Filed pursuant to Rule 424(b)(5)

Registration No. 333-207564

PROSPECTUS SUPPLEMENT

(To Prospectus Dated December 7, 2015)

Majesco Entertainment Company

1,500,000 Shares of Common Stock

Common Stock Purchase Warrants, exercisable for 1,125,000 shares of Common Stock

Pursuant to this prospectus supplement and the accompanying prospectus, we are offering 1,500,000 shares of common stock at a negotiated price of $1.00 per share.

In addition pursuant to this prospectus supplement and the accompanying prospectus, we are selling to the purchasers of shares of our common stock, Common Stock Purchase Warrants, which we refer to as our Warrants, and the 1,125,000 shares of common stock issuable upon exercise of our Warrants. The Warrants are exercisable for a period of two years from date of issuance at an exercise price of $1.15 per share.

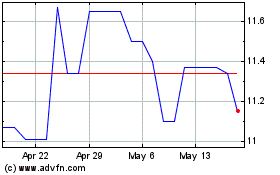

Our common stock is currently quoted on The NASDAQ Capital Market under the symbol “COOL”. On April 13, 2016, the last reported sale price of our common stock on The NASDAQ Capital Market was $0.89.

We are not listing our Warrants on an exchange or any trading system and we do not expect that a market for our Warrants will develop.

Our business and an investment in our securities involve a high degree of risk. See “Risk Factors” beginning on page S-4 of this prospectus supplement for a discussion of information that you should consider before investing in our securities.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

We have retained Chardan Capital Markets, LLC to act as our placement agent in connection with the arrangement of this transaction. We have agreed to pay the placement agent a flat fee of $75,000 for the transaction. The placement agent is not required to arrange for the sale of any specific number of shares of common stock or dollar amount but will use its “reasonable best efforts” to arrange for the sale of the common stock

|

|

|

Total

|

|

|

Offering price

|

|

$

|

1,500,000

|

|

|

Placement agent fees

|

|

$

|

75,000

|

|

|

Proceeds, before expenses, to us

|

|

$

|

1,425,000

|

|

We estimate the total expenses of this offering, excluding the placement agent fees, will be approximately $25,000.

We expect to deliver the securities being offered pursuant to this prospectus supplement on or about April 19, 2016.

Chardan Capital Markets, LLC

The date of this prospectus supplement is April 13, 2016.

Prospectus Supplement

|

|

Page

|

|

|

S-1

|

|

|

S-1

|

|

|

S-2

|

|

|

S-4

|

|

|

S-5

|

|

|

S-5

|

|

|

S-5

|

|

|

S-6

|

|

|

S-7

|

|

|

S-8

|

|

|

S-9

|

|

|

S-9

|

Prospectus

|

|

Page

|

|

|

1

|

|

|

2

|

|

|

4

|

|

|

4

|

|

|

5

|

|

|

5

|

|

|

5

|

|

|

8

|

|

|

14

|

|

|

16

|

|

|

17

|

|

|

19

|

|

|

22

|

|

|

22

|

|

|

22

|

|

|

22

|

ABOUT

THIS PROSPECTUS SUPPLEMENT

Unless the context otherwise requires, all references in this prospectus supplement to “Majesco,” the Company,” “we,” “us” or “our” refer to Majesco Entertainment Company, a Delaware corporation.

This prospectus supplement is part of a registration statement that we have filed with the Securities and Exchange Commission, or the SEC, utilizing a continuous registration process. Under this continuous registration process, we are offering to sell our securities using this prospectus supplement and the accompanying prospectus. Both this prospectus supplement and the accompanying prospectus include important information about us, our securities being offered and other information you should know before investing. This prospectus supplement also adds, updates and changes information contained in the accompanying prospectus.

You should rely only on the information contained in or incorporated by reference into this prospectus supplement and the accompanying prospectus. To the extent the information contained in this prospectus supplement differs or varies from the information contained in the accompanying prospectus or any document filed prior to the date of this prospectus supplement and incorporated by reference, the information in this prospectus supplement will control. We have not authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. The information in this prospectus supplement and the accompanying prospectus is accurate only as of the date it is presented. You should read this prospectus supplement, the accompanying prospectus, the documents incorporated by reference described in the section entitled “Incorporation of Certain Documents by Reference” into this prospectus supplement and the accompanying prospectus in their entirety before investing in our securities.

We are offering to sell, and seeking offers to buy, the securities offered by this prospectus supplement only in jurisdictions where offers and sales are permitted. The distribution of this prospectus supplement and the accompanying prospectus and the offering of the securities offered by this prospectus supplement in certain jurisdictions may be restricted by law. Persons outside the United States who come into possession of this prospectus supplement and the accompanying prospectus must inform themselves about, and observe any restrictions relating to, the offering of the common stock and warrants and the distribution of this prospectus supplement and the accompanying prospectus outside the United States. This prospectus supplement and the accompanying prospectus do not constitute, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy, any securities offered by this prospectus supplement and the accompanying prospectus by any person in any jurisdiction in which it is unlawful for such person to make such an offer or solicitation.

STATEMENT REGARDING

FORWARD

-LOOKING INFORMATION

This prospectus supplement, the accompanying prospectus and the documents incorporated by reference in this prospectus supplement and the accompanying prospectus, include statements about future events and expectations that constitute forward-looking statements. Such forward-looking statements include, without limitation, statements concerning regulatory filings, development activity and capital expenditures, and capital raising activities. Words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates,” and variations of such words and similar expressions are intended to identify such forward-looking statements. Such statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements to be materially different from the results of operations or plans expressed or implied by such forward-looking statements. Such factors include, among other things, unanticipated adverse business developments and adverse changes in general and local economies and business conditions. Although we believe that the assumptions underlying such forward-looking statements are reasonable, any of the assumptions could be inaccurate, and therefore such statements may not prove to be accurate. In light of the significant uncertainties inherent in the forward-looking statements included herein, the inclusion of such information should not be regarded as a representation by us or any other person that the results or conditions described in such statements or our objectives and plans will be achieved.

We caution you not to place undue reliance on forward-looking statements because our future results may differ materially from those expressed or implied by them. We do not intend to update any forward-looking statement, whether written or oral, relating to the matters discussed in this prospectus supplement and the accompanying prospectus, except as required by law.

This summary highlights information contained elsewhere in this prospectus supplement and the accompanying prospectus or incorporated by reference in this prospectus supplement and the accompanying prospectus. This summary does not contain all of the information that you should consider before making an investment decision. Before making an investment decision, you should read carefully this entire prospectus supplement and the accompanying prospectus, including the matters discussed in “Risk Factors” in this prospectus supplement, the accompanying prospectus, and our Annual Report on Form 10-K for the year ended October 31, 2015, as such risk factors may be amended, updated or modified periodically in our reports filed with the Securities and Exchange Commission, or the SEC, and the financial data and related notes and the reports incorporated by reference in this prospectus supplement and the accompanying prospectus.

