UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): October

2, 2015

Canterbury Park Holding Corporation

(Exact name of registrant as specified in its charter)

Minnesota

(State or Other Jurisdiction of Incorporation)

| 001-31569 |

41-1775532 |

| (Commission File Number) |

(IRS Employer Identification No.) |

| |

|

| 1100 Canterbury Road, Shakopee, Minnesota |

55379 |

| (Address of Principal Executive Offices) |

(Zip Code) |

(952) 445-7223

(Registrant’s telephone number, including area

code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously

satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| |

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

|

| |

☒ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

|

| |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

|

| |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Section 1 – Registrant’s

Business and Operations

Item 1.01 – Entry into a Material Definitive Agreement

On October 2, 2015, Canterbury Park Holding Corporation

(the “Company”), together with (i) New Canterbury Park Holding Corporation (“New Canterbury”), a recently

formed Minnesota corporation and subsidiary of the Company and (ii) Canterbury Park Entertainment LLC, a recently formed Minnesota

limited liability company and subsidiary of New Canterbury, entered into a Agreement and Plan of Reorganization (“Plan of

Reorganization”) to reorganize and reincorporate the Company into a holding company structure (the “Business Restructuring”).

The Business Restructuring is a key step in the future

development of approximately 200 acres of the Company’s underutilized property (“Development Land), because it will

create the legal framework to enable the Company to separate its regulated pari-mutuel wagering, card casino, concessions and other

related businesses (“Racetrack Operations”) from the Development Land.

The Plan of Reorganization requires shareholder approval.

On October 2, 2015, the Company filed preliminary proxy materials with the Securities and Exchange Commission for a special meeting

of shareholders to approve the Plan of Reorganization. The Company expects to hold the special meeting of shareholders in late

November 2015 or early December 2015.

Upon approval of the Plan of Reorganization by the shareholders,

the Company’s business will be reorganized as follows:

| · | New Canterbury will become the public company owned by the Company’s shareholders, and,

without the need to take any action, each shareholder will have the same percentage ownership in New Canterbury (and, indirectly,

in all property and other assets currently owned by the Company) immediately after the Business Restructuring as that shareholder

had immediately before the Business Restructuring; |

| · | New Canterbury will be a holding company for, and parent company of two, recently formed subsidiaries,

Canterbury Park Entertainment and LLC and Canterbury Development LLC; |

| · | Canterbury Park Entertainment LLC will be the surviving business entity in a merger with the

Company and will directly own all land, facilities, and substantially all other assets related to the Company’s Racetrack

Operations, will conduct these businesses consistent with current practices, and will be subject to direct regulation by the Minnesota

Racing Commission (“MRC”); and |

| · | Canterbury Development LLC will continue the Company’s efforts to commercially develop

approximately 200 acres of land currently owned or controlled by the Company that are not needed for the Racetrack Operations.

Canterbury Development LLC will not be subject to direct regulation by the MRC. |

The Company issued a press release describing the proposed

Business Restructuring on October 5, 2015. A copy of the Plan of Reorganization will be attached to the definitive Proxy Statement

for the special meeting of shareholders.

Section 9 - Financial Statements and

Exhibits

Item 9.01 - Financial Statements and Exhibits

The following is filed as an Exhibit to this Report:

| Exhibit No. |

|

Description of Exhibit |

| 99.1 |

|

Canterbury

Park Holding Corporation press release dated October 5, 2015, as revised, describing the Business Restructuring. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange

Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

CANTERBURY PARK HOLDING CORPORATION |

| |

|

|

| Dated: October 7, 2015 |

By: |

/s/ Randall D. Sampson |

| |

|

Randall D. Sampson

Chief Executive Officer |

Exhibit 99.1

| CANTERBURY PARK |

1100 Canterbury Road

Shakopee, MN 55379 |

Canterbury Park Announces Business Restructuring

to Facilitate

Property Development

New Canterbury to be a Holding Company

for and Parent Company of Two Subsidiaries,

Canterbury Park Entertainment and Canterbury Development

For Immediate Release:

Monday, October 5, 2015 (Revised)

| Contact: | Jeff Maday

Media Relations Manager

(952) 292-7524

jmaday@canterburypark.com |

Shakopee, Minn. — Canterbury Park (Nasdaq: CPHC) announced that on October

2, 2015, the Company’s Board of Directors approved a Plan of Reorganization to reorganize and reincorporate the Company into

a holding company structure (the “Business Restructuring”). The Business Restructuring is a key step in the future

development of up to approximately 200 acres of the Company’s underutilized property (“Development Land”), because

it will create the legal framework to enable the Company to separate its regulated pari-mutuel wagering, card casino, concessions

and other related businesses (“Racetrack Operations”) from the Development Land.

The Business Restructuring requires shareholder approval, and on October

2, 2015, the Company filed preliminary proxy materials with the Securities and Exchange Commission for a special meeting of shareholders

to approve the Business Restructuring. The Company expects the special shareholders meeting will be held in late November 2015.

