As filed with the Securities and Exchange Commission on April 29, 2016

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

MAJESCO ENTERTAINMENT COMPANY

(Exact name of registrant as specified in its charter)

|

Delaware

|

06-1529524

|

|

(State or other jurisdiction of

incorporation or organization)

|

(I.R.S. Employer

Identification No.)

|

4041-T Hadley Rd.

S. Plainfield, New Jersey 07080

(732) 225-8910

(Address, including zip code, and telephone number, including

area code, of registrant’s principal executive offices)

Barry Honig

Chief Executive Officer

Majesco Entertainment Company

4041-T Hadley Rd.

S. Plainfield, New Jersey 07080

(732) 225-8910

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Please send copies of all communications to:

Harvey J. Kesner, Esq.

Sichenzia Ross Friedman Ference LLP

61 Broadway, 32nd Floor

New York, New York 10006

Telephone: (212) 930-9700

Approximate date of commencement of proposed sale to the public:

From time to time after the effective date of this registration statement.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box.

o

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box.

x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

o

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box.

o

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box.

o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “

large accelerated filer

”, “

accelerated filer

” and “

smaller reporting company

” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer

o

|

Accelerated filer

o

|

Non-accelerated filer

o

(do not check if smaller

reporting company)

|

Smaller reporting company

x

|

CALCULATION OF REGISTRATION FEE

|

Title of each class of

securities to be registered

|

|

Amount to be

registered

(1)

|

|

|

Proposed maximum

offering price

per share

|

|

Proposed maximum

aggregate

offering price

|

|

|

Amount of

registration fee

|

|

|

Common Stock, $0.001 par value

|

|

|

3,287,800

|

|

|

$

|

0.85

|

(2)

|

|

$

|

2,794,630

|

|

|

$

|

281,42

|

|

|

Common Stock, $0.001 par value per share issuable upon conversion of Series A Convertible Preferred Stock

|

|

|

8,177,334

|

|

|

$

|

0.85

|

(2)

|

|

$

|

6,950,734

|

|

|

$

|

699.94

|

|

|

Common Stock, $0.001 par value per share issuable upon conversion of Series B Convertible Preferred Stock

|

|

|

5,420,171

|

|

|

$

|

0.85

|

(2)

|

|

$

|

4,607,146

|

|

|

$

|

463.94

|

|

|

Common Stock, $0.001 par value per share issuable upon conversion of Series C Convertible Preferred Stock

|

|

|

2,576,353

|

|

|

$

|

0.85

|

(2)

|

|

$

|

2,189,900

|

|

|

$

|

220.52

|

|

|

Common Stock, $0.001 par value per share issuable upon conversion of Series D Convertible Preferred Stock

|

|

|

1,563,320

|

|

|

$

|

0.85

|

(2)

|

|

$

|

1,328,822

|

|

|

$

|

133.82

|

|

|

TOTAL

|

|

|

21,024,978

|

|

|

|

|

|

|

|

|

|

|

$

|

1,799.64

|

|

|

|

(1)

|

Pursuant to Rule 416 under the Securities Act of 1933, as amended, this registration statement also covers such additional shares as may hereafter be offered or issued to prevent dilution resulting from stock splits, stock dividends, recapitalizations or certain other capital adjustments.

|

|

|

(2)

|

Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(c) under the Securities Act of 1933, as amended. In accordance with Rule 457(c) of the Securities Act of 1933, as amended, the price shown is the average of the high and low sales prices of the common stock on April 28, 2016 as reported on The NASDAQ Capital Market.

|

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment that specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until this Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities or accept an offer to buy these securities until the Securities and Exchange Commission declares our registration statement effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED APRIL 29, 2016

PROSPECTUS

MAJESCO ENTERTAINMENT COMPANY

21,024,978 Shares of Common Stock

This prospectus relates to the disposition from time to time of 3,287,800 shares of common stock and up to 17,737,178 shares of common stock which are issuable upon the conversion of our outstanding shares of Series A Convertible Preferred Stock, Series B Convertible Preferred Stock, Series C Convertible Preferred Stock and Series D Convertible Preferred Stock held by certain of the selling stockholders named in this prospectus. We are not selling any common stock under this prospectus and will not receive any of the proceeds from the sale of shares by the selling stockholders.

The selling stockholders may sell the shares of common stock described in this prospectus in a number of different ways and at varying prices. We provide more information about how the selling stockholders may sell their shares of common stock in the section entitled “Plan of Distribution” on page

21

. The selling stockholders will bear all commissions and discounts, if any, attributable to the sale or disposition of the shares, or interests therein. We will bear all costs, expenses and fees in connection with the registration of the shares. We will not be paying any underwriting discounts or commissions in this offering.

Our common stock is traded on The NASDAQ Capital Market under the symbol “COOL.” On April 28, 2016, the last reported sale price of our common stock was $0.85 per share.

An investment in our common stock involves a high degree of risk. See “Risk Factors” on page

2

of this prospectus for more information on these risks.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities, or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2016.

|

|

Page

|

|

|

|

|

|

1

|

|

|

|

|

|

2

|

|

|

|

|

|

7

|

|

|

|

|

|

9

|

|

|

|

|

|

9

|

|

|

|

|

|

17

|

|

|

|

|

|

21

|

|

|

|

|

|

21

|

|

|

|

|

|

21

|

|

|

|

|

|

21

|

|

|

|

|

|

21

|

Majesco Entertainment Company is an innovative developer, marketer, publisher and distributor of interactive entertainment for consumers around the world. Building on more than 25 years of operating history, Majesco develops and publishes a wide range of video games on digital networks through its Midnight City label, including Nintendo’s DS, 3DS, Wii and WiiU, Sony’s PlayStation 3 and 4, or PS3 and PS4, Microsoft’s Xbox 360 and Xbox One and the personal computer, or PC. Majesco is headquartered in South Plainfield, New Jersey, and its common stock is traded on The NASDAQ Capital Market under the symbol “COOL”.

Although, historically, we have sold packaged console software to large retail chains, specialty retail stores, video game rental outlets and distributors and through digital distribution for platforms such as Xbox Live Arcade, PlayStation Network, or PSN, and Steam, and for mobile devices and online platforms, we now operate, almost exclusively a digital software distribution and licensing business.

On July 31, 2015, we transferred to Zift Interactive LLC (“Zift”), a newly-formed subsidiary, certain rights under certain of our publishing licenses related to developing, publishing, and distributing video game products through retail distribution for a term of one year. We then transferred Zift to our former chief executive officer, Jesse Sutton in exchange for a portion of its net revenue from retail sales and other consideration.

Our titles are targeted at various demographics at a range of various price points. Due to the larger budget requirements for developing and marketing premium console titles, recently we have focused on publishing lower-cost games targeting casual-game consumers and independent game developer fans. In some instances, our titles are based on licenses of well-known properties and, in other cases, original properties. We enter into agreements with content providers and video game development studios for the creation of video games sold domestically and internationally.

Since October 2014, we have implemented reductions of our workforce to reduce our fixed costs. The reductions include development and game-testing, selling and marketing, and support personnel. We are currently not developing any significant new packaged games for release in fiscal 2016 and our objectives include evaluating strategic alternatives to maximize shareholder value, including the potential merger with or acquisition of a new business in a similar or different industry from our current and historical operations, although no business or industry has been determined to be an attractive candidate.