Company Overview

We are an innovative developer, marketer, publisher and distributor of interactive entertainment for consumers around the world. Building on more than 25 years of operating history, we develop and publish a wide range of video games on digital networks through our Midnight City label, including Nintendo’s DS, 3DS, Wii and WiiU, Sony’s PlayStation 3 and 4, or PS3 and PS4, Microsoft’s Xbox 360 and Xbox One and the personal computer, or PC. We are headquartered in SouthPlainfield, New Jersey and our common stock is traded on The NASDAQ Capital Market under the symbol “COOL”.

Although, historically, we have sold packaged console software to large retail chains, specialty retail stores, video game rental outlets and distributors and through digital distribution for platforms such as Xbox Live Arcade, PlayStation Network, or PSN, and Steam, and for mobile devices and online platforms, we now operate, almost exclusively a digital software distribution and licensing business.

On July 31, 2015, we transferred to Zift Interactive LLC (“Zift”), a newly-formed subsidiary, certain rights under certain of our publishing licenses related to developing, publishing, and distributing video game products through retail distribution for a term of one year. We then transferred Zift to our former chief executive officer, Jesse Sutton in exchange for a portion of its net revenue from retail sales and other consideration.

Our titles are targeted at various demographics at a range of various price points. Due to the larger budget requirements for developing and marketing premium console titles, recently we have focused on publishing lower-cost games targeting casual-game consumers and independent game developer fans. In some instances, our titles are based on licenses of well-known properties and, in other cases, original properties. We enter into agreements with content providers and video game development studios for the creation of video games sold domestically and internationally.

Since October 2014, we have implemented reductions of our workforce to reduce our fixed costs. The reductions include development and game-testing, selling and marketing, and support personnel. We are currently not developing any significant new packaged games for release in fiscal 2016 and our objectives include evaluating strategic alternatives to maximize shareholder value, including the potential merger with or acquisition of a new business in a similar or different industry from our current and historical operations, although no business or industry has been determined to be an attractive candidate.

Company History and Available Information

Our principal executive offices are located at 4041-T Hadley Road, South Plainfield, NJ 07080 and our telephone number is (732) 225-8910. Our web site address is

www.majescoentertainment.com

. Majesco Holdings Inc. (formerly ConnectivCorp) was incorporated in 2004 under the laws of the State of Delaware. As a result of a merger, Majesco Sales Inc. became a wholly-owned subsidiary and the sole operating business of the Company, which changed its name to Majesco Entertainment Company.

The Offering

|

Issuer

|

|

Majesco Entertainment Company, a Delaware corporation.

|

|

|

|

|

|

Common stock offered

|

|

1,500,000 shares of our common stock, par value $0.001 per share.

|

|

|

|

|

|

Common Stock Outstanding

after this Offering

|

|

14,572,474, assuming the Warrants are exercised in full

|

|

|

|

|

|

Warrants offered

|

|

This prospectus supplement also relates to the offering of the 1,125,000 shares of common stock issuable upon exercise of the Warrants.

|

|

|

|

|

|

Exercise Price

|

|

$

1.15

per share

|

|

|

|

|

|

Term

|

|

Exercisable upon issuance until

two years

from date of issuance

|

|

|

|

|

|

Use of proceeds

|

|

We intend to use the net proceeds from the sale of the shares that we may offer under this prospectus supplement and the accompanying prospectus, after deducting commissions and estimated offering expenses, for general corporate purposes and working capital requirements. Pending their ultimate use, we intend to invest the net proceeds in a variety of securities, including commercial paper, government and non-government debt securities and/or money market funds that invest in such securities. See “Use of Proceeds.”

|

|

|

|

|

|

Risk factors

|

|

Before deciding to invest in shares of our common stock, you should read carefully the risks set forth under the caption “Risk Factors” beginning on page S-4 of this prospectus supplement and page 4 of the accompanying prospectus, and the risks set forth under the caption “Item 1A. Risk Factors” included in our most recent Annual Report on Form 10-K for certain considerations relevant to an investment in our common stock.

|

|

|

|

|

|

NASDAQ Capital Market symbol

|

|

COOL

|

|

|

|

|

|

Transfer Agent and Registrar

|

|

Equity Stock Transfer LLC

|

The number of shares of common stock to be outstanding after this offering as reflected in the table above is based on the actual number of shares outstanding

at April 13, 2016, which was 11,947,474 and does not include, as of that date:

|

●

|

321,706 shares of common stock issuable upon the exercise of outstanding options, with a weighted average exercise price of $3.11 per share;

|

|

●

|

8,247,065 shares of common stock issuable upon the conversion of 8,247,065 shares of Series A Convertible Preferred Stock, 5,420,171 shares of common stock issuable upon the conversion 54,201 shares of Series B Convertible Preferred Stock, 2,576,353 shares of common stock issuable upon the conversion of 25,763 shares of Series C Convertible Preferred Stock and 1,629,990 shares of common stock issuable upon the conversion of 162,999 shares of Series D Convertible Preferred Stock; and

|

|

●

|

4,198,320 shares of common stock reserved for future issuance under our equity incentive plans.

|

Investing in our securities involves a high degree of risk. Before purchasing our securities, you should carefully consider the risks, uncertainties and forward-looking statements described under “Risk Factors” in Item 1A of our most recent Annual Report on Form 10-K for the fiscal year ended October 31, 2015 and filed with the SEC on January 29, 2016 and amended on February 26, 2016, as well as information incorporated by reference into this prospectus, any applicable prospectus supplement or any free writing prospectus. If any of these risks were to occur, our business, financial condition or results of operations would likely suffer. In that event, the value of our securities could decline, and you could lose part or all of your investment. The risks and uncertainties we describe are not the only ones facing us. Additional risks not presently known to us or that we currently deem immaterial may also impair our business operations.

Additional Risks Related to This Offering

Management will have broad discretion as to the use of the proceeds from this offering, and may not use the proceeds effectively.

Because we have not designated the amount of net proceeds from this offering to be used for any particular purpose, our management will have broad discretion as to the application of the net proceeds from this offering and could use them for purposes other than those contemplated at the time of the offering. Our management may use the net proceeds for corporate purposes that may not improve our financial condition or market value.

You may experience immediate and substantial dilution.

Since the price per share of our common stock being offered is substantially higher than the net tangible book value per share of our common stock, you will suffer substantial dilution with respect to the net tangible book value of the common stock you purchase in this offering. In the event that you exercise your Warrants, you will experience additional dilution to the extent that the exercise price of these Warrants is higher than the net tangible book value per share of our common stock. If we issue additional common stock, or securities convertible into or exchangeable or exercisable for common stock, our stockholders, including investors who purchase shares of common stock in this offering, may experience additional dilution, and any such issuances may result in downward pressure on the price of our common stock. We may not be able to sell shares or other securities in any other offering at a price per share that is equal to or greater than the price per share paid by investors in this offering, and investors purchasing shares or other securities in the future could have rights superior to existing stockholders.

There is no public market for the Warrants in this offering.

There is no established public trading market for the Warrants being offered in this offering, and we do not expect a market to develop. In addition, we do not intend to apply for listing of the Warrants on any national securities exchange or other nationally recognized trading system. Without an active market, the liquidity of the Warrants will be limited.

