As filed with the Securities and Exchange Commission on November 10, 2014

Registration No. 333-_________

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-8

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

CROWN CRAFTS, INC.

(Exact name of Registrant as specified in its charter)

|

|

|

|

Delaware |

58-0678148 |

|

(State or other jurisdiction of

incorporation or organization) |

(I.R.S. Employer

Identification No.) |

|

|

|

|

916 South Burnside Avenue

Gonzales, Louisiana 70737

(225) 647-9100

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices) |

Crown Crafts, Inc. 2014 Omnibus Equity Compensation Plan

(Full title of the plan)

Copies of communications to:

|

Jody L. Spencer, Esq.

Rogers & Hardin LLP

2700 International Tower

229 Peachtree Street, NE

Atlanta, Georgia 30303

(404) 522-4700

(404) 525-2224 (facsimile) |

Mr. E. Randall Chestnut

Chief Executive Officer

Crown Crafts, Inc.

916 South Burnside Avenue

Gonzales, Louisiana 70737

(225) 647-9100

(225) 647-8331 (facsimile) |

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer ☐ |

Accelerated Filer ☐ |

|

Non-accelerated filer ☐ |

Smaller reporting company ☒ |

Calculation of Registration Fee

|

Title of each class of

securities to be registered |

Amount to

be registered(1) |

Proposed maximum

offering price

per share(2) |

Proposed maximum

aggregate offering

price(2) |

Amount of

registration fee |

|

Series A Common Stock, $0.01 par value |

1,200,000 |

$7.38 |

$8,856,000 |

$1,029.07 |

|

(1) |

Represents the shares of the Registrant’s Series A common stock that may be issuable pursuant to the Crown Crafts, Inc. 2014 Omnibus Equity Compensation Plan (the “Plan”), together with an indeterminate number of additional shares which may be necessary to adjust the number of shares reserved for issuance under the Plan as a result of any future stock split, stock dividend or similar adjustment of the outstanding common stock, as provided in Rule 416(a) under the Securities Act of 1933, as amended (the “Securities Act”). |

|

(2) |

Estimated solely for purposes of calculating the registration fee pursuant to Rules 457(c) and 457(h) under the Securities Act based upon the average of the high and low sales prices per share of the Registrant’s common stock as reported on the NASDAQ Capital Market on November 6, 2014. |

PART I

INFORMATION REQUIRED IN THE SECTION 10(A) PROSPECTUS

Item 1. Plan Information.*

Item 2. Registrant Information and Employee Plan Annual Information.*

*The documents constituting Part I of this Registration Statement will be delivered to the participants in the Plan as specified by Rule 428(b)(1) under the Securities Act. These documents and the documents incorporated by reference in this Registration Statement pursuant to Item 3 of Part II of this Registration Statement, taken together, constitute a prospectus that meets the requirements of Section 10(a) of the Securities Act.

Upon written or oral request, the Registrant will provide, without charge, the documents incorporated by reference in Item 3 of Part II of this Registration Statement. The documents are incorporated by reference in the Section 10(a) prospectus. The Registrant will also provide, without charge, upon written or oral request, other documents required to be delivered to employees pursuant to Rule 428(b) under the Securities Act. Requests for the above-mentioned information should be directed to Crown Crafts, Inc., P.O. Box 1028, Gonzales, Louisiana 70707, Attention: Corporate Secretary, telephone number (225) 647-9100.

PART II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

Item 3. Incorporation of Documents by Reference.

The following documents are incorporated by reference into this Registration Statement:

|

|

(i) |

The Registrant’s Annual Report on Form 10-K for the year ended March 30, 2014, filed with the Securities and Exchange Commission (the “Commission”) on June 18, 2014 (the “2014 Form 10-K”); |

| |

(ii) |

Portions of the Registrant’s Definitive Proxy Statement on Schedule 14A that are incorporated by reference into Part III of the 2014 Form 10-K, filed with the Commission on June 27, 2014; |

| |

(iii) |

The Registrant’s Quarterly Report on Form 10-Q for the quarter ended June 29, 2014, filed with the Commission on August 13, 2014; |

| |

(iv) |

The Registrant’s Current Report on Form 8-K filed with the Commission on July 28, 2014; |

| |

(v) |

Item 5.07 of the Registrant’s Current Report on Form 8-K filed with the Commission on August 13, 2014; and |

| |

(vi) |

The description of the Registrant’s common stock contained in the Registrant’s Definitive Proxy Statement on Schedule 14A filed with the Commission on September 3, 2003, and any amendments or reports filed for the purpose of updating such description. |

In addition, all documents subsequently filed by the Registrant pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Securities Exchange Act of 1934, as amended, prior to the Registrant’s filing of a post-effective amendment which indicates that all securities offered have been sold or which deregisters all securities then remaining unsold, shall be deemed to be incorporated by reference into this Registration Statement and to be a part hereof from the date of filing of such documents.

Item 4. Description of Securities.

Not applicable.

Item 5. Interests of Named Experts and Counsel.

Not applicable.

Item 6. Indemnification of Directors and Officers.

Under Section 145 of the Delaware General Corporation Law (the “DGCL”), a corporation may indemnify its directors, officers, employees and agents and its former directors, officers, employees and agents and those who serve, at the corporation’s request, in such capacities with another enterprise, against expenses (including attorneys’ fees), as well as judgments, fines and settlements in non-derivative lawsuits, actually and reasonably incurred in connection with the defense of any action, suit or proceeding in which they or any of them were or are made parties or are threatened to be made parties by reason of their serving or having served in such capacity. The DGCL provides, however, that such person must have acted in good faith and in a manner such person reasonably believed to be in (or not opposed to) the best interests of the corporation and, in the case of a criminal action, such person must have had no reasonable cause to believe his or her conduct was unlawful. In addition, the DGCL does not permit indemnification in an action or suit by or in the right of the corporation, where such person has been adjudged liable to the corporation, unless, and only to the extent that, a court determines that, despite the adjudication of liability but in view of all circumstances of the case, such person fairly and reasonably is entitled to indemnity for costs the court deems proper. Indemnity is mandatory to the extent a claim, issue or matter has been successfully defended. The Registrant’s Amended and Restated Certificate of Incorporation, as amended, and Amended and Restated Bylaws contain provisions that provide for the indemnification of the Registrant’s directors and officers to the fullest extent permitted by the DGCL.

The foregoing summaries are necessarily subject to the complete text of the statute and the Registrant’s Amended and Restated Certificate of Incorporation and Amended and Restated Bylaws and are qualified in their entirety by reference thereto.

Item 7. Exemption from Registration Claimed.

Not applicable.

Item 8. Exhibits.

Reference is made to the Exhibit Index below filed as part of this Registration Statement. Each such exhibit is incorporated herein by reference.

Item 9. Undertakings.

| |

(a) |

The undersigned Registrant hereby undertakes: |

(1) To file, during any period in which offers or sales are being made, a post-effective amendment to this Registration Statement:

(i) To include any prospectus required by Section 10(a)(3) of the Securities Act of 1933;

(ii) To reflect in the prospectus any facts or events arising after the effective date of the Registration Statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the Registration Statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than 20% change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective Registration Statement; and

(iii) To include any material information with respect to the plan of distribution not previously disclosed in the Registration Statement or any material change to such information in the Registration Statement;

provided, however, that paragraphs (a)(1)(i) and (a)(1)(ii) of this section do not apply if the Registration Statement is on Form S-3, Form S-8 or Form F-3, and the information required to be included in a post-effective amendment by those paragraphs is contained in periodic reports filed with or furnished to the Commission by the Registrant pursuant to Section 13 or Section 15(d) of the Securities Exchange Act that are incorporated by reference in the Registration Statement.

(2) That, for the purpose of determining any liability under the Securities Act of 1933, each such post-effective amendment shall be deemed to be a new Registration Statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(3) To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

(b) The undersigned Registrant hereby undertakes that, for purposes of determining any liability under the Securities Act of 1933, each filing of the Registrant’s annual report pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 (and, where applicable, each filing of an employee benefit plan’s annual report pursuant to Section 15(d) of the Securities Exchange Act of 1934) that is incorporated by reference in the Registration Statement shall be deemed to be a new Registration Statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(c) Insofar as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers and controlling persons of the Registrant pursuant to the foregoing provisions, or otherwise, the Registrant has been advised that in the opinion of the Commission such indemnification is against public policy as expressed in the Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the Registrant of expenses incurred or paid by a director, officer or controlling person of the Registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the Registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Act and will be governed by the final adjudication of such issue.

SIGNATURES

Pursuant to the requirements of the Securities Act, the Registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-8 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Gonzales, State of Louisiana, on November 10, 2014.

| |

|

CROWN CRAFTS, INC. |

| |

|

|

| |

By: |

/s/ E. Randall Chestnut |

| |

|

E. Randall Chestnut

President and Chief Executive Officer |

SIGNATURES AND POWER OF ATTORNEY

Each person whose individual signature appears below hereby authorizes and appoints E. Randall Chestnut and Olivia W. Elliott, and each of them, with full power of substitution and full power to act without the other, as his true and lawful attorney-in-fact and agent to act in his name, place and stead and to execute in the name and on behalf of each person, individually and in each capacity stated below, and to file any and all amendments to this Registration Statement, including any and all post-effective amendments.

Pursuant to the requirements of the Securities Act, this Power of Attorney has been signed by the following persons in the capacities indicated on November 10, 2014.

|

Signature |

|

Title |

|

|

|

|

|

/s/ E. Randall Chestnut |

|

Chairman of the Board, President and Chief Executive Officer |

| E. Randall Chestnut |

|

(Principal Executive Officer) |

|

|

|

|

|

/s/ Olivia W. Elliott |

|

Vice President and Chief Financial Officer (Principal Financial |

| Olivia W. Elliott |

|

Officer and Principal Accounting Officer) |

|

|

|

|

|

/s/ Sidney Kirschner |

|

Director |

| Sidney Kirschner |

|

|

|

|

|

|

|

/s/ Zenon S. Nie |

|

Director |

| Zenon S. Nie |

|

|

| |

|

|

|

/s/ Donald Ratajczak |

|

Director |

| Donald Ratajczak |

|

|

|

|

|

|

|

/s/ Patricia Stensrud |

|

Director |

| Patricia Stensrud |

|

|

Exhibit Index

|

Exhibit

Number |

|

Description |

|

4.1 |

|

Amended and Restated Certificate of Incorporation of Crown Crafts, Inc. (incorporated herein by reference to Exhibit 3.1 to the Registrant’s Quarterly Report on Form 10-Q for the quarter ended December 28, 2003). |

|

4.2 |

|

Certificate of Amendment to the Amended and Restated Certificate of Incorporation of Crown Crafts, Inc. (incorporated herein by reference to Exhibit 3.1 to the Registrant’s Current Report on Form 8-K dated August 9, 2011). |

|

4.3 |

|

Amended and Restated Bylaws of Crown Crafts, Inc. (incorporated herein by reference to Exhibit 3.1 to the Registrant’s Current Report on Form 8-K dated April 4, 2011). |

|

5.1 |

|

Opinion of Rogers & Hardin LLP. |

|

23.1 |

|

Consent of KPMG LLP. |

|

23.2 |

|

Consent of Rogers & Hardin LLP (included in Exhibit 5.1). |

|

24.1 |

|

Powers of Attorney (included on signature page). |

|

99.1 |

|

Crown Crafts, Inc. 2014 Omnibus Equity Compensation Plan (incorporated by reference to Appendix A to the Registrant's Definitive Proxy Statement on Schedule 14A filed on June 27, 2014). |

|

99.2 |

|

Form of Incentive Stock Option Grant Agreement. |

|

99.3 |

|

Form of Nonqualified Stock Option Grant Agreement. |

|

99.4 |

|

Form of Restricted Stock Grant Agreement. |

5

Exhibit 5.1

November 10, 2014

Crown Crafts, Inc.

916 South Burnside Avenue

Gonzales, Louisiana 70737

Ladies and Gentlemen:

We have acted as counsel to Crown Crafts, Inc., a Delaware corporation (the “Company”), in connection with the preparation of a Registration Statement on Form S-8 (the “Registration Statement”) under the Securities Act of 1933, as amended (the “Act”), which is being filed with the Securities and Exchange Commission (the “Commission”) with respect to 1,200,000 shares of the Series A common stock, par value $0.01 per share, of the Company (the “Shares”) which may be issued pursuant to the Crown Crafts, Inc. 2014 Omnibus Equity Compensation Plan (the “Plan”). We are furnishing this opinion letter pursuant to Item 8 of Form S-8 and Item 601(b)(5) of the Commission’s Regulation S-K.

In connection with our opinion set forth below, we have examined the Amended and Restated Certificate of Incorporation, as amended, of the Company, the Amended and Restated Bylaws of the Company, records of proceedings of the Board of Directors of the Company deemed by us to be relevant to this opinion letter, the Plan and the Registration Statement. We also have made such further legal and factual examinations and investigations as we deemed necessary for purposes of expressing the opinion set forth below. In our examination, we have assumed the genuineness of all signatures, the legal capacity and competency of all natural persons, the authenticity of all documents submitted to us as originals and the conformity to original documents of all documents submitted to us as certified, conformed, facsimile, electronic or photostatic copies.

As to certain factual matters relevant to this opinion letter, we have relied conclusively upon originals or copies, certified or otherwise identified to our satisfaction, of such other records, agreements, documents and instruments, including certificates or comparable documents of officers of the Company and of public officials, as we have deemed appropriate as a basis for the opinion set forth below. Except to the extent expressly set forth herein, we have made no independent investigations with regard to matters of fact, and, accordingly, we do not express any opinion as to matters that might have been disclosed by independent verification.

Our opinion set forth below is limited to the laws of the State of Delaware that, in our professional judgment, are normally applicable to transactions of the type contemplated by the Plan, and we do not express any opinion herein concerning any other laws.

Rogers & Hardin LLP | 2700 International Tower | 229 Peachtree Street NE | Atlanta, GA 30303 | 404.522.4700 Phone | 404.525.2224 Fax | rh-law.com

Crown Crafts, Inc.

November 10, 2014

Page 2

Based on the foregoing, it is our opinion that the Shares are duly authorized for issuance and, when issued by the Company in accordance with the terms of the Plan, will be validly issued, fully paid and non-assessable.

This opinion letter is provided for use solely in connection with the transactions contemplated by the Registration Statement and may not be used, circulated, quoted or otherwise relied upon for any other purpose without our express written consent. The only opinion rendered by us consists of those matters set forth in the immediately preceding paragraph, and no opinion may be implied or inferred beyond the opinion expressly stated. Our opinion expressed herein is as of the date hereof, and we undertake no obligation to advise you of any changes in applicable law or any other matters that may come to our attention after the date hereof that may affect our opinion expressed herein.

We hereby consent to the filing of this opinion letter as an exhibit to the Registration Statement. In giving such consent, we do not thereby admit that we are within the category of persons whose consent is required to be filed pursuant to Section 7 of the Act or the rules and regulations of the Commission promulgated thereunder.

Sincerely,

/s/ Rogers & Hardin LLP

Exhibit 23.1

Consent of Independent Registered Public Accounting Firm

The Board of Directors

Crown Crafts, Inc.:

We consent to the use of our report dated June 17, 2014, with respect to the consolidated balance sheets of Crown Crafts, Inc. and subsidiaries as of March 30, 2014 and March 31, 2013, and the related consolidated statements of income, changes in shareholders’ equity, and cash flows for the years then ended, and the related financial statement schedule, incorporated by reference herein.

/s/ KPMG LLP

Baton Rouge, Louisiana

November 10, 2014

Exhibit 99.2

CROWN CRAFTS, INC.

INCENTIVE STOCK OPTION GRANT AGREEMENT

(Pursuant to the 2014 Omnibus Equity Compensation Plan)

THIS INCENTIVE STOCK OPTION GRANT AGREEMENT (the “Agreement”) is made and entered into as of the date of grant set forth below (the “Date of Grant”), by and between Crown Crafts, Inc., a Delaware corporation (the “Company”), and the individual listed below (the “Participant”).

1. Option Grant. Pursuant to the Crown Crafts, Inc. 2014 Omnibus Equity Compensation Plan (the “Plan”; unless otherwise defined herein, capitalized terms used in this Agreement have the meanings set forth in the Plan), the Company hereby grants to the Participant, as of the Date of Grant, an Incentive Stock Option (the “Option”) to purchase the number of shares of Series A common stock, par value $0.01 per share, of the Company (“Company Stock”) set forth below, as such Option may become vested and exercisable, in accordance with the terms and conditions of this Agreement and subject in all respects to the terms and conditions set forth in the Plan, which is incorporated herein by this reference and made a part hereof.

|

Participant |

Date of Grant |

Number of Shares of Company Stock |

Exercise Price Per Share |

|

________________________ |

________________ |

____________ |

$_________ |

| |

|

|

|

|

Vesting of the Option: |

Except as otherwise set forth herein, the Option will vest and become exercisable with respect to [____________] of the shares of Company Stock subject to the Option on [each of] [____________________] ([each, a] [the] “Vesting Date”), provided that (i) the Participant continues to be employed by the Employer through the [applicable] Vesting Date and (ii) the performance criteria, if any, set forth on Appendix A, attached hereto and incorporated herein by this reference, with respect to the [applicable] Vesting Date have been met. |

|

Vesting Upon Death or Disability: |

In the event the Participant dies or becomes Disabled while employed by, or providing service to, the Employer, the Option will automatically accelerate and become fully vested and exercisable upon the occurrence of the Participant’s death or Disability. |

|

Vesting Upon Change of Control: |

In the event a Change of Control occurs while the Participant is employed by the Employer, the Option will automatically accelerate and become fully vested and exercisable on the date of the effective time of such Change of Control. |

2. Exercisability of the Option.

(a) The Option will become vested and exercisable as set forth in Section 1 hereof.

(b) The exercisability of the Option is cumulative, but shall not exceed 100% of the shares of Company Stock subject to the Option.

(c) If the schedule set forth in Section 1 hereof would produce fractional shares of Company Stock, the number of shares of Company Stock for which the Option becomes exercisable shall be rounded down to the nearest whole share of Company Stock.

3. Term of Option.

(a) The Option will have a term of ten (10) years from the Date of Grant and will terminate at the expiration of that period, unless it is terminated at an earlier date pursuant to the provisions of this Agreement or the Plan.

(b) The Option will automatically terminate, and no longer be exercisable with respect to any vested portion thereof, upon the happening of the first to occur of the following events:

(i) the expiration of the three-month period after the Participant ceases to be employed by, or provide service to, the Employer, if the termination is for any reason other than death or Disability (unless the Participant’s death occurs within such three-month period);

(ii) the expiration of the one-year period after the Participant’s death; and

(iii) the expiration of the one-year period after the Participant becomes Disabled in the event that the Participant’s termination was by reason of such Disability.

Notwithstanding the foregoing, in no event may the Option be exercised after the date immediately preceding the tenth (10th) anniversary of the Date of Grant.

(c) Any portion of the Option that is not exercisable immediately prior to, or that does not become exercisable upon, the Participant’s ceasing to be employed by the Employer will immediately terminate at such time.

4. Exercise Procedures.

(a) Subject to the provisions of Sections 2 and 3 above, the Participant may exercise part or all of the exercisable Option by giving the Company written notice of intent to exercise in a form prescribed by the Committee or satisfying such other procedures as shall be set forth by the Committee from time to time, specifying the number of shares of Company Stock as to which the Option is to be exercised. At the time of the Participant’s delivery of such notice or such other time as the Committee shall determine, the Participant shall pay the aggregate Exercise Price for that number of shares of Company Stock for which the Option is being exercised as follows: (i) in cash; (ii) with the approval of the Committee, by delivering shares of Company Stock, which shall be valued at their Fair Market Value on the date of delivery, or by attestation (on a form prescribed by the Committee) to ownership of shares of Company Stock having a Fair Market Value on the date of exercise equal to the aggregate Exercise Price; (iii) by payment through a broker in accordance with procedures permitted by Regulation T of the Federal Reserve Board; (iv) by surrender of all or any part of the shares of Company Stock for which the Option is exercisable to the Company for an appreciation distribution payable in shares of Company Stock with a Fair Market Value at the time of the Option surrender equal to the dollar amount by which the then Fair Market Value of the shares of Company Stock subject to the surrendered portion exceeds the aggregate Exercise Price payable for those shares of Company Stock; or (v) by such other method as the Committee may approve, to the extent permitted by applicable law. The Committee may impose from time to time such limitations as it deems appropriate on the use of shares of Company Stock to exercise the Option.

(b) Promptly after receipt of a notice of exercise and full payment of the Exercise Price for the shares of Company Stock being acquired, the Company shall issue and deliver to the Participant (or other person validly exercising the Option) a certificate or certificates representing the shares of Company Stock being purchased, or evidence of the issuance of such shares in book-entry form, registered in the name of the Participant (or such other person), or, upon request, in the name of the Participant (or such other person) and in the name of another person in such form of joint ownership as requested by the Participant (or such other person) pursuant to applicable state law.

(c) The obligation of the Company to deliver shares of Company Stock upon exercise of the Option shall be subject to all applicable laws, rules and regulations and such approvals by governmental agencies as may be deemed appropriate by the Committee, including such actions as Company counsel shall deem necessary or appropriate to comply with relevant securities laws and regulations. The Company may require that the Participant (or other person exercising the Option after the Participant’s death) represent that the Participant is purchasing shares of Company Stock for the Participant’s own account and not with a view to or for sale in connection with any distribution of the shares of Company Stock, or such other representation as the Committee deems appropriate.

(d) All obligations of the Company under this Agreement shall be subject to the rights of the Company as set forth in the Plan to withhold amounts required to be withheld for any taxes, if applicable. The Participant may elect to satisfy any tax withholding obligation of the Employer with respect to the Option by, upon exercise of the Option, having shares of Company Stock withheld having a Fair Market Value up to an amount that does not exceed the minimum applicable withholding tax rate for federal (including FICA), state and local tax liabilities.

5. No Stockholder Rights. Neither the Participant, nor any person entitled to exercise the Participant’s rights in the event of the Participant’s death, shall have any of the rights and privileges of a stockholder with respect to the shares of Company Stock subject to the Option until a certificate or certificates for shares of Company Stock, or evidence of the issuance of such shares in book-entry form, shall have been issued upon the exercise of the Option.

6. Notice of Sale. The Participant (or other person exercising the Option after the Participant’s death) shall promptly give notice to the Company in the event of the sale or other disposition of shares of Company Stock issued upon the exercise of the Option within the later of (i) two (2) years from the Date of Grant or (ii) one (1) year from the date of exercise. Shares of Company Stock issued upon the exercise of the Option may also be subject to stock-transfer orders for the sole purpose of informing the Company of a disqualifying disposition of such shares (and any such stop-transfer order shall be administered solely for this purpose).

7. Loss of Incentive Stock Option Status. If any portion of the Option shall fail, for any reason, to qualify as an “incentive stock option” under Section 422 of the Code (or any successor provision), it shall be treated as a Nonqualified Stock Option under the Plan. The Participant acknowledges that the Option will lose such qualification if the shares acquired upon exercise of the Option are sold or otherwise disposed of within one of the time periods described in Section 6 hereof.

8. Change of Control. Except as set forth in Section 1 hereof, the provisions of the Plan applicable to a Change of Control will apply to the Option, and in the event of a Change of Control, the Committee may take such actions as it deems appropriate pursuant to the Plan.

9. Restrictions on Exercise. Except as the Committee may otherwise permit pursuant to the Plan, only the Participant may exercise the Option during the Participant’s lifetime, and after the Participant’s death, the Option will be exercisable (subject to the limitations specified in the Plan) solely by the legal representatives of the Participant, or by the person who acquires the right to exercise the Option by will or by the laws of descent and distribution, to the extent that the Option is exercisable pursuant to this Agreement.

10. Assignment and Transfers. Except as the Committee may otherwise permit pursuant to the Plan, the rights and interests of the Participant under this Agreement may not be sold, assigned, encumbered or otherwise transferred, except, in the event of the death of the Participant, by will or by the laws of descent and distribution. In the event of any attempt by the Participant to alienate, assign, pledge, hypothecate or otherwise dispose of the Option or any right hereunder, except as provided for in this Agreement, or in the event of the levy or any attachment, execution or similar process upon the rights or interests hereby conferred, the Company may terminate the Option by notice to the Participant, and the Option and all rights hereunder will thereupon become null and void. The rights and protections of the Company hereunder will extend to any successors or assigns of the Company and to the Company’s parents, subsidiaries and affiliates. This Agreement may be assigned by the Company without the Participant’s consent.

11. Clawback Rights. The Participant agrees that the Participant will be subject to any compensation, clawback and recoupment policies that may be applicable to the Participant, as in effect from time to time and as approved by the Board, the Committee or a duly authorized committee thereof, whether or not approved before or after the Date of Grant.

12. Amendment of Agreement. Without limitation of Section 11 or Section 17 hereof, this Agreement may be amended in accordance with the provisions of the Plan and may otherwise be amended in writing by the Participant and the Company without the consent of any other person.

13. Grant Subject to Plan Provisions. The grant reflected by this Agreement (a) is made pursuant to the Plan, the terms of which are incorporated herein by reference, (b) in all respects will be interpreted in accordance with the Plan and (c) is subject to interpretations, regulations and determinations concerning the Plan established from time to time by the Committee in accordance with the provisions of the Plan, including, but not limited to, provisions pertaining to (i) rights and obligations with respect to withholding taxes, (ii) the registration, qualification or listing of shares of Company Stock, (iii) changes in capitalization of the Company and (iv) other requirements of applicable law. The Committee will have the authority to interpret and construe the grant and this Agreement pursuant to the terms of the Plan, and its decisions will be conclusive as to any questions arising hereunder or with respect such grant.

14. No Employment or Other Rights. This Agreement will not confer upon the Participant any right to be retained in the employment of the Employer and will not interfere in any way with the right of the Employer to terminate the Participant’s employment at any time. The right of the Employer to terminate at will the Participant’s employment at any time for any reason is specifically reserved.

15. Notice. Any notice to the Company provided for in this Agreement will be addressed to the Company in care of the Corporate Secretary at the Company’s corporate headquarters, and any notice to the Participant will be addressed to the Participant at the current address shown on the payroll records of the Company, or to such other address as the Participant may designate to the Company in writing. Any notice will be delivered by hand, sent by facsimile or enclosed in a properly sealed envelope addressed as stated above, registered and deposited, postage prepaid, in a post office regularly maintained by the United States Postal Service or with an overnight courier.

16. Applicable Law. The validity, construction, interpretation and effect of this Agreement will be governed by and construed in accordance with the laws of the State of Delaware, without giving effect to the conflicts of laws provisions thereof.

17. Application of Section 409A of the Code. The grant is intended to be exempt from Section 409A of the Code, and this Agreement shall be administered and interpreted in accordance with such intent. The Committee reserves the right (including the right to delegate such right) to unilaterally amend this Agreement without the consent of the Participant in order to maintain an exclusion from the application of, or to maintain compliance with, Section 409A of the Code, and the Participant hereby acknowledges and consents to such rights of the Committee.

18. Severability. The various provisions of this Agreement are severable in their entirety. Any judicial or legal determination of invalidity or unenforceability of any one provision shall have no effect on the continuing force and effect of the remaining provisions.

19. Counterparts; Electronic Signature. This Agreement may be executed in any number of counterparts, all of which, taken together, shall constitute one and the same instrument, and any of the parties or signatories hereto may execute this Agreement by signing any such counterpart. Electronic signatures in the form of handwritten signatures on a facsimile transmittal and scanned and digitized images of a handwritten signature (e.g., scanned document in PDF format) shall have the same force and effect as original manual signatures.

20. Participant Acceptance. By signing below, the Participant agrees to be bound by the terms and conditions of the Plan and this Agreement and accepts the Option as of the Date of Grant. The Participant accepts as binding, conclusive and final all decisions and determinations of the Committee upon any questions arising under this Agreement or the Plan. The Participant acknowledges delivery of the Plan and the Plan prospectus together with this Agreement.

[Signature page follows.]

IN WITNESS WHEREOF, the parties hereto have executed this Agreement as of the Date of Grant set forth herein.

|

COMPANY: |

|

PARTICIPANT: |

|

| |

|

|

|

|

| |

|

|

|

|

|

CROWN CRAFTS, INC. |

|

|

|

| |

|

|

(Signature) |

|

| |

|

|

|

|

| By: |

|

|

|

|

| Name: |

|

|

(Printed Name) |

|

| Title: |

|

|

|

|

[Signature Page to Incentive Stock Option Grant Agreement]

Appendix A

[Performance criteria, if applicable, to be determined at the time of grant.]

Exhibit 99.3

CROWN CRAFTS, INC.

NONQUALIFIED STOCK OPTION GRANT AGREEMENT

(Pursuant to the 2014 Omnibus Equity Compensation Plan)

THIS NONQUALIFIED STOCK OPTION GRANT AGREEMENT (the “Agreement”) is made and entered into as of the date of grant set forth below (the “Date of Grant”), by and between Crown Crafts, Inc., a Delaware corporation (the “Company”), and the individual listed below (the “Participant”).

1. Option Grant. Pursuant to the Crown Crafts, Inc. 2014 Omnibus Equity Compensation Plan (the “Plan”; unless otherwise defined herein, capitalized terms used in this Agreement have the meanings set forth in the Plan), the Company hereby grants to the Participant, as of the Date of Grant, a Nonqualified Stock Option (the “Option”) to purchase the number of shares of Series A common stock, par value $0.01 per share, of the Company (“Company Stock”) set forth below, as such Option may become vested and exercisable, in accordance with the terms and conditions of this Agreement and subject in all respects to the terms and conditions set forth in the Plan, which is incorporated herein by this reference and made a part hereof.

|

Participant |

Date of Grant |

Number of Shares of Company Stock |

Exercise Price Per Share |

|

________________________ |

________________ |

____________ |

$_________ |

| |

|

|

|

|

Vesting of the Option: |

Except as otherwise set forth herein, the Option will vest and become exercisable with respect to [____________] of the shares of Company Stock subject to the Option on [each of] [____________________] ([each, a] [the] “Vesting Date”), provided that (i) the Participant continues to be employed by, or provide service to, the Employer through the [applicable] Vesting Date and (ii) the performance criteria, if any, set forth on Appendix A, attached hereto and incorporated herein by this reference, with respect to the [applicable] Vesting Date have been met. |

|

Vesting Upon Death or Disability: |

In the event the Participant dies or becomes Disabled while employed by, or providing service to, the Employer, the Option will automatically accelerate and become fully vested and exercisable upon the occurrence of the Participant’s death or Disability. |

|

Vesting Upon Change of Control: |

In the event a Change of Control occurs while the Participant is employed by, or providing service to, the Employer, the Option will automatically accelerate and become fully vested and exercisable on the date of the effective time of such Change of Control. |

2. Exercisability of the Option.

(a) The Option will become vested and exercisable as set forth in Section 1 hereof.

(b) The exercisability of the Option is cumulative, but shall not exceed 100% of the shares of Company Stock subject to the Option.

(c) If the schedule set forth in Section 1 hereof would produce fractional shares of Company Stock, the number of shares of Company Stock for which the Option becomes exercisable shall be rounded down to the nearest whole share of Company Stock.

3. Term of Option.

(a) The Option will have a term of ten (10) years from the Date of Grant and will terminate at the expiration of that period, unless it is terminated at an earlier date pursuant to the provisions of this Agreement or the Plan.

(b) The Option will automatically terminate, and no longer be exercisable with respect to any vested portion thereof, upon the happening of the first to occur of the following events:

(i) the expiration of the three-month period after the Participant ceases to be employed by, or provide service to, the Employer, if the termination is for any reason other than death or Disability (unless the Participant’s death occurs within such three-month period);

(ii) the expiration of the one-year period after the Participant’s death; and

(iii) the expiration of the one-year period after the Participant becomes Disabled in the event that the Participant’s termination was by reason of such Disability.

Notwithstanding the foregoing, in no event may the Option be exercised after the date immediately preceding the tenth (10th) anniversary of the Date of Grant.

(c) Any portion of the Option that is not exercisable immediately prior to, or that does not become exercisable upon, the Participant’s ceasing to be employed by, or provide service to, the Employer will immediately terminate at such time.

4. Exercise Procedures.

(a) Subject to the provisions of Sections 2 and 3 above, the Participant may exercise part or all of the exercisable Option by giving the Company written notice of intent to exercise in a form prescribed by the Committee or satisfying such other procedures as shall be set forth by the Committee from time to time, specifying the number of shares of Company Stock as to which the Option is to be exercised. At the time of the Participant’s delivery of such notice or such other time as the Committee shall determine, the Participant shall pay the aggregate Exercise Price for that number of shares of Company Stock for which the Option is being exercised as follows: (i) in cash; (ii) with the approval of the Committee, by delivering shares of Company Stock, which shall be valued at their Fair Market Value on the date of delivery, or by attestation (on a form prescribed by the Committee) to ownership of shares of Company Stock having a Fair Market Value on the date of exercise equal to the aggregate Exercise Price; (iii) by payment through a broker in accordance with procedures permitted by Regulation T of the Federal Reserve Board; (iv) by surrender of all or any part of the shares of Company Stock for which the Option is exercisable to the Company for an appreciation distribution payable in shares of Company Stock with a Fair Market Value at the time of the Option surrender equal to the dollar amount by which the then Fair Market Value of the shares of Company Stock subject to the surrendered portion exceeds the aggregate Exercise Price payable for those shares of Company Stock; or (v) by such other method as the Committee may approve, to the extent permitted by applicable law. The Committee may impose from time to time such limitations as it deems appropriate on the use of shares of Company Stock to exercise the Option.

(b) Promptly after receipt of a notice of exercise and full payment of the Exercise Price for the shares of Company Stock being acquired, the Company shall issue and deliver to the Participant (or other person validly exercising the Option) a certificate or certificates representing the shares of Company Stock being purchased, or evidence of the issuance of such shares in book-entry form, registered in the name of the Participant (or such other person), or, upon request, in the name of the Participant (or such other person) and in the name of another person in such form of joint ownership as requested by the Participant (or such other person) pursuant to applicable state law.

(c) The obligation of the Company to deliver shares of Company Stock upon exercise of the Option shall be subject to all applicable laws, rules and regulations and such approvals by governmental agencies as may be deemed appropriate by the Committee, including such actions as Company counsel shall deem necessary or appropriate to comply with relevant securities laws and regulations. The Company may require that the Participant (or other person exercising the Option after the Participant’s death) represent that the Participant is purchasing shares of Company Stock for the Participant’s own account and not with a view to or for sale in connection with any distribution of the shares of Company Stock, or such other representation as the Committee deems appropriate.

(d) All obligations of the Company under this Agreement shall be subject to the rights of the Company as set forth in the Plan to withhold amounts required to be withheld for any taxes, if applicable. The Participant may elect to satisfy any tax withholding obligation of the Employer with respect to the Option by, upon exercise of the Option, having shares of Company Stock withheld having a Fair Market Value up to an amount that does not exceed the minimum applicable withholding tax rate for federal (including FICA), state and local tax liabilities.

5. No Stockholder Rights. Neither the Participant, nor any person entitled to exercise the Participant’s rights in the event of the Participant’s death, shall have any of the rights and privileges of a stockholder with respect to the shares of Company Stock subject to the Option until a certificate or certificates for shares of Company Stock, or evidence of the issuance of such shares in book-entry form, shall have been issued upon the exercise of the Option.

6. Change of Control. Except as set forth in Section 1 hereof, the provisions of the Plan applicable to a Change of Control will apply to the Option, and in the event of a Change of Control, the Committee may take such actions as it deems appropriate pursuant to the Plan.

7. Restrictions on Exercise. Except as the Committee may otherwise permit pursuant to the Plan, only the Participant may exercise the Option during the Participant’s lifetime, and after the Participant’s death, the Option will be exercisable (subject to the limitations specified in the Plan) solely by the legal representatives of the Participant, or by the person who acquires the right to exercise the Option by will or by the laws of descent and distribution, to the extent that the Option is exercisable pursuant to this Agreement.

8. Assignment and Transfers. Except as the Committee may otherwise permit pursuant to the Plan, the rights and interests of the Participant under this Agreement may not be sold, assigned, encumbered or otherwise transferred, except, in the event of the death of the Participant, by will or by the laws of descent and distribution. In the event of any attempt by the Participant to alienate, assign, pledge, hypothecate or otherwise dispose of the Option or any right hereunder, except as provided for in this Agreement, or in the event of the levy or any attachment, execution or similar process upon the rights or interests hereby conferred, the Company may terminate the Option by notice to the Participant, and the Option and all rights hereunder will thereupon become null and void. The rights and protections of the Company hereunder will extend to any successors or assigns of the Company and to the Company’s parents, subsidiaries and affiliates. This Agreement may be assigned by the Company without the Participant’s consent.

9. Clawback Rights. The Participant agrees that the Participant will be subject to any compensation, clawback and recoupment policies that may be applicable to the Participant, as in effect from time to time and as approved by the Board, the Committee or a duly authorized committee thereof, whether or not approved before or after the Date of Grant.

10. Amendment of Agreement. Without limitation of Section 9 or Section 15 hereof, this Agreement may be amended in accordance with the provisions of the Plan and may otherwise be amended in writing by the Participant and the Company without the consent of any other person.

11. Grant Subject to Plan Provisions. The grant reflected by this Agreement (a) is made pursuant to the Plan, the terms of which are incorporated herein by reference, (b) in all respects will be interpreted in accordance with the Plan and (c) is subject to interpretations, regulations and determinations concerning the Plan established from time to time by the Committee in accordance with the provisions of the Plan, including, but not limited to, provisions pertaining to (i) rights and obligations with respect to withholding taxes, (ii) the registration, qualification or listing of shares of Company Stock, (iii) changes in capitalization of the Company and (iv) other requirements of applicable law. The Committee will have the authority to interpret and construe the grant and this Agreement pursuant to the terms of the Plan, and its decisions will be conclusive as to any questions arising hereunder or with respect such grant.