Company Background

Our principal executive offices are located at 4041-T Hadley Road, South Plainfield, NJ 07080 and our telephone number is (732) 225-8910. Our web site address is www.majescoentertainment.com.

Majesco Holdings Inc. (formerly ConnectivCorp) was incorporated in 2004 under the laws of the State of Delaware. As a result of a merger, Majesco Sales Inc. became a wholly-owned subsidiary and the sole operating business of the Company, which changed its name to Majesco Entertainment Company.

In this prospectus, “Majesco,” “the Company,” “we,” “us,” and “our” refer to Majesco Entertainment Company, a Delaware corporation, unless the context otherwise requires.

You should carefully consider the risks described below before making an investment decision. The risks described below are not the only ones we face. Additional risks we are not presently aware of or that we currently believe are immaterial may also impair our business operations. Our business could be harmed by any of these risks. The trading price of our common stock could decline due to any of these risks, and you may lose all or part of your investment. In assessing these risks, you should also refer to the other information contained or incorporated by reference into this prospectus, including our financial statements and related notes.

Our review of our strategic alternatives may result in a complete transformation of our Company and we may not be successful in this new venture.

We are currently considering potential pursuit of new business ventures and other strategic alternatives. We have significantly reduced our video game publishing and development activities. We may (although we have no current arrangements in place) invest in a totally unrelated business or businesses. Such an action may result in a change in our board of directors, management, or financial structure and may lead to substantial reduction in our cash balances or substantial dilution to existing shareholders should we utilize our shares for acquisition. Despite our best efforts, we may not be successful in financing and/or operating any new venture.

Our financial resources are limited and we will need to raise additional capital in the future to continue our business.

We do not expect to generate the level of revenues going forward that we have achieved in prior years from our video game business. This significantly reduced revenue will impact our needs for future capital. We cannot ensure that additional funding will be available or, if it is available, that it can be obtained on terms and conditions we will deem acceptable. Any additional funding derived from the sale of equity securities is likely to result in significant dilution to our existing stockholders. These matters involve risks and uncertainties that may prevent us from raising additional capital or may cause the terms upon which we raise additional capital, if additional capital is available, to be less favorable to us than would otherwise be the case. If we reach a point where we are unable to raise needed additional funds to continue as a going concern, we will be forced to cease our business activities and dissolve the Company. In such an event, we will need to satisfy various severances, contract termination, and other dissolution-related obligations.

If we make a significant acquisition that requires the issuance of our shares we may be required to reapply for NASDAQ listing.

Reapplying for NASDAQ listing may require us to satisfy the more stringent original listing standards of the NASDAQ Capital Market, which has substantially higher standards than the continuing listing standards. If any such application is not approved, our shares of common stock could be delisted from the NASDAQ Capital Market.

We have experienced recent net losses and we may incur future net losses, which may

cause a decrease in our stock price.

We incurred net losses of $3.8 million in fiscal 2015 and $16.2 million in fiscal 2014. We may not be able to generate revenues sufficient to offset our costs and may sustain net losses in future periods. Any such losses may have an adverse effect on our future operating prospects, liquidity and stock price.

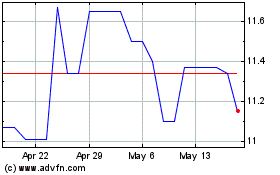

We have experienced volatility in the price of our stock and are subject to volatility in the future.

The price of our common stock has experienced significant volatility. The high and low bid quotations for our common stock, as reported by the NASDAQ Capital Market, ranged between a high of $5.18 and a low of $0.55 during the past 24 months. The historic market price of our common stock may be higher or lower than the price paid for our shares and may not be indicative of future market prices, depending on many factors, some of which are beyond our control. In addition, as we have significantly reduced our video game operations, and are seeking strategic alternatives, we cannot predict the performance of our stock. The price of our stock may change dramatically in response to our success or failure to consummate a strategic transaction.

Substantial future sales of our common stock by us or by our existing stockholders could cause our stock price to fall.

Additional equity financings or other share issuances by us, including shares issued in connection with strategic alliances and corporate partnering transactions, could adversely affect the market price of our common stock. Sales by existing stockholders of a large number of shares of our common stock in the public market or the perception that additional sales could occur could cause the market price of our common stock to drop.

We may not be able to maintain our listing on the NASDAQ Capital Market.

Our common stock currently trades on the NASDAQ Capital Market. This market has continued listing requirements that we must continue to maintain to avoid delisting. The standards include, among others, a minimum bid price requirement of $1.00 per share and any of: (i) a minimum stockholders’ equity of $2.5 million; (ii) a market value of listed securities of $35 million; or (iii) net income from continuing operations of $500,000 in the most recently completed fiscal year or in the two of the last three fiscal years. Our results of operations and our fluctuating stock price directly impact our ability to satisfy these listing standards. In the event we are unable to maintain these listing standards, we may be subject to delisting.

A delisting from NASDAQ would result in our common stock being eligible for quotation on the Over-The-Counter market which is generally considered to be a less efficient system than listing on markets such as NASDAQ or other national exchanges because of lower trading volumes, transaction delays and reduced security analyst and news media coverage. These factors could contribute to lower prices and larger spreads in the bid and ask prices for our common stock. Additionally, trading of our common stock on the OTCBB may make us less desirable to institutional investors and may, therefore, limit our future equity funding options and could negatively affect the liquidity of our stock.

The rights of our common stockholders are limited by and subordinate to the rights of the holders of Series A Convertible Preferred Stock, Series B Convertible Preferred Stock, Series C Convertible Preferred Stock and Series D Convertible Preferred Stock; these rights may have a negative effect on the value of shares of our common stock.

The holders of our outstanding shares of Series A Preferred Stock, Series B Preferred Stock, Series C Preferred Stock and Series D Preferred Stock have rights and preferences generally superior to those of the holders of common stock. The existence of these superior rights and preferences may have a negative effect on the value of shares of our common stock. These rights are more fully set forth in the certificates of designations governing these instruments, and include, but are not limited to:

|

●

|

the right to receive a liquidation preference, prior to any distribution of our assets to the holders of our common stock; and

|

|

●

|

the right to convert into shares of our common stock at the conversion price set forth in the certificates of designations governing the respective preferred stock, which may be adjusted as set forth therein.

|

A significant portion of our revenue has been generated from games based on the

Zumba Fitness

property.

A significant portion of our revenue since fiscal 2010 was generated from the

Zumba Fitness

series of games. We license the rights to publish these games from a third party. In November 2011, we released the sequels

Zumba Fitness 2

and

Zumba Fitness Rush

for the Wii and Kinect platforms, respectively. In November 2012, we released the sequel

Zumba Fitness Core

for the Wii and Kinect platforms. In November 2013, we released the sequel

Zumba Fitness World Party

for the Wii and Kinect platforms. We do not expect to release any new Zumba games in the future.

A decrease in the popularity of our licensed brands and, correspondingly, the video games we publish based on those brands could negatively impact our revenues and financial position.

