Hulu Adds CBS to Its Lineup Ahead of Streaming Launch -- WSJ

January 05 2017 - 3:03AM

Dow Jones News

By Shalini Ramachandran

Hulu struck a deal to license CBS Corp.'s broadcast network and

cable channels for its live-streaming service, bulking up the

lineup for its highly anticipated launch in the coming months.

CBS will receive more than $3 per monthly subscriber for its

channels initially, with its take under the multiyear deal possibly

rising above $4, people familiar with the matter said. Those rates

exceed what it charges traditional pay-TV distributors. The

arrangement includes carriage of CBS Sports Network and Pop, the

pop culture cable channel CBS co-owns with Lions Gate Entertainment

Corp.

The pact also gives Hulu the option to include CBS's Smithsonian

Channel and the CW Network in the future, and allows it to sell

CBS's premium network Showtime as an add-on to the live-streaming

service. Hulu already allows subscribers to its video-on-demand

service to buy Showtime for an additional $8.99 a month.

Hulu Chief Executive Mike Hopkins announced the agreement with

CBS at an investor conference in Las Vegas on Wednesday, confirming

a report by The Wall Street Journal.

Hulu won't be getting on-demand access to full current seasons

of popular CBS shows such as "NCIS," which will remain exclusive to

CBS's own streaming service, CBS All Access, the people said. Hulu

will receive a few recent episodes of such shows to offer on-demand

for customers of the new live service.

Mr. Hopkins also revealed the live-streaming service will cost

"under $40" and include Hulu's existing subscription

video-on-demand library, which on its own costs subscribers $7.99

or $11.99 a month. Hulu's deep library, with full seasons of past

shows such as "Seinfeld," and an existing subscriber base of at

least 12 million could give it a leg up as it competes with other

live-streaming rivals such as AT&T Inc.'s DirecTV Now, Dish

Network Corp.'s Sling TV and Sony Corp.'s PlayStation Vue.

Hulu has already signed up other major network groups, including

Walt Disney Co., 21st Century Fox and Time Warner Inc., and said it

is in talks with Comcast Corp.'s NBCUniversal and other companies.

The streaming service aims to offer a more personalized, intuitive

version of cable TV than that offered by traditional pay-TV

distributors and even newer streaming entrants. At launch, Hulu's

offering will also include a cloud-based digital video recorder and

many local station affiliates.

Getting CBS on board may also help Hulu differentiate its

service. CBS has so far taken an unorthodox approach to digital

distribution and hasn't been afraid to hold out from the likes of

DirecTV Now and Sling TV, even as rival media companies have signed

on.

CBS's strategy has been to charge about $2 per monthly

subscriber to its traditional cable and satellite distributors, $4

for new live-streaming entrants and $6 for subscribers to its CBS

All Access streaming service.

The robustness of CBS All Access has stirred up some

distributors, who privately complain the service is now a better

product than the one CBS sells them. CBS offers full current

seasons of shows such as "NCIS" for on-demand streaming through All

Access, but it holds back those rights from traditional partners

unless they pay much more.

Some distribution executives believe as CBS All Access gains

more subscribers, it becomes easier for them to justify going

without CBS if it demands too high a rate, posing a long-term risk

to CBS. CBS executives have brushed off the threat, noting that as

the No. 1 network, CBS's absence would hurt distributors.

CBS's pact with Hulu shows that at least for now the network is

finding a way to have its cake and eat it, too -- striking deals

with distributors while maintaining a stand-alone streaming service

with some 1.2 million subscribers. Moreover, the deal with Hulu

involves CBS's direct rivals; the streaming service is owned by

Disney, Fox, Comcast and Time Warner.

While Hulu loses money today, Mr. Hopkins said he expects the

service to become profitable over time. Hulu's targeted advertising

capabilities can help it "transform advertising" for traditional

television and make money, he said.

"I don't anticipate us perpetually being in a loss mode."

Write to Shalini Ramachandran at

shalini.ramachandran@wsj.com

(END) Dow Jones Newswires

January 05, 2017 02:48 ET (07:48 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

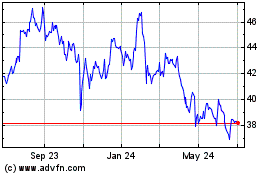

Comcast (NASDAQ:CMCSA)

Historical Stock Chart

From Mar 2024 to Apr 2024

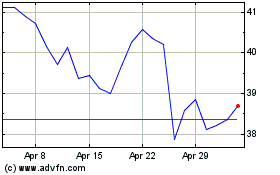

Comcast (NASDAQ:CMCSA)

Historical Stock Chart

From Apr 2023 to Apr 2024