You may experience future dilution as a result of future equity offerings.

In order to raise additional capital, we may in the future offer additional shares of our common stock or other securities convertible into or exchangeable for our common stock at prices that may not be the same as the price per share in this offering. We may sell shares or other securities in any other offering at a price per share that is less than the price per share paid by investors in this offering, and investors purchasing shares or other securities in the future could have rights superior to existing stockholders. The price per share at which we sell additional shares of our common stock, or securities convertible or exchangeable into common stock, in future transactions may be higher or lower than the price per share paid by investors in this offering.

We estimate that the net proceeds we will receive from this offering will be approximately $1,400,000, after deducting estimated offering expenses.

We intend to use the net proceeds from the sale of the shares that we may offer under this prospectus supplement and the accompanying prospectus, after deducting commissions and estimated offering expenses, for general corporate purposes and working capital requirements. We have not determined the amounts we plan to spend or the timing of expenditures. As a result, our management will have broad discretion to allocate the net proceeds from the sale of the shares that we may offer under this prospectus supplement and the accompanying prospectus. Pending their ultimate use, we intend to invest the net proceeds in a variety of securities, including commercial paper, government and non-government debt securities and/or money market funds that invest in such securities.

Other than with respect to the cash dividend paid to stockholders of record on January 14, 2016, we have never declared or paid cash dividends on our capital stock. We currently intend to retain our future earnings, if any, for use in our business and therefore do not anticipate paying cash dividends in the foreseeable future. Payment of future dividends, if any, will be at the discretion of our board of directors after taking into account various factors, including our financial condition, operating results, current and anticipated cash needs and plans for expansion.

If you purchase our common stock in this offering, your interest will be diluted to the extent of the difference between the public offering price per share and the net tangible book value per share of our common stock after this offering. We calculate net tangible book value per share by dividing our net tangible assets (tangible assets less total liabilities) by the number of shares of our common stock issued and outstanding as of January 31, 2016.

Our pro forma net tangible book value at January

31, 2016 was $5.7 million, or $0.48 per share, after giving effect to the issuance of 31,670 shares of common stock by us since such time. After giving effect to the sale of our common stock in the offering in the aggregate amount of $1,

500

,000 at an offering price of $1.00 per share, and after deducting commissions and estimated aggregate offering expenses payable by us, our pro forma as adjusted net tangible book value as of January 31, 2016 would have been approximately

$

7.

1

million, or $0.

53 per

share of common stock

, which excludes Warrants issued in the offering.

This represents an immediate increase in the net tangible book value of $0.

05 per

share to our existing stockholders and an immediate dilution in net tangible book value of $0.

47

per share to new investors. The following table illustrates this per share dilution:

|

Offering price per share

|

|

|

|

$

|

1.00

|

|

|

Pro forma net tangible book value per share as of January 31, 2016

|

$

|

0.48

|

|

|

|

|

Increase in net tangible book value per share attributable to this offering

|

$

|

0.

05

|

|

|

|

|

|

|

|

|

|

|

|

Pro forma as adjusted net tangible book value per share as of January 31, 2016, after giving effect to this offering

|

|

|

|

$

|

0.

53

|

|

|

|

|

|

|

|

|

|

Dilution per share to new investors purchasing shares in this offering

|

|

|

|

$

|

0.

47

|

|

The above discussion and table are based on 11,947,474 shares of our common stock issued and outstanding as of January 31, 2016 on a pro forma basis giving effect to the issuance of 31,670 shares in February and March 2016 and excludes the following:

|

·

|

8,247,065 shares of common stock issuable upon conversion of outstanding Series A Convertible Preferred Stock;

|

|

·

|

5,420,171 shares of common stock issuable upon conversion of outstanding Series B Convertible Preferred Stock;

|

|

·

|

2,576,353 shares of common stock issuable upon conversion of outstanding Series C Convertible Preferred Stock;

|

|

·

|

1,629,990 shares of common stock issuable upon conversion of outstanding Series D Convertible Preferred Stock; and

|

|

·

|

321,706 shares of our common stock issuable upon exercise of outstanding stock options under our stock incentive plans at a weighted average exercise price of $3.11 per share as of January 31, 2016.

|

To the extent that options outstanding as of January 31, 2016 have been or are exercised, or other shares are issued, investors purchasing shares in this offering could experience further dilution. In addition, we

may choose to raise additional capital due to market conditions or strategic considerations, even if we believe we have sufficient funds for our current or future operating plans. To the extent that additional capital is raised through the sale of equity or convertible debt securities, the issuance of these securities could result in further dilution to our stockholders.

Pursuant to a placement agency agreement between us and Chardan Capital Markets, LLC (“Chardan Capital”) we have engaged Chardan Capital as our non- exclusive placement agent to solicit offers to purchase the common stock and Warrants in this offering. The placement agent is not required to arrange the purchase or sale of any specific number of the common stock and Warrants or dollar amount, and it has agreed to use commercially reasonable efforts to arrange for the sale of the common stock and Warrants. The placement agent may retain sub-agents and selected dealers in connection with this offering.

The placement agent proposes to arrange for the sale of the common stock and Warrants we are offering pursuant to this prospectus supplement to one or more investors through securities purchase agreements directly between the purchasers and us. All of the common stock and Warrants will be sold at the same price and, we expect, at a single closing. We established the price following negotiations with prospective investors and the placement agent and with reference to the prevailing market price of our Common Stock, recent trends in such price and other factors. It is possible that not all of the common stock and Warrants we are offering pursuant to this prospectus supplement will be sold at the closing, in which case our net proceeds would be reduced. We anticipate that the sale of the common stock and Warrants will be completed on the date indicated on the cover page of this prospectus supplement, subject to customary closing conditions. On the closing date, the following will occur:

|

●

|

we will receive funds in the amount of the aggregate purchase price;

|

|

●

|

Chardan Capital, as placement agent, will receive the placement agent fees in accordance with the terms of the placement agency agreement; and

|

|

●

|

we will deliver the shares and Warrants to the investors.

|

In connection with this offering, the placement agent may distribute this prospectus supplement and the accompanying prospectus electronically.

We will pay the placement agent a cash fee of $75,000.

The estimated offering expenses payable by us, excluding the placement agent fees, will be approximately $25,000, which includes legal and printing costs and various other fees associated with registering the securities. After deducting fees due to the placement agent and our estimated offering expenses, we expect the net proceeds from this offering to be approximately $1,400,000.

We have agreed to indemnify the placement agent against certain liabilities, including liabilities under the Securities Act of 1933, as amended. We have also agreed to contribute to payments the placement agent may be required to make in respect of such liabilities.

The placement agency agreement is included as an exhibit to our Current Report on Form 8-K that we will file with the Commission in connection with this offering.

