UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

|

|

|

|

Date of Report (Date of Earliest Event Reported): |

|

December 9, 2014 |

Corinthian Colleges, Inc.

__________________________________________

(Exact name of registrant as specified in its charter)

|

|

|

|

|

Delaware |

0-25283 |

33-0717312 |

|

_____________________

(State or other jurisdiction |

_____________

(Commission |

______________

(I.R.S. Employer |

|

of incorporation) |

File Number) |

Identification No.) |

|

|

|

|

|

6 Hutton Centre Drive, Suite 400, Santa Ana, California |

|

92707 |

|

_________________________________

(Address of principal executive offices) |

|

___________

(Zip Code) |

|

|

|

|

|

Registrant’s telephone number, including area code: |

|

(714) 427-3000 |

Not Applicable

______________________________________________

Former name or former address, if changed since last report

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 1.01. Entry into a Material Definitive Agreement.

Corinthian Colleges, Inc. (the “Company”) has entered into a Consent Agreement and Amendment No. 5 to Credit Agreement (the “Fifth Amendment”), dated as of December 9, 2014, by and among the Company, Everest Colleges Canada, Inc., the Guarantors party thereto (collectively with the Company and Everest Colleges Canada, Inc., the “Loan Parties”), the Lenders party thereto and Bank of America, N.A., as Domestic Administrative Agent and Canadian Agent (“Agent”). This Fifth Amendment amends in part the Company’s Credit Facility among the same parties dated May 17, 2012 (as previously amended, the “Credit Agreement”).

Pursuant to the terms of the Fifth Amendment, the Lenders agreed to permit the Company and certain of its subsidiaries to sell certain assets that are used in the operation of 56 of the Company’s Everest and WyoTech campuses as well as Everest online programs (the “Everest Plus Business” and such sale, the “Everest Plus Sale”), so long as (a) the purchase agreement relating to the Everest Plus Sale shall not have been amended, supplemented or otherwise modified in any material respect without the approval of the Lenders, and no material provision of such purchase agreement shall have been waived by the Loan Parties without approval of the Lenders; (b) all letters of credit outstanding in connection with the Everest Plus Business shall be terminated, replaced or cash collateralized upon the closing of the Everest Plus Sale; (c) all net cash proceeds to the Company from the Everest Plus Sale shall be applied as follows: (i) 35% will be distributed to a reserve account established pursuant to the Operating Agreement entered into with the U.S. Department of Education (“ED”) and (ii) all remaining amounts will be applied as a repayment of amounts outstanding under the Credit Agreement; (d) concurrent with or prior to the closing of the Everest Plus Sale, the Loan Parties shall have entered into binding agreements (contingent upon the closing of the Everest Plus Sale) for the sale of the real property of the Loan Parties located in Thornton, Colorado and Blairsville, Pennsylvania, with all net proceeds to the Company from such real property sales to be paid to the Domestic Administrative Agent for the benefit of the Lenders; and (e) the Everest Plus Sale shall be consummated on or prior to January 31, 2015. The Fifth Amendment also provides that (x) the Company will apply the proceeds from the sale of its owned parcel of real property located in Tampa, Florida to repay amounts outstanding under the Credit Agreement and (y) upon a sale of substantially all of the assets of the domestic Loan Parties (other than the assets included in the Everest Plus Sale), or, in certain circumstances, upon the consummation of the Everest Plus Sale, the Company shall make an additional payment of $3.0 million to the Domestic Administrative Agent from funds maintained in a separate bank account pursuant to the Forbearance and Consent Agreement described in a Current Report on Form 8-K filed by the Company with the U.S. Securities and Exchange Commission on October 16, 2014.

In addition, pursuant to the Fifth Amendment, (i) the Lenders consented to the Company’s execution of a Third Amendment to Operating Agreement with ED, and (ii) the terms of the Forbearance and Consent Agreement were amended such that the Forbearance Period (as defined in the Forbearance and Consent Agreement) was extended from December 31, 2014 to the earlier of (i) March 31, 2015 and (ii) the date on which each of the Everest Plus Sale and the sale of substantially all of the assets of the domestic Loan Parties (other than the assets included in the Everest Plus Sale) shall have been consummated, subject to earlier termination of the Forbearance Period as contemplated by the Forbearance and Consent Agreement.

The foregoing summary of the Fifth Amendment is a summary only and is qualified in its entirety by reference to the Fifth Amendment, which is attached hereto as Exhibit 10.1 and is incorporated by reference into this Item 1.01.

