Companies To Press Lawmakers, Regulators For Better Trading Data

March 07 2011 - 4:48PM

Dow Jones News

U.S. companies are becoming concerned that the country's

fragmented stock trading sector has made it difficult to track

their ownership and assess what impact corporate announcements will

have on their share prices.

A group of companies plan to press lawmakers and regulators for

greater disclosure about who buys and sells their shares each day,

and why--a task complicated by the scattered nature and lightning

speed of trading in the electronic age.

"Having good trading data are key to knowing what trading

behaviors react to earnings and news," said Derek Drysdale,

director of investor relations for tax preparer H&R Block Inc.

(HRB).

With more and more trades arranged privately--rather than

through the big exchanges--"it's more difficult to tell if real

volume or just noise is causing our stock price to go up or down,"

he said.

H&R Block and other companies want a better view into where

their stocks are being traded, and who's doing the buying, selling

and shorting. Currently, issuers rely on officials at the exchange

that lists their shares, or third-party services, to provide a

window on trading.

Evolving U.S. market regulation has clouded that window.

Thirteen domestic stock exchanges now compete for business against

dozens of private electronic trading platforms, known as "dark

pools," as well as Wall Street banks that trade millions of shares

internally and then report them to market supervisors. In February,

about one-third of all U.S. share-trading was done away from

publicly accessible exchanges.

The shift, driven by regulators' efforts over the past decade to

make markets more competitive for stock investors, has

disadvantaged the public companies whose equity provides fuel for a

market that trades more than 8 billion shares per day, according to

analysis firm ModernIR LLC.

"We have a construct today that's antithetical to capital

formation," said Tim Quast, managing director for the firm, which

is leading the push for greater transparency into

share-dealing.

H&R Block's Drysdale estimated that 60% of the trading in

his company's shares was driven by high-frequency traders that are

not long-term investors, with more than two-thirds of deals done

away from its listing venue at NYSE Euronext (NYX).

Quast and others point to regulation as a catalyst for

reorienting U.S. securities markets around speed and trading. A

requirement that trades take place at the best price available

nationally, alongside a lower bar for introducing new trading

platforms, has slashed costs for retail investors and ushered in a

generation of high-speed electronic firms that rapidly buy and sell

across dozens of venues.

Amassing and analyzing market data is a key component of

professional traders' business, but share-issuing companies

frequently say they have little clue what drives much of the

activity in their stock, causing headaches when trying to measure

the impact of earnings reports or institutional interest in their

company.

"For us, as the market activity continues to fragment, our data

become less complete," said Matt Smith, treasurer for Consolidated

Communications Holdings Inc. (CNSL), a telephone service company

listed on the Nasdaq Stock Market. "It's disconnected from more

transparency in other facets of the marketplace."

Exchanges, dark pools and firms that internally match up stock

trades all report business into a "consolidated tape" which

compiles daily trading activity. Public companies like Consolidated

Communications and H&R Block want the Securities and Exchange

Commission to direct the disclosure of broker data that goes into

the consolidated tape, giving companies a closer approximation of

the data that traders use.

"There is unfair discrimination in markets today," ModernIR

officials wrote in a letter that the company expects will be signed

by up to 100 companies and submitted to members of the House

Financial Services Committee and the SEC. "This effort will level

the playing field for public companies."

Representatives for NYSE Euronext, Nasdaq OMX, BATS Global

Markets and Direct Edge had no immediate comment, but Quast said

exchanges have not objected to the effort.

A spokeswoman for the Financial Industry Regulatory Authority,

which oversees U.S. securities firms, declined comment.

Representatives of the SEC did not respond to a request for

comment.

The coalition of companies and ModernIR intend to firm up their

group and formally submit their request to lawmakers in late March,

in time to put the issue on the legislative agenda for April and

May, Quast said.

-By Jacob Bunge, Dow Jones Newswires; 312-750-4117;

jacob.bunge@dowjones.com

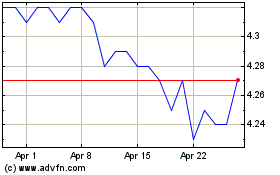

Consolidated Communicati... (NASDAQ:CNSL)

Historical Stock Chart

From Mar 2024 to Apr 2024

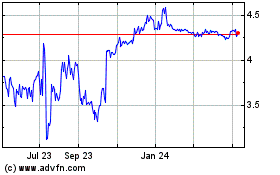

Consolidated Communicati... (NASDAQ:CNSL)

Historical Stock Chart

From Apr 2023 to Apr 2024