Canterbury Park Holding Corporation (NASDAQ:CPHC) today

announced financial results for its fourth quarter and year ended

December 31, 2015, and also reported on business developments

during and following 2015 and the Company’s upcoming Annual

Shareholders Meeting.

Results for the Year Ended December 31,

2015

The Company’s net revenues in 2015 were $52.3 million, a 7.8%

increase compared to 2014 net revenues of $48.5 million. The $3.8

million increase over 2014 reflects increases of $1.9 million in

Card Casino revenues, $978,000 in Food and Beverage revenues, and

$980,000 in Other Revenues. Partially offsetting these increases

was a $171,000 decline in Pari-mutuel revenues.

Operating expenses in 2015 were $47.6 million compared to $44.4

million in 2014. This 7.4% increase is primarily attributable to

increased salaries and other operating expenses needed to support

our increased revenue levels and business development initiatives,

as well as a $462,000 decrease in gain from insurance proceeds. The

increases were partially offset by a $659,000 gain on sale of land

and a $347,000 gain on disposal of our Shakopee Valley RV Park

property and equipment.

The Company’s net income increased 13% to $2,727,000, or $0.64

per diluted share, in 2015 compared to net income of $2,411,000, or

$0.57 per diluted share, in 2014.

For the twelve months ended December 31, 2015 compared to the

same period in 2014, earnings before interest, taxes, depreciation

and amortization (“EBITDA”) increased to $6.9 million from $6.2

million. Our Adjusted EBITDA, which excludes gain on disposal of

assets, gain on sale of land and gains on insurance recoveries, was

$5.4 million in 2015 compared to $5.3 million in 2014.

Results for the Quarter Ended December

31, 2015

The Company’s net revenues in the fourth quarter were

$10,802,000, a 5.2% increase from net revenues of $10,264,000

during the same period in 2014, reflecting an increase in Card

Casino revenues of 4.8%, an increase in Food and Beverage revenues

of 15.9% offset by a decrease in Pari-mutuel revenues of 7.2%. 2015

fourth quarter net income was $954,000 or $.22 per share, an

increase of 1.6% over fourth quarter net income of $939,000, or

$.22 per share in 2014.

Additional Financial

Information

Further financial information for the fourth quarter and year

ended December 31, 2015 is presented in the accompanying table, and

additional information will be provided in the Company’s Form 10-K

Report that will be filed on March 30, 2016 with the Securities and

Exchange Commission.

Management Comments

Mr. Randy Sampson, Canterbury Park’s President and Chief

Executive Officer, commented: “We are pleased with the strong

increases in revenue and net income in 2015 over the prior year,

primarily due to solid growth in our Card Casino and Food and

Beverage operations. We are also pleased with our progress in 2015

to build a foundation for future growth in revenue and

profitability.

“One element of our plan for revenue and profit growth includes

increasing our catering and events business. In addition to having

a full year of operation of our Expo Center, which hosted its first

event in September of 2014, in May we reopened the remodeled 8,000

square foot area now called the ‘Triple Crown Club.’ This

improvement gives us more capacity and flexibility to host a wide

variety of banquets and events in an upscale atmosphere.

“During 2015 we also made progress in planning and preparing for

the development of our underutilized land for potential uses such

as multifamily housing, business park, as well as retail and

entertainment including restaurant and hotel opportunities. This

effort has resulted in several transactions supportive of our

development plan. In October 2015 we completed the sale of

approximately six acres on the south side of our property for $1.43

million to the Minnesota Municipal Power Agency. In December 2015,

the Company entered into an agreement to acquire approximately 32

acres of land immediately southwest of the Racetrack for

approximately $4.9 million. Finally, I am pleased to announce that

we have finalized a purchase agreement to sell 23.8 acres on the

north side of our property to United Properties for approximately

$4.3 million. The location of this parcel makes it most suitable

for development as a business park, and we are excited to be

working with United Properties on this project. The sale will

generate cash that can be used in our development activities and

the closing of the transaction in the second quarter will complete

a 1031 exchange that allows us to defer taxes on the gain from the

sale.”

Mr. Sampson next stated: “In October 2015 we announced we would

be seeking shareholder approval for the proposed reorganization of

our business structure to facilitate development of our

underutilized land (the “Reorganization”). The Company’s Board of

Directors subsequently decided, for several business reasons, to

postpone shareholder consideration of the Reorganization until the

Company’s 2016 Annual Meeting. The Reorganization remains a key

element to our future development of the Company’s underutilized

land, because it will create the legal framework that will enable

the Company to separate its regulated gaming businesses from its

real estate development activities. In early April we expect to

make necessary filings with the Securities and Exchange Commission

that will enable us to include the proposed Reorganization on our

Annual Shareholders Meeting agenda.”

Mr. Sampson concluded: “As we pursue new business opportunities,

we remain committed to our core businesses and will remain focused

on providing our guests with premier gaming, entertainment and

event experiences. With our healthy cash position, positive cash

flow and competitive live racing purse funds provided by our

Cooperative Marketing Agreement with the Shakopee Mdewakanton Sioux

Community, we believe we are well positioned to continue to

profitably grow revenues in our core operations, while at the same

time making strategic investments that will diversify and

strengthen our business and enhance shareholder value.”

Annual Shareholders

Meeting

The Company also announced that its 2016 Annual Meeting of

Shareholders will be held on Thursday, June 9, 2016 at 4 p.m., at

the Racetrack in Shakopee, Minnesota. The date of record for

shareholders entitled to vote at the Annual Meeting is April 13,

2016.