Certain games released in 2014 and 2015 were based upon popular licensed brands. A decrease in the popularity of our licensed properties would negatively impact our ability to sell games based upon such licenses and could lead to lower net sales, profitability, and/or an impairment of our licenses, which would negatively impact our profitability.

A weak global economic environment could result in increased volatility in our stock price.

Current uncertainty in global economic conditions poses a risk to the overall economy as consumers and retailers may defer or choose not to make purchases in response to tighter credit and negative financial news, which could negatively affect demand for our products. Additionally, due to the weak economic conditions and tightened credit environment, some of our retailers and customers may not have the same purchasing power, leading to lower purchases of our games for placement into distribution channels. Reduced consumer demand for our products could materially impact our operating results.

Termination or modification of our agreements with platform hardware manufacturers may

adversely affect our business.

We are required to obtain a license in order to develop and distribute software for each of the manufacturers of video game hardware. We currently have licenses from: (i) Sony to develop products for PlayStation, PlayStation 2, PlayStation 3 and PlayStation 4; (ii) from Nintendo to develop products for the DS, DSi, 3DS, Wii and WiiU; and (iii) from Microsoft to develop products for the Xbox, Xbox 360 and Xbox One. These licenses must be periodically renewed, and if they are not, or if any of our licenses are terminated or adversely modified, we may not be able to distribute any of our games on that platform or we may be required to do so on less attractive terms.

Our platform licensors control the fee structures for online distribution of our games on their platforms.

Pursuant to the terms of certain publisher license agreements, platform licensors retain sole discretion to determine the fees to be charged for both base level and premium online services available via their online platforms. Each licensor’s ability to set royalty rates makes it challenging for us to predict our costs, and increased costs may negatively impact our operating margins. As a result of such varying fee structures, we may be unable to distribute our games in a cost-effective manner through such distribution channels.

Intellectual property claims may increase our costs or require us to cease selling affected products, which could adversely affect our financial condition and results of operations.

Development of original content, including publication and distribution, sometimes results in claims of intellectual property infringement. Although we make efforts to ensure our products do not violate the intellectual property rights of others, it is possible that third parties may still allege infringement. These claims and any litigation resulting from these claims may result in damage awards payable by us; could prevent us from selling the affected product; or require us to redesign the affected product to avoid infringement or obtain a license for future sales of the affected product.

Any of the foregoing could have an adverse effect on our financial condition and results of operations. Any litigation resulting from these claims could require us to incur substantial costs.

A reduced workforce presents additional risk to the effectiveness of our internal controls.

We have significantly reduced our workforce. A smaller workforce impacts our ability to continue to undertake our historic business which could have an impact on our ability to maintain internal controls including over financial reporting, and can affect the adequacy of our controls. We cannot be certain that our internal controls over financial reporting are or will remain effective. If we cannot adequately maintain the effectiveness of our internal controls over financial reporting, we may be subject to liability and/or sanctions or investigation by regulatory authorities, such as the SEC. Any such action could adversely affect our financial results and the market price of our common stock.

Our reputation with consumers is critical to our success. Negative consumer perceptions about our brands, games, services and/or business practices may damage our business and any costs incurred in addressing consumer concerns may increase our operating expenses.

Individual consumers form our ultimate customer base, and consumer expectations regarding the quality, performance and integrity of our products and services are high. Consumers may be critical of our brands, games, services and/or business practices for a wide variety of reasons. These negative consumer reactions may not be foreseeable or within our control to manage effectively. Actions we take to address consumer concerns may be costly and, in any case, may not be successful. In addition, negative consumer sentiment about our business practices may result in inquiries or investigations from regulatory agencies and consumer groups, as well as litigation, which, regardless of their outcome, may be damaging to our reputation. Any of these may have a negative impact on our business.

If our games and services do not function as consumers expect, it may have a negative impact on our business.

If our games and services do not function as consumers expect, whether because they fail to function as advertised or otherwise, our sales may suffer. If our games and services do not function as consumers expect, it may negatively impact our business.

If we are unable to sustain traditional pricing levels for our titles, our business, financial condition, results of operations, profitability, cash flows or liquidity could suffer materially.

If we are unable to sustain traditional pricing levels for our titles, whether due to competitive pressure, because retailers elect to price these products at a lower price or otherwise, it could have a negative impact on our business. Further, we make provisions for retail inventory price protection based upon certain assumed lowest prices and if competitive pressures force us to lower our prices below those levels, it could similarly have a negative impact on our business.

Our industry is subject to rapid technological change, and if we do not adapt to, and appropriately allocate our new resources among, emerging technologies and business models, our business may be negatively impacted.

Technology changes rapidly in the interactive entertainment industry. We must continually anticipate and adapt our products to emerging technologies, delivery platforms and business models in order to stay competitive. When we choose to incorporate a new technology into a product or to develop a product for a new platform, operating system or media format, we often are required to make a substantial investment prior to the introduction of the product. If we invest in the development of interactive entertainment products incorporating a new technology or for a new platform that does not achieve significant commercial success, our revenues from those products likely will be lower than we anticipated and may not cover our development costs. Further, our competitors may adapt to an emerging technology or business model more quickly or effectively than we do, creating products that are technologically superior to ours, more appealing to consumers, or both. If, on the other hand, we elect not to pursue the development of products incorporating a new technology or for new platforms, or otherwise elect not to pursue a new business model, that achieves significant commercial success, it may have adverse consequences. It may take significant time and resources to shift product development resources to that technology, platform or business model, as the case may be, and may be more difficult to compete against existing products incorporating that technology or for that platform or against companies using that business model. Any failure to successfully adapt to, and appropriately allocate resources among, emerging technologies could negatively impact our business.

Competition within, and to, the interactive entertainment industry is intense, and competitors may succeed in reducing our sales.

Within the interactive entertainment industry, we compete with other publishers of interactive entertainment software developed for use on the PC, video game consoles and handheld, mobile and tablet devices or social networking sites, both within the United States and, increasingly, in international jurisdictions. Our competitors include very large corporations with significantly greater financial, marketing and product development resources than we have. A relatively small number of titles account for a significant portion of net revenues, and an even greater portion of net profit, in the interactive entertainment industry, and the availability of significant financial resources is a major competitive factor in the production of high-quality products and in the marketing of products that are ultimately well-received. Our larger competitors may be able to leverage their greater financial, technical, personnel and other resources to finance larger budgets for development and marketing and make higher offers to licensors and developers for commercially desirable properties as well as adopt more aggressive pricing policies to develop more commercially successful products for the PC or video game platforms than we do. In addition, competitors with large product lines and popular titles typically have greater leverage with retailers, distributors and other customers, who may be willing to promote titles with less consumer appeal in return for access to those competitors' more popular titles.

Increased consumer acceptance and availability of interactive entertainment developed for use by consumers on handheld, mobile and tablet devices or social networking sites or other online games, consumer acceptance and availability of technology which allows users to play games on televisions without consoles, or technological advances in online game software or the Internet could result in a decline in sales of our platform-based software.