Item 9.01 Financial Statements and Exhibits

| (d) |

Exhibits. |

| |

|

|

10.1 |

Consent Agreement and Amendment No. 5 to Credit Agreement, dated as of December 9, 2014, by and among the Company, Everest Colleges Canada, Inc., the Guarantors party thereto, the Lenders party thereto and Bank of America, N.A., as Domestic Administrative Agent and Canadian Agent. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

CORINTHIAN COLLEGES, INC. |

|

|

|

|

|

|

|

|

|

December 12, 2014 |

|

/s/ Stan A. Mortensen |

|

|

|

Stan A. Mortensen |

|

|

|

Executive Vice President and General Counsel |

|

|

|

|

4

Exhibit 10.1

EXECUTION COPY

CONSENT AGREEMENT

AND AMENDMENT NO. 5 TO CREDIT AGREEMENT

This CONSENT AGREEMENT AND AMENDMENT NO. 5 TO CREDIT AGREEMENT, dated as of December 9, 2014 (this “Consent”), is by and among Corinthian Colleges, Inc. (the “Domestic Borrower”), Everest Colleges Canada, Inc. (the “Canadian Borrower”; the Domestic Borrower and the Canadian Borrower are referred to herein collectively as the “Borrowers”), the Guarantors party hereto, the Lenders party hereto and Bank of America, N.A., as Domestic Administrative Agent (in such capacity, the “Domestic Administrative Agent”) and Canadian Agent (in such capacity, the “Canadian Administrative Agent”; the Domestic Administrative Agent and the Canadian Administrative Agent are referred to herein collectively as the “Administrative Agents”). Capitalized terms which are used in this Consent without definition and which are defined in the Credit Agreement shall have the same meanings herein as in the Credit Agreement.

R E C I T A L S:

WHEREAS, the Borrowers, the lenders party thereto from time to time (the “Lenders”) and the Administrative Agents are parties to that certain Fourth Amended and Restated Credit Agreement, dated as of May 17, 2012 (as amended, restated, supplemented or otherwise modified from time to time, the “Credit Agreement”);

WHEREAS, the Domestic Borrower and the U. S. Department of Education are parties to that certain Operating Agreement, dated as of July 8, 2014 (as amended, the “Operating Agreement”);

WHEREAS, the Borrowers, the Lenders party thereto and the Administrative Agents are parties to that certain Forbearance and Consent Agreement dated as of October 10, 2014 (the “Forbearance Agreement”);

WHEREAS, the Domestic Borrower, Corinthian Schools, Inc., a Delaware corporation (“CSI”), Everest College Phoenix, Inc., an Arizona corporation (“ECP”), Rhodes Colleges, Inc., a Delaware corporation (“Rhodes”), Titan Schools, Inc., a Delaware corporation (“Titan”), MJB Acquisition Corporation, a Wyoming corporation (“MJB”), Florida Metropolitan University, Inc., a Florida corporation (“FMU”), Sequoia Education, Inc., a California corporation (“Sequoia”), Eton Education, Inc., a Washington corporation (“Eton”), Ashmead Education, Inc., a Washington corporation (“Ashmead”), Grand Rapids Educational Center, Inc., a Michigan corporation (“GREC”), Rhodes Business Group, Inc., a Delaware corporation (“RBG”), Pegasus Education, Inc., a Delaware corporation (“Pegasus”), and Socle Education, Inc., a Delaware corporation (“Socle” and, together with the Domestic Borrower, CSI, ECP, Rhodes, Titan, MJB, FMU, Sequoia, Eton, Ashmead, GREC, RBG and Pegasus, the “Sellers”), have agreed to sell the “Purchased Assets” (as defined in the Purchase Agreement (as defined below)) to the Purchaser pursuant to that certain Asset Purchase Agreement, dated as of November 19, 2014 (the “Purchase Agreement”), by and among the Sellers, Zenith Education Group, Inc., a Delaware nonprofit corporation (the “Purchaser”), as purchaser, and ECMC Group, Inc., a Delaware nonprofit corporation, as guarantor, and the Loan Parties have requested that the Administrative Agents and the Lenders consent to such sale (the “Everest Plus Sale”);

WHEREAS, the Domestic Borrower has requested that the Administrative Agents and the Lenders consent to its entry into a Third Amendment to the Operating Agreement (“Amendment No. 3 to the Operating Agreement”) substantially in the form of that certain draft delivered to the Domestic Administrative Agent on December 8, 2014;

WHEREAS, the Administrative Agents and the Lenders have agreed to consent to the Everest Plus Sale and the entry by the Domestic Borrower into Amendment No. 3 to the Operating Agreement on the terms and conditions set forth herein;

WHEREAS, the Borrowers have requested that the Administrative Agents and Lenders amend the Credit Agreement and the Forbearance Agreement in certain respects; and

WHEREAS, the Administrative Agents and the Lenders have agreed to amend the Credit Agreement and the Forbearance Agreement on the terms and conditions set forth herein.

