voting rights or other rights as a stockholder with respect to any Shares covered by his or her Award prior to the issuance of such Shares (as evidenced by an appropriate entry on the books of the Company or a duly authorized transfer agent of the Company). No adjustment shall be made for cash dividends or other rights for which the record date is prior to the date when such Shares are issued, except as expressly provided in Section 9.

(c) Regulatory Requirements. Any other provision of the Plan notwithstanding, the obligation of the Company to issue Shares or other securities under the Plan shall be subject to all applicable laws, rules and regulations and such approval by any regulatory body as may be required. The Company reserves the right to restrict, in whole or in part, the delivery of Shares or other securities pursuant to any Award prior to the satisfaction of all legal requirements relating to the issuance of such Shares or other securities, to their registration, qualification or listing or to an exemption from registration, qualification or listing.

SECTION 12. WITHHOLDING TAXES.

(a) General. A Participant shall make arrangements satisfactory to the Company for the satisfaction of any withholding tax obligations that arise in connection with his or her Award. The Company shall not be required to issue any Shares or make any cash payment under the Plan until such obligations are satisfied.

(b) Share Withholding. If a public market for the Company’s Shares exists, the Committee may permit a Participant to satisfy all or part of his or her withholding or income tax obligations by having the Company withhold all or a portion of any Shares that otherwise would be issued to him or her or by surrendering or attesting to all or a portion of any Shares that he or she previously acquired. Such Shares shall be valued based on the value of the actual trade or, if there is none, the Fair Market Value as of the previous day. Any payment of

taxes by assigning Shares to the Company may be subject to restrictions, including, but not limited to, any restrictions required by rules of the SEC. The Committee may, in its discretion, also permit a Participant to satisfy withholding or income tax obligations related to an Award through Cashless Exercise or through a sale of Shares underlying the Award.

SECTION 13. DURATION AND AMENDMENTS.

(a) Term of the Plan. The Plan shall become effective upon its approval by Board, subject to the approval of the Company’s stockholders in compliance, when required, with Section 260.140.41(g) of Title 10 of the California Code of Regulations. The Plan shall terminate on the ninth anniversary of the date of approval by the Company’s stockholders and may be terminated on any earlier date pursuant to this Section 13.

(b) Right to Amend or Terminate the Plan. The Board may amend or terminate the Plan at any time and for any reason. The termination of the Plan, or any amendment thereof, shall not impair the rights or obligations of any Participant under any Award previously granted under the Plan without the Participant’s consent. No Awards shall be granted under the Plan after the Plan’s termination. An amendment of the Plan shall be subject to the approval of the Company’s shareholders only to the extent such approval is otherwise required by applicable laws, regulations or rules.

Exhibit 99.2

CISCO SYSTEMS, INC.

RESTRICTED STOCK UNIT ASSUMPTION AGREEMENT

Dear [Field: Full Name]:

As you know, on June 12, 2015 (the "Closing Date"), Cisco Systems, Inc. ("Cisco") acquired Piston Cloud Computing, Inc. ("Piston Cloud") (the "Acquisition"), pursuant to the Agreement and Plan of Merger by and among Cisco, Pegasus Acquisition Corp., Piston Cloud and the Shareholders Representative dated as of May 29, 2015 (the "Acquisition Agreement"). On the Closing Date, you held one or more outstanding restricted stock units related to shares of Piston Cloud common stock that were previously granted to you under the Piston Cloud Computing, Inc. 2015 Equity Incentive Plan (the “Plan”). Pursuant to the Acquisition Agreement, on the Closing Date, Cisco assumed all obligations of Piston Cloud under your outstanding restricted stock unit award(s). This Restricted Stock Unit Assumption Agreement (the "Agreement") evidences the terms of Cisco's assumption of any restricted stock unit award(s) related to shares of Piston Cloud common stock granted to you under the Plan (the "Piston Cloud RSUs") and documented by a restricted stock unit agreement(s) and any amendment(s) entered into by and between you and Piston Cloud (collectively, the "RSU Agreement(s)"), including the necessary adjustments for assumption of the Piston Cloud RSUs that are required by the Acquisition.

