UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): June 12, 2015

|

Crown Crafts, Inc. |

|

(Exact name of registrant as specified in its charter) |

|

Delaware |

1-7604 |

58-0678148 |

|

(State or other jurisdiction |

(Commission File Number) |

(IRS Employer |

|

of incorporation) |

|

Identification No.) |

|

916 South Burnside Avenue, Gonzales, LA |

70737 |

|

(Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including area code: (225) 647-9100

| |

|

(Former name or former address if changed since last report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Item 2.02. |

Results of Operations and Financial Condition |

On June 12, 2015, Crown Crafts, Inc. (the “Company”) issued a press release announcing its financial results for the fourth quarter and fiscal year 2015, which ended March 29, 2015. A copy of that press release is attached hereto as Exhibit 99.1.

The information in this Item 2.02 is being furnished and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of such section. The information in this Item 2.02 shall not be incorporated by reference into any registration statement or document pursuant to the Securities Act of 1933, as amended.

|

Item 9.01. |

Financial Statements and Exhibits. |

| |

99.1 |

Press Release dated June 12, 2015. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| |

CROWN CRAFTS, INC. |

|

| |

|

|

|

Date: June 12, 2015 |

/s/ Olivia W. Elliott |

|

| |

Olivia W. Elliott |

|

| |

Vice President and Chief Financial Officer |

|

Exhibit Index

|

Exhibit No. |

Description of Exhibit |

| |

|

|

99.1 |

Press Release dated June 12, 2015. |

Exhibit 99.1

|

For immediate release |

June 12, 2015 |

Crown Crafts Reports Results for Fiscal 2015 Fourth Quarter and Full Year

| |

● |

Net sales up 8.7% for the fourth quarter and 5.8% for the full year |

| |

● |

Fiscal 2015 adjusted net income up 8.3% for the full year |

| |

● |

Full-year adjusted EBITDA increases 6.3% from last year and reaches 12.9% of net sales |

| |

● |

Full-year adjusted diluted earnings per share of $0.62 up from last year’s record $0.59 diluted earnings per share |

Gonzales, Louisiana – Crown Crafts, Inc. (NASDAQ-CM: CRWS) today reported results for the fiscal fourth quarter and full year ended March 29, 2015.

“Fiscal 2015 was another strong year for Crown Crafts as our adjusted EBITDA reached a milestone of 12.9% of net sales for the year. Our strong performance is a result of a number of factors, including expanded business placements which solidified our position as a market leader. Once again, we finished the year with no debt, and our cash balances increased to $1.8 million from $560,000 at the end of fiscal year 2014. We are proud of our performance, and we believe our shareholders value the long-term consistency we provide,” said E. Randall Chestnut, Chairman, President and Chief Executive Officer.

Financial Results

Net income for the fourth quarter of fiscal 2015 was $2.1 million, or $0.21 per diluted share, on net sales of $26.1 million, compared with net income of $2.0 million, or $0.21 per diluted share, on net sales of $24.0 million for the fourth quarter of fiscal 2014.

Net income for the full year of fiscal 2015 was $5.7 million, or $0.57 per diluted share, on net sales of $86.0 million, compared with net income of $5.8 million, or $0.59 per diluted share, on net sales of $81.3 million for fiscal 2014. Fiscal 2015 net income was impacted by an after-tax charge of $530,000 in the second quarter related to the settlement of a lawsuit. Excluding that charge, net income for fiscal 2015 would have been $6.2 million, or $0.62 per diluted share, up 8.3% from the year earlier. Adjusted EBITDA increased 6.3% to $11.1 million for fiscal 2015, compared with $10.4 million for the prior year. As a percentage of net sales, adjusted EBITDA rose to 12.9% from 12.8% a year ago.

916 S. Burnside Avenue * PO Box 1028 * Gonzales, LA 70707-1028 * (225) 647-9100 * Fax (225) 647-9104

Quarterly Cash Dividend

As announced on May 19, 2015, the Board of Directors declared a quarterly cash dividend on the Company’s Series A common stock of $0.08 per share, which will be paid on July 2, 2015 to shareholders of record at the close of business on June 12, 2015. “With our continued strong cash flow and financial position, we have been able to maintain an attractive and consistent dividend payout to shareholders, as this marks our 22nd consecutive quarterly dividend,” Chestnut said.