NOW, THEREFORE, in consideration of the premises and the agreements, provisions and covenants herein contained, and subject to the terms and conditions hereof, the parties hereto agree as follows:

section 1. CONSENTS.

1.1 Consent to Everest Plus Sale. Subject to the satisfaction of the conditions precedent set forth in Section 3 hereof, the Administrative Agents and the Lenders hereby consent to the Loan Parties’ entry into the Purchase Agreement and the consummation of the the Everest Plus Sale; provided, that:

(a) The Purchase Agreement shall not have been amended, supplemented or otherwise modified in any material respect without the approval of the Lenders, and no material provision of the Purchase Agreement shall have been waived by the Loan Parties without the approval of the Lenders;

(b) All Letters of Credit outstanding in connection with the Everest Plus Business shall be terminated, replaced or Cash Collateralized upon closing of the Everest Plus Sale; provided, that the Domestic Borrower and the Domestic Administrative Agent shall cooperate in good faith prior to the closing of the Everest Plus Sale to determine which Letters of Credit will require Cash Collateralization;

(c) All net cash proceeds (after all negative adjustments to proceeds pursuant to the Purchase Agreement) received by the Loan Parties upon the consummation of the Everest Plus Sale and all amounts from the Indemnification Escrow Fund (as defined in the Purchase Agreement) and the Adjustment Escrow Fund (as defined in the Purchase Agreement) returned to the Loan Parties shall be applied as follows: (i) an amount equal to 35% thereof shall be distributed to the reserve established pursuant to Section VI.F of the Operating Agreement, as amended, to the extent required by the Operating Agreement and (ii) all remaining amounts shall be applied as a repayment of the Total Obligations;

(d) Concurrent with or prior to the closing of the Everest Plus Sale, the Loan Parties shall have entered into binding agreements (contingent upon the closing of the Everest Plus Sale) for the sale of the real property of the Loan Parties located in Thornton, CO and Blairsville, PA (the “Specified Real Property”), which agreements shall provide for the direct payment of all net proceeds to the Domestic Administrative Agent for the benefit of the Lenders, on terms and conditions otherwise acceptable to the Required Lenders; and

(e) The Everest Plus Sale shall be consummated on or prior to January 31, 2015.

1.2 Consent to Amendment No. 3 to the Operating Agreement. Subject to the satisfaction of the conditions precedent set forth in Section 3 hereof, the Required Lenders hereby consent to the Domestic Borrower’s entry into Amendment No. 3 to the Operating Agreement; provided, that Amendment No. 3 to the Operating Agreement shall not have been modified in any material respect from the draft delivered to the Domestic Administrative Agent on December 8, 2014 without the approval of the Lenders.

1.3 Reservation of Rights. Each of the Administrative Agents and the Lenders hereby reserve all rights with respect to (a) any additional consents that may be required from the Administrative Agents and the Lenders under the Loan Documents (including, without limitation, in connection with any Foreclosure (as defined in the Purchase Agreement)) with respect to satisfaction of the conditions precedent to closing of the Everest Plus Sale set forth in the Purchase Agreement and (b) the right of the Required Lenders to consent to any sale of the Specified Real Property in their sole discretion; provided, that if the Required Lenders shall unreasonably withhold their consent to any proposed agreement for the sale of any Specified Real Property, the condition precedent set forth in Section 1.1(d) above shall be deemed satisfied with respect to such Specified Real Property.

1.4 Application. All repayments of the Total Outstandings made pursuant to this Section 1 shall be applied (1) first, to repay the principal on outstanding Loans of the Domestic Borrower, (2) second, to Cash Collateralize the L/C Obligations of the Domestic Borrower, (3) third, to repay the principal on outstanding Loans of the Canadian Borrower and (4) fourth, to Cash Collateralize the L/C Obligations and Acceptances of the Canadian Borrower.

1.5 Budget. From and after the date hereof, the thirteen-week cash flow budget titled Corinthian Colleges, Inc. Cash Flow Analysis dated November 25, 2014 shall constitute the applicable budget for purposes of Section 2.2 of the Forbearance Agreement.

section 2. REAL ESTATE PROCEEDS; ADDITIONAL PAYMENT; EXTENSION OF MATURITY.

