Canterbury Park Holding Corporation Announces 2016 Annual Shareholders' Meeting Voting Results

June 29 2016 - 1:14PM

Business Wire

Canterbury Park Holding Corporation (NASDAQ: CPHC) (the

“Company”) today announced results of voting at its Annual

Shareholders’ Meeting held on June 28, 2016. Approximately 94.8 %

of all outstanding shares were present or represented by proxy at

the meeting.

The Company reported that shareholders approved the election of

each of the six director nominees recommended by the Board: Curtis

A. Sampson, Dale H. Schenian, Randall D. Sampson, Patrick R.

Cruzen, Burton F. Dalhberg, and Carin J. Offerman. Each director

nominee received affirmative votes from approximately 94% or more

of the shares voted, excluding abstentions and broker

non-votes.

Shareholders also approved each of the following four proposals

presented for shareholder action at the Annual Meeting:

- Shareholders approved the

reorganization of the Company’s business into a holding company

structure pursuant to an Agreement and Plan of Merger, dated as of

March 1, 2016, among the Company, New Canterbury Park Holding, a

Minnesota corporation, and Canterbury Park Entertainment, LLC, a

Minnesota limited liability corporation. Of the shares voted on

this proposal, 99% were voted in favor of this proposal, which

represented more than 76% of all outstanding shares.

- Shareholders approved the acquisition

of shares of Company common stock in 2015 by investment advisory

firms affiliated with Mario J. Gabelli (the “Gabelli Group”) that

constituted a Control Share Acquisition under the Minnesota Control

Share Acquisition Act (“CSAA”) that raised their ownership stake in

the Company from approximately 18% to approximately 24% of all

Company shares. The Gabelli Group’s Control Share Acquisition was

approved by 96% of all shares voted at the meeting and, in a

separate vote required by the CSAA, by approximately 57% of all

outstanding shares held by persons other than the Gabelli Group and

executive officers of the Company considered be to be Interested

Shareholders under the CSAA for purposes of the second vote.

- Shareholders also ratified Wipfli LLP

as the Company’s independent registered public accounting firm,

with affirmative votes from approximately 99% of the shares that

were present in person or represented by proxy at the meeting and

entitled to vote.

- Finally, on an advisory basis,

shareholders approved the executive compensation policies and

practices of the Company as described in its 2016 proxy statement,

with approximately 98% of the shares present in person or

represented by proxy voting in favor of this proposal.

The official voting results for each of these proposals will be

disclosed in a Form 8-K Report with the Securities and Exchange

Commission.

Following the shareholders’ meeting, President & CEO Randy

Sampson reported to the shareholders present on the Company’s

business including its real estate development activities, by means

of a power point presentation. This power point presentation can be

viewed at www.canterburypark.com/investorrelations.

About Canterbury

Park:Canterbury Park Holding Corporation owns and

operates Canterbury Park Racetrack, Minnesota’s only thoroughbred

and quarter horse racing facility. The Company’s 69-day 2016 live

race meet begins on May 20 and ends September 17. In addition,

Canterbury Park’s Card Casino hosts “unbanked” card games 24 hours

a day, seven days a week, offering both poker and table games. The

Company also conducts year-round wagering on simulcast horse racing

and hosts a variety of other entertainment and special events at

its facility in Shakopee, Minnesota. For more information about the

Company, please visit www.canterburypark.com.

Cautionary

Statement:

From time-to-time, in reports filed with the Securities and

Exchange Commission, in press releases, and in other communications

to shareholders or the investing public, we may make

forward-looking statements concerning possible or anticipated

future financial performance, prospective business activities or

plans which are typically preceded by words such as “believes,”

“expects,” “anticipates,” “intends” or similar expressions. For

such forward-looking statements, we claim the protection of the

safe harbor for forward-looking statements contained in federal

securities laws. Shareholders and the investing public should

understand that such forward-looking statements are subject to

risks and uncertainties which could affect our actual results and

cause actual results to differ materially from those indicated in

the forward-looking statements. Such risks and uncertainties

include, but are not limited to: material fluctuations in

attendance at the Racetrack, decline in interest in wagering on

horse races at the Racetrack, at other tracks, or on unbanked card

games offered at the Card Casino, competition from other

venues offering unbanked card games or other forms of wagering, a

greater than anticipated expenses or lower than anticipated return

on our development of our underutilized land. competition from

other sports and entertainment options, increases in compensation

and employee benefit costs, increases in the percentage of revenues

allocated for purse fund payments, higher than expected expenses

related to new marketing initiatives, the impact of wagering

products and technologies introduced by competitors, legislative

and regulatory decisions and changes, the general health of the

gaming sector, and other factors that are beyond our ability to

control or predict.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160629006226/en/

Canterbury Park Holding CorporationRandy Sampson,

952-445-7223

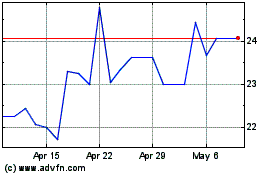

Canterbury Park (NASDAQ:CPHC)

Historical Stock Chart

From Mar 2024 to Apr 2024

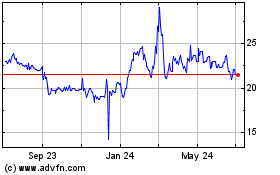

Canterbury Park (NASDAQ:CPHC)

Historical Stock Chart

From Apr 2023 to Apr 2024