Private Equity Warming To For-Profit Colleges; Hurdles Remain

January 19 2011 - 2:57PM

Dow Jones News

Private-equity firms are showing some renewed interest in

operators of for-profit colleges, though deal activity still may

not pick up until regulatory clouds begin to clear later this

year.

Industry insiders say that private-equity firms have been

inquiring about a number of companies in recent months, with

potential targets ranging from schools that offer short certificate

programs to more expensive bachelor's degree offerings. They are

looking at both private and publicly traded companies, these people

say.

BMO Capital Markets equity analyst Jeff Silber said his group

has had "at least one conversation with private-equity investors

about every post-secondary name we cover, as well as some we

don't."

Silber declined to provide the names of which firms have been

showing interest. His team covers private and publicly traded

companies including Corinthian Colleges Inc. (COCO) and Lincoln

Educational Services Corp. (LINC), both of which have been

considered takeover targets because of their low valuations, as

well as industry giant Apollo Group Inc. (APOL), DeVry Inc. (DV),

Education Management Corp. (EDMC) and others.

Companies, current stakeholders and prospective investors are

all awaiting a new rule from the U.S. Department of Education that

could transform the for-profit higher-education landscape. The

regulation, which is intended to measure how well programs prepare

students for gainful employment, could force schools to overhaul or

even shutter programs if their graduates have heavy debt loads.

Bruce Eatroff, a partner at private-equity firm Halyard Capital,

said his firm is "very bullish" over the medium term, defining that

time frame as anywhere from one to three years. Still, he said, the

firm "would not be against making the right for-profit investment

in the next year," once the regulatory environment becomes more

certain.

The uncertainty over the final version of the rule, and what

information will be used to measure how programs stack up, has kept

prospective investors at bay for much of the past year.

Regulatory issues brought "a screeching halt to the market for

post-secondary transactions" in mid-2010, said Jay Bartlett,

partner at The Parthenon Group and co-head of its global

private-equity practice, which helps conduct due diligence for

prospective investors.

Once the rule is released, likely within the next two months,

insiders say the deal pipeline will begin to fill back up.

"As soon as the regulations are published, I think you can

expect to see post-secondary assets coming to the market," said

Robert Lytle, a Parthenon partner focusing on for-profit

education.

To be sure, there is no shortage of private-equity firms testing

the waters. "The number of people who have looked at education

assets in North America in the last three years has really gone up

exponentially," Lytle said. The pickup began in earnest after

Laureate Education Inc. was taken private in early 2007. Lytle said

that this past summer, prospectuses were going out to "north of 100

different parties." That interest just didn't translate into

action.

There are other issues blocking the deal path even when

investors are ready to pounce. Lenders have been willing to give

for-profit college operators new credit lines or expand their

borrowing capacity, but are expected to remain skittish on funding

acquisitions for a few quarters.

"It's not like the lending flood gates open the day the

[regulation] comes on the books," BMO's Silber said, predicting it

will take months for companies to assess how the gainful-employment

measure will affect their growth capacity and access to the federal

student financial aid on which they rely for the vast majority of

their revenue. That, in turn, will keep lenders guessing how they

can determine companies' projected cash flows.

Eatroff said that in the meantime, companies looking to offload

assets to private-equity firms may need to extend seller financing

or find other creative means to close deals.

No matter what happens this year, "it'll certainly be more

active than the second half of 2010," Lytle said. "That was almost

a goose egg."

-By Melissa Korn, Dow Jones Newswires; 212-416-2271;

melissa.korn@dowjones.com

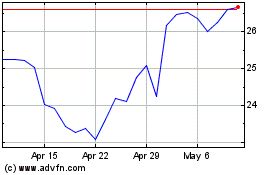

Vita Coco (NASDAQ:COCO)

Historical Stock Chart

From Mar 2024 to Apr 2024

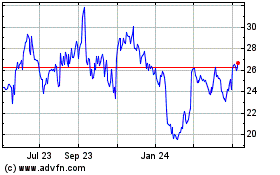

Vita Coco (NASDAQ:COCO)

Historical Stock Chart

From Apr 2023 to Apr 2024