Additionally, we compete with other forms of entertainment and leisure activities. For example, the overall growth in the use of the Internet and online services such as social networking sites by consumers may pose a competitive threat if consumers and potential consumers spend less of their available time using interactive entertainment software and more using the Internet, including those online services. Further, it is difficult to predict and prepare for rapid changes in consumer demand that could materially alter public preferences for different forms of entertainment and leisure activities. Failure to adequately identify and adapt to the competitive pressures described herein could negatively impact our business.

We are exposed to seasonality in the sale of our products.

The interactive entertainment industry is highly seasonal, with the highest levels of consumer demand occurring during the year-end holiday buying season in the fourth quarter of the year. Receivables and credit risk are likewise higher during the second half of the year, as retailers increase their purchases of our products in anticipation of the holiday season. Delays in development, licensor approvals or manufacturing can affect the timing of the release of products, causing us to miss key selling periods such as the year-end holiday buying season.

We may be involved in legal proceedings that may result in material adverse outcomes.

From time to time, we may be involved in claims, suits, government investigations, audits and proceedings arising from the ordinary course of our business, including actions with respect to intellectual property, competition and antitrust matters, privacy matters, tax matters, labor and employment matters, unclaimed property matters, compliance and commercial claims. Such claims, suits, government investigations, audits and proceedings are inherently uncertain and their results cannot be predicted with certainty. Regardless of the outcome, such legal proceedings can have an adverse impact on us because of legal costs, diversion of management resources and other factors. In addition, it is possible that a resolution of one or more such proceedings could result in substantial fines and penalties, criminal sanctions, consent decrees or orders preventing us from offering certain features, functionalities, products or services, requiring us to change our development process or other business practices.

Our products are subject to ratings by the Entertainment Software Rating Board in the U.S. and similar agencies in international jurisdictions. Our failure to obtain our target ratings for our products could negatively impact our business.

The Entertainment Software Rating Board (the "ESRB") is a self-regulatory body based in the United States that provides consumers of interactive entertainment software with ratings information, including information on the content in such software, such as violence, nudity or sexual content contained in software titles. The ESRB rating categories are "Early Childhood" (i.e., content is intended for young children), "Everyone" (i.e., content is generally suitable for all ages), "Everyone 10+" (i.e., content is generally suitable for ages 10 and up), "Teen" (i.e., content is generally suitable for ages 13 and up), "Mature" (i.e., content is generally suitable for ages 17 and up) and "Adults Only" (i.e., content is suitable for adults ages 18 and up). Certain countries other than the United States have also established content rating systems as prerequisites for product sales in those countries. In some countries, a company may be required to modify its products to comply with the requirements of the rating systems, which could delay or disrupt the release of any given product, or may prevent its sale altogether in certain territories. Further, if an agency re-rates one of our games for any reason, retailers could refuse to sell it and demand that we accept the return of any unsold or returned copies or consumers could demand a refund for copies purchased. If we are unable to obtain the ratings we have targeted for our products as a result of changes in a content rating organization's ratings standards or for other reasons, it could have a negative impact on our business.

Our business, products, and distribution are subject to increasing regulation of content in key territories. If we do not successfully respond to these regulations, our business, financial condition, results of operations, profitability, cash flows or liquidity could be materially adversely affected.

Legislation is continually being introduced, and litigation and regulatory enforcement actions are taking place, that may affect the way in which we, and other industry participants, may offer content and features, and distribute and advertise our products. For example, privacy laws and regulatory guidance in many countries impose various restrictions on online and mobile advertising, as well as the collection, storage and use of personally identifiable information. We may be required to modify certain of our product development processes or alter our marketing strategies to comply with such regulations, which could be costly or delay the release of our products. In addition, many foreign countries, such as China and Germany, have laws that permit governmental entities to restrict the content and/or advertising of interactive entertainment software or prohibit certain types of content. Further, legislation which attempts to restrict marketing or distribution of such products because of the content therein has been introduced at one time or another at the federal and state levels in the United States. There is on-going risk of enhanced regulation of interactive entertainment marketing, content or sales. These laws and regulations vary by territory and may be inconsistent with one another, imposing conflicting or uncertain restrictions. The adoption and enforcement of legislation which restricts the marketing, content or sales of our products in countries in which we do business may harm the sales of our products, as the products we are able to offer to our customers and the size of the potential market for our products may be limited. Failure to comply with any applicable legislation may also result in government-imposed fines or other penalties. Moreover, the increased public dialogue concerning interactive entertainment may have an adverse impact on our reputation and consumers' willingness to purchase our products

FORWARD-LOO

KING STATEMENTS

This prospectus and any accompanying prospectus supplement, including the documents that we incorporate by reference, contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Any statements in this prospectus and any accompanying prospectus supplement about our expectations, beliefs, plans, objectives, assumptions or future events or performance are not historical facts and are forward-looking statements. These statements are often, but not always, made through the use of words or phrases such as "believe," "will," "expect," "anticipate," "estimate," "intend," "plan" and "would." For example, statements concerning financial condition, possible or assumed future results of operations, growth opportunities, industry ranking, plans and objectives of management, markets for our common stock and future management and organizational structure are all forward-looking statements. Forward-looking statements are not guarantees of performance. They involve known and unknown risks, uncertainties and assumptions that may cause actual results, levels of activity, performance or achievements to differ materially from any results, levels of activity, performance or achievements expressed or implied by any forward-looking statement.

Any forward-looking statements are qualified in their entirety by reference to the risk factors discussed throughout this prospectus and any accompanying prospectus supplement. Some of the risks, uncertainties and assumptions that could cause actual results to differ materially from estimates or projections contained in the forward-looking statements include but are not limited to:

|

|

Our ability to compete with larger better financed companies;

|

|

|

Our ability to develop and commercialize our products;

|

|

|

Our ability to maintain and protect intellectual property rights;

|

|

|

The inability to raise additional future financing and lack of financial and other resources;

|

|

|

Our ability to control product development costs;

|

|

|

We may not be able to attract and retain key employees;

|

|

|

We may not be able to compete effectively;

|

|

|

Our ability to gain access to wider distribution channels; and

|

|

|

Our ability to secure the rights to valuable licenses.

|

The foregoing list sets forth some, but not all, of the factors that could affect our ability to achieve results described in any forward-looking statements. You should read this prospectus and any accompanying prospectus supplement and the documents that we reference herein and therein and have filed as exhibits to the registration statement, of which this prospectus is part, completely and with the understanding that our actual future results may be materially different from what we expect. You should assume that the information appearing in this prospectus and any accompanying prospectus supplement is accurate as of the date on the front cover of this prospectus or such prospectus supplement only. Because the risk factors referred to on page 2 of this prospectus and incorporated herein by reference, could cause actual results or outcomes to differ materially from those expressed in any forward-looking statements made by us or on our behalf, you should not place undue reliance on any forward-looking statements. Further, any forward-looking statement speaks only as of the date on which it is made, and we undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events. New factors emerge from time to time, and it is not possible for us to predict which factors will arise. In addition, we cannot assess the impact of each factor on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. We qualify all of the information presented in this prospectus and any accompanying prospectus supplement, and particularly our forward-looking statements, by these cautionary statements.

The net proceeds from any disposition of the shares covered hereby would be received by the selling stockholders. We will not receive any of the proceeds from any such sale of the common stock offered by this prospectus.