The table below summarizes your Piston Cloud RSUs immediately before and after the Acquisition:

Grant Details

|

| |

Employee ID | [Field: Employee ID] |

Grant Date | [Field: Grant Date] |

Type of Award | [Field: Grant Type] |

Grant Number | [Field: Grant Number] |

Cisco Number of Shares | [Field: Shares Granted] |

Original Number of Shares | [Field: Acquisition Shares] |

Vesting Commencement Date | [Field: Vest Start Date] |

The post-Acquisition adjustments are intended to preserve immediately after the Acquisition the aggregate fair market value of the underlying shares immediately prior to the Acquisition. The number of shares of Cisco common stock subject to your assumed Piston Cloud RSUs shall equal the number of shares of Piston Cloud common stock subject to your Piston Cloud RSUs on the Closing Date.

Unless the context otherwise requires, any references in the Plan and the RSU Agreement(s) to: (i) the "Company" or the "Corporation" means Cisco, (ii) "Stock," "Common Stock," "Shares" or "Ordinary Shares" means shares of Cisco common stock, (iii) the "Board of Directors" or the "Board" means the Board of Directors of Cisco and (iv) the "Committee" means the Compensation and Management Development Committee of the Board of Directors of Cisco. As used in this Agreement, "Employer" means your actual employer. All references in the RSU Agreement(s) and the Plan relating to your status as an employee or consultant of Piston Cloud or a subsidiary or affiliate will now refer to your status as an employee or consultant of Cisco or any present or future Cisco parent, subsidiary or affiliate.

The vesting commencement date, vesting schedule and expiration date of your assumed Piston Cloud RSUs remain the same as set forth in the RSU Agreement(s) and/or any notice of grant but with the number of shares subject to each vesting installment adjusted to reflect the effect of the Acquisition. (In this respect, please note that any discussion of terms in any employment offer letter (whether from Cisco, Piston Cloud or any other related employer) is explanatory in nature and will not result in duplication of benefits (including vesting) with respect to your assumed Piston Cloud RSUs.) Vesting of your assumed Piston Cloud RSUs will be suspended during all leaves of absence in accordance with Cisco's policies. Cisco will withhold applicable taxes by withholding vested Cisco shares that would otherwise be released under the assumed Piston Cloud RSU on the vest date. The amount of Cisco shares withheld will be equal in value to the amount necessary to satisfy any such withholding tax obligation. All other provisions which govern either the settlement or the termination of your

assumed Piston Cloud RSUs remain the same as set forth in the RSU Agreement(s), and the provisions of the RSU Agreement(s), will govern and control your rights under this Agreement to acquire shares of Cisco common stock, except as expressly modified by this Agreement, the Acquisition Agreement or otherwise in connection with the Acquisition.

UNLESS EXPRESSLY SET FORTH IN AN EMPLOYMENT AGREEMENT OR OFFER LETTER WITH CISCO, UPON NOTICE OF TERMINATION OF YOUR EMPLOYMENT WITH CISCO OR ANY PRESENT OR FUTURE CISCO SUBSIDIARY, ALL UNVESTED RESTRICTED STOCK UNITS SHALL BE IMMEDIATELY FORFEITED WITHOUT CONSIDERATION, EXCEPT AS MAY BE OTHERWISE DETERMINED BY CISCO IN ITS SOLE DISCRETION.

Nothing in this Agreement or the RSU Agreement(s) interferes in any way with your right and the right of Cisco or its parent, subsidiary or affiliate, which rights are expressly reserved, to terminate your employment at any time for any reason and whether or not in breach of local labor laws. Future restricted stock units, if any, you may receive from Cisco will be governed by the terms of the Cisco equity plan under which such restricted stock units are granted, and such terms may be different from the terms of your assumed Piston Cloud RSUs, including, but not limited to, vesting and forfeiture upon your termination of employment.

Until Cisco's Stock Administration Department is in receipt of your understanding and acceptance of this Agreement (which can be accomplished electronically by following the instructions under the heading of Acknowledgment below) your Cisco account will not be activated and your assumed Piston Cloud RSUs will not be settled.

If you have any questions regarding this Agreement or your assumed Piston Cloud RSUs, please contact at ( ).

|

| |

CISCO SYSTEMS, INC. |

| |

By: | /s/ Mark Chandler |

| Mark Chandler |

| Corporate Secretary |

| |

ACKNOWLEDGMENT

[Field: Full Name] acknowledges that clicking on the I Agree button constitutes acceptance and agreement to be bound by the terms of this Agreement, as well as understanding and agreement that all rights and liabilities with respect to the assumed Piston Cloud RSUs listed on the table above are hereby assumed by Cisco and are as set forth in the RSU Agreement(s) for such assumed Piston Cloud RSUs, the Plan (as applicable) and this Restricted Stock Unit Assumption Agreement.

