Intercontinental Exchange Opts Not to Bid for London Stock Exchange -- 4th Update

May 04 2016 - 9:36AM

Dow Jones News

By Eyk Henning, Giles Turner and Lisa Beilfuss

New York Stock Exchange operator Intercontinental Exchange Inc.

said Wednesday that it doesn't intend to make an offer for London

Stock Exchange Group PLC, helping to pave the way for the U.K.

exchange's merger with Germany's Deutsche Börse.

ICE said in a short statement in conjunction with its earnings

report that it couldn't confirm the potential market and

shareholder benefits of a deal and therefore wouldn't make an

offer.

The company had said in March that it was considering a bid for

LSE after the U.K. firm agreed to combine with Deutsche Börse in a

deal that would establish Europe's biggest stock-exchange

operator.

The all-share agreement between Deutsche Börse and LSE would

form a combined company with a market value of about $30 billion,

and would be 45.6%-owned by LSE shareholders and the remainder by

Deutsche Börse shareholders.

That pact was thought to set the stage for a potential bidding

war, as U.S. competitors such as Atlanta-based ICE and CME Group

Inc. considered their next moves.

LSE shares declined 6.8% as hopes for a counter offer were

dashed, while Deutsche Börse rose 5.6% and ICE gained 3.7%

premarket. CME was inactive.

Analysts and industry executives have said that among the

attractive features of LSE, the real prize is its majority stake in

a company called LCH.Clearnet Group Ltd., a so-called clearinghouse

that plays an important role in the market for global interest-rate

swaps, bonds and other instruments.

ICE in particular has made the business of clearing a pillar of

its global constellation of futures and stock exchanges. Its

interest in LSE's clearing business was in some ways similar to its

$8.2 billion acquisition of the owner of the New York Stock

Exchange in 2013. In that deal, ICE's primary target was the London

International Financial Futures and Options Exchange, known as

Liffe. The NYSE was viewed as a problematic asset in need of

significant cost cuts.

The deal between Deutsche Börse and LSE still faces formidable

obstacles such as the U.K.'s referendum on its membership in the

European Union on June 23.

People familiar with the matter said German authorities likely

wouldn't approve the deal if Deutsche Börse were controlled by a

holding company located and supervised outside the EU. That is

currently the plan, however.

Deutsche Börse CEO Carsten Kengeter said in Frankfurt Tuesday

that he is in talks with domestic and EU regulators, which implies

the offer documents for Germany's watchdog BaFin haven't been

submitted yet.

That is significant because it indicates that the tender offer

the U.K. holding company would launch for Deutsche Börse will

likely last into summer and will end after the U.K.'s

referendum.

By logic, that also means LSE will hold its scheme of

arrangement -- the shareholder meeting decisive for the merger --

after the referendum.

While the leaders of both firms have stressed the deal is a good

one even in the event the U.K. leave the EU, shareholders might

think otherwise.

Some Deutsche Börse shareholders privately argue that a U.K.

exit would see the British Pound drop further, making the exchange

ratio look worse for them. Some say trading volumes at LSE might

drop.

Meanwhile, ICE's announcement came as it reported higher

earnings and revenue for its first quarter, helped by a doubling of

data-service revenue and benefits from busier markets.

Trading volume picked up in the quarter, driving transaction

fees higher. Like some of its rivals, volume snapped back for ICE

after a rough end to 2015. CME similarly reported increased

earnings for the first quarter thanks in part to renewed trading

interest after global economic concerns spooked traders and

investors late last year. For ICE, trading volume rose 9.6% during

the quarter, pushing transaction and clearing fees up 11% to $929

million.

ICE has been snapping up firms in a bid to grow its footprint

and broaden its revenue base. ICE last year bought Interactive Data

Corp., giving it hard-to-get pricing data on corporate bonds, as

well as London-based energy-trading venue Trayport.

ICE's acquisition of IDC has been helping to propel results, and

first-quarter data and services revenue rose to $477 million from

$206 million a year earlier -- now representing more than 30% of

the company's top line.

In all, profit grew to $369 million, or $3.08 a share, up from

$315 million, or $2.80 a share, a year earlier. Excluding

merger-related costs, among other items, earnings rose to $3.68 a

share from $3.06.

Revenue jumped 32% to $1.55 billion. Analysts projected $3.65 in

adjusted earnings per share on $1.16 billion in sales, according to

Thomson Reuters.

--Bradley Hope contributed to this article.

Write to Eyk Henning at eyk.henning@wsj.com, Giles Turner at

giles.turner@wsj.com and Lisa Beilfuss at lisa.beilfuss@wsj.com

(END) Dow Jones Newswires

May 04, 2016 09:21 ET (13:21 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

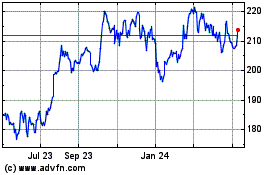

CME (NASDAQ:CME)

Historical Stock Chart

From Mar 2024 to Apr 2024

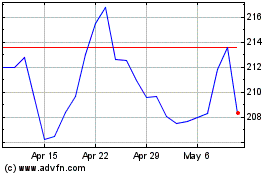

CME (NASDAQ:CME)

Historical Stock Chart

From Apr 2023 to Apr 2024