2.1 Tampa Proceeds. On the Effective Date, the Borrowers shall apply the Tampa Proceeds (as defined in the Forbearance Agreement) (in an amount not less than $858,274.58) as a repayment of the Total Outstandings. Such repayment shall be applied on a pro rata basis to the Obligations of the Domestic Borrower and the Obligations of the Canadian Borrower (according to the Total Outstandings of each Borrower). Amounts applied to the Obligations of any Borrower pursuant to this Section 2.1 shall be applied: (1) first, to repay the principal on outstanding Loans of such Borrower and (2) second, to Cash Collateralize the L/C Obligations and Acceptances of such Borrower (or in such other order as the Required Lenders shall specify).

2.2 Specified Real Property. Upon consummation of the sale of any Specified Real Property, the Borrowers shall immediately apply 100% of the net cash proceeds thereof as a repayment of the Total Outstandings. Such repayments shall be applied (1) first, to repay the principal on outstanding Loans of the Domestic Borrower, (2) second, to Cash Collateralize the L/C Obligations of the Domestic Borrower, (3) third, to repay the principal on outstanding Loans of the Canadian Borrower and (4) fourth, to Cash Collateralize the L/C Obligations and Acceptances of the Canadian Borrower.

2.3 Additional Payment. Upon the earlier of (i) the closing of the Everest Plus Sale (other than pursuant to Section 6.1(a)(i) of the Purchase Agreement) and (ii) a sale of substantially all of the assets of the Domestic Loan Parties (other than the Everest Plus Business) (the “Heald and California Schools Sale”), the Domestic Borrower shall make an additional payment of $3,000,000 to the Domestic Administrative Agent from funds maintained in the Specified Account (as defined in the Forbearance Agreement), which amount shall be applied to the Obligations or maintained as a reserve as the Required Lenders shall direct (and, when any amount is released from any reserve required by the Required Lenders, such amount shall be applied to the Obligations) (the “Additional Payment”). It is acknowledged and agreed that only one Additional Payment shall be required between the Everest Plus Sale and the Heald and California Schools Sale.

2.4 Amendments to Credit Agreement. Subject to the satisfaction of the conditions precedent set forth in Section 3 hereof, the Credit Agreement is hereby amended as follows:

(a) Section 1.01 of the Credit Agreement is hereby amended to insert alphabetically therein the following new defined term:

“Everest Plus Consent” means that certain Consent Agreement and Amendment No. 5 to Credit Agreement, dated as of December 8, 2014, by and among the Borrowers, the Guarantors, the Lenders and the Administrative Agents.

(b) Section 1.01 of the Credit Agreement is hereby amended to replace the reference to “December 31, 2014” in the definition of “Maturity Date” with “the earlier of (i) March 31, 2015 and (ii) the date on which each of the Everest Plus Sale (as defined in the Everest Plus Consent) and the Heald and California Schools Sale (as defined in the Everest Plus Consent) shall have been consummated”.

2.5 Amendment to Forbearance Agreement. Subject to the satisfaction of the conditions precedent set forth in Section 3 hereof, Section 1.1(a) of the Forbearance Agreement is hereby amended to replace the reference to “December 31, 2014” with “the earlier of (i) March 31, 2015 and (ii) the date on which each of the Everest Plus Sale (as defined in the Everest Plus Consent) and the Heald and California Schools Sale (as defined in the Everest Plus Consent) shall have been consummated”.

section 3. CONDITIONS. This Consent shall become effective as of the date hereof (the “Effective Date”) upon receipt by the Domestic Administrative Agent of duly executed counterparts to this Consent from the Borrowers, the Guarantors, the Administrative Agents and the Lenders.

section 4. COLLATERAL ALLOCATION MECHANISM

4.1 CAM Exercise. Each Lender hereby agrees that, on the CAM Exercise Date, (x) such Lender shall purchase from each other Lender, and each such other Lender shall sell, at par, a risk participation in such other Lender’s outstanding Loans such that, after giving effect to such purchase and sale, each Lender holds a risk participation in each outstanding Loan in an amount equal to such Lender’s Aggregate Pro Rata Share thereof and (y) such Lender’s risk participation in each Swing Line Loan, L/C Obligation and Acceptance shall be adjusted to an amount equal to such Lender’s Aggregate Pro Rata Share thereof. It is understood and agreed that all consideration for such purchases and sales shall be paid in Dollars on a net basis (in the case of the Canadian Loans, Canadian Letters of Credit and Acceptances, based on the Dollar Equivalent thereof determined by the Administrative Agents on or about the CAM Exercise Date). Each Lender agrees to take such actions as may be reasonably requested by the Administrative Agents to effect the foregoing and acknowledge in writing its respective holdings after giving effect to the purchases and adjustments set forth in this Section 4.1.