If approved by the shareholders,

upon consummation of the transactions contemplated by the Business Restructuring, the Company’s business will be reorganized

as follows:

| · | A

recently formed corporation, “New Canterbury” will be the public company

owned by the Company’s shareholders, and without the need to take any action, each

shareholder will have the same percentage ownership in New Canterbury (and, indirectly,

in all property and other assets currently owned by the Company) immediately after the

Business Restructuring as that shareholder had immediately before the Business Restructuring.

|

| · | New

Canterbury will be a holding company for and parent company of two, recently formed subsidiaries,

Canterbury Park Entertainment LLC and Canterbury Development LLC. |

| · | Canterbury

Park Entertainment LLC will be the surviving business entity in a merger with the Company

and will directly own all land, facilities, and substantially all other assets related

to the Company’s Racetrack Operations, will conduct these businesses consistent

with current practices, and will be subject to direct regulation by the Minnesota Racing

Commission (“MRC”). |

| · | Canterbury

Development LLC will continue the Company’s efforts to commercially develop up

to approximately 200 acres of land currently owned or controlled by the Company that

is not needed for the Racetrack Operations. Canterbury Development will not be subject

to direct regulation by the MRC. |

Canterbury Park also announced today that it has completed the sale of an

approximately six-acre parcel located at Vierling Drive East and Eagle Creek Blvd for $1.43 million to Minnesota Municipal Power

Agency (MMPA). MMPA has begun the process of seeking the necessary state and local approvals to develop a natural gas fired electric

power generation and production facility.

Canterbury Park CEO Randy Sampson stated “The Business Restructuring,

along with our recent application to the City of Shakopee to plat and subdivide all of the approximately 407 acres we own, are

steps that will give the Company the flexibility it needs to develop our underutilized property. The proposed Business Restructuring

will allow us to pursue development of our underutilized land in a business entity that is not subject to the direct Minnesota

Racing Commission regulation that is required for our Racetrack Operations. Also, conducting real estate development in a separate

entity will minimize the financial risk to our Racetrack Operations that is inherent in real estate development.”

Sampson continued “We believe the land sale to MMPA demonstrates our

opportunity to build shareholder value through the development of our underutilized land, even though we have recently decided

to change the emphasis of our development plans. Because of information we recently gained in our ongoing due diligence, rather

than relocating our barn area and pursuing a destination lifestyle retail development, we will focus our immediate development

plans to take advantage of opportunities that do not require moving the barn area. We have changed our focus because we determined

the cost to move the barn area is too significant an impediment to the financial viability of a large scale retail development

in that location at this time. As a result, we will now pursue approvals necessary for apartments and business park development

as our first phases of development. We believe the dramatic job growth underway in Shakopee has created an opportunity to develop

a unique multi-family residential community with a variety of apartment types and attractive amenities at Canterbury Park. We will

also continue to explore the viability of a smaller scale project that would not require a complete relocation of our barn area

and possibly feature restaurants, a hotel, a grocery anchor and other retail.”

About Canterbury Park:

Canterbury Park Holding Corporation (NASDAQ:CPHC) owns and operates Canterbury

Park Racetrack and Card Casino, Minnesota’s only thoroughbred and quarter horse racing facility. The Company recently concluded

a 70-day live race meet. Canterbury Park’s Card Casino hosts card games 24 hours a day, seven days a week, offering both

poker and table games. In addition, the Company conducts year-round wagering on simulcast horse racing and hosts a variety of other

entertainment and special events at its facility in Shakopee, Minnesota. For more information about the Company, please visit www.canterburypark.com.

Cautionary Statement:

From time to time, in press releases and in other

communications to shareholders or the investing public, Canterbury Park Holding Corporation may make forward-looking statements

concerning possible or anticipated future financial performance, business activities or plans based on management’s beliefs

and assumptions. These forward looking statements are typically preceded by the words such as "believes," "expects,"

"anticipates," "intends" or similar expressions. Shareholders and the investing public should understand that

these forward-looking statements are subject to risks and uncertainties, including those disclosed in our periodic filings with

the Securities and Exchange Commission, which could cause actual performance, activities or plans after the date the statements

are made to differ significantly from those indicated in the forward-looking statements when made.

Important Information filed with the SEC

The Company has filed a Preliminary Proxy Statement

with the Securities and Exchange Commission with respect to the Business Restructuring, will make a copy of the definitive Proxy

Statement available through our website when it is available, and will transit to all our shareholders information how to access

this Proxy Statement. The Company will file other relevant materials with the SEC. The Proxy Statement and other relevant materials

will contain important information about Business Restructuring. Shareholder are urged to read the Proxy Statement and the other

relevant materials carefully when they become available before deciding how to vote on the Business Restructuring.

Investors and shareholder may obtain free

copies of the Proxy Statement and relevant other documents filed with the SEC by the Company through the EDGAR website maintained

by the SEC at www.sec.gov. In addition, shareholders may obtain free copies of the Proxy Statement and the other relevant documents

filed by the Company with the SEC by contacting David C. Hansen, Secretary, Canterbury Park Holding Corporation Dhansen@canterburypark.com.

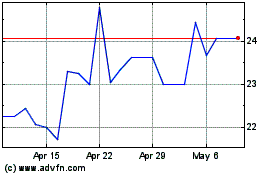

Canterbury Park (NASDAQ:CPHC)

Historical Stock Chart

From Mar 2024 to Apr 2024

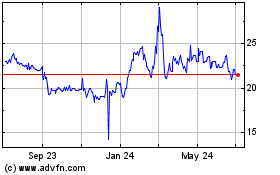

Canterbury Park (NASDAQ:CPHC)

Historical Stock Chart

From Apr 2023 to Apr 2024