We have prepared this prospectus to allow the selling stockholders, to sell, from time to time, of 3,287,800 shares of common stock and up to 17,737,178 shares of our common stock underlying our outstanding shares of Series A Convertible Preferred Stock, Series B Convertible Preferred Stock, Series C Convertible Preferred Stock and Series D Convertible Preferred Stock, each of which are described under “

Description of Capital Stock

” below. All of the common stock offered by this prospectus may be offered by the selling stockholders for their own account. We will receive no proceeds from any such sale of these shares by the selling stockholders.

On December 17, 2014, we issued and sold to certain accredited investors $6 million of units at a purchase price of $0.68 per unit with each unit consisting of Series A Preferred Stock and a warrant to purchase one share of common stock. The warrants were subsequently exchanged for shares of our common stock and our Series B Convertible Preferred Stock on April 30, 2015.

On May 15, 2015, we issued and sold to certain accredited investors $5,050,000 of units at a purchase price of $1.20 per unit with each unit consisting of either common stock, or at the election of any investor who, as a result of the receipt of common stock would hold in excess of 4.99% of our issued and outstanding common stock, shares of our Series C Preferred Stock and a warrant to purchase one share of common stock. The warrants were subsequently exchanged for shares of our common stock and our Series D Convertible Preferred Stock on September 25, 2015. This registration statement registers the shares of common stock: (i) issuable upon conversion of the Series A Convertible Preferred Stock; (ii) issuable upon conversion of the Series B Convertible Preferred Stock; (iii) issued upon exchange of the December 2014 warrants; (iv) issuable upon conversion of the Series C Convertible Preferred Stock; (v) issuable upon conversion of the Series D Convertible Preferred Stock and (vi) issued upon exchange of the May 2015 warrants.

Selling Stockholder Table

The following table sets forth information with respect to our common stock known to us to be beneficially owned by the selling stockholders as of April 29, 2016. To our knowledge, each of the selling stockholders have sole voting and investment power over the common stock listed in the table below. Except as otherwise disclosed herein, each selling stockholder, to our knowledge, has not had a material relationship with us during the three years immediately preceding the consummation of the private placement.

|

Name of Selling Stockholder

|

|

Number of Shares of Common Stock Beneficially Owned Prior to Offering

|

|

|

Percentage of Common Stock Beneficially Owned After this Offering**

|

|

|

Share of Common Stock Offered in this Offering

|

|

|

Shares of Common Stock Beneficially Owned After this Offering

|

|

|

Percentage of Common Stock Beneficially Owned After this Offering**

|

|

|

Frost Gamma Investments Trust

(1)

|

|

|

1,461,397

|

(2)

|

|

|

9.99

|

%

|

|

|

4,948,176

|

(3)

|

|

|

0

|

|

|

|

0

|

|

|

Barry Honig

(4)

|

|

|

682,269

|

(5)

|

|

|

4.99

|

%

|

|

|

3,781,513

|

(6)

|

|

|

682,269

|

(7)

|

|

|

4.99

|

%

|

|

GRQ Consultants, Inc. 401K

(4)

|

|

|

708,619

|

(8)

|

|

|

4.99

|

%

|

|

|

1,166,664

|

(9)

|

|

|

91,706

|

|

|

|

*

|

|

|

GRQ Consultants, Inc. Roth 401K FBO Barry Honig

(4)

|

|

|

265,127

|

(10)

|

|

|

1.93

|

%

|

|

|

265,127

|

(10)

|

|

|

0

|

|

|

|

0

|

|

|

Marlin Capital Investments, LLC

(4)

|

|

|

201,682

|

(11)

|

|

|

1.46

|

%

|

|

|

201,682

|

(11)

|

|

|

0

|

|

|

|

0

|

|

|

Michael Brauser

(12)

|

|

|

679,274

|

(13)

|

|

|

4.99

|

%

|

|

|

3,781,513

|

(14)

|

|

|

679,274

|

(15)

|

|

|

4.99

|

%

|

|

Grander Holdings, Inc. 401K

(12)

|

|

|

705,731

|

(16)

|

|

|

4.99

|

%

|

|

|

758,337

|

(17)

|

|

|

116,500

|

|

|

|

*

|

|

|

Betsy and Michael Brauser Charitable Foundation, Inc.

(12)

|

|

|

175,000

|

(18)

|

|

|

1.27

|

%

|

|

|

175,000

|

(18)

|

|

|

0

|

|

|

|

*

|

|

|

Melechdavid, Inc.

(19)

|

|

|

1,458,808

|

(20)

|

|

|

9.99

|

%

|

|

|

1,615,272

|

(21)

|

|

|

440,000

|

|

|

|

3.24

|

%

|

|

Erica and Mark Groussman Foundation Inc.

(19)

|

|

|

150,000

|

|

|

|

1.10

|

%

|

|

|

150,000

|

|

|

|

0

|

|

|

|

0

|

|

|

Melechdavid Inc., Retirement Plan

(19)

|

|

|

630,254

|

(22)

|

|

|

4.64

|

%

|

|

|

630,254

|

(22)

|

|

|

0

|

|

|

|

0

|

|

|

Sandor Capital Master Fund

(23)

|

|

|

697,732

|

(24)

|

|

|

4.99

|

%

|

|

|

841,311

|

(25)

|

|

|

0

|

|

|

|

0

|

|

|

JSL Kids

(23)

|

|

|

126,051

|

|

|

|

*

|

%

|

|

|

126,051

|

|

|

|

0

|

|

|

|

0

|

|

|

Darwin Investments, LLC

(26)

|

|

|

350,561

|

(27)

|

|

|

2.58

|

%

|

|

|

350,561

|

(27)

|

|

|

0

|

|

|

|

0

|

|

|

Darwin Retirement Investments, LLC

(26)

|

|

|

250,000

|

|

|

|

1.84

|

%

|

|

|

250,000

|

|

|

|

0

|

|

|

|

0

|

|

|

Paradox Capital Partners, LLC

(26)

|

|

|

400,000

|

|

|

|

2.94

|

%

|

|

|

400,000

|

|

|

|

0

|

|

|

|

0

|

|

|

American European Insurance Company

(28)

|

|

|

191,101

|

|

|

|

1.41

|

%

|

|

|

191,101

|

|

|

|

0

|

|

|

|

0

|

|

|

Nachum Stein

|

|

|

417,992

|

(29)

|

|

|

3.08

|

%

|

|

|

226,891

|

|

|

|

191,101

|

(30)

|

|

|

1.41

|

%

|

|

Sable Ridge Capital Opportunity Fund LP

(31)

|

|

|

110,616

|

|

|

|

*

|

|

|

|

110,616

|

|

|

|

0

|

|

|

|

0

|

|

|

ATG Capital, LLC

(32)

|

|

|

214,790

|

|

|

|

1.58

|

%

|

|

|

214,790

|

|

|

|

0

|

|

|

|

0

|

|

|

John O'Rourke

|

|

|

334,329

|

(33)

|

|

|

2.49

|

%

|

|

|

119,539

|

|

|

|

214,790

|

(34)

|

|

|

1.58

|

%

|

|

Pinehurst Capital, LLC

(35)

|

|

|

172,714

|

(36)

|

|

|

1.27

|

%

|

|

|

172,714

|

(36)

|

|

|

0

|

|

|

|

0

|

|

|

DBGJ Irrevocable Trust

(37)

|

|

|

175,000

|

(38)

|

|

|

1.29

|

%

|

|

|

175,000

|

(38)

|

|

|

0

|

|

|

|

0

|

|

|

Stetson Capital Investments, Inc.