Chardan Capital may be deemed to be an underwriter within the meaning of Section 2(a)(11) of the Securities Act, and any commissions received by it and any profit realized on the resale of the shares sold by it while acting as principal might be deemed to be underwriting discounts or commissions under the Securities Act. As an underwriter, Chardan Capital would be required to comply with the requirements of the Securities Act and the Exchange Act, including, without limitation, Rule 415(a)(4) under the Securities Act and Rule 10b-5 and Regulation M under the Exchange Act. These rules and regulations may limit the timing of purchases and sales of shares by Chardan Capital acting as principal. Under these rules and regulations, Chardan Capital:

|

●

|

may not engage in any stabilization activity in connection with our securities; and

|

|

|

|

|

●

|

may not bid for or purchase any of our securities or attempt to induce any person to purchase any of our securities, other than as permitted under the Exchange Act, until it has completed its participation in the distribution.

|

Our common stock is currently quoted on The NASDAQ Capital Market under the symbol “COOL”. The transfer agent and registrar for our common stock is Equity Stock Transfer, LLC, with an address of 237 W. 37

th

Street, Suite 601, New York, NY 10018. We will act as transfer agent for the Warrants being offered hereby.

WHERE

YOU CAN FIND MORE INFORMATION

We file annual, quarterly and other reports, proxy statements and other information with the SEC. Our SEC filings are available to the public over the Internet at the SEC’s website at http://www.sec.gov. You may also read and copy any document we file at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further information on the Public Reference Room. Our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K, including any amendments to those reports, and other information that we file with or furnish to the SEC pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended, or the Exchange Act, can also be accessed free of charge through the Internet. These filings will be available as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC.

We maintain a web site at

www.majescoentertainment.com

. Information contained on our website is not part of this prospectus supplement, the accompanying prospectus, or any other document we file with or furnish to the SEC.

The SEC allows us to incorporate by reference into this prospectus supplement and the accompanying prospectus certain information we file with it, which means that we can disclose important information by referring you to those documents. The information incorporated by reference is considered to be a part of this prospectus supplement and the accompanying prospectus, and information that we file later with the SEC will automatically update and supersede information contained in this prospectus supplement and the accompanying prospectus. We incorporate by reference the documents listed below that we have previously filed with the SEC (excluding any portions of any Form 8-K that are not deemed “filed” pursuant to the General Instructions of Form 8-K):

|

●

●

|

our Annual Report on Form 10-K and 10-K/A for the fiscal year ended October 31, 2015, filed on January 29, 2016 and February 26, 2016, respectively;

our Quarterly Report on Form 10-Q for the fiscal quarter ended January 31, 2016, filed on March 15, 2016;

|

|

●

|

Current Reports on Form 8-K or Form 8-K/A (excluding any reports or portions thereof that are deemed to be furnished and not filed) filed on December 21, 2015, December 28, 2015 and March 4, 2016

; and

|

|

●

|

the description of our common stock contained in our Registration Statement on Form 8-A as filed with the SEC on January 21, 2005, and any further amendment or report filed hereafter for the purpose of updating such description pursuant to Section 12(b) of the Exchange Act.

|

We also incorporate by reference into this prospectus supplement and the accompanying prospectus additional documents that we may file with the SEC under Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act on or after the date of this prospectus supplement and before the completion or termination of the offering, including all such documents we may file with the SEC after the date of the initial registration statement and prior to the effectiveness of the registration statement, but excluding any information deemed furnished and not filed with the SEC. Any statements contained in a previously filed document incorporated by reference into this prospectus supplement or the accompanying prospectus is deemed to be modified or superseded for purposes of this prospectus supplement or the accompanying prospectus to the extent that a statement contained in this prospectus supplement or the accompanying prospectus, or in a subsequently filed document also incorporated by reference herein, modifies or supersedes that statement.

As explained above in “Where You Can Find More Information,” these incorporated documents (as well as other documents filed by us under the Exchange Act) are available at the SEC and may be accessed in a number of ways, including online via the Internet.

You may request a copy of any of the documents described above, at no cost to you, by telephoning us at (732) 225-8910 or by writing us at the following address:

Majesco Entertainment Company

4041-T Hadley Rd.

S. Plainfield, NJ 07080

United States of America

Attn: Investor Relations

Certain legal matters in connection with this offering will be passed upon for us by Sichenzia Ross Friedman Ference LLP, New York, NY.

The consolidated balance sheets of Majesco Entertainment Company and Subsidiary (the “Company”) as of October 31, 2015 and 2014, and the related consolidated statements of operations, comprehensive loss, stockholders’ equity, and cash flows for each of the years in the two-year period ended October 31, 2015, have been audited by EisnerAmper LLP, independent registered public accounting firm, as stated in their report which is incorporated herein by reference which report includes an explanatory paragraph about the existence of substantial doubt concerning the Company's ability to continue as a going concern. Such financial statements have been incorporated herein by reference in reliance on the report of such firm given upon their authority as experts in accounting and auditing

.

PROSPECTUS

MAJESCO ENTERTAINMENT COMPANY

$50,000,000

Common Stock

Preferred Stock

Debt Securities

Warrants

Units

We may offer and sell, from time to time in one or more offerings, any combination of common stock, preferred stock, debt securities or warrants to purchase common stock, preferred stock or debt securities, or any combination of the foregoing, either individually or as units comprised of one or more of the other securities, having an aggregate initial offering price not exceeding $50,000,000.

This prospectus provides a general description of the securities we may offer.

Each time we sell a particular class or series of securities, we will provide specific terms of the securities offered in a supplement to this prospectus. T

he prospectus supplement and any related free writing prospectus may also add, update or change information contained in this prospectus. We may also authorize one or more free writing prospectuses to be provided to you in connection with these offerings. You should read carefully this prospectus, the applicable prospectus supplement and any related free writing prospectus, as well as any documents incorporated by reference herein or therein before you invest in any of our securitie

s.

This prospectus may not be used to offer or sell our securities unless accompanied by a prospectus supplement relating to the offered securities.

Our common stock is presently listed on The NASDAQ Capital Market under the symbol “COOL.” On November 20, 2015, the last reported sale price of our common stock was $1.24.

The applicable prospectus supplement will contain information, where applicable, as to any other listing on The NASDAQ Capital Market or any securities market or other exchange of the securities, if any, covered by the prospectus supplement.

These securities may be sold directly by us, through dealers or agents designated from time to time, to or through underwriters, dealers or through a combination of these methods on a continuous or delayed basis. See “Plan of Distribution” in this prospectus. We may also describe the plan of distribution for any particular offering of our securities in a prospectus supplement. If any agents, underwriters or dealers are involved in the sale of any securities in respect of which this prospectus is being delivered, we will disclose their names and the nature of our arrangements with them in a prospectus supplement. The price to the public of such securities and the net proceeds we expect to receive from any such sale will also be included in a prospectus supplement.

Pursuant to General Instruction I.B.6 of Form S-3, in no event will we sell securities in a primary public offering with a value exceeding more than one-third of the aggregate market value of our common stock held by non-affiliates (our “public float”) in any 12-month period so long as our public float remains below $75 million. As of the date of this prospectus, our public float was approximately $9.0 million. Accordingly, based on our public float as of the date of this prospectus, we may only sell $3,001,279 worth of securities under General Instruction I.B.6 of Form S-3 in any 12-month period. In addition to the shares covered under this prospectus, we have a pending resale registration statement on Form S-3 (File No. 333-205037) on file with the Securities and Exchange Commission for the resale of our common stock common stock.