Fiscal 2015 Performance Reflects Ongoing Strengths

In conclusion, Chestnut said, “We are very pleased with our performance in fiscal 2015, which was driven by our leading position in the marketplace, the ongoing popularity of our products, our strong balance sheet and our operating efficiency. We would like to thank our employees, customers, suppliers, lenders and shareholders for their continued support of our Company. We remain excited about our business and our future.”

Conference Call

The Company will host a teleconference today at 1:00 p.m. Central Daylight Time to discuss the Company’s results, during which interested individuals will be given the opportunity to ask appropriate questions. To join the teleconference, dial (877) 317-6789 and ask to be joined into the Crown Crafts call. The teleconference can also be accessed in listen-only mode by visiting the Company’s website at www.crowncrafts.com. The financial information to be discussed during the teleconference may be accessed prior to the call on the investor relations portion of the Company’s website.

A telephone replay of the teleconference will be available from one hour after the end of the call through 8:00 a.m. Central Daylight Time on June 19, 2015. To access the replay, dial (877) 344-7529 in the United States or (412) 317-0088 from international locations and refer to conference number 10065508.

About Crown Crafts, Inc.

Crown Crafts, Inc. designs, markets and distributes infant, toddler and juvenile consumer products, including crib and toddler bedding; blankets; nursery accessories; room décor; burp cloths; bathing accessories; reusable and disposable bibs; and disposable placemats, floor mats, toilet seat covers and changing mats. The Company’s operating subsidiaries consist of Crown Crafts Infant Products, Inc. in California and Hamco, Inc. in Louisiana. Crown Crafts is among America’s largest producers of infant bedding, bibs and bath items. The Company’s products include licensed and branded collections as well as exclusive private label programs for certain of its customers. The Company’s website is www.crowncrafts.com.

Forward-Looking Statements

The foregoing contains forward-looking statements within the meaning of the Securities Act of 1933, the Securities Exchange Act of 1934 and the Private Securities Litigation Reform Act of 1995. Such statements are based upon management’s current expectations, projections, estimates and assumptions. Words such as “expects,” “believes,” “anticipates” and variations of such words and similar expressions identify such forward-looking statements. Forward-looking statements involve known and unknown risks and uncertainties that may cause future results to differ materially from those suggested by the forward-looking statements. These risks include, among others, general economic conditions, including changes in interest rates, in the overall level of consumer spending and in the price of oil, cotton and other raw materials used in the Company’s products, changing competition, changes in the retail environment, the level and pricing of future orders from the Company’s customers, the extent to which the Company’s business is concentrated in a small number of customers, the Company’s dependence upon third-party suppliers, including some located in foreign countries, customer acceptance of both new designs and newly-introduced product lines, actions of competitors that may impact the Company’s business, disruptions to transportation systems or shipping lanes used by the Company or its suppliers, and the Company’s dependence upon licenses from third parties. Reference is also made to the Company’s periodic filings with the Securities and Exchange Commission for additional factors that may impact the Company’s results of operations and financial condition. The Company does not undertake to update the forward-looking statements contained herein to conform to actual results or changes in our expectations, whether as a result of new information, future events or otherwise.