(39)

|

|

|

116,664

|

(40)

|

|

|

*

|

|

|

|

116,664

|

(40)

|

|

|

0

|

|

|

|

0

|

|

|

Stetson Capital Investments, Inc. Retirement Plan

(39)

|

|

|

116,664

|

(40)

|

|

|

*

|

|

|

|

116,664

|

(40)

|

|

|

0

|

|

|

|

0

|

|

|

John Stetson

|

|

|

452,866

|

(41)

|

|

|

3.33

|

%

|

|

|

119,538

|

(42)

|

|

|

333,328

|

(43)

|

|

|

2.45

|

%

|

|

Special Equities Group, LLC

(44)

|

|

|

20,000

|

|

|

|

*

|

|

|

|

20,000

|

|

|

|

0

|

|

|

|

0

|

|

|

TOTAL

|

|

|

--

|

|

|

|

--

|

|

|

|

21,024,978

|

|

|

|

--

|

|

|

|

--

|

|

* Less than 1%.

** Based on 13,583,875 shares of common stock issued and outstanding as of April 29, 2016.

|

(1)

|

Dr. Phillip Frost, M.D. is the trustee of Frost Gamma Investments Trust (“FGIT”). Frost Gamma L.P. is the sole and exclusive beneficiary of FGIT. Dr. Frost is one of two limited partners of Frost Gamma L.P. The general partner of Frost Gamma L.P. is Frost Gamma, Inc., and the sole shareholder of Frost Gamma, Inc. is Frost-Nevada Corporation. Dr. Frost is the sole shareholder of Frost-Nevada Corporation. Dr. Frost disclaims beneficial ownership of these securities, except to the extent of any pecuniary interest therein and this report shall not be deemed an admission that Dr. Frost is the beneficial owner of these securities for purposes of Section 16 or for any other purpose.

|

|

(2)

|

Represents (i) 416,666 shares of common stock and (ii) 1,044,731 shares of common stock underlying Series A Convertible Preferred Stock.

Excludes

(i) 1,161,151 shares of common stock underlying Series A Convertible Preferred Stock; (ii) 1,575,631 shares of common stock underlying Series B Convertible Preferred Stock; (iii) 416,667 shares of common stock underlying Series C Convertible Preferred Stock; and (iv) 333,330 shares of common stock underlying Series D Convertible Preferred Stock.

Each of the forgoing classes of preferred stock contains an ownership limitation such that the holder may not convert any of such securities to the extent that such conversion would result in the holder’s beneficial ownership being in excess of 4.99% of the Company’s issued and outstanding common stock together with all shares owned by the holder and its affiliates. On April 4, 2016, FGIT submitted notice to the Company, effective 61 days therefrom, of its election to increase its beneficial ownership limitation to 9.99%. This increased ownership limitation is reflected in this table.

|

|

(3)

|

Represents (i) 416,666 shares of common stock, (ii) 2,205,882 shares of common stock underlying Series A Convertible Preferred Stock, (iii) 1,575,631 shares of common stock underlying Series B Convertible Preferred Stock, (iv) 416,667 shares of common stock underlying Series C Convertible Preferred Stock and (v) 333,330 shares of common stock underlying Series D Convertible Preferred Stock.

|

|

(4)

|

Barry Honig is the Trustee of GRQ Consultants, Inc. 401K and GRQ Consultants, Inc. Roth 401K FBO Barry Honig, and he is the managing member of Marlin Capital Investments, LLC. In such capacities he is deemed to hold voting and dispositive power over the securities held by such entities.

|

|

(5)

|

Represents (i) 391,225 shares of common stock held by Barry Honig, of which 133,336 represents the vested portion (including shares vesting with 60 days) of a restricted stock grant of 400,000 shares under the 2014 Equity Incentive Plan, which award shares vest at a rate for 1/24 of such award shares per month, (ii) 110,470 shares of common stock held by GRQ Consultants, Inc. Roth 401K FBO Barry Honig, (iii) 91,706 shares of common stock held by GRQ Consultants, Inc. 401K and (iv) 88,868 shares of Series A Convertible Preferred Stock held by Barry Honig. Excludes (i) 2,117,015 shares of common stock underlying Series A Convertible Preferred Stock held by Barry Honig and 154,657 shares of common stock underlying Series A Convertible Preferred Stock held by GRQ Consultants Inc. Roth 401K FBO Barry Honig; (ii) 84,034 shares of common stock underlying Series B Convertible Preferred Stock held by Marlin Capital Investments, LLC; (iii) 833,334 shares of common stock underlying Series C Convertible Preferred Stock held by GRQ Consultants, Inc. 401K; and (iv) and 333,330 shares of common stock underlying Series D Convertible Preferred Stock held by GRQ Consultants, Inc. 401K.

Each of the forgoing classes of preferred stock contains an ownership limitation such that the holder may not convert any of such securities to the extent that such conversion would result in the holder’s beneficial ownership being in excess of 4.99% of the Company’s issued and outstanding common stock together with all shares owned by the holder and its affiliates.

|

|

(6)

|

Represents (i) 2,205,883 shares of common stock underlying Series A Convertible Preferred Stock and (ii) 1,575,630 shares of common stock underlying Series B Convertible Preferred Stock.

|

|

(7)

|

Represents (i) 391,225 shares of common stock held by Barry Honig, of which 133,336 represents the vested portion (including shares vesting with 60 days) of a restricted stock grant of 400,000 shares under the 2014 Equity Incentive Plan, which award shares vest at a rate for 1/24 of such award shares per month; (ii) 91,706 shares of common stock held by GRQ Consultants, Inc. 401K; (iii) 110,470 shares of common stock held by GRQ Consultants, Inc. Roth 401K FBO Barry Honig; and (iv) 88,868 shares of common stock underlying Series A Convertible Preferred Stock held by GRQ Consultants Inc. Roth 401K FBO Barry Honig. Excludes (i) 65,789 shares of common stock underlying Series A Convertible Preferred Stock held by GRQ Consultants, Inc. Roth 401K FBO Barry Honig; (ii) 117,648 shares of common stock underlying Series A Convertible Preferred Stock and 84,034 shares of common stock underlying Series B Convertible Preferred Stock held by Marlin Capital, LLC; and (iii) 833,334 shares of common stock underlying Series C Convertible Preferred Stock and 333,330 shares of common stock underlying Series D Convertible Preferred Stock held by GRQ Consultants, Inc. 401K.

|

|

(8)

|

Represents (i) 91,706 shares of common stock and (ii) 616,913 shares of common stock underlying Series C Convertible Preferred Stock. Excludes (i) 216,421 shares of common stock underlying Series C Convertible Preferred Stock and (ii) 333,330 shares of common stock underlying shares of Series D Convertible Preferred Stock.