4.2 Retention of Proceeds. Each of Bank of America, N.A. and U.S. Bank National Association (in each case, in its capacity as a Domestic Lender and a Canadian Lender) (the “Specified Lenders”) hereby authorizes the Administrative Agents to hold and retain in escrow all proceeds of any repayments of the Total Outstandings allocable to such Specified Lender received on or after the Effective Date and on or prior to the CAM Exercise Date (such proceeds, together with any funds of any Specified Lender retained by the Administrative Agents for such purpose with the consent of such Specified Lender prior the Effective Date, “Retained Funds”). The Administrative Agents shall, on the CAM Exercise Date, (i) apply the Retained Funds of each Specified Lender to the payment of the cash consideration owing by such Specified Lender to the non-Specified Lenders in connection with the purchases, sales and adjustments described in Section 4.1 and (ii) distribute to each Specified Lender any Retained Funds of such Specified Lender remaining after the application specified in the foregoing clause (i).

4.3 CAM Exercise Date. The “CAM Exercise Date” shall be a date specified by the Domestic Administrative Agent, on not less than three (3) Business Days prior notice to each Lender, occurring not later than the date five (5) Business Days prior to the anticipated closing date for the Everest Plus Sale.

section 5. REPRESENTATION AND WARRANTIES.

5.1 Enforceability. Each Loan Party hereby represents and warrants that this Consent, the Forbearance Agreement as amended hereby and (in the case of the Borrowers) the Credit Agreement as amended hereby is the legal, valid and binding obligation of such Loan Party and is enforceable against such Loan Party in accordance with its terms, except as may be limited by bankruptcy, insolvency, reorganization, moratorium or similar laws relating to or limiting creditors’ rights generally or by equitable principles relating to enforceability.

5.2 Authorization; No Conflicts. Each Loan Party hereby represents and warrants that its execution and delivery of this Consent and performance of this Consent, the Forbearance Agreement as amended hereby and (in the case of the Borrowers) the Credit Agreement as amended hereby (i) have been duly authorized by all necessary corporate or other organizational action on the part of such Loan Party and are within such Loan Party’s corporate or other organizational power and authority, (ii) do not (A) contravene the terms of such Loan Party’s Organization Documents, (B) conflict with or result in any breach or contravention of, or the creation of any Lien under (i) any Contractual Obligation to which such Loan Party is a party or (ii) any order, injunction, writ or decree of any Governmental Authority or any arbitral award to which such Loan Party or its property is subject; or (C) violate any Law.

5.3 No Default; Representations and Warranties in Loan Documents. Each Loan Party hereby represents and warrants that, after giving effect to Section 2 hereof, (i) no Default has occurred and is continuing (other than the Specified Defaults (as defined in the Forbearance Agreement)) and (ii) all of the representations and warranties of such Loan Party contained in each Loan Document to which it is a party are true and correct in all material respects on and as of the date hereof, except to the extent that such representations and warranties specifically refer to an earlier date, in which case they shall be true and correct in all material respects as of such earlier date (except that, for purposes of this Section 5.3, the representations and warranties contained in subsection (a) of Section 5.05 of the Credit Agreement shall be deemed to refer to the most recent financial statements furnished pursuant to subsection (a) and (b), respectively of Section 6.01 of the Credit Agreement), except:

(i) with respect to the Representation and Warranty Exception (as defined in Amendment No. 2) and the existence of the Specified Defaults;

(ii) Section 5.03 of the Credit Agreement, with respect to any approvals, consents, exemptions, authorizations or other actions, or notices, or filings, necessary or required in connection with the performance by any Loan Party of the Credit Agreement pursuant to the Operating Agreement;

(iii) Section 5.06 of the Credit Agreement, with respect to any matters disclosed in the Domestic Borrower’s public filings with the SEC prior to the date hereof; and

(iv) the first sentence of Section 5.07 of the Credit Agreement.

section 6. RATIFICATION AND RELEASE.