ATTACHMENTS

Exhibit A - Form S-8 Prospectus

CISCO SYSTEMS, INC.

NON-U.S. RESTRICTED STOCK UNIT ASSUMPTION AGREEMENT

Dear [Field: Full Name]:

As you know, on June 12, 2015 (the “Closing Date”), Cisco Systems, Inc. (“Cisco”) acquired Piston Cloud Computing, Inc. (“Piston Cloud”) (the "Acquisition"), pursuant to the Agreement and Plan of Merger by and among Cisco, Pegasus Acquisition Corp., Piston Cloud and the Shareholders Representative dated as of May 29, 2015 (the “Acquisition Agreement”). On the Closing Date, you held one or more outstanding restricted stock units related to shares of Piston Cloud common stock that were previously granted to you under the Piston Cloud Computing, Inc. 2015 Equity Incentive Plan (the “Plan”). Pursuant to the Acquisition Agreement, on the Closing Date, Cisco assumed all obligations of Piston Cloud under your outstanding restricted stock unit award(s). This Non-U.S. Restricted Stock Unit Assumption Agreement (the “Agreement”) evidences the terms of Cisco's assumption of any restricted stock unit award(s) related to shares of Piston Cloud common stock granted to you under the Plan (the "Piston Cloud RSUs") and documented by a restricted stock unit agreement(s) and any amendment(s) entered into by and between you and Piston Cloud (collectively, the "RSU Agreement(s)"), including the necessary adjustments for assumption of the Piston Cloud RSUs that are required by the Acquisition.

The table below summarizes your Piston Cloud RSUs immediately before and after the Acquisition:

Grant Details

|

| |

Employee ID | [Field: Employee ID] |

Grant Date | [Field: Grant Date] |

Type of Award | [Field: Grant Type] |

Grant Number | [Field: Grant Number] |

Cisco Number of Shares | [Field: Shares Granted] |

Original Number of Shares | [Field: Acquisition Shares] |

Vesting Commencement Date | [Field: Vest Start Date] |

The post-Acquisition adjustments are intended to preserve immediately after the Acquisition the aggregate fair market value of the underlying shares immediately prior to the Acquisition. The number of shares of Cisco common stock subject to your assumed Piston Cloud RSUs shall equal the number of shares of Piston Cloud common stock subject to your Piston Cloud RSUs on the Closing Date.

Unless the context otherwise requires, any references in the Plan and the RSU Agreement(s) to: (i) the "Company" or the "Corporation" means Cisco, (ii) "Stock," "Common Stock," "Shares" or "Ordinary Shares" means shares of Cisco common stock, (iii) the "Board of Directors" or the "Board" means the Board of Directors of Cisco and (iv) the "Committee" means the Compensation and Management Development Committee of the Board of Directors of Cisco. As used in this Agreement, "Employer" means your actual employer. All references in the RSU Agreement(s) and the Plan relating to your status as an employee or consultant of Piston Cloud or a subsidiary or affiliate will now refer to your status as an employee or consultant of Cisco or any present or future Cisco parent, subsidiary or affiliate.

The vesting commencement date, vesting schedule and expiration date of your assumed Piston Cloud RSUs remain the same as set forth in the RSU Agreement(s) and/or any notice of grant but with the number of shares subject to each vesting installment adjusted to reflect the effect of the Acquisition. (In this respect, please note that any discussion of grant terms in any employment offer letter or any other documentation (whether from Cisco, Piston Cloud or any other related employer) is explanatory in nature and will not result in duplication of benefits (including vesting) with respect to your assumed Piston Cloud RSUs.) Vesting of your assumed Piston Cloud RSUs will be suspended during all leaves of absence in accordance with Cisco's policies subject to applicable law. All other provisions which govern either the settlement or the termination of your assumed Piston Cloud RSUs remain the same as set forth in the RSU Agreement(s) and the provisions of the RSU Agreement(s) will govern and control your rights under this Agreement to acquire Cisco common stock, except as expressly modified by this Agreement (including any Country-Specific Addendum), the Acquisition Agreement or otherwise in connection with the Acquisition.

