UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 17, 2015

MAJESCO ENTERTAINMENT COMPANY

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

000-51128

|

|

06-1529524

|

|

(State or other jurisdiction

|

|

(Commission File Number)

|

|

(IRS Employer

|

|

of incorporation)

|

|

|

|

Identification No.)

|

404I-T Hadley Road

S. Plainfield, New Jersey 07080

(Address of principal executive offices and zip code)

Registrant’s telephone number, including area code: (732) 225-8910

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory

Arrangements of Certain Officers.

On February 17, 2015, Michael Vesey and Majesco Entertainment Company (the “Company”) entered into a separation agreement (the “Vesey Separation Agreement”) pursuant to which Mr. Vesey will resign as Chief Financial Officer of the Company effective March 17, 2015. Pursuant to the Vesey Separation Agreement and following his resignation, Mr. Vesey will provide general business and consulting services to the Company to assist in transitional needs and activities of the Company for a period of six (6) months following his resignation. Pursuant to the Vesey Separation Agreement, upon his resignation and in addition to the other benefits as outlined in the Vesey Employment Agreement, Mr. Vesey is expected to receive a lump sum payment of $200,000 and an additional payment of $100,000 thereafter payable in six equal monthly installments. In addition, the Company agreed to vest all of Mr. Vesey’s previously unvested securities he holds, other than the securities granted pursuant to the Company’s new equity plan and, subject to shareholder approval of such new equity plan, in consideration for Mr. Vesey’s consulting services, the Company expects to grant Mr. Vesey 30,000 shares of restricted common stock under such equity plan. The foregoing description of the Vesey Separation Agreement is qualified in its entirety by reference to the Vesey Separation Agreement, a copy of which is filed herewith as Exhibit 10.1 and is incorporated herein by reference.

Item 8.01 Other Events.

On February 17, 2015, Adam Sultan, the Company’s General Counsel, Senior Vice President, Business and Legal Affairs and Secretary, executed a separation agreement providing for Mr. Sultan’s resignation from the Company effective March 17, 2015.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

10.1 Separation Agreement, dated as of February 17, 2015, by and between Michael Vesey and Majesco Entertainment Company.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

MAJESCO ENTERTAINMENT COMPANY

|

| |

|

| |

|

|

Dated: February 17, 2015

|

/s/ Jesse Sutton

|

| |

Jesse Sutton

|

| |

Chief Executive Officer

|

| |

|

EXHIBIT INDEX

10.1 Separation Agreement, dated as of February 17, 2015, by and between Michael Vesey and Majesco Entertainment Company.

Exhibit 10.1

SEPARATION AGREEMENT

THIS SEPARATION AGREEMENT (the “Agreement”) is entered into as of the 17th day of February, 2015 by and between Michael Vesey (“Vesey”) and Majesco Entertainment Company, a Delaware corporation (the “Company”).

WHEREAS, Vesey is employed as the Chief Financial Officer of the Company pursuant to the amended and restated Employment Agreement dated as of August 22, 2013, as amended (the “Vesey Employment Agreement”); and

WHEREAS, the Company and Vesey desire to enter into this Agreement providing for Vesey’s amicable resignation from the Company’s employment, and to provide for a payment to Vesey for continued services as a consultant following termination in order to assure a smooth transition.

NOW, THEREFORE, in consideration of the mutual covenants and agreements contained herein and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, and intending to be legally bound, the parties hereby agree as follows:

1. Termination Date. Vesey acknowledges that his last day of employment with the Company will be March 17, 2015, (the “Termination Date”). Vesey will also resign as an officer. Vesey further understands and agrees that, as of the Termination Date, he will be no longer authorized to conduct any business on behalf of the Company as an executive or to hold himself out as an officer of the Company or its subsidiaries (the “Subsidiaries”), except as otherwise provided herein. Any and all positions and/or titles held by Vesey with the Company or any Subsidiaries of the Company will be deemed to have been resigned as of the Termination Date, except as otherwise provided herein.

2. Severance Payment. (a) Provided that Vesey: (A) continues as an officer (Principal Financial and Accounting Officer) through the filing of the Quarterly Report on Form 10-Q for the quarter ended January 31, 2015 (the “10Q”) including execution of all certifications thereon and (B) resigns as of the Termination date, the Company shall pay or provide to Vesey the following benefits (as his sole compensation therefore and from the Company):

(i) $200,000 on the Termination Date provided the 10Q is filed with the Securities and Exchange Commission (or, if not so filed by the Termination Date, on such later date that the 10Q is filed);

(ii) $100,000, payable in six (6) equal monthly installments beginning April 1, 2015 (the “Deferred Payment”);

(b) on the Termination Date, all restricted stock awards and/or stock option grants held by Vesey on the Termination Date shall, other than those grants made in December 2014 which shall remain subject to their applicable vesting provisions, vest in full provided that Vesey shall have a period of eighteen (18) months from the Termination Date to exercise any previously issued such stock options, but such eighteen (18) month period shall not extend the original expiration date of any such options.