6.1 Ratification. Each Loan Party hereby (a) ratifies and reaffirms all of its payment and performance obligations, contingent or otherwise, and each grant of security interests and liens in favor of each Administrative Agent, the L/C Issuers or the Lenders, as the case may be, under each Loan Document, (b) agrees and acknowledges that the liens in favor of each Administrative Agent, the L/C Issuers or the Lenders under each Loan Document constitute valid, binding, enforceable and perfected first priority liens and security interests and are not subject to avoidance, disallowance or subordination pursuant to any requirement of Law, (c) agrees and acknowledges the Obligations constitute legal, valid and binding obligations of the Loan Parties and that (x) no offsets, defenses or counterclaims to the Obligations or any other causes of action with respect to the Obligations or the Loan Documents exist and (y) no portion of the Obligations is subject to avoidance, disallowance, reduction or subordination pursuant to any requirement of Law, (d) agrees that such ratification and reaffirmation is not a condition to the continued effectiveness of the Loan Documents, and (e) agrees that neither such ratification and reaffirmation, nor the Administrative Agents’, the L/C Issuers’ nor any Lender’s solicitation of such ratification and reaffirmation, constitutes a course of dealing giving rise to any obligation or condition requiring a similar or any other ratification or reaffirmation from each party to the Loan Documents with respect to any subsequent modifications, consent or waiver with respect to the Credit Agreement or other Loan Documents. This Consent shall not constitute a waiver of, or forbearance with respect to, any Default, whether known or unknown, and the Administrative Agent and the Lenders shall reserve all rights and remedies in respect thereof. This Consent shall constitute a “Loan Document” for purposes of the Credit Agreement.

6.2 Release; Covenant Not to Sue; Acknowledgement. (a) Each Loan Party hereby absolutely and unconditionally releases and forever discharges each Administrative Agent, each L/C Issuer, each Swing Line Lender, each Lender and each of their respective Related Parties (each a “Released Party”) from any and all claims, demands or causes of action of any kind, nature or description, whether arising in law or equity or upon contract or tort or under any state or federal law or otherwise, which any Loan Party has had, now has or has made claim to have against any such Person for or by reason of any act, omission, matter, cause or thing whatsoever arising out of or with respect to the Obligations, the Credit Agreement, this Consent or any other Loan Document from the beginning of time to and including the Effective Date, whether such claims, demands and causes of action are matured or unmatured or known or unknown. It is the intention of each Loan Party in providing this release that the same shall be effective as a bar to each and every claim, demand and cause of action specified. Each Loan Party acknowledges that it may hereafter discover facts different from or in addition to those now known or believed to be true with respect to such claims, demands, or causes of action and agrees that this instrument shall be and remain effective in all respects notwithstanding any such differences or additional facts. Each Loan Party understands, acknowledges and agrees that the release set forth above may be pleaded as a full and complete defense and may be used as a basis for an injunction against any action, suit or other proceeding which may be instituted, prosecuted or attempted in breach of the provisions of such release. Nothing in this Section 6.2 shall relieve any Administrative Agent or Lender of any continuing contractual obligations under this Amendment.

(b) Each Loan Party, on behalf of itself and its successors, assigns, and other legal representatives, hereby absolutely, unconditionally and irrevocably, covenants and agrees with and in favor of each Released Party above that it will not sue (at law, in equity, in any regulatory proceeding or otherwise) any Released Party on the basis of any claim released, remised and discharged by any Loan Party pursuant to the above release. If any Loan Party or any of their successors, assigns or other legal representatives violates the foregoing covenant, each Loan Party, for itself and its successors, assigns and legal representatives, agrees to pay, in addition to such other damages as any Released Party may sustain as a result of such violation, all reasonable attorneys’ fees and costs incurred by such Released Party as a result of such violation.

(c) Each Loan Party represents and warrants that, to its knowledge, there are no liabilities, claims, suits, debts, liens, losses, causes of action, demands, rights, damages or costs, or expenses of any kind, character or nature whatsoever, fixed or contingent, which any Loan Party may have or claim to have against any Released Party arising with respect to the Obligations, the Credit Agreement, this Consent or any other Loan Document.

(d) Each of the Loan Parties has been advised by counsel with respect to the release contained in this Section 6.2. Upon advice of such counsel, each of the Loan Parties hereby waives and relinquishes all of the rights and benefits each Loan Party has, or may have, with respect to the claims released under Section 1542 of the California Civil Code or any other similar statute. Section 1542 states as follows:

A GENERAL RELEASE DOES NOT EXTEND TO CLAIMS WHICH THE CREDITOR DOES NOT KNOW OR SUSPECT TO EXIST IN HIS FAVOR AT THE TIME OF EXECUTING THE RELEASE, WHICH IF KNOWN BY HIM MUST HAVE MATERIALLY AFFECTED HIS SETTLEMENT WITH THE DEBTOR.

section 7. MISCELLANEOUS.

