Comcast, Charter Push Into Wireless Comes With Limits

September 22 2016 - 5:53PM

Dow Jones News

By Ryan Knutson and Shalini Ramachandran

The two biggest cable companies said this week they will soon

start selling wireless service but they will be entering a

competitive market with handcuffs.

The CEOs at Comcