UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE TO

Tender Offer Statement Under Section 14(d)(1) or 13(e)(1)

of the Securities Exchange Act of 1934

COPART, INC.

(Name of Subject Company (Issuer) and Name of Filing Person (Offeror))

Common Stock, Par Value $0.0001 Per Share

(Title of Class of Securities)

217204106

(CUSIP Number

of Class of Securities)

A. Jayson Adair

Chief

Executive Officer

Copart, Inc.

14185 Dallas Parkway, Suite 300

Dallas, TX 75254

(972)

391-5000

(Name, address and telephone number of person authorized to receive notices and communication on behalf of Filing Persons)

Copy to:

Paul A. Styer

Senior

Vice President, General Counsel and Secretary

Copart, Inc.

14185 Dallas Parkway, Suite 300

Dallas, TX 75254

(972)

391-5000

Copy to:

Robert F. Kornegay

Michael Occhiolini

Wilson Sonsini Goodrich & Rosati

Professional Corporation

12235 El Camino Real, Suite 200

San Diego, California 92130-3002

Tel: (858) 350-2300

CALCULATION

OF REGISTRATION FEE

|

|

|

| Transaction Valuation |

|

Amount of Filing Fee |

| Not Applicable* |

|

Not Applicable* |

| |

| * |

A filing fee is not required in connection with this filing as it relates solely to preliminary communications made before the commencement of a tender offer. |

| ¨ |

Check the box if any part of the filing fee is offset as provided by Rule 0-11(a)(2) and identify the filing with which the offsetting fee was previously paid. Identify the

previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

|

|

|

| Amount Previously Paid: N/A |

|

|

Filing Party: N/A |

|

| Form or Registration No.: N/A |

|

|

Date Filed: N/A |

|

| x |

Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer. |

Check the appropriate boxes below to designate any transaction to which the statement relates:

| |

¨ |

third party tender offer subject to Rule 14d-1. |

| |

x |

issuer tender offer subject to Rule 13e-4. |

| |

¨ |

going private transaction subject to Rule 13e-3. |

| |

¨ |

amendment to Schedule 13D under Rule 13d-2. |

Check the following box if the filing is a final amendment reporting the results of the tender offer: ¨

If applicable, check the appropriate box(es) below to designate the appropriate rule

provision(s) relied upon:

| |

¨ |

Rule 13e-4(i) (Cross-Border Issuer Tender Offer) |

| |

¨ |

Rule 14d-1(d) (Cross-Border Third-Party Tender Offer) |

On November 23, 2015, Copart, Inc., a Delaware corporation (the “Company”), issued

a press release announcing that it expects to commence a modified “Dutch auction” tender offer on November 24, 2015 to purchase up to 7,317,073 shares of its common stock at a price per share not less than $38.00 and not greater than

$41.00. A copy of the press release is included as Exhibit 99.1 to this Schedule TO.

The press release is for informational purposes

only and is not an offer to buy or the solicitation of an offer to sell any shares of the Company’s common stock. The anticipated tender offer described in the attached press release has not yet commenced. If the Company commences the offer,

the offer will be made solely by an Offer to Purchase and the related Letter of Transmittal, as they may be amended or supplemented. Stockholders and investors are urged to read the Company’s commencement tender offer statement on Schedule TO

anticipated to be filed with the Securities and Exchange Commission (the “SEC”) in connection with the offer, which will include as exhibits the Offer to Purchase, the related Letter of Transmittal and other offer materials, as well as any

amendments or supplements to the Schedule TO when they become available, because they will contain important information. If the Company commences the offer, each of these documents will be filed with the SEC, and, when available, investors may

obtain them for free from the SEC at its website (www.sec.gov) or from the Company’s information agent in connection with the offer.

Item 12. Exhibits.

|

|

|

| Exhibit

No. |

|

Description |

|

|

| 99.1 |

|

Press release of Copart, Inc., issued on November 23, 2015. |

-1-

Exhibit 99.1

Copart Announces Intent to Repurchase Up to 7,317,073 Shares of Its Common Stock Through A Modified “Dutch Auction” Tender Offer

Dallas, TX (November 23, 2015) – Copart, Inc. (NASDAQ: CPRT) today announced that it expects to commence a modified “Dutch Auction”

tender offer to purchase up to 7,317,073 shares of its common stock at a price per share not less than $38.00 and not greater than $41.00. The tender offer is expected to commence on November 24, 2015, and to expire on December 23, 2015,

unless extended. The number of shares proposed to be purchased in the tender offer represents approximately 6.1% of Copart’s currently outstanding common stock. Assuming 7,317,073 shares are repurchased at the maximum price of $41.00 per share

in the tender offer, the Company will repurchase a total of approximately $300.0 million of its common stock in the tender offer. Tenders of shares must be made prior to the expiration of the tender offer and may be withdrawn at any time prior to

that time.

On the terms and subject to the conditions of the tender offer, Copart’s stockholders will have the opportunity to tender some or all of

their shares at a price within the $38.00 to $41.00 per share range. Based on the number of shares tendered and the prices specified by the tendering stockholders, Copart will determine the lowest per-share price within the range that will enable it

to purchase 7,317,073 shares or such lesser number of shares that are tendered and not withdrawn. All shares accepted in the tender offer will be purchased at the same price per share even if a stockholder tenders at a lower price. If stockholders

tender more than 7,317,073 shares at or below the purchase price per share, Copart will purchase the shares tendered at or below the determined purchase price by those stockholders, subject to pro-ration and certain other factors.

The tender offer is not contingent upon any minimum number of shares being tendered. The tender offer is, however, subject to a number of customary terms and

conditions.

None of Copart, its board of directors, the depositary, or the information agent is making any recommendations to stockholders as to whether

to tender or refrain from tendering their shares into the tender offer. Stockholders must decide how many shares they will tender, if any, and the price within the stated range at which they will offer their shares for purchase by Copart.

Copart’s directors and executive officers have advised Copart that they do not intend to tender any of their shares in the tender offer.

The information agent is Georgeson Inc. and the depositary is Computershare Trust Company, N.A. The Offer to Purchase, a letter of transmittal, and related

documents will be mailed to stockholders of record and also will be made available for distribution to beneficial owners of Copart’s stock. For questions and information, please call the information agent at 1-800-932-9864.

News Release for Informational Purposes Only

THIS PRESS

RELEASE IS FOR INFORMATIONAL PURPOSES ONLY AND DOES NOT CONSTITUTE AN OFFER TO BUY OR SOLICITATION OF AN OFFER TO SELL SHARES OF COPART’S COMMON STOCK. THE TENDER OFFER WILL BE MADE ONLY PURSUANT TO THE OFFER TO PURCHASE, LETTER OF TRANSMITTAL,

AND RELATED MATERIALS THAT COPART WILL DISTRIBUTE TO ITS STOCKHOLDERS AFTER COPART FILES WITH THE SECURITIES AND EXCHANGE COMMISSION ITS “SCHEDULE TO” AND OFFER TO PURCHASE. STOCKHOLDERS AND INVESTORS SHOULD READ CAREFULLY

THE OFFER TO PURCHASE, LETTER OF TRANSMITTAL, AND RELATED MATERIALS BECAUSE THEY WILL CONTAIN IMPORTANT

INFORMATION, INCLUDING THE VARIOUS TERMS OF, AND CONDITIONS TO, THE TENDER OFFER. AFTER COPART FILES ITS “SCHEDULE TO” AND OFFER TO PURCHASE WITH THE SECURITIES AND EXCHANGE COMMISSION, WHICH FILING IS PRESENTLY EXPECTED TO BE MADE ON

NOVEMBER 24, 2015, STOCKHOLDERS AND INVESTORS MAY OBTAIN A FREE COPY OF THE TENDER OFFER STATEMENT ON “SCHEDULE TO,” THE OFFER TO PURCHASE, LETTER OF TRANSMITTAL, AND OTHER DOCUMENTS THAT COPART WILL BE FILING WITH THE SECURITIES AND

EXCHANGE COMMISSION AT THE SECURITIES AND EXCHANGE COMMISSION’S WEBSITE AT WWW.SEC.GOV OR BY CONTACTING GEORGESON INC., THE INFORMATION AGENT FOR THE TENDER OFFER, AT 1-800-932-9864. STOCKHOLDERS ARE URGED TO CAREFULLY READ THESE MATERIALS

PRIOR TO MAKING ANY DECISION WITH RESPECT TO THE TENDER OFFER.

About Copart

Copart, founded in 1982, provides vehicle sellers with a full range of remarketing services to process and sell salvage and clean title vehicles to dealers,

dismantlers, rebuilders, exporters and, in some locations, to end users. Copart remarkets the vehicles through Internet sales utilizing its VB3 technology. Copart sells vehicles on behalf of insurance companies, banks, finance companies, fleet

operators, dealers, car dealerships and others as well as cars sourced from the general public. The company currently operates in the United States and Canada, the United Kingdom, Brazil, Germany, the United Arab Emirates, Oman and Bahrain, India,

and Spain.

Forward-Looking Statements

This press

release contains forward-looking statements, as defined under federal securities laws. These forward-looking statements include statements regarding Copart’s expectations regarding the timing for filing its Schedule TO, Offer to Purchase, and

other tender offer documents and launching and completing its common stock tender offer. These forward-looking statements are not guarantees and are subject to risks, uncertainties, and assumptions that could cause the timing of the filing of the

Schedule TO, Offer to Purchase, and other tender documents and launching and completing the tender offer to differ materially and adversely from the timing expressed in the forward-looking statements in this press release. Factors that could cause

actual results to differ materially include risks and uncertainties, including, but not limited to, risks associated with the completion of the review and preparation of such filings and the review and completion of our application by the Securities

and Exchange Commission. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as to Copart’s expectations as of the date hereof. Copart undertakes no obligation to update these forward-looking

statements as a result of events or circumstances after the date hereof or to reflect the occurrence of unanticipated events.

-2-

Company names used herein are trademarks or registered trademarks of their respective owners.

CONTACT:

Christopher M.

Smith, Senior Analyst, Office of the Chief Financial Officer

972-391-5021 or christopher.smith3@copart.com

-3-

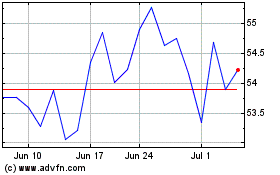

Copart (NASDAQ:CPRT)

Historical Stock Chart

From Mar 2024 to Apr 2024

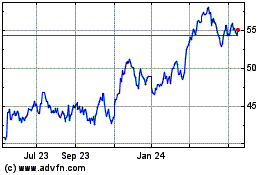

Copart (NASDAQ:CPRT)

Historical Stock Chart

From Apr 2023 to Apr 2024