Investing in our securities involves various risks. See “Risk Factors” contained herein for more information on these risks. Additional risks will be described in the related prospectus supplements under the heading “Risk Factors”. You should review that section of the related prospectus supplements for a discussion of matters that investors in our securities should consider.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities, or passed upon the adequacy or accuracy of this prospectus or any accompanying prospectus supplement. Any representation to the contrary is a criminal offense.

The date of this Prospectus is December 7, 2015.

|

|

Page

|

|

|

1

|

|

|

2

|

|

|

4

|

|

|

4

|

|

|

5

|

|

|

5

|

|

|

5

|

|

|

8

|

|

|

14

|

|

|

16

|

|

|

17

|

|

|

19

|

|

|

22

|

|

|

22

|

|

|

22

|

|

|

22

|

This prospectus is part of a registration statement that we filed with the Securities and Exchange Commission (the “SEC”) under the Securities Act of 1933, as amended (the “Securities Act”) using a “shelf” registration process. Under this shelf registration process, we may from time to time sell common stock, preferred stock, debt securities or warrants to purchase common stock, preferred stock or debt securities, or any combination of the foregoing, either individually or as units comprised of one or more of the other securities, in one or more offerings up to a total dollar amount of $50,000,000. We have provided to you in this prospectus a general description of the securities we may offer. Each time we sell securities under this shelf registration, we will, to the extent required by law, provide a prospectus supplement that will contain specific information about the terms of that offering. We may also authorize one or more free writing prospectuses to be provided to you that may contain material information relating to these offerings. The prospectus supplement and any related free writing prospectus that we may authorize to be provided to you may also add, update or change information contained in this prospectus or in any documents that we have incorporated by reference into this prospectus. To the extent there is a conflict between the information contained in this prospectus and the prospectus supplement or any related free writing prospectus, you should rely on the information in the prospectus supplement or the related free writing prospectus; provided that if any statement in one of these documents is inconsistent with a statement in another document having a later date — for example, a document incorporated by reference in this prospectus or any prospectus supplement or any related free writing prospectus — the statement in the document having the later date modifies or supersedes the earlier statement.

We have not authorized any dealer, agent or other person to give any information or to make any representation other than those contained or incorporated by reference in this prospectus, any accompanying prospectus supplement or any related free writing prospectus that we may authorize to be provided to you. You must not rely upon any information or representation not contained or incorporated by reference in this prospectus or an accompanying prospectus supplement, or any related free writing prospectus that we may authorize to be provided to you. This prospectus, the accompanying prospectus supplement and any related free writing prospectus, if any, do not constitute an offer to sell or the solicitation of an offer to buy any securities other than the registered securities to which they relate, nor do this prospectus, the accompanying prospectus supplement or any related free writing prospectus, if any, constitute an offer to sell or the solicitation of an offer to buy securities in any jurisdiction to any person to whom it is unlawful to make such offer or solicitation in such jurisdiction. You should not assume that the information contained in this prospectus, any applicable prospectus supplement or any related free writing prospectus is accurate on any date subsequent to the date set forth on the front of the document or that any information we have incorporated by reference is correct on any date subsequent to the date of the document incorporated by reference (as our business, financial condition, results of operations and prospects may have changed since that date), even though this prospectus, any applicable prospectus supplement or any related free writing prospectus is delivered or securities are sold on a later date.

As permitted by the rules and regulations of the SEC, the registration statement, of which this prospectus forms a part, includes additional information not contained in this prospectus. You may read the registration statement and the other reports we file with the SEC at the SEC’s web site or at the SEC’s offices described below under the heading “Where You Can Find Additional Information.”

In this prospectus, “Majesco,” “the Company,” “we,” “us,” and “our” refer to Majesco Entertainment Company, a Delaware corporation, unless the context otherwise requires.

We are a provider of video game products primarily for the, casual-game consumer. We have historically sold our products primarily to large retail chains, specialty retail stores, video game rental outlets and distributors. However, during 2015, we discontinued our retail gaming focus and currently principally are engaged in publishing games for online download via numerous digital gaming server platforms.

Our principal executive offices are located at 4041-T Hadley Road, S. Plainfield, NJ 07080, and our telephone number is (732) 225-8910. Our website address is

www.majescoentertainment.com

. The information contained on, or accessible through, our website is not part of this prospectus or any prospectus supplement.

The Securities We May Offer

We may offer shares of our common stock and preferred stock, various series of debt securities and warrants to purchase any of such securities, either individually or in units, with a total value of up to $50,000,000 from time to time under this prospectus, together with any applicable prospectus supplement and related free writing prospectus, at prices and on terms to be determined by market conditions at the time of offering. If we issue any debt securities at a discount from their original stated principal amount, then, for purposes of calculating the total dollar amount of all securities issued under this prospectus, we will treat the initial offering price of the debt securities as the total original principal amount of the debt securities. Each time we offer securities under this prospectus, we will provide offerees with a prospectus supplement that will describe the specific amounts, prices and other important terms of the securities being offered, including, to the extent applicable:

|

|

|

designation or classification;

|

|

|

|

aggregate principal amount or aggregate offering price;

|

|

|

|

original issue discount, if any;

|

|

|

|

rates and times of payment of interest or dividends, if any;

|

|

|

|

redemption, conversion, exchange or sinking fund terms, if any;

|

|

|

|

conversion or exchange prices or rates, if any, and, if applicable, any provisions for changes to or adjustments in the conversion or exchange prices or rates and in the securities or other property receivable upon conversion or exchange;

|

|

|

|

restrictive covenants, if any;

|

|

|

|

voting or other rights, if any; and

|

|

|

|

important United States federal income tax considerations.

|

A prospectus supplement and any related free writing prospectus that we may authorize to be provided to you may also add, update or change information contained in this prospectus or in documents we have incorporated by reference. However, no prospectus supplement or free writing prospectus will offer a security that is not registered and described in this prospectus at the time of the effectiveness of the registration statement of which this prospectus is a part.

We may sell the securities to or through underwriters, dealers or agents or directly to purchasers. We, as well as any agents acting on our behalf, reserve the sole right to accept and to reject in whole or in part any proposed purchase of securities. Each prospectus supplement will set forth the names of any underwriters, dealers or agents involved in the sale of securities described in that prospectus supplement and any applicable fee, commission or discount arrangements with them, details regarding any over-allotment option granted to them, and net proceeds to us. The following is a summary of the securities we may offer with this prospectus.

We currently have authorized 250,000,000 shares of common stock, par value $0.001 per share. We may offer shares of our common stock either alone or underlying other registered securities convertible into or exercisable for our common stock. Holders of our common stock are entitled to such dividends as our Board of Directors may declare from time to time out of legally available funds, subject to the preferential rights of the holders of any shares of our preferred stock that are outstanding or that we may issue in the future. Currently, we do not pay any dividends on our common stock. Each holder of our common stock is entitled to one vote per share. In this prospectus, we provide a general description of, among other things, the rights and restrictions that apply to holders of our common stock.