(c) Vesey shall receive 30,000 shares of restricted stock under the Company’s 2014 Equity Incentive Plan, provided such plan is approved by the Company’s stockholders at its 2015 Annual Meeting of Stockholders. Such shares of restricted stock shall be issued on the date immediately following stockholder approval and shall have identical vesting provisions as such other options and restricted stock that were granted to Vesey in December 2014.

(d) On the Termination Date, provided the 10Q is filed with the SEC, the non-competition provisions of Section 6(c)(i) of the Vesey Employment Agreement shall terminate.

(e) The Company shall continue its contribution towards Vesey’s health care, dental, disability, and life insurance benefits on the same basis as immediately prior to the Termination Date, except as provided below, for twelve (12) months following the Termination Date. During the period the Company provides Vesey with this coverage, an amount equal to the applicable COBRA premiums (or such other amounts as may be required by law) will be included in Vesey’s income for tax purposes to the extent required by applicable law and the Company may withhold taxes from Vesey’s other payments. Notwithstanding the foregoing, the Company shall not be required to provide any health care, dental, disability or life insurance benefit otherwise receivable by Vesey if Vesey is actually covered or becomes covered by an equivalent benefit (at the same cost to Vesey, if any) for another source. Any such benefit made available to Vesey shall be reported to the Company.

(f) The Company will pay any accrued but untaken vacation through the last day of actual employment.

Vesey shall be responsible for the payment of all payroll taxes, Medicare and other taxes, and shall indemnify the Company with respect to the payment of all such amounts. Except as otherwise set forth herein, Vesey will not be entitled to payment of any bonus, vacation or other incentive compensation. Any tax, penalties or interest as a result thereof shall be the sole responsibility of Vesey who agrees to indemnify and hold harmless the Company with respect thereto.

3. Consulting Services. During the six (6) month period following the Termination Date, , Vesey agrees that he shall provide general business and consulting services to the Company to assist in transitional needs and activities of the Company upon the reasonable request of the Company in support of management of the Company, provided, however, that other than the requirement for Vesey to provide reasonable continued cooperation to the Company, the Company Deferred Payment amounts shall be payable to Vesey and shall not be terminated, including, without limitation, should Vesey accept employment or additional consulting engagements with any other party. The parties agree that the consulting services are limited to responding to inquiries regarding and advising on matters related to Vesey’s historical knowledge of the Company. There is no expectation regarding standard of performance nor is Vesey responsible for preparing financial reports, regulatory filings, maintaining financial systems, reporting procedures or financial controls of the Company, including any assessment of controls related to compliance with the provisions of the Sarbanes Oxley Act.