Each of the forgoing classes of preferred stock contains an ownership limitation such that the holder may not convert any of such securities to the extent that such conversion would result in the holder’s beneficial ownership being in excess of 4.99% of the Company’s issued and outstanding common stock together with all shares owned by the holder and its affiliates.

|

|

(9)

|

Represents (i) 833,334 shares of common stock underlying Series C Convertible Preferred Stock and (ii) 333,330 shares of common stock underlying Series D Convertible Preferred Stock.

|

|

(10)

|

Represents (i) 110,470 shares of common stock and (ii) 154,657 shares of common stock underlying shares of Series A Convertible Preferred Stock.

|

|

(11)

|

Represents (i) 117,648 shares of common stock underlying Series A Convertible Preferred Stock and (ii) 84,034 shares of common stock underlying Series B Convertible Preferred Stock. Each of the forgoing classes of preferred stock contains an ownership limitation such that the holder may not convert any of such securities to the extent that such conversion would result in the holder’s beneficial ownership being in excess of 4.99% of the Company’s issued and outstanding common stock together with all shares owned by the holder and its affiliates.

|

|

(12)

|

Michael Brauser is Chairman of the Betsy & Michael Brauser Charitable Family Foundation, Trustee of Grander Holdings, Inc. 401K and a Manager of Marlin Capital Investments, LLC. In such capacities he is deemed to hold voting and dispositive power over the securities held by such entities.

|

|

(13)

|

Represents (i) 378,745 shares of common stock held by Michael Brauser, of which 100 shares are held by Michael Brauser, 235,786 shares are jointly held by Michael Brauser jointly with his spouse, 133,336 shares represent the vested portion (including shares vesting with 60 days) of a restricted stock grant of 400,000 shares under the 2014 Equity Incentive Plan, which award shares vest at a rate for 1/24 of such award shares per month, and 9,523 shares represent shares of common stock underlying options to purchase common stock at a price of $1.05 per share, which were granted under the 2014 Equity Incentive Plan and fully vest on June 17, 2016; (ii) 146,684 shares of common stock held by Grander Holdings, Inc. 401K; (iii) 125,000 shares of common stock held by the Betsey and Michael Brauser Charitable Foundation, Inc.; and (iv) 28,845 shares of common stock underlying shares of Series A Convertible Preferred Stock held by Michael Brauser. Excludes (i) 2,177,038 shares of common stock underlying Series A Convertible Preferred Stock and 1,575,630 shares of common stock underlying Series B Convertible Preferred Stock held by Michael Brauser; (ii) 511,483 shares of common stock underlying Series C Convertible Preferred Stock and 216,670 shares of common stock underlying Series D Convertible Preferred Stock held by Grander Holdings, Inc. 401K; and (iii) 50,000 shares of common stock underlying Series D Convertible Preferred Stock held by the Betsey and Michael Brauser Charitable Foundation, Inc. Each of the forgoing classes of preferred stock contains an ownership limitation such that the holder may not convert any of such securities to the extent that such conversion would result in the holder’s beneficial ownership being in excess of 4.99% of the Company’s issued and outstanding common stock together with all shares owned by the holder and its affiliates.

|

|

(14)

|

Represents 2,205,883 shares of common stock underlying Series A Convertible Preferred Stock and 1,575,630 shares of common stock underlying Series B Convertible Preferred Stock held by Michael Brauser.

|

|

(15)

|

Represents (i) 378,745 shares of common stock held by Michael Brauser, of which 100 shares are held by Michael Brauser, 235,786 shares are jointly held by Michael Brauser jointly with his spouse, 133,336 shares represent the vested portion (including shares vesting with 60 days) of a restricted stock grant of 400,000 shares under the 2014 Equity Incentive Plan, which award shares vest at a rate for 1/24 of such award shares per month, and 9,523 shares represent shares of common stock underlying options to purchase common stock at a price of $1.05 per share, which were granted under the 2014 Equity Incentive Plan and fully vest on June 17, 2016; (ii) 146,684 shares of common stock held by Grander Holdings, Inc. 401K; (iii) 125,000 shares of common stock held by the Betsey and Michael Brauser Charitable Foundation, Inc.; and (iv) 28,845 shares of common stock underlying Series C Convertible Preferred Stock held by Grander Holdings, Inc. 401K. Excludes (i) 482,638 shares of common stock underlying Series C Convertible Preferred Stock and 216,670 shares of Series D Convertible Preferred Stock held by Grander Holdings, Inc. 401K; and (ii) 50,000 shares of Series D Convertible Preferred Stock held by the Betsey & Michael Brauser Charitable Foundation, Inc.

|

|

(16)

|

Represents (i) 146,684 shares of common stock, (ii) 511,483 shares of common stock underlying Series C Convertible Preferred Stock and (iii) 47,564 shares of common stock underlying Series D Convertible Preferred Stock. Excludes 169,106 shares of common stock underlying Series D Convertible Preferred Stock. Each of the forgoing classes of preferred stock contains an ownership limitation such that the holder may not convert any of such securities to the extent that such conversion would result in the holder’s beneficial ownership being in excess of 4.99% of the Company’s issued and outstanding common stock together with all shares owned by the holder and its affiliates.

|

|

(17)

|

Represents (i) 30,184 shares of common stock, (ii) 511,483 shares of common stock underlying Series C Convertible Preferred Stock and (iii) 216,670 shares of common stock underlying Series D Convertible Preferred Stock.

|

|

(18)

|

Represents (i) 125,000 shares of common stock and (ii) 50,000 shares of common stock underlying shares of Series D Convertible Preferred Stock. The forgoing class of preferred stock contains an ownership limitation such that the holder may not convert any of such securities to the extent that such conversion would result in the holder’s beneficial ownership being in excess of 4.99% of the Company’s issued and outstanding common stock together with all shares owned by the holder and its affiliates.

|

|

(19)

|

Mark Groussman is the President of Melechdavid, Inc., and the Trustee of each of the Erica and Mark Groussman Foundation, Inc., and the Melechdavid Inc., Retirement Plan. In such capacities, he has voting and dispositive control over the securities held by such entities.

|

|

(20)

|

Represents (i) 440,000 shares of common stock, (ii) 335,925 shares of common stock underlying shares of Series A Convertible Preferred Stock, (iii) 346,640 shares of common stock underlying Series B Convertible Preferred Stock and (iv) 336,243 shares of common stock underlying Series C Convertible Preferred Stock. Excludes (i) 230,424 shares of common stock underlying Series C Convertible Preferred Stock, and (ii) 266,670 shares of common stock underlying Series D Convertible Preferred Stock. Each of the forgoing classes of preferred stock contains an ownership limitation such that the holder may not convert any of such securities to the extent that such conversion would result in the holder’s beneficial ownership being in excess of 4.99% of the Company’s issued and outstanding common stock together with all shares owned by the holder and its affiliates. On October 15, 2015, Melechdavid, Inc. submitted notice to the Company, effective 61 days therefrom, of its election to increase its beneficial ownership limitation to 9.99%. This increased ownership limitation is reflected in this table.

|

|

(21)

|

Represents (i) 335,295 shares of common stock underlying Series A Convertible Preferred Stock, (ii) 346,640 shares of common stock underlying Series B Convertible Preferred Stock, (iii) 666,667 shares of common stock underlying Series C Convertible Preferred Stock and (iv) 266,670 shares of common stock underlying Series D Convertible Preferred Stock.