12. No Employment or Other Rights. This Agreement will not confer upon the Participant any right to be retained in the employment or service of the Employer and will not interfere in any way with the right of the Employer to terminate the Participant’s employment or service at any time. The right of the Employer to terminate at will the Participant’s employment or service at any time for any reason is specifically reserved.

13. Notice. Any notice to the Company provided for in this Agreement will be addressed to the Company in care of the Corporate Secretary at the Company’s corporate headquarters, and any notice to the Participant will be addressed to the Participant at the current address shown on the payroll records of the Company, or to such other address as the Participant may designate to the Company in writing. Any notice will be delivered by hand, sent by facsimile or enclosed in a properly sealed envelope addressed as stated above, registered and deposited, postage prepaid, in a post office regularly maintained by the United States Postal Service or with an overnight courier.

14. Applicable Law. The validity, construction, interpretation and effect of this Agreement will be governed by and construed in accordance with the laws of the State of Delaware, without giving effect to the conflicts of laws provisions thereof.

15. Application of Section 409A of the Code. The grant is intended to be exempt from Section 409A of the Code, and this Agreement shall be administered and interpreted in accordance with such intent. The Committee reserves the right (including the right to delegate such right) to unilaterally amend this Agreement without the consent of the Participant in order to maintain an exclusion from the application of, or to maintain compliance with, Section 409A of the Code, and the Participant hereby acknowledges and consents to such rights of the Committee.

16. Severability. The various provisions of this Agreement are severable in their entirety. Any judicial or legal determination of invalidity or unenforceability of any one provision shall have no effect on the continuing force and effect of the remaining provisions.

17. Counterparts; Electronic Signature. This Agreement may be executed in any number of counterparts, all of which, taken together, shall constitute one and the same instrument, and any of the parties or signatories hereto may execute this Agreement by signing any such counterpart. Electronic signatures in the form of handwritten signatures on a facsimile transmittal and scanned and digitized images of a handwritten signature (e.g., scanned document in PDF format) shall have the same force and effect as original manual signatures.

18. Participant Acceptance. By signing below, the Participant agrees to be bound by the terms and conditions of the Plan and this Agreement and accepts the Option as of the Date of Grant. The Participant accepts as binding, conclusive and final all decisions and determinations of the Committee upon any questions arising under this Agreement or the Plan. The Participant acknowledges delivery of the Plan and the Plan prospectus together with this Agreement.

[Signature page follows.]

IN WITNESS WHEREOF, the parties hereto have executed this Agreement as of the Date of Grant set forth herein.

|

COMPANY: |

|

PARTICIPANT: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CROWN CRAFTS, INC. |

|

|

|

|

|

|

|

(Signature) |

|

|

|

|

|

|

|

|

By: |

|

|

|

|

|

Name: |

|

|

(Printed Name) |

|

|

Title: |

|

|

|

|

[Signature Page to Nonqualified Stock Option Grant Agreement]

Appendix A

[Performance criteria, if applicable, to be determined at the time of grant.]

Exhibit 99.4

CROWN CRAFTS, INC.

RESTRICTED STOCK GRANT AGREEMENT

(Pursuant to the 2014 Omnibus Equity Compensation Plan)

THIS RESTRICTED STOCK GRANT AGREEMENT (the “Agreement”) is made and entered into as of the date of grant set forth below (the “Date of Grant”), by and between Crown Crafts, Inc., a Delaware corporation (the “Company”), and the individual listed below (the “Participant”).

1. Grant of Shares. Pursuant to the Crown Crafts, Inc. 2014 Omnibus Equity Compensation Plan (the “Plan”; unless otherwise defined herein, capitalized terms used in this Agreement have the meanings set forth in the Plan), the Company hereby grants to the Participant, as of the Date of Grant, that number of shares of Series A common stock, par value $0.01 per share, of the Company (“Company Stock”) that may become vested as set forth below (the “Restricted Stock”), in accordance with the terms and conditions of this Agreement and subject in all respects to the terms and conditions set forth in the Plan, which is incorporated herein by this reference and made a part hereof.

|

Participant |

Date of Grant |

Number of Shares of Company Stock |

|

________________________ |

_____________________ |

________________________ |

| |

|

|

|

Vesting Schedule: |

Except as otherwise set forth herein, the shares of Restricted Stock shall become vested, and the restrictions described in Sections 2(b) and 2(c) hereof shall lapse, on [each of] [____________________] ([each, a] [the] “Vesting Date”), provided that (i) the Participant continues to be employed by, or provide service to, the Employer through the [applicable] Vesting Date and (ii) the performance criteria, if any, set forth on Appendix A, attached hereto and incorporated herein by this reference, with respect to the [applicable] Vesting Date have been met. |

|

Vesting Upon Death or Disability: |

In the event the Participant dies or becomes Disabled during the Restriction Period (as defined below) and while employed by, or providing service to, the Employer, the Restriction Period shall end immediately upon the occurrence of the Participant’s death or Disability and all unvested shares of Restricted Stock will automatically vest in full at such time. |

|

Vesting Upon Change of Control: |

In the event a Change of Control occurs during the Restriction Period and while the Participant is employed by, or providing service to, the Employer, the Restriction Period shall end on the date of the effective time of such Change of Control and all unvested shares of Restricted Stock will automatically vest in full on such date. |

2. Vesting and Nonassignability of Restricted Stock.

(a) The shares of Restricted Stock will become vested as set forth in Section 1 hereof.

(b) Except as otherwise provided in this Agreement, if the Participant ceases to be employed by, or provide service to, the Employer for any reason before the Restricted Stock fully vests, then the shares of Restricted Stock that are not then vested shall be forfeited and immediately returned to the Company.

(c) During the period before all of the shares of Restricted Stock vest (the “Restriction Period”), the unvested shares of Restricted Stock may not be assigned, transferred, pledged or otherwise disposed of by the Participant. Any attempt to assign, transfer, pledge or otherwise dispose of the shares contrary to the provisions hereof, and the levy of any execution, attachment or similar process upon the shares, shall be null, void and without effect.

(d) If the Vesting Schedule set forth in Section 1 hereof would result in the Participant vesting in a fractional share of Restricted Stock, the number of shares in which the Participant becomes vested shall be rounded down to the nearest whole share of Restricted Stock.

3. Issuance of Certificates.

(a) Stock certificates representing the Restricted Stock may be issued by the Company and held in escrow by the Company until the Restricted Stock vests, or the Company may hold evidence of the issuance of shares in book-entry form until the Restricted Stock vests. The Participant agrees to execute, if required by the Company, a stock power with respect to each stock certificate representing shares of Restricted Stock, or other evidence of book-entry stock ownership, in favor of the Company. When the Participant obtains a vested right to shares of Restricted Stock, a certificate, or evidence of the issuance of shares in book-entry form, representing the vested shares shall be delivered to the Participant, free of the restrictions under Sections 2(b) and 2(c) of this Agreement.