Contact:

Olivia W. Elliott

Vice President and Chief Financial Officer

(225) 647-9124

oelliott@crowncrafts.com

or

Halliburton Investor Relations

(972) 458-8000

CROWN CRAFTS, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF INCOME

SELECTED FINANCIAL DATA

In thousands, except percentages and per share data

| |

|

Three-Month Period Ended |

|

|

Fiscal Year Ended |

|

| |

|

March 29, 2015 |

|

|

March 30, 2014 |

|

|

March 29, 2015 |

|

|

March 30, 2014 |

|

| |

|

(Unaudited) |

|

|

|

|

|

|

|

|

|

|

Net sales |

|

$ |

26,090 |

|

|

$ |

24,011 |

|

|

$ |

85,978 |

|

|

$ |

81,294 |

|

|

Gross profit |

|

|

6,794 |

|

|

|

6,359 |

|

|

|

23,550 |

|

|

|

22,534 |

|

|

Gross profit percentage |

|

|

26.0 |

% |

|

|

26.5 |

% |

|

|

27.4 |

% |

|

|

27.7 |

% |

|

Income from operations |

|

|

3,489 |

|

|

|

3,350 |

|

|

|

9,220 |

|

|

|

9,378 |

|

|

Income before income tax expense |

|

|

3,470 |

|

|

|

3,340 |

|

|

|

9,160 |

|

|

|

9,346 |

|

|

Income tax expense |

|

|

1,331 |

|

|

|

1,312 |

|

|

|

3,442 |

|

|

|

3,575 |

|

|

Net income |

|

|

2,139 |

|

|

|

2,028 |

|

|

|

5,718 |

|

|

|

5,771 |

|

|

Basic earnings per share |

|

$ |

0.21 |

|

|

$ |

0.21 |

|

|

$ |

0.57 |

|

|

$ |

0.59 |

|

|

Diluted earnings per share |

|

$ |

0.21 |

|

|

$ |

0.21 |

|

|

$ |

0.57 |

|

|

$ |

0.59 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted Average Shares Outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

10,065 |

|

|

|

9,859 |

|

|

|

10,047 |

|

|

|

9,848 |

|

|

Diluted |

|

|

10,100 |

|

|

|

9,872 |

|

|

|

10,080 |

|

|

|

9,858 |

|

CONDENSED CONSOLIDATED BALANCE SHEETS

SELECTED FINANCIAL DATA

In thousands

| |

|

March 29, 2015 |

|

|

March 30, 2014 |

|

|

Cash and cash equivalents |

|

$ |

1,807 |

|

|

$ |

560 |

|

|

Accounts receivable, net of allowances |

|

|

22,370 |

|

|

|

21,712 |

|

|

Inventories |

|

|

15,468 |

|

|

|

13,607 |

|

|

Total current assets |

|

|

42,519 |

|

|

|

38,069 |

|

|

Finite-lived intangible assets - net |

|

|

4,507 |

|

|

|

5,248 |

|

|

Goodwill |

|

|

1,126 |

|

|

|

1,126 |

|

|

Total assets |

|

$ |

49,946 |

|

|

$ |

46,215 |

|

| |

|

|

|

|

|

|

|

|

|

Total current liabilities |

|

|

10,374 |

|

|

|

10,298 |

|

| |

|

|

|

|

|

|

|

|

|

Shareholders’ equity |

|

|

39,572 |

|

|

|

35,917 |

|

|

Total liabilities and shareholders’ equity |

|

$ |

49,946 |

|

|

$ |

46,215 |

|

CROWN CRAFTS, INC. AND SUBSIDIARIES

NON-GAAP RECONCILIATIONS

In thousands, except percentages

(Unaudited)

| |

|

|

|

|

|

|

|

|

|

% |

|

| |

|

Fiscal Year Ended |

|

|

Increase / |

|

| |

|

March 29, 2015 |

|

|

March 30, 2014 |

|

|

(Decrease) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-GAAP Reconciliation of Net Income to Adjusted Net Income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income |

|

$ |

5,718 |

|

|

$ |

5,771 |

|

|

|

(0.9% |

) |

|

Legal Settlement |

|

|

850 |

|

|

|

- |

|

|

|

|

|

|

Income tax benefit of legal settlement |

|

|

(320 |

) |

|

|

- |

|

|

|

|

|

|

Adjusted net income |

|

$ |

6,248 |

|

|

$ |

5,771 |

|

|

|

8.3 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted Average Shares Outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

10,047 |

|

|

|

9,848 |

|

|

|

|

|

|

Diluted |

|

|

10,080 |

|

|

|

9,858 |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings per Share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