7.1 Effect.

(a) Upon the effectiveness of this Consent, each reference in the Credit Agreement to “this Agreement,” “hereunder,” “hereof” or words of like import shall mean and be a reference to the Credit Agreement as modified hereby and each reference in the other Loan Documents to the Credit Agreement, “thereunder,” “thereof,” or words of like import shall mean and be a reference to the Credit Agreement as modified hereby. This Consent shall constitute a Loan Document.

(b) Upon the effectiveness of this Consent, each reference in the Forbearance Agreement to “this Agreement,” “hereunder,” “hereof” or words of like import shall mean and be a reference to the Forbearance Agreement as modified hereby and each reference in the other Loan Documents to the Forbearance Agreement, “thereunder,” “thereof,” or words of like import shall mean and be a reference to the Forbearance Agreement as modified hereby.

(c) Except as specifically set forth in this Consent, the execution, delivery and effectiveness of this Consent shall not (i) limit, impair, constitute an amendment, forbearance or waiver by, or otherwise affect any right, power or remedy of, any Administrative Agent or any Lender under the Credit Agreement, the Forbearance Agreement or any other Loan Document or waive, affect or diminish any right of any Administrative Agent or any Lender to demand strict compliance and performance therewith, (ii) constitute a waiver of, or forbearance with respect to, any Default, whether known or unknown or (iii) alter, modify, amend or in any way affect any of the terms, conditions, obligations, covenants or agreements contained in the Credit Agreement, the Forbearance Areement or any of the other Loan Documents, all of which are ratified and affirmed in all respects and shall continue in full force and effect.

7.2 Severability. Any provision of this Consent held by a court of competent jurisdiction to be invalid or unenforceable in any jurisdiction shall not impair or invalidate the remainder of this Consent and the effect thereof shall be confined to the provision so held to be invalid or unenforceable and will not affect the effectiveness thereof in any other jurisdiction.

7.3 Counterparts. This Consent may be executed in one or more counterparts, each of which shall constitute an original, but all of which taken together shall be one and the same instrument. This Consent may also be executed by facsimile or electronic transmission and each facsimile or electronic transmission signature hereto shall be deemed for all purposes to be an original signatory page.

7.5 GOVERNING LAW. This CONSENT SHALL BE GOVERNED BY, AND CONSTRUED IN ACCORDANCE WITH, THE LAW OF THE STATE OF CALIFORNIA APPLICABLE TO AGREEMENTS MADE AND TO BE PERFORMED ENTIRELY WITHIN SUCH STATE; PROVIDED THAT EACH ADMINISTRATIVE AGENT AND EACH LENDER SHALL RETAIN ALL RIGHTS ARISING UNDER FEDERAL LAW.

7.6 Section Titles. The Section titles contained in this Consent are and shall be without substance, meaning or content of any kind whatsoever and are not a part of the agreement between the parties hereto.

7.7 Reimbursement of each Administrative Agent’s Expenses. Without limiting any of the Administrative Agents’ or the Lenders’ rights, or any of Borrowers’ obligations, under Section 10.04(a) of the Credit Agreement, each Borrower agrees to reimburse the Administrative Agents and the Lenders for all reasonable and documented out-of-pocket fees, costs and expenses incurred in connection with this Consent.

7.8 Entire Agreement. This Consent contains the final and complete integration of all prior expressions by the parties hereto with respect to the subject matter hereof and shall constitute the entire agreement among the parties hereto with respect to the subject matter hereof superseding all prior oral or written understandings or agreements.

[Signature Pages Follow]

WITNESS the due execution hereof by the respective duly authorized officers of the undersigned of this Consent as of the date first written above.

| BORROWERS: |

| |

| CORINTHIAN COLLEGES, INC. |

|

By:

|

/s/ Robert C. Owen |

| |

Name: Robert C. Owen |

| |

Title: EVP and CFO |

| |

| EVEREST COLLEGES CANADA, INC. |

|

By:

|

/s/ Robert C. Owen |

| |

Name: Robert C. Owen |

| |

Title: SVP and CAO |

Signature Page to

Consent Agreement and Amendment No. 5

|

GUARANTORS:

Ashmead Education, Inc.

Career Choices, Inc.

CDI Education USA, Inc.

Corinthian Property Group, Inc.

Corinthian Schools, Inc.

ECAT Acquisition, Inc.

Eton Education, Inc.

Florida Metropolitan University, Inc.

Grand Rapids Educational Center, Inc.

Heald Capital, LLC

Heald Education, LLC

Heald Real Estate, LLC

MJB Acquisition Corporation

Pegasus Education, Inc.

Rhodes Business Group, Inc.