|

|

(22)

|

Represents (i) 367,648 shares of common stock underlying Series A Convertible Preferred Stock and (ii) 262,606 shares of common stock underlying Series B Convertible Preferred Stock.

|

|

(23)

|

John S. Lemak is the Manager of Sandor Capital Master Fund and the Trustee of JSL Kids Trust. In such capacities, he has voting and dispositive control over the securities held by such entities.

|

|

(24)

|

Represents (i) 298,994 shares of common stock, (ii) 294,118 shares of common stock underlying Series A Convertible Preferred Stock and (iii) 104,620 shares of common stock underlying Series C Convertible Preferred Stock. Excludes (i) 10,249 shares of common stock underlying Series C Convertible Preferred Stock and (ii) 133,330 shares of common stock underlying Series D Convertible Preferred Stock. Each of the forgoing classes of preferred stock contains an ownership limitation such that the holder may not convert any of such securities to the extent that such conversion would result in the holder’s beneficial ownership being in excess of 4.99% of the Company’s issued and outstanding common stock together with all shares owned by the holder and its affiliates.

|

|

(25)

|

Represents (i) 298,994 shares of common stock, (ii) 294,118 shares of common stock underlying Series A Convertible Preferred Stock, (iii) 114,869 shares of Series C Convertible Preferred Stock and (iv) 133,330 shares of common stock underlying Series D Convertible Preferred Stock.

|

|

(26)

|

Harvey Kesner is the Managing Member of each of Darwin Investments, LLC and Darwin Retirement Investments, LLC and Paradox Capital Partners, LLC. In such capacities, he has voting and dispositive control over the securities held by such entities.

|

|

(27)

|

Represents (i) 103,502 shares of common stock, (ii) 147,059 shares of common stock underlying Series A Convertible Preferred Stock and (iii) 100,000 shares of common stock underlying Series D Convertible Preferred Stock. The forgoing class of preferred stock contains an ownership limitation such that the holder may not convert any of such securities to the extent that such conversion would result in the holder’s beneficial ownership being in excess of 4.99% of the Company’s issued and outstanding common stock together with all shares owned by the holder and its affiliates.

|

|

(28)

|

Nachum Stein is the President of American European Insurance Company. In such capacity he has voting and dispositive control over the securities held by such entity.

|

|

(29)

|

Represents (i) 226,891 shares of common stock held by Nachum Stein and (ii) 191,101 shares of common stock held by American European Insurance Company.

|

|

(30)

|

Represents shares of common stock held by American European Insurance Company.

|

|

(31)

|

Eric Weisblum is the Manager of Sable Ridge Capital Opportunity Fund LP. In such capacity he has voting and dispositive control over the securities held by such entity.

|

|

(32)

|

John O’Rourke is the Managing Member of ATG Capital, LLC. In such capacity he has voting and dispositive control over the securities held by such entity.

|

|

(33)

|

Represents (i) 119,539 shares of common stock held by John O’Rourke, and (ii) 214,790 shares of common stock held by ATG Capital, LLC.

|

|

(34)

|

Represents 214,790 shares of common stock held by ATG Capital, LLC.

|

|

(35)

|

Jack Fruchter is the Manager of Pinehurst Capital. In such capacity he has voting and dispositive control over the securities held by such entity.

|

|

(36)

|

Represents (i) 52,521 shares of common stock, (ii) 73,530 shares of common stock underlying Series A Convertible Preferred Stock, (iii) 33,333 shares of common stock underlying Series C Convertible Preferred Stock and (iv) 13,330 shares of common stock underlying Series D Convertible Preferred Stock.

|

|

(37)

|

Joel Brauser is the Trustee of DBGJ Irrevocable Trust. In such capacity he has voting and dispositive control over the securities held by such entity.

|

|

(38)

|

Represents (i) 125,000 shares of common stock and (ii) 50,000 shares of common stock underlying Series D Convertible Preferred Stock.

|

|

(39)

|

John Stetson is the President of Stetson Capital Investments, Inc., and the Trustee of Stetson Capital Investments, Inc. Retirement Plan. In these capacities, he has voting and dispositive control over the securities held by such entities.

|

|

(40)

|

Represents (i) 83,334 shares of common stock, and (ii) 33,330 shares of common stock underlying Series D Convertible Preferred Stock. The forgoing class of preferred stock contains an ownership limitation such that the holder may not convert any of such securities to the extent that such conversion would result in the holder’s beneficial ownership being in excess of 4.99% of the Company’s issued and outstanding common stock together with all shares owned by the holder and its affiliates.

|

|

(41)

|

Represents (i) 164,198 shares of common stock held by John Stetson, of which 100,000 shares represent the vested portion (including shares vesting with 60 days) of a restricted stock grant of 300,000 shares under the 2014 Equity Incentive Plan, which award shares vest at a rate for 1/24 of such award shares per month, 83,334 shares of common stock held by each of Stetson Capital Investments, Inc. and Stetson Capital Investments, Inc Retirement Plan; (ii) 69,731 shares of common stock underlying shares of Series A Convertible Preferred Stock held by John Stetson; and (iii) 33,330 shares of common stock underlying Series D Convertible Preferred Stock held by each of Stetson Capital Investments, Inc. and Stetson Capital Investments, Inc Retirement Plan.

|

|

(42)

|

Represents (i) 49,807 shares of common stock and (ii) 69,731 shares of common stock underlying shares of Series A Convertible Preferred Stock.

|

|

(43)

|

Represents (i) 266,668 shares of common stock, of which 100,000 shares represent the vested portion (including shares vesting with 60 days) of a restricted stock grant of 300,000 shares under the 2014 Equity Incentive Plan, which award shares vest at a rate for 1/24 of such award shares per month, 83,334 shares are held by Stetson Capital Investments, Inc. and 83,334 shares are held by Stetson Capital Investments, Inc. Retirement Plan, and (ii) 33,330 shares of common stock underlying shares of Series D Convertible Preferred Stock held by each of Stetson Capital Investments, Inc. and Stetson Capital Investments, Inc. Retirement Plan.

|

|

(44)

|

Jonathan Schechter is the Manager of Special Equities Group, LLC. In this capacity, he has voting and dispositive control over the securities held by such entity.

|

DESCR

IPTION OF CAPITAL STOCK

General

The following description of our capital stock, together with any additional information we include in any applicable prospectus supplement or any related free writing prospectus, summarizes the material terms and provisions of our common stock and the preferred stock that we may offer under this prospectus. While the terms we have summarized below will apply generally to any future common stock or preferred stock that we may offer, we will describe the particular terms of any class or series of these securities in more detail in the applicable prospectus supplement. For the complete terms of our common stock and preferred stock, please refer to our restated certificate of incorporation and our restated bylaws that are incorporated by reference into the registration statement of which this prospectus is a part or may be incorporated by reference in this prospectus or any applicable prospectus supplement. The terms of these securities may also be affected by Delaware General Corporation Law. The summary below and that contained in any applicable prospectus supplement or any related free writing prospectus are qualified in their entirety by reference to our amended and restated certificate of incorporation and our amended and restated bylaws.