Use of Non-GAAP Financial

Measures

To supplement our financial statements, we also provide

investors with information about our EBITDA and Adjusted EBITDA,

both of which are a non-GAAP measures. EBITDA is not a measure of

performance or liquidity calculated in accordance with generally

accepted accounting principles ("GAAP"), and should not be

considered an alternative to, or more meaningful than, net income

as an indicator of our operating performance, or cash flows from

operating activities as a measure of liquidity. EBITDA has been

presented as a supplemental disclosure because it is a widely used

measure of performance and basis for valuation of companies in our

industry. Moreover, other companies that provide EBITDA information

may calculate EBITDA differently than we do. Adjusted EBITDA

represents our earnings before interest income, income tax expense,

depreciation and amortization and gain from disposal of assets,

gain on sale of land, and gain from insurance recoveries.

About Canterbury Park

Canterbury Park Holding Corporation owns and operates Canterbury

Park Racetrack, Minnesota’s only thoroughbred and quarter horse

racing facility. The Company’s 69-day 2016 live race meet begins on

May 20 and ends September 17. In addition, Canterbury Park’s Card

Casino hosts card games 24 hours a day, seven days a week, offering

both poker and table games. The Company also conducts year-round

wagering on simulcast horse racing and hosts a variety of other

entertainment and special events at its facility in Shakopee,

Minnesota. For more information about the Company, please visit us

at www.canterburypark.com.

Important Information Regarding

Information to be filed with the SEC

The Company intends to file a Registration Statement on Form S-4

and a preliminary Proxy Statement with the Securities and Exchange

Commission with respect to the Reorganization described above. The

Company will make a copy of the definitive Proxy Statement

available through our website when it is available, and will

transit to all our shareholders information how to access this

definitive Proxy Statement. The Company will file other relevant

materials with the SEC. The Proxy Statement and other relevant

materials will contain important information about Reorganization.

Shareholders are urged to read the Proxy Statement and the other

relevant materials carefully when they become available before

deciding how to vote on the Reorganization.

Investors and shareholder may obtain free copies of the Proxy

Statement and relevant other documents filed with the SEC by the

Company through the EDGAR website maintained by the SEC at

www.sec.gov. In addition, shareholders may obtain free copies of

the Proxy Statement and the other relevant documents filed by the

Company with the SEC by contacting David C. Hansen, Secretary,

Canterbury Park Holding Corporation

Dhansen@canterburypark.com.

Cautionary Statement

From time to time, in reports filed with the Securities and

Exchange Commission, in press releases, and in other communications

to shareholders or the investing public, we may make

forward-looking statements concerning possible or anticipated

future financial performance, business activities or plans which

are typically preceded by the words “believes,” “expects,”

“anticipates,” “intends” or similar expressions. For such

forward-looking statements, we claim the protection of the safe

harbor for forward-looking statements contained in federal

securities laws. Shareholders and the investing public should

understand that such forward-looking statements are subject to

risks and uncertainties which could affect our actual results, and

cause actual results to differ materially from those indicated in

the forward-looking statements. Such risks and uncertainties

include, but are not limited to: material fluctuations in

attendance at the Racetrack, material changes in the level of

wagering by patrons, decline in interest in the unbanked card games

offered in the Card Casino, competition from other venues offering

unbanked card games or other forms of wagering, competition from

other sports and entertainment options, increases in compensation

and employee benefit costs; increases in the percentage of revenues

allocated for purse fund payments; higher than expected expense

related to new marketing initiatives; the impact of wagering

products and technologies introduced by competitors; legislative

and regulatory decisions and changes; the general health of the

gaming sector; and other factors that are beyond our ability to

control or predict.

NOTE: Financial summary on following page.

CANTERBURY PARK

HOLDING CORPORATION’S

SUMMARY OF

OPERATING RESULTS

(Unaudited)

Three Months Three Months Twelve Months

Twelve Months Ended Ended Ended Ended December 31, December 31,

December 31, December 31, 2015 2014 2015 2014

Net Operating Revenues $10,802,370 $10,263,711 $52,263,003

$48,469,837 Operating Expenses ($9,207,288 ) ($8,673,352 )

($47,649,186 ) ($44,369,912 ) Income from Operations

$1,595,082 $1,590,359 $4,613,867 $4,099,925

Non-Operating Revenues, net

$1,151

$414

$2,804

$2,407

Income Tax Expense ($642,601 ) ($651,865 ) ($1,889,649 )

($1,691,177 ) Net Income $953,673 $938,908 $2,727,022

$2,411,155 Basic Net Income Per Common Share

$0.22

$0.22

$0.65

$0.58

Diluted Net Income Per Common Share

$0.22

$0.22

$0.64

$0.57

RECONCILIATION OF NET INCOME TO

Adjusted EBITDA

(Unaudited)

Year Ended

Year Ended

Dec. 31,

Dec. 31,

2015

2014

Net income $ 2,727,022 $ 2,411,155 Interest income,

net of interest expense (2,804 ) (2,407 ) Income tax expense

1,889,649 1,691,177 Depreciation 2,297,613

2,137,778 EBITDA $ 6,911,480 $ 6,237,703

Gain on disposal of assets (347,348 ) 0 Gain on sale of land

(659,562 ) 0 Gain on Insurance Recoveries (495,465 )

(957,597 ) Adjusted EBITDA $ 5,409,105 $ 5,280,106

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160329006444/en/

Canterbury Park Holding CorporationRandy Sampson,

952-445-7223

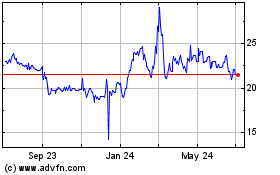

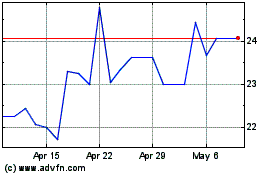

Canterbury Park (NASDAQ:CPHC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Canterbury Park (NASDAQ:CPHC)

Historical Stock Chart

From Apr 2023 to Apr 2024