UPON TERMINATION OF YOUR EMPLOYMENT WITH CISCO OR ANY PRESENT OR FUTURE CISCO SUBSIDIARY, ALL UNVESTED RESTRICTED STOCK UNITS SHALL BE IMMEDIATELY FORFEITED WITHOUT CONSIDERATION, EXCEPT AS MAY BE OTHERWISE DETERMINED BY CISCO IN ITS SOLE DISCRETION.

Nothing in this Agreement or the RSU Agreement(s) interferes in any way with your right and the right of Cisco or its parent, subsidiary or affiliate, which rights are expressly reserved, to terminate your employment at any time for any reason, whether or not in breach of local labor laws. Future restricted stock units, if any, you may receive from Cisco will be governed by the terms of the Cisco equity plan under which such restricted stock units are granted, and such terms may be different from the terms of your assumed Piston Cloud RSUs, including, but not limited to, vesting and forfeiture upon your termination of employment.

The following are additional terms and conditions of your assumed Piston Cloud RSUs:

Tax-Related Items.

Prior to conversion of the assumed Piston Cloud RSUs if the conversion is a taxable event in your country, you authorize Cisco and/or your Employer, or their respective agents, at their discretion to satisfy any obligations for tax liability, including income tax, payroll tax, social contributions, or any other tax-related withholding ("Tax-Related Items") in relation to your assumed Piston Cloud RSUs by one or a combination of the following: (1) withholding all applicable Tax-Related Items from your wages or other cash compensation paid to you by Cisco and/or the Employer; (2) withholding from proceeds of the sale of the Shares issued upon settlement of the Piston Cloud RSUs either through a voluntary sale or through a mandatory sale arranged by Cisco (on your behalf, pursuant to this authorization); (3) withholding of Shares that would otherwise be issued upon vesting of the Piston Cloud RSUs or (4) requiring you to satisfy the liability for Tax-Related Items by means of any other arrangement approved by Cisco. If the obligation for Tax-Related Items is satisfied by withholding of Shares, for tax purposes, you are deemed to have been issued the full number of Shares subject to the vested Piston Cloud RSUs, notwithstanding that a number of the Shares are held back solely for the purpose of paying the Tax-Related Items due as a result of any aspect of your participation in the Plan. To avoid financial accounting charges under applicable accounting guidance, Cisco may withhold or account for Tax-Related Items by considering applicable minimum statutory withholding rates or may take any other action required to avoid financial accounting charges under applicable accounting guidance. Finally, you must pay to Cisco or the Employer any amount of Tax-Related Items that Cisco or the Employer may be required to withhold or account for as a result of your participation in the Plan that cannot be satisfied by the means previously described. Cisco may refuse to convert your assumed Piston Cloud RSUs and/or refuse to issue or deliver the Shares or the proceeds of the sale of Shares if you fail to comply with your obligations in connection with the Tax-Related Items as described in this Paragraph.

Regardless of any action Cisco or the Employer takes with respect to any or all Tax-Related Items, you acknowledge that the ultimate liability for all Tax-Related Items is and remains your responsibility and may exceed the amount actually withheld by Cisco or the Employer. You further acknowledge that Cisco and/or the Employer (1) make no representations or undertakings regarding the treatment of any Tax-Related Items in connection with any aspect of the Piston Cloud RSUs, including the grant, vesting, conversion into restricted stock units over Cisco Shares, any acceleration of vesting, the subsequent sale of Shares acquired pursuant to vesting and the receipt of any dividends; and (2) do not commit to structure the terms of the conversion of Piston Cloud RSUs into restricted stock units over Cisco Shares, any acceleration of vesting or any aspect of the Piston Cloud RSUs to reduce or eliminate your liability for Tax-Related Items or achieve a particular tax result. Further, if you become subject to taxation in more than one jurisdiction between the grant date and the date of any relevant taxable event, you acknowledge that Cisco and/or the Employer (or former employer, as applicable) may be required to withhold or account for Tax-Related Items in more than one jurisdiction.

Data Privacy.

You hereby explicitly and unambiguously consent to the collection, use and transfer, in electronic or other form, of your personal information as described in this Agreement by and among, as applicable, the Employer, and Cisco and its parent, subsidiaries and affiliates for the exclusive purpose of implementing, administering and managing your participation in the Plan.