Canterbury Park Holding Corporation (NASDAQ: CPHC) (the

“Company”) today announced financial results for the first quarter

ended March 31, 2016.

The Company’s 2016 first quarter consolidated net revenues

increased $512,273, or 5.2%, to $10,393,311, as compared to first

quarter 2015 revenues of $9,881,038. All three segments posted

gains. Card Casino revenues increased 4.1%, primarily due to growth

in table games revenues. Food and beverage revenues increased 7.7%,

and pari-mutuel revenues increased 1.8% increase.

Total operating expenses in the 2016 first quarter increased

$651,586, or 7.1%, to $9,870,318 compared to $9,218,730 in the 2015

first quarter. Most of this increase is attributable to a $462,000,

or 10%, increase in salary and benefit expense and a $154,000, or

17%, increase in purse expense. The increase in salary and benefit

expense is, to a substantial degree, due to the 12.5% increase in

Minnesota’s minimum wage from $8.00 to $9.00 per hour that took

effect on August 1, 2015. The increase in purse expense is largely

due to a change in calculating purse expense that is further

discussed below.

For the three months ended March 31, 2016 the Company’s net

income was $310,752 as compared to 2015 first quarter net income of

$388,680. The Company’s diluted earnings per share in the 2016

first quarter were $.07, compared to diluted earnings per share of

$.09 for the same period last year.

Additional information regarding the Company’s first quarter

2016 results is presented in the accompanying table and in our Form

10-Q report that will be filed with the Securities and Exchange

Commission on May 16, 2016.

Management Comments

Randy Sampson, Canterbury Park’s President and Chief Executive

Officer, commented: “We were pleased with the Company’s improved

revenues in the 2016 first quarter compared to the 2015 first

quarter. Along with solid increases in our Card Casino and Food and

Beverage segments, we were encouraged by the modest increase in our

simulcast revenues. Our goal to leverage this revenue growth into

quarter-over-quarter bottom line growth was, unfortunately,

undermined by two factors. The first was the $1.00 per hour

increase in Minnesota’s minimum wage on August 1, 2015 that, along

with staffing increases to support our catering and events growth

initiatives were the main factors in the $462,000 increase in our

salary and benefit expense in the first quarter. While this minimum

wage increase will continue to present challenges when a further

$.50 per hour increase takes effect August 1, 2016, we remain

committed to finding ways to mitigate the impact of these increases

without diminishing the quality of our services or the loyalty of

our customers. The second factor adversely affecting our first

quarter results was the $154,000 increase in our purse expense that

was due to a change in the statutory formula by which our purse

expense is determined. Pursuant to legislation that took effect

January 1, purse accruals are now determined based on a single

rate, rather than the variable rate depending on the time of the

year that was previously in effect. This change will cause our

purse expense to be higher in the first and fourth quarters and

lower in the second and third quarters when compared to payments

calculated under the previous statutory structure. However, the

change is not expected to have any material impact on our purse

expense on an annual basis.”

Mr. Sampson added: “We are excited about prospects for our live

meet that begins May 20. With support from our Cooperative

Marketing Agreement with the Shakopee Mdewakanton Sioux Community,

we anticipate offering the highest quality and most competitive

live race meet in the history of Canterbury Park. Adding to our

excitement is our decision to reduce the takeout on wagers made on

our live races to the lowest level at any racetrack in the U.S. in

order to increase the amount paid to winning horseplayers. Over the

years we have earned the reputation of being one of the most

horsemen-friendly racetracks in the country. By this move we seek

to also become known as one of the most horseplayer-friendly

racetracks. While the take-out reduction will decrease our revenue

as a percentage of on-track handle, we anticipate that this bold

move will draw the attention of serious horse-players both locally

and throughout the country to our improving racing product and will

result in a significant increase in wagering handle for our live

race meet.“

Use of Non-GAAP Financial

Measures:

To supplement our financial statements, we also provide

investors with EBITDA (defined below), which is a non-GAAP measure.

EBITDA represents earnings before interest income, income tax

expense, and depreciation and amortization. EBITDA is not a measure

of performance or liquidity calculated in accordance with generally

accepted accounting principles ("GAAP"), and should not be

considered an alternative to, or more meaningful than, net income

as an indicator of our operating performance, or cash flows from

operating activities as a measure of liquidity. EBITDA has been

presented as a supplemental disclosure because it is a widely used

measure of performance and basis for valuation of companies in our

industry. Moreover, other companies that provide EBITDA information

may calculate EBITDA differently than we do.

About Canterbury

Park:

Canterbury Park Holding Corporation owns and operates Canterbury

Park Racetrack, Minnesota’s only thoroughbred and quarter horse

racing facility. The Company’s 69-day 2016 live race meet begins on

May 20th and ends September 17th. In addition, Canterbury Park’s

Card Casino hosts “unbanked” card games 24 hours a day, seven days

a week, offering both poker and table games. The Company also

conducts year-round wagering on simulcast horse racing and hosts a

variety of other entertainment and special events at its facility

in Shakopee, Minnesota. For more information about the Company,

please visit us at www.canterburypark.com.

Cautionary

Statement:

From time to time, in press releases and in other communications

to shareholders or the investing public, the Canterbury Park

Holding Corporation may make forward-looking statements concerning

possible or anticipated future financial performance, business

activities or plans based on management’s beliefs and assumptions.

These forward looking statements are typically preceded by the

words such as "believes," "expects," "anticipates," "intends" or

similar expressions. Shareholders and the investing public should

understand that these forward-looking statements are subject to

risks and uncertainties, including those disclosed in our periodic

filings with the Securities and Exchange Commission, which could

cause actual performance, activities or plans after the date the

statements are made to differ significantly from those indicated in

the forward-looking statements when made.

CANTERBURY PARK

HOLDING CORPORATION’S

SUMMARY OF

OPERATING RESULTS

(UNAUDITED)

Three Months Three Months Ended Ended

March 31, 2016 March 31, 2015 Operating Revenues, (net)

$10,393,311 $9,881,038 Operating Expenses $9,870,318

$9,218,730

Non-Operating Income, net

$945

$616

Income Before Income Taxes

$523,938

$662,924

Income Tax Expense $(213,186 ) $(274,242 ) Net Income

$310,752 $388,680

Basic Net Income Per Common Share

$.07

$0.09

Diluted Net Income Per Common Share

$.07

$0.09

RECONCILIATION OF

NET INCOME TO EBITDA

Three Months Three Months Ended Ended

March 31, 2016

March 31, 2015 Net income $ 310,752 $ 388,682

Interest income, net of interest expense (945 ) (616 )

Income tax expense 213,186 274,242 Depreciation

576,480

564,105

EBITDA $ 1,099,473 $ 1,236,413

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160513005057/en/

Canterbury Park Holding CorporationRandy Sampson,

952-445-7223

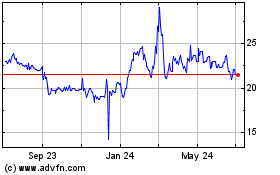

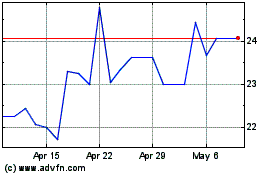

Canterbury Park (NASDAQ:CPHC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Canterbury Park (NASDAQ:CPHC)

Historical Stock Chart

From Apr 2023 to Apr 2024