Rhodes Colleges, Inc.

SD III-B Heald Holdings Corp.

Sequoia Education, Inc.

Socle Education, Inc.

Sp PE VII-B Heald Holdings Corp.

Titan Schools, Inc.

|

|

By:

|

/s/ Robert C. Owen |

| |

Name: Robert C. Owen |

| |

Title: EVP, CFO, Treasurer and Assistant Secretary |

| CAREER CANADA C.F.P. LIMITED |

|

By:

|

/s/ Robert C. Owen |

| |

Name: Robert C. Owen |

| |

Title: SVP adn CAO |

| EVEREST COLLEGE PHOENIX, INC. |

|

By:

|

/s/ Robert C. Owen |

| |

Name: Robert C. Owen |

| |

Title: EVP, CFO and Treasurer |

Signature Page to

Consent Agreement and Amendment No. 5

|

HEALD COLLEGE, LLC |

|

By:

|

/s/ Robert C. Owen |

| |

Name: Robert C. Owen |

| |

Title: CAO |

| Quickstart Intelligence Corporation |

|

By:

|

/s/ Robert C. Owen |

| |

Name: Robert C. Owen |

| |

Title: EVP and Treasurer |

Signature Page to

Consent Agreement and Amendment No. 5

|

BANK OF AMERICA, N.A., as Domestic Administrative Agent |

| |

| |

|

By: |

/s/ Anthea Del Bianco |

| |

Name: Anthea Del Bianco |

| |

Title: Vice President |

Signature Page to

Consent Agreement and Amendment No. 5

|

BANK OF AMERICA, N.A., as a Domestic Lender |

| |

| |

|

By: |

/s/ Janet Sleeper |

| |

Name: Janet Sleeper |

| |

Title: Senior Vice President |

Signature Page to

Consent Agreement and Amendment No. 5

|

BANK OF AMERICA, N.A., acting through its Canada Branch, as Canadian Administrative Agent |

| |

| |

|

By: |

/s/ Medina Sales de Andrade |

| |

Name: Medina Sales de Andrade |

| |

Title: Vice President |

Signature Page to

Consent Agreement and Amendment No. 5

|

BANK OF AMERICA, N.A., acting through its Canada Branch, as a Canadian Lender |

| |

| |

|

By: |

/s/ Medina Sales de Andrade |

| |

Name: Medina Sales de Andrade |

| |

Title: Vice President |

Signature Page to

Consent Agreement and Amendment No. 5

|

U.S. BANK NATIONAL ASSOCIATION, as a Domestic Lender |

| |

| |

|

By: |

/s/ Saqib Khawaja |

| |

Name: Saqib Khawaja |

| |

Title: Vice President |

Signature Page to

Consent Agreement and Amendment No. 5

|

U.S. BANK NATIONAL ASSOCIATION,

acting through its Canada Branch,

as a Canadian Lender |

| |

| |

|

By: |

/s/ John P. Rehob |

| |

Name: John P. Rehob |

| |

Title: Principal Officer |

Signature Page to

Consent Agreement and Amendment No. 5

|

MUFG UNION BANK, N.A., formerly known as Union Bank, N.A.,

as a Domestic Lender |

| |

| |

|

By: |

/s/ Andrew Jarms |

| |

Name: Andrew Jarms |

| |

Title: Associate |

Signature Page to

Consent Agreement and Amendment No. 5

|

BANK OF THE WEST,

as a Domestic Lender |

| |

| |

|

By: |

/s/ Christiana Creekpaum |

| |

Name: Christiana Creekpaum |

| |

Title: Vice President |

Signature Page to

Consent Agreement and Amendment No. 5

|

ONEWEST BANK N.A.,

as a Domestic Lender |

| |

| |

|

By: |

/s/ Todd Camp |

| |

Name: Todd Camp |

| |

Title: Senior Vice President |

Signature Page to

Consent Agreement and Amendment No. 5

Exhibit A

Signature Page to

Consent Agreement and Amendment No. 5

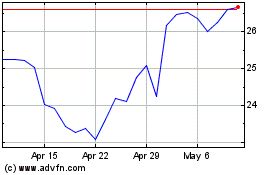

Vita Coco (NASDAQ:COCO)

Historical Stock Chart

From Mar 2024 to Apr 2024

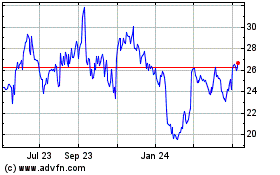

Vita Coco (NASDAQ:COCO)

Historical Stock Chart

From Apr 2023 to Apr 2024