We currently have authorized 10,000,000 shares of preferred stock, par value $0.001 per share, 9,025,266.24 which are outstanding. Any authorized and undesignated shares of preferred stock may be issued from time to time in one or more series pursuant to a resolution or resolutions providing for such issue duly adopted by our Board of Directors (authority to do so being hereby expressly vested in the Board of Directors). The Board of Directors is further authorized, subject to limitations prescribed by law, to fix by resolution or resolutions the designations, powers, preferences and rights, and the qualifications, limitations or restrictions thereof, of any wholly unissued series of preferred stock, including without limitation authority to fix by resolution or resolutions the dividend rights, dividend rate, conversion rights, voting rights, rights and terms of redemption (including sinking fund provisions), redemption price or prices, and liquidation preferences of any such series, and the number of shares constituting any such series and the designation thereof, or any of the foregoing.

The rights, preferences, privileges and restrictions granted to or imposed upon any series of preferred stock that we offer and sell under this prospectus and applicable prospectus supplements will be set forth in a certificate of designation relating to the series. We will incorporate by reference into the registration statement of which this prospectus is a part the form of any certificate of designation that describes the terms of the series of preferred stock we are offering before the issuance of shares of that series of preferred stock. You should read any prospectus supplement and any free writing prospectus that we may authorize to be provided to you related to the series of preferred stock being offered, as well as the complete certificate of designation that contains the terms of the applicable series of preferred stock.

We may offer general debt obligations, which may be secured or unsecured, senior or subordinated and convertible into shares of our common stock. In this prospectus, we refer to the senior debt securities and the subordinated debt securities together as the “debt securities.” We may issue debt securities under a note purchase agreement or under an indenture to be entered between us and a trustee; forms of the senior and subordinated indentures are included as an exhibit to the registration statement of which this prospectus is a part. The indentures do not limit the amount of securities that may be issued under it and provides that debt securities may be issued in one or more series. The senior debt securities will have the same rank as all of our other indebtedness that is not subordinated. The subordinated debt securities will be subordinated to our senior debt on terms set forth in the applicable prospectus supplement. In addition, the subordinated debt securities will be effectively subordinated to creditors and preferred stockholders of our subsidiaries. Our Board of Directors will determine the terms of each series of debt securities being offered. This prospectus contains only general terms and provisions of the debt securities. The applicable prospectus supplement will describe the particular terms of the debt securities offered thereby. You should read any prospectus supplement and any free writing prospectus that we may authorize to be provided to you related to the series of debt securities being offered, as well as the complete note agreements and/or indentures that contain the terms of the debt securities. Forms of indentures have been filed as exhibits to the registration statement of which this prospectus is a part, and supplemental indentures and forms of debt securities containing the terms of debt securities being offered will be incorporated by reference into the registration statement of which this prospectus is a part from reports we file with the SEC.

We may offer warrants for the purchase of shares of our common stock or preferred stock or of debt securities. We may issue the warrants by themselves or together with common stock, preferred stock or debt securities, and the warrants may be attached to or separate from any offered securities. Each series of warrants will be issued under a separate warrant agreement to be entered into between us and the investors or a warrant agent. Our Board of Directors will determine the terms of the warrants. This prospectus contains only general terms and provisions of the warrants. The applicable prospectus supplement will describe the particular terms of the warrants being offered thereby. You should read any prospectus supplement and any free writing prospectus that we may authorize to be provided to you related to the series of warrants being offered, as well as the complete warrant agreements that contain the terms of the warrants. Specific warrant agreements will contain additional important terms and provisions and will be incorporated by reference into the registration statement of which this prospectus is a part from reports we file with the SEC.

We may offer units consisting of our common stock or preferred stock, debt securities and/or warrants to purchase any of these securities in one or more series. We may evidence each series of units by unit certificates that we will issue under a separate agreement. We may enter into unit agreements with a unit agent. Each unit agent will be a bank or trust company that we select. We will indicate the name and address of the unit agent in the applicable prospectus supplement relating to a particular series of units. This prospectus contains only a summary of certain general features of the units. The applicable prospectus supplement will describe the particular features of the units being offered thereby. You should read any prospectus supplement and any free writing prospectus that we may authorize to be provided to you related to the series of units being offered, as well as the complete unit agreements that contain the terms of the units. Specific unit agreements will contain additional important terms and provisions and will be incorporated by reference into the registration statement of which this prospectus is a part from reports we file with the SEC.

An investment in our securities involves a high degree of risk. The prospectus supplement applicable to each offering of our securities will contain a discussion of the risks applicable to an investment in our securities. Prior to making a decision about investing in our securities, you should carefully consider the specific factors discussed under the heading “Risk Factors” in the applicable prospectus supplement, together with all of the other information contained or incorporated by reference in the prospectus supplement or appearing or incorporated by reference in this prospectus. You should also consider the risks, uncertainties and assumptions discussed under Item 1A, “Risk Factors,” in our Annual Report on Form 10-K for the fiscal year ended October 31, 2014 and any updates described in our Quarterly Reports on Form 10-Q, all of which are incorporated herein by reference, and may be amended, supplemented or superseded from time to time by other reports we file with the SEC in the future and any prospectus supplement related to a particular offering. The risks and uncertainties we have described are not the only ones we face. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also affect our operations. The occurrence of any of these known or unknown risks might cause you to lose all or part of your investment in the offered securities.

FORWARD-LOO

KING

STATEMENTS

This prospectus and any accompanying prospectus supplement, including the documents that we incorporate by reference, contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”)

. Any statements in this prospectus and any accompanying prospectus supplement about our expectations, beliefs, plans, objectives, assumptions or future events or performance are not historical facts and are forward-looking statements. These statements are often, but not always, made through the use of words or phrases such as "believe," "will," "expect," "anticipate," "estimate," "intend," "plan" and "would." For example, statements concerning financial condition, possible or assumed future results of operations, growth opportunities, industry ranking, plans and objectives of management, markets for our common stock and future management and organizational structure are all forward-looking statements. Forward-looking statements are not guarantees of performance. They involve known and unknown risks, uncertainties and assumptions that may cause actual results, levels of activity, performance or achievements to differ materially from any results, levels of activity, performance or achievements expressed or implied by any forward-looking statement.

Any forward-looking statements are qualified in their entirety by reference to the risk factors discussed throughout this

prospectus and any accompanying prospectus supplement

. Some of the risks, uncertainties and assumptions that could cause actual results to differ materially from estimates or projections contained in the forward-looking statements include but are not limited to:

|

●

|

|

Our ability to compete with larger better financed companies;

|

|

●

|

|

Our ability to develop and commercialize our products;

|

|

●

|

|

Our ability to maintain and protect intellectual property rights;

|

|

●

|

|

The inability to raise additional future financing and lack of financial and other resources;

|

|

●

|

|

Our ability to control product development costs;

|

|

●

|

|

We may not be able to attract and retain key employees;

|

|

●

|

|

We may not be able to compete effectively;

|

|

●

|

|

Our ability to gain access to wider distribution channels; and

|

|

●

|

|

Our ability to secure the rights to valuable licenses.

|

The foregoing list sets forth some, but not all, of the factors that could affect our ability to achieve results described in any forward-looking statements.