4. Vesey’s Release. In consideration for the payments and benefits described above and for other good and valuable consideration, Vesey hereby releases and forever discharges the Company and its Subsidiaries, as well as its affiliates and all of their respective directors, officers, employees, members, agents, and attorneys, of and from any and all manner of actions and causes of action, suits, debts, claims, and demands whatsoever, in law or equity, known or unknown, asserted or unasserted, which he ever had, now has, or hereafter may have on account of his employment with the Company and the termination of his employment with the Company, , including but not limited to any and all claims for wrongful termination; breach of any implied or express employment contract; unpaid compensation of any kind; breach of any fiduciary duty and/or duty of loyalty; breach of any implied covenant of good faith and fair dealing; negligent or intentional infliction of emotional distress; defamation; fraud; unlawful discrimination, harassment; or retaliation based upon age, race, sex, gender, sexual orientation, marital status, religion, national origin, medical condition, disability, handicap, or otherwise; any and all claims arising under arising under Title VII of the Civil Rights Act of 1964, as amended (“Title VII”); the Equal Pay Act of 1963, as amended (“EPA”); the Age Discrimination in Employment Act of 1967, as amended (“ADEA”); the Americans with Disabilities Act of 1990, as amended (“ADA”); the Family and Medical Leave Act, as amended (“FMLA”); the Employee Retirement Income Security Act of 1974, as amended ("ERISA"); the Sarbanes-Oxley Act of 2002, as amended (“SOX”); the Worker Adjustment and Retraining Notification Act of 1988, as amended (“WARN”); and/or any other federal, state, or local law(s) or regulation(s); any and all claims for damages of any nature, including compensatory, general, special, or punitive; and any and all claims for costs, fees, or other expenses, including attorneys' fees, incurred in any of these matters (the “Release”). The Company acknowledges, however, that Vesey does not release or waive any rights to contribution or indemnity under this Agreement, or any other agreement under which Vesey may be entitled to any such contribution or indemnity, to which he may otherwise be entitled. The Company also acknowledges that Vesey does not release or waive any claims, and that he retains any rights he may have, to any vested 401(k) monies (if any) or benefits (if any), or any other benefit entitlement that is vested as of the Termination Date pursuant to the terms of any Company-sponsored benefit plan governed by ERISA. Nothing contained herein shall release the Company from its obligations set forth in this Agreement. Upon execution of this Agreement, Vesey agrees and confirms that the Vesey Employment Agreement is hereby terminated and neither the Company nor Vesey shall have any further obligations under the Vesey Employment Agreement other than with respect to the subsections of Section 6 of the Vesey Employment Agreement not otherwise terminated elsewhere herein. For the avoidance of doubt, upon execution of this Agreement, the Company shall have no obligation to Vesey for any payments pursuant to the Vesey Employment Agreement, including pursuant Sections 3 or 5 therein and Vesey hereby releases the Company from any obligations or payments thereunder.

5. Company Release. In exchange for the consideration provided for in this Agreement, the Company irrevocably and unconditionally releases Vesey of and from all claims, demands, causes of actions, fees and liabilities of any kind whatsoever, which it had, now has or may have against Vesey, as of the date of this Agreement, by reason of any actual or alleged act, omission, transaction, practice, conduct, statement, occurrence, or any other matter, within the reasonable scope of Vesey’s employment. The Company represents that, as of the date of this Agreement, there are no known claims relating to Vesey. The Company agrees to indemnify Vesey against any future claims to the extent permitted under the Company’s bylaws. Notwithstanding the foregoing, this release does not include any fraud, gross negligence, material misrepresentation or the Company’s right to enforce the terms of this Agreement nor does this release include the release of any obligation of Vesey to repay or surrender any benefits received by him as a result of the occurrence of any restatement of any Company financial results from which any benefit derived by Vesey shall have been determined, including pursuant to the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 or any other applicable law

6. Confidential Information. Vesey understands and acknowledges that during the course of his employment by the Company and during the Term of this Agreement, he had access to Confidential Information (as defined below) of the Company. Vesey agrees that, at no time during the Term or a period of two (2) years immediately after the Term, will Vesey (a) use Confidential Information for any purpose other than in connection with services provided under this Agreement or (b) disclose Confidential Information to any person or entity other than to the Company or persons or entities to whom disclosure has been authorized by the Company. As used herein, "Confidential Information" means all information of a technical or business nature relating to the Company or its affiliates, including, without limitation, trade secrets, inventions, drawings, file data, documentation, diagrams, specifications, know-how, processes, formulae, models, test results, marketing techniques and materials, marketing and development plans, price lists, pricing policies, business plans, information relating to customer or supplier identities, characteristics and agreements, financial information and projections, flow charts, software in various stages of development, source codes, object codes, research and development procedures and employee files and information; provided, however, that "Confidential Information" shall not include any information that (i) has entered the public domain through no action or failure to act of Vesey; (ii) was already lawfully in Vesey's possession without any obligation of confidentiality; (iii) subsequent to disclosure hereunder is obtained by Vesey on a non-confidential basis from a third party who has the right to disclose such information to Vesey; or (iv) is ordered to be or otherwise required to be disclosed by Vesey by a court of law or other governmental body; provided, however, that the Company is notified of such order or requirement and given a reasonable opportunity to intervene.

7. Applicable Law and Dispute Resolution. Except as to matters preempted by ERISA or other laws of the United States of America, this Agreement shall be interpreted solely pursuant to the laws of the State of New York, exclusive of its conflicts of laws principles. Each of the parties hereto irrevocably submits to the exclusive jurisdiction of the courts of the State of New York, for the purposes of any suit, action, or other proceeding arising out of this Agreement or any transaction contemplated hereby.

