Additional Proxy Soliciting Materials (definitive) (defa14a)

March 03 2017 - 4:26PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

SCHEDULE

14A

Proxy

Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

|

Filed

by the Registrant

|

[X]

|

|

|

Filed

by a Party other than the Registrant

|

[ ]

|

|

Check

the appropriate box:

|

[ ]

|

Preliminary

Proxy Statement

|

|

[ ]

|

Confidential,

For Use of the Commission Only (as Permitted by Rule 14a-6(e)(2))

|

|

[ ]

|

Definitive

Proxy Statement

|

|

[X]

|

Definitive

Additional Materials

|

|

[ ]

|

Soliciting

Material Pursuant to § 240.14a-12

|

POLARITYTE,

INC.

(Name

of Registrant as Specified in its Charter)

(Name

of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment

of Filing Fee (Check the appropriate box):

|

[X]

|

No

fee required

|

|

|

|

|

[ ]

|

Fee

computed on table below per Exchange Act Rules 14a-6(i) (1) and 0-11

|

|

|

|

|

(1)

|

Title

of each class of securities to which transaction applies:

|

|

|

|

|

(2)

|

Aggregate

number of securities to which transaction applies:

|

|

|

|

|

(3)

|

Per

unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which

the filing fee is calculated and state how it was determined):

|

|

|

|

|

(4)

|

Proposed

maximum aggregate value of transaction:

|

|

|

|

|

(5)

|

Total

fee paid:

|

|

|

|

|

[ ]

|

Fee

paid previously with preliminary materials:

|

|

|

|

|

[ ]

|

Check

box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting

fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date

of its filing.

|

|

|

|

|

(1)

|

Amount

previously paid:

|

|

|

|

|

(2)

|

Form,

Schedule or Registration Statement No.:

|

|

|

|

|

(3)

|

Filing

Party:

|

|

|

|

|

(4)

|

Date

Filed:

|

RE:

Special Meeting of Stockholders of PolarityTe, Inc., March 10, 2017 at 1:00PM

Dear

Shareholder:

As

you are aware, you are a holder of certain shares of convertible preferred stock (the “Preferred Shares”) that are

entitled to vote at the special meeting of the stockholders of PolarityTE, Inc. (the “Company”), as of January 17,

2017, the record date for the meeting. As a result, you are entitled to vote your Preferred Shares at the meeting on an “as

converted” basis, subject to conversion limitations.

Specifically,

such Preferred Shares owned by you as of the record date that are entitled to vote at the special meeting consist of shares of

common stock underlying your Series A Convertible Preferred Stock, shares of common stock underlying your Series B Convertible

Preferred Stock and shares of common stock underlying your Series C Convertible Preferred Stock. Collectively, such Convertible

Preferred Stock may vote the equivalent of common shares.

The

attachment to this letter contains four proposals to be voted upon at that meeting which have been communicated to all holders

of our common stock as of the record date via conventional proxy communications.

The PolarityTE, Inc. Board of Directors recommends

a “FOR” vote for each of those proposals.

This

letter serves as the vehicle for you to cast a vote for the shares described above.

Please

indicate your vote in the space provided below and returning it to me before 5:00PM on March 9, 2017 at

stetson@polarityte.com

.

|

Sincerely,

|

|

|

|

|

|

John

Stetson, CFO

|

|

_________

votes in the following manner:

|

|

|

|

For

|

|

|

Against

|

|

|

|

Abstain

|

|

|

Proposal

#1

|

|

|

__

|

|

|

__

|

|

|

|

__

|

|

|

Proposal #2

|

|

|

__

|

|

|

__

|

|

|

|

__

|

|

|

Proposal #3

|

|

|

__

|

|

|

__

|

|

|

|

__

|

|

|

Proposal #4

|

|

|

__

|

|

|

__

|

|

|

|

__

|

|

POLARITYTE,

INC.

Proposals

to be Voted Upon

at

the

Special

Meeting of Stockholders

On

March

10, 2017

|

|

1.

|

To

approve, in accordance with NASDAQ Listing Rule 5635, the securities issued to the Seller under the Agreement whereby the

Company will acquire the Intellectual Property from the Seller and the transactions contemplated thereunder (the “Intellectual

Property Acquisition”), including the issuance of 7,050 shares of the Company’s newly designated Series E Preferred

Stock convertible into an aggregate of 7,050,000 shares of the Company’s Common Stock (the “Merger Consideration”)

as consideration for the Intellectual Property;

|

|

|

|

|

|

|

2.

|

To

approve a change in control in accordance with NASDAQ Listing Rule 5635 that will result from the issuance of the Merger Consideration

to the Seller in as consideration for the Intellectual Property Acquisition;

|

|

|

|

|

|

|

3.

|

To

approve the Company’s 2017 Equity Incentive Plan (the “2017 Plan”) and the reservation of 3,450,000 shares

of Common Stock for issuance thereunder; and

|

|

|

|

|

|

|

4.

|

To

approve an amendment to the Company’s Restated Certificate of Incorporation, as amended (the “Certificate of Incorporation”)

to increase the authorized number of shares of the Company’s blank check preferred stock, par value $0.001 per share

(the “Authorized Blank Check Preferred Stock”) from 10,000,000 shares to 25,000,000 shares.

|

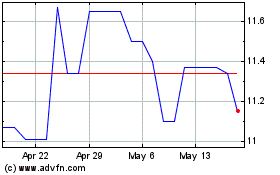

Corner Growth Acquisition (NASDAQ:COOL)

Historical Stock Chart

From Mar 2024 to Apr 2024

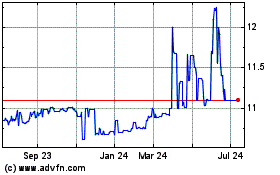

Corner Growth Acquisition (NASDAQ:COOL)

Historical Stock Chart

From Apr 2023 to Apr 2024