(b) During the Restriction Period, the Participant shall receive any cash dividends with respect to the shares of Restricted Stock, may vote the shares of Restricted Stock and may participate in any distribution pursuant to a plan of dissolution or complete liquidation of the Company. In the event of a dividend or distribution payable in stock or other property or a reclassification, split up or similar event during the Restriction Period, the shares or other property issued or declared with respect to the unvested shares of Restricted Stock shall be subject to the same terms and conditions relating to vesting as the shares to which they relate.

(c) The obligation of the Company to deliver shares upon the vesting of the Restricted Stock shall be subject to all applicable laws, rules and regulations and such approvals by governmental agencies as may be deemed appropriate to comply with relevant securities laws and regulations.

4. Withholding of Taxes. The Participant shall be required to pay to the Company, or make other arrangements satisfactory to the Company to provide for the payment of, any federal, state, local or other taxes that the Employer is required to withhold with respect to the grant or vesting of the Restricted Stock. To the extent applicable, the Committee may provide that upon vesting the number of shares of Restricted Stock will be reduced by a number of shares of Restricted Stock sufficient to satisfy the amount of any federal, state or local income and employment taxes associated with vesting of the Restricted Stock. In no event will the amount of withholding exceed the minimum applicable withholding tax rate for federal (including FICA), state, local and other tax liabilities.

5. Successors and Assigns. The rights and protections of the Company hereunder will extend to any successors or assigns of the Company and to the Company’s parents, subsidiaries and affiliates. This Agreement may be assigned by the Company without the Participant’s consent.

6. Clawback Rights. The Participant agrees that the Participant will be subject to any compensation, clawback and recoupment policies that may be applicable to the Participant, as in effect from time to time and as approved by the Board, the Committee or a duly authorized committee thereof, whether or not approved before or after the Date of Grant.

7. Amendment of Agreement. Without limitation of Section 6 or Section 12 hereof, this Agreement may be amended in accordance with the provisions of the Plan and may otherwise be amended in writing by the Participant and the Company without the consent of any other person.

8. Grant Subject to Plan Provisions. The grant reflected by this Agreement (a) is made pursuant to the Plan, the terms of which are incorporated herein by reference, (b) in all respects will be interpreted in accordance with the Plan and (c) is subject to interpretations, regulations and determinations concerning the Plan established from time to time by the Committee in accordance with the provisions of the Plan, including, but not limited to, provisions pertaining to (i) rights and obligations with respect to withholding taxes, (ii) the registration, qualification or listing of shares of Company Stock, (iii) changes in capitalization of the Company and (iv) other requirements of applicable law. The Committee will have the authority to interpret and construe the grant and this Agreement pursuant to the terms of the Plan, and its decisions will be conclusive as to any questions arising hereunder or with respect such grant.

9. No Employment or Other Rights. This Agreement will not confer upon the Participant any right to be retained in the employment or service of the Employer and will not interfere in any way with the right of the Employer to terminate the Participant’s employment or service at any time. The right of the Employer to terminate at will the Participant’s employment or service at any time for any reason is specifically reserved.

10. Notice. Any notice to the Company provided for in this Agreement will be addressed to the Company in care of the Corporate Secretary at the Company’s corporate headquarters, and any notice to the Participant will be addressed to the Participant at the current address shown on the payroll records of the Company, or to such other address as the Participant may designate to the Company in writing. Any notice will be delivered by hand, sent by facsimile or enclosed in a properly sealed envelope addressed as stated above, registered and deposited, postage prepaid, in a post office regularly maintained by the United States Postal Service or with an overnight courier.

11. Applicable Law. The validity, construction, interpretation and effect of this Agreement will be governed by and construed in accordance with the laws of the State of Delaware, without giving effect to the conflicts of laws provisions thereof.

12. Application of Section 409A of the Code. The grant is intended to be exempt from Section 409A of the Code, and this Agreement shall be administered and interpreted in accordance with such intent. The Committee reserves the right (including the right to delegate such right) to unilaterally amend this Agreement without the consent of the Participant in order to maintain an exclusion from the application of, or to maintain compliance with, Section 409A of the Code, and the Participant hereby acknowledges and consents to such rights of the Committee.

13. Severability. The various provisions of this Agreement are severable in their entirety. Any judicial or legal determination of invalidity or unenforceability of any one provision shall have no effect on the continuing force and effect of the remaining provisions.

14. Counterparts; Electronic Signature. This Agreement may be executed in any number of counterparts, all of which, taken together, shall constitute one and the same instrument, and any of the parties or signatories hereto may execute this Agreement by signing any such counterpart. Electronic signatures in the form of handwritten signatures on a facsimile transmittal and scanned and digitized images of a handwritten signature (e.g., scanned document in PDF format) shall have the same force and effect as original manual signatures.

15. Participant Acceptance. By signing below, the Participant agrees to be bound by the terms and conditions of the Plan and this Agreement and accepts the Restricted Stock as of the Date of Grant. The Participant accepts as binding, conclusive and final all decisions and determinations of the Committee upon any questions arising under this Agreement or the Plan. The Participant acknowledges delivery of the Plan and the Plan prospectus together with this Agreement.

[Signature page follows.]

IN WITNESS WHEREOF, the parties hereto have executed this Agreement as of the Date of Grant set forth herein.

|

COMPANY: |

|

PARTICIPANT: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CROWN CRAFTS, INC. |

|

|

|

|

|

|

|

(Signature) |

|

|

|

|

|

|

|

|

By: |

|

|

|

|

|

Name: |

|

|

(Printed Name) |

|

|

Title: |

|

|

|

|

[Signature Page to Restricted Stock Grant Agreement]

Appendix A

[Performance criteria, if applicable, to be determined at the time of grant.]

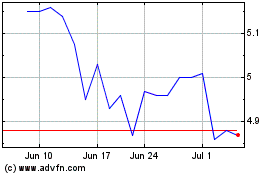

Crown Crafts (NASDAQ:CRWS)

Historical Stock Chart

From Mar 2024 to Apr 2024

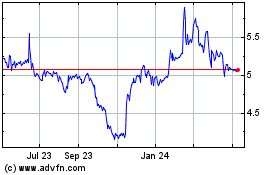

Crown Crafts (NASDAQ:CRWS)

Historical Stock Chart

From Apr 2023 to Apr 2024