You should read this prospectus and any accompanying prospectus supplement and the documents that we reference herein and therein and have filed as exhibits to the registration statement, of which this prospectus is part, completely and with the understanding that our actual future results may be materially different from what we expect. You should assume that the information appearing in this prospectus and any accompanying prospectus supplement is accurate as of the date on the front cover of this prospectus or such prospectus supplement only. Because the risk factors referred to on page 4 of this prospectus and incorporated herein by reference, could cause actual results or outcomes to differ materially from those expressed in any forward-looking statements made by us or on our behalf, you should not place undue reliance on any forward-looking statements. Further, any forward-looking statement speaks only as of the date on which it is made, and we undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events. New factors emerge from time to time, and it is not possible for us to predict which factors will arise. In addition, we cannot assess the impact of each factor on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. We qualify all of the information presented in this prospectus and any accompanying prospectus supplement, and particularly our forward-looking statements, by these cautionary statements.

Except as described in any prospectus supplement and any free writing prospectus in connection with a specific offering, we currently intend to use the net proceeds from the sale of the securities offered under this prospectus for general corporate purposes, including for the development and commercialization of our products, general administrative expenses, acquisitions, and working capital and capital expenditures. We may also use the net proceeds to repay any debts and/or invest in or acquire complementary or unrelated businesses, products or technologies, although we have no current commitments or agreements with respect to any such investments or acquisitions as of the date of this prospectus. We have not determined the amount of net proceeds to be used specifically for the foregoing purposes. As a result, our management will have broad discretion in the allocation of the net proceeds and investors will be relying on the judgment of our management regarding the application of the proceeds of any sale of the securities. Pending use of the net proceeds, we intend to invest the proceeds in short-term, investment-grade, interest-bearing instruments.

Each time we offer securities under this prospectus, we will describe the intended use of the net proceeds from that offering in the applicable prospectus supplement. The actual amount of net proceeds we spend on a particular use will depend on many factors, including, our future capital expenditures, the amount of cash required by our operations, and our future revenue growth, if any. Therefore, we will retain broad discretion in the use of the net proceeds.

THE SEC

URI

TIES WE MAY OFFER

We may offer shares of common stock, shares of preferred stock, debt securities or warrants to purchase common stock, preferred stock or debt securities, or any combination of the foregoing, either individually or as units comprised of one or more of the other securities. We may offer up to $50,000,000 of securities under this prospectus. If securities are offered as units, we will describe the terms of the units in a prospectus supplement.

DESCR

IPTI

ON OF CAPITAL STOCK

General

The following description of our capital stock, together with any additional information we include in any applicable prospectus supplement or any related free writing prospectus, summarizes the material terms and provisions of our common stock and the preferred stock that we may offer under this prospectus. While the terms we have summarized below will apply generally to any future common stock or preferred stock that we may offer, we will describe the particular terms of any class or series of these securities in more detail in the applicable prospectus supplement. For the complete terms of our common stock and preferred stock, please refer to our certificate of incorporation and our bylaws that are incorporated by reference into the registration statement of which this prospectus is a part or may be incorporated by reference in this prospectus or any applicable prospectus supplement. The terms of these securities may also be affected by Delaware General Corporation Law. The summary below and that contained in any applicable prospectus supplement or any related free writing prospectus are qualified in their entirety by reference to our amended and restated certificate of incorporation and our amended and restated bylaws.

As of the date of this prospectus, our authorized capital stock consisted of 250,000,000 shares of common stock, $0.001 par value per share, and 10,000,000 shares of preferred stock, $0.001 par value per share. Our board of directors may establish the rights and preferences of the preferred stock from time to time. As of the date of this prospectus, there were 9,665,701 shares of our common stock issued and outstanding, 8,776,968 shares of Series A preferred stock issued and outstanding, 54,201.71 shares of Series B preferred stock issued and outstanding, 25,763.53 shares of Series C preferred stock issued and outstanding and 168,333 shares of Series D preferred stock issued and outstanding.

Common Stock

Holders of our common stock are entitled to one vote per share. Our Certificate of Incorporation does not provide for cumulative voting. Holders of our common stock are entitled to receive ratably such dividends, if any, as may be declared by our board of directors (the “Board”) out of legally available funds. However, the current policy of our Board is to retain earnings, if any, for the operation and expansion of our company. Upon liquidation, dissolution or winding-up, the holders of our common stock are entitled to share ratably in all of our assets which are legally available for distribution, after payment of or provision for all liabilities. The holders of our common stock have no preemptive, subscription, redemption or conversion rights.

Preferred Stock

Preferred A Shares

The Preferred A Shares are convertible into shares of Common Stock based on a conversion calculation equal to the stated value of such Preferred A Share, plus all accrued and unpaid dividends, if any, on such Preferred A Share, as of such date of determination, divided by the conversion price. The stated value of each Preferred A Share is $0.68 and the initial conversion price is $0.68 per share, each subject to adjustment for stock splits, stock dividends, recapitalizations, combinations, subdivisions or other similar events. In addition, in the event the Company issues or sells, or is deemed to issue or sell, shares of Common Stock at a per share price that is less than the conversion price then in effect, the conversion price shall be reduced to such lower price, subject to certain exceptions. The Company is prohibited from effecting a conversion of the Preferred A Shares to the extent that, as a result of such conversion, such Investor would beneficially own more than 4.99% of the number of shares of Common Stock outstanding immediately after giving effect to the issuance of shares of Common Stock upon conversion of the Preferred A Shares, which beneficial ownership limitation may be increased by the holder up to, but not exceeding, 9.99% (the “A Limit”).

Each holder of Preferred A Shares is entitled to vote on all matters submitted to stockholders of the Company, and shall have the number of votes equal to the number of shares of Common Stock issuable upon conversion of such holder’s Preferred A Shares,

provided

that a holder is only entitled to vote shares of Common Stock underlying the Preferred A Shares to the extent such shares do not result in the holder exceeding the A Limit and

provided further

that in no event shall the holders be entitled to cast votes in excess of the number of votes that holders would be entitled to cast if the Preferred A Shares were converted at $0.59 per share (equal to the market price as determined by NASDAQ on the trading date immediately prior to closing) (the “Voting Floor”). The Voting Floor shall only be removed in accordance with applicable Nasdaq Listing Rules. Pursuant to the Certificate of Designations, Preferences and Rights of the 0% Series A Convertible Preferred Stock of Majesco Entertainment Company (the “Series A Certificate of Designations”), the Company is prohibited from incurring debt or liens, or entering into new financing transactions without the consent of the Lead Investor (as defined in the Subscription Agreements). The Preferred A Shares bear no interest.