As Reported: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

0.57 |

|

|

$ |

0.59 |

|

|

|

|

|

|

Diluted |

|

$ |

0.57 |

|

|

$ |

0.59 |

|

|

|

(3.4% |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

0.62 |

|

|

$ |

0.59 |

|

|

|

|

|

|

Diluted |

|

$ |

0.62 |

|

|

$ |

0.59 |

|

|

|

5.1 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-GAAP Reconciliation of Net Income to EBITDA and Adjusted EBITDA: |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income |

|

$ |

5,718 |

|

|

$ |

5,771 |

|

|

|

|

|

|

Interest expense |

|

|

37 |

|

|

|

49 |

|

|

|

|

|

|

Interest income |

|

|

(19 |

) |

|

|

(21 |

) |

|

|

|

|

|

Income tax expense |

|

|

3,442 |

|

|

|

3,575 |

|

|

|

|

|

|

Depreciation |

|

|

314 |

|

|

|

299 |

|

|

|

|

|

|

Amortization |

|

|

741 |

|

|

|

758 |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

EBITDA |

|

$ |

10,233 |

|

|

$ |

10,431 |

|

|

|

(1.9% |

) |

|

Legal Settlement |

|

|

850 |

|

|

|

- |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted EBITDA |

|

$ |

11,083 |

|

|

$ |

10,431 |

|

|

|

6.3 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net sales |

|

$ |

85,978 |

|

|

$ |

81,294 |

|

|

|

5.8 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted EBITDA as a Percentage of Net Sales |

|

|

12.9 |

% |

|

|

12.8 |

% |

|

|

|

|

Use of Non-GAAP Financial Information

In addition to the Company’s presentation of its financial position and results of operations in conformity with accounting principles generally accepted in the United States (“GAAP”), the Company has also presented certain financial measures which are not determined in accordance with GAAP. Specifically, with respect to the financial results for the fiscal year ended March 29, 2015, the Company has disclosed its earnings before interest, taxes, depreciation and amortization (“EBITDA”) and has further disclosed the after-tax impact of a charge associated with the settlement of a lawsuit (the “Settlement Charge”), as well as a presentation of what net income, net income per diluted share and EBITDA would have been if the Settlement Charge had not been recognized (to arrive at “adjusted net income”, “adjusted net income per diluted share” and “adjusted EBITDA”, respectively). The Company believes that the presentation of these non-GAAP financial measures is useful as an important indicator of the Company’s ability to generate cash sufficient to service its debt, declare and pay dividends, make strategic investments, meet capital expenditures and working capital requirements and otherwise meet its obligations as they become due in future reporting periods. The Settlement Charge is a significant component in an understanding and assessment of the Company’s results of operations for the fiscal year ended March 29, 2015. The Company uses these non-GAAP financial measures internally to monitor its operating results and to evaluate the performance of its businesses. These non-GAAP financial measures are provided as supplemental information and should be considered in addition to, and not as a substitute for, the Company’s GAAP measures, including its net income and cash flow provided by or used in operating, investing or financing activities, and other measures of financial position or results of operations reported in accordance with GAAP. Because these non-GAAP financial measures are not calculated in accordance with GAAP, another company using the same GAAP financial information could possibly arrive at a different calculation of these non-GAAP financial measures. Therefore, the non-GAAP financial measures as presented by the Company may not be comparable to similarly-titled measures that may be presented by another company.

-6-

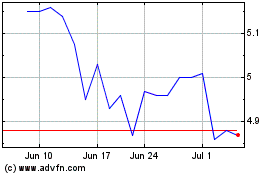

Crown Crafts (NASDAQ:CRWS)

Historical Stock Chart

From Mar 2024 to Apr 2024

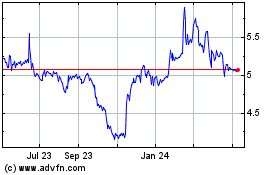

Crown Crafts (NASDAQ:CRWS)

Historical Stock Chart

From Apr 2023 to Apr 2024