8. Entire Agreement. This Agreement may not be changed or altered, except by a writing signed by both parties. Until such time as this Agreement has been executed and subscribed by both parties hereto: (i) its terms and conditions and any discussions relating thereto, without any exception whatsoever, shall not be binding nor enforceable for any purpose upon any party; and (ii) no provision contained herein shall be construed as an inducement to act or to withhold an action, or be relied upon as such. This Agreement constitutes an integrated, written contract, expressing the entire agreement and understanding between the parties with respect to the subject matter hereof and supersedes any and all prior agreements and understandings, oral or written, between the parties.

9. Assignment. Vesey has not assigned or transferred any claim he is releasing, nor has he purported to do so. If any provision in this Agreement is found to be unenforceable, all other provisions will remain fully enforceable. This Agreement binds Vesey’s heirs, administrators, representatives, executors, successors, and assigns, and will insure to the benefit of all Released Parties and their respective heirs, administrators, representatives, executors, successors, and assigns.

10. Acknowledgement. Vesey acknowledges that he: (a) has carefully read this Agreement in its entirety; (b) has been advised to consult and has been provided with an opportunity to consult with legal counsel of his choosing in connection with this Agreement; (c) fully understands the significance of all of the terms and conditions of this Agreement and has discussed them with his independent legal counsel or has been provided with a reasonable opportunity to do so; (d) has had answered to his satisfaction any questions asked with regard to the meaning and significance of any of the provisions of this Agreement; (e) is signing this Agreement voluntarily and of his own free will and agrees to abide by all the terms and conditions contained herein; and (f) following his execution of this Agreement, he has seven (7) days in which to revoke his release and that, if he chooses not to so revoke, this Agreement shall become effective and enforceable on the eighth (8th) day following his execution of this Agreement (the “Effective Date”). To revoke the Release, Vesey understands that he must give a written revocation to the Company, within the seven (7)-day period following the date of execution of this Agreement. If the last day of the revocation period is a Saturday, Sunday, or legal holiday in the State of New York, then the revocation period shall not expire until the next following day which is not a Saturday, Sunday or legal holiday. If Vesey revokes the Release, this Agreement will not become effective or enforceable and Vesey acknowledges and agrees that he will not be entitled to any benefits hereunder, including in Section 2.

11. Notices. For the purposes of this Agreement, notices, demands and all other communications provided for in this Agreement shall be in writing and shall be delivered (i) personally, (ii) by first class mail, certified, return receipt requested, postage prepaid, (iii) by overnight courier, with acknowledged receipt, or (iv) by facsimile transmission followed by delivery by first class mail or by overnight courier, in the manner provided for in this Section, and properly addressed as follows:

If to the Company: Majesco Entertainment Company

4041-T Hadley Road

S. Plainfield, NJ 07080

ATT: Trent Davis, Chairman

Fax:

If to Vesey: Mr. Michael Vesey

12. Counterparts. This Agreement may be executed in one or more counterparts, all of which shall be considered one and the same agreement, and shall become effective when one or more such counterparts have been signed by each of the parties and delivered to the other parties. In the event that any signature is delivered by facsimile transmission or by an e-mail which contains a portable document format (.pdf) file of an executed signature page, such signature page shall create a valid and binding obligation of the party executing (or on whose behalf such signature is executed) with the same force and effect as if such signature page were an original thereof.

13. Counsel Representation. The Parties hereto further agree that this Agreement has been carefully read and fully understood by them. Each Party hereby represents, warrants, and agrees that he was represented by counsel in connection with the Agreement, has had the opportunity to consult with counsel about the Agreement, has carefully read and considered the terms of this Agreement, and fully understands the same. Vesey represents, warrants and acknowledges that he has retained independent counsel and that counsel to the Company does not represent Vesey.

IN WITNESS HEREOF, the parties hereby enter into this Agreement and affix their signatures as of the date first above written.

MAJESCO ENTERTAINMENT COMPANY

By: /s/ Jesse Sutton

Name: Jesse Sutton

Title: Chief Executive Officer

/s/ Michael Vesey

Michael Vesey

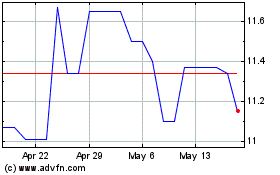

Corner Growth Acquisition (NASDAQ:COOL)

Historical Stock Chart

From Mar 2024 to Apr 2024

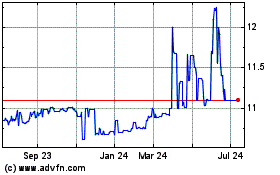

Corner Growth Acquisition (NASDAQ:COOL)

Historical Stock Chart

From Apr 2023 to Apr 2024