CME Group Launches Indexes to Track Bitcoin -- WSJ

November 15 2016 - 3:03AM

Dow Jones News

By Alexander Osipovich

Bitcoin has moved one step closer to mainstream credibility

after the world's largest futures exchange operator launched a pair

of indexes designed to track the virtual currency's price.

The gauges from CME Group Inc. could be used as building blocks

for futures contracts that would make it easier for both

professional and individual investors to trade bitcoin.

The new CME indexes "are clearly precursors to a listing of some

kind" of futures contract, said Daniel Masters, chief investment

officer at Global Advisors (Jersey) Ltd., which manages $25 million

in bitcoin assets. "There is tremendous pent-up demand in the U.S.

for bitcoin exposure that doesn't require an investor to select one

of the current bitcoin exchanges in order to invest."

Trading the virtual currency can be logistically tricky. Since

U.S. brokerages generally don't offer a way to trade it, people who

want to buy or sell it need to set up accounts directly with a

bitcoin exchange. There are dozens of such exchanges around the

world, many of them small and lightly regulated. But if major

players such as CME launch exchange-traded funds or futures tied to

bitcoin, investing in the digital currency would become similar to

trading stocks or commodities.

By entering the bitcoin space, CME is associating itself with a

virtual currency with a questionable past. Bitcoin has been linked

to criminal enterprises such as Silk Road, the online drug bazaar

shut down by the FBI in 2013. It is also notoriously volatile, with

the price of a single coin jumping from $552.82 in August to about

$700 today, according to CoinDesk.

CME could be risking its reputation by teaming up with the murky

overseas bitcoin exchanges where prices are set, said Mark T.

Williams, a lecturer at Boston University and critic of the digital

currency.

"Bitcoin pricing is still in the Wild West stage with

unregulated bucket shops influencing daily price discovery," Mr.

Williams said.

The reputation of bitcoin exchanges has been tarnished by

regulatory scrutiny and a series of high-profile cyberattacks. In

August, the Hong Kong-based digital currency exchange Bitfinex said

it was hacked, resulting in the theft of more than $60 million

worth of bitcoin.

CME said its new indexes are based on data contributed by six

bitcoin exchanges, including the international arm of China-based

OKCoin, whose mainland Chinese platform is the world's most active

marketplace for trading the digital currency, according to

bitcoinity.org.

"Our products launched will bring greater transparency to the

bitcoin market," said a CME spokeswoman. "We have a long history of

developing nascent markets across asset classes for this same

reason."

The bitcoin exchanges contributing data to CME's indexes "have

been extensively vetted," the spokeswoman added.

CME declined to comment on whether it planned to launch bitcoin

futures. The exchange operator would need approval from the

Commodity Futures Trading Commission before it could move ahead

with such a listing.

The new CME indexes shed light on a brewing battle among

exchanges to cash in on the seven-year-old digital currency. Bats

Global Markets Inc. is seeking regulatory approval to list an ETF

linked to bitcoin prices that was developed by Cameron and Tyler

Winklevoss, the twin brothers and entrepreneurs made famous by

their early role in the creation of Facebook Inc.

The Securities and Exchange Commission is expected to decide

whether to allow the proposed ETF by the Winklevoss brothers by

early next year. There is already an ETF-style product called the

Bitcoin Investment Trust available to U.S. investors, but it trades

in the lightly regulated over-the-counter markets and has a spotty

record of tracking the price.

The New York Stock Exchange started publishing a daily U.S.

dollar price index for bitcoin last year. CME is seeking to one-up

NYSE by introducing both a daily index and a real-time index

updated every second, saying it has the best methodology for

calculating a bitcoin benchmark. The real-time index went live on

Sunday, while CME's first daily index started Monday.

The Chicago-based exchange giant said it designed its new

indexes to comply with international standards for the regulation

of financial benchmarks. An independent oversight committee will

help ensure the gauges aren't prone to gaming by unscrupulous

traders, CME says.

"Non-susceptibility to price manipulation is a core principle

that is very important," said Sandra Ro, executive director and

digitization lead at CME.

Write to Alexander Osipovich at

alexander.osipovich@dowjones.com

(END) Dow Jones Newswires

November 15, 2016 02:48 ET (07:48 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

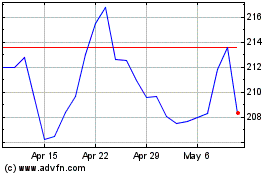

CME (NASDAQ:CME)

Historical Stock Chart

From Mar 2024 to Apr 2024

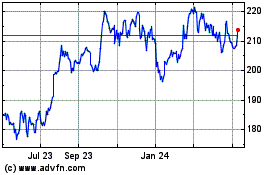

CME (NASDAQ:CME)

Historical Stock Chart

From Apr 2023 to Apr 2024