Preferred B Shares

The Preferred B Shares are convertible into shares of Common Stock based on a conversion calculation equal to the stated value of such Preferred B Share, plus all accrued and unpaid dividends, if any, on such Preferred B Share, as of such date of determination, divided by the conversion price. The stated value of each Preferred B Share is $140.00 and the initial conversion price is $1.40 per share, each subject to adjustment for stock splits, stock dividends, recapitalizations, combinations, subdivisions or other similar events. The Company is prohibited from effecting a conversion of the Preferred B Shares to the extent that, as a result of such conversion, such Investor would beneficially own more than 4.99% of the number of shares of Common Stock outstanding immediately after giving effect to the issuance of shares of Common Stock upon conversion of the Preferred B Shares, which beneficial ownership limitation may be increased by the holder up to, but not exceeding, 9.99% (the “B Limit”).

Each holder of Preferred B Shares is entitled to vote on all matters submitted to stockholders of the Company, and shall have the number of votes equal to the number of shares of Common Stock issuable upon conversion of such holder’s Preferred B Shares,

provided

that a holder is only entitled to vote shares of Common Stock underlying the Preferred B Shares to the extent such shares do not result in the holder exceeding the B Limit. Pursuant to the Certificate of Designations, Preferences and Rights of the 0% Series B Convertible Preferred Stock of Majesco Entertainment Company (the “Series B Certificate of Designations”), the Company is prohibited from incurring debt or liens, or entering into new financing transactions without the consent of the Lead Investor (as defined in the Subscription Agreements). The Preferred B Shares bear no interest.

Preferred C Shares

The Series C Preferred Shares are convertible into shares of common stock based on a conversion calculation equal to the stated value of such Series C Preferred Shares, plus all accrued and unpaid dividends, if any, on such Series C Preferred Shares, as of such date of determination, divided by the conversion price. The stated value of each Series C Preferred Share is $120.00 per share, and the initial conversion price is $1.20 per share, each subject to adjustment for stock splits, stock dividends, recapitalizations, combinations, subdivisions or other similar events. In addition, in the event the Company issues or sells, or is deemed to issue or sell, shares of common stock at a per share price that is less than the conversion price then in effect, the conversion price shall be reduced to such lower price, subject to certain exceptions and provided that the conversion price may not be reduced to less than $0.86, unless and until such time as the Company obtains shareholder approval to allow for a lower conversion price. The Company is prohibited from effecting a conversion of the Series C Preferred Shares to the extent that, as a result of such conversion, such May Investor would beneficially own more than 4.99% of the number of shares of common stock outstanding immediately after giving effect to the issuance of shares of common stock upon conversion of the Series C Preferred Shares, which beneficial ownership limitation may be increased by the holder up to, but not exceeding, 9.99%.

Subject to the beneficial ownership limitations discussed previously, each holder is entitled to vote on all matters submitted to stockholders of the Company, and shall have the number of votes equal to the number of shares of common stock issuable upon conversion of such holder’s Series C Preferred Shares. Pursuant to the Certificate of Designations, Preferences and Rights of the 0% Series C Convertible Preferred Stock of Majesco Entertainment Company (the “Series C Certificate of Designations”), the Series C Preferred Shares bear no dividends and shall rank junior to the Company’s Series A Preferred Shares but senior to the Company’s Series B Preferred Shares.

Preferred D Shares

The Preferred D Shares are convertible into shares of common stock based on a conversion calculation equal to the stated value of such Preferred C Share, plus all accrued and unpaid dividends, if any, on such Preferred D Share, as of such date of determination, divided by the conversion price. The stated value of each Preferred D Share is $1,000.00 and the initial conversion price is $100.00 per share, each subject to adjustment for stock splits, stock dividends, recapitalizations, combinations, subdivisions or other similar events. The Company is prohibited from effecting a conversion of the Preferred D Shares to the extent that, as a result of such conversion, such investor would beneficially own more than 4.99% of the number of shares of Common Stock outstanding immediately after giving effect to the issuance of shares of Common Stock upon conversion of the Preferred D Shares. Upon 61 days written notice, the beneficial ownership limitation may be increased by the holder up to, but not exceeding, 9.99%. Each holder is entitled to vote on all matters submitted to stockholders of the Company, and shall have the number of votes equal to the number of shares of Common Stock issuable upon conversion of such holder’s Preferred D Shares. Pursuant to the Certificate of Designations, Preferences and Rights of the 0% Series D Convertible Preferred Stock, the Preferred D Shares bear no interest and shall rank senior to the Company’s other classes of capital stock.

Anti-Takeover Effects of Certain Provisions of our Certificate of Incorporation, Bylaws and the DGCL

Certain provisions of our Certificate of Incorporation and Bylaws, which are summarized in the following paragraphs, may have the effect of discouraging potential acquisition proposals or making a tender offer or delaying or preventing a change in control, including changes a stockholder might consider favorable. Such provisions may also prevent or frustrate attempts by our stockholders to replace or remove our management. In particular, the Certificate of Incorporation and Bylaws and Delaware law, as applicable, among other things:

|

|

|

provide the board of directors with the ability to alter the bylaws without stockholder approval;

|

|

|

|

place limitations on the removal of directors; and

|

|

|

|

provide that vacancies on the board of directors may be filled by a majority of directors in office, although less than a quorum.

|

These provisions are expected to discourage certain types of coercive takeover practices and inadequate takeover bids and to encourage persons seeking to acquire control of us to first negotiate with its board. These provisions may delay or prevent someone from acquiring or merging with us, which may cause our market price of our common stock to decline.

Blank Check Preferred.

Our Board of Directors is authorized to create and issue from time to time, without stockholder approval, up to an aggregate of 10,000,000 shares of preferred stock in one or more series and to establish the number of shares of any series of preferred stock and to fix the designations, powers, preferences and rights of the shares of each series and any qualifications, limitations or restrictions of the shares of each series.

The authority to designate preferred stock may be used to issue series of preferred stock, or rights to acquire preferred stock, that could dilute the interest of, or impair the voting power of, holders of the common stock or could also be used as a method of determining, delaying or preventing a change of control.

Advance Notice Bylaws.

The Bylaws contain an advance notice procedure for stockholder proposals to be brought before any meeting of stockholders, including proposed nominations of persons for election to our Board of Directors. Stockholders at any meeting will only be able to consider proposals or nominations specified in the notice of meeting or brought before the meeting by or at the direction of our Board of Directors or by a stockholder who was a stockholder of record on the record date for the meeting, who is entitled to vote at the meeting and who has given our corporate secretary timely written notice, in proper form, of the stockholder's intention to bring that business before the meeting. Although the Bylaws do not give our Board of Directors the power to approve or disapprove stockholder nominations of candidates or proposals regarding other business to be conducted at a special or annual meeting, the Bylaws may have the effect of precluding the conduct of certain business at a meeting if the proper procedures are not followed or may discourage or deter a potential acquirer from conducting a solicitation of proxies to elect its own slate of directors or otherwise attempting to obtain control of us.

Interested Stockholder Transactions.

We are subject to Section 203 of the DGCL which, subject to certain exceptions, prohibits "business combinations" between a publicly-held Delaware corporation and an "interested stockholder," which is generally defined as a stockholder who becomes a beneficial owner of 15% or more of a Delaware corporation's voting stock for a three-year period following the date that such stockholder became an interested stockholder.

Limitations on Liability, Indemnification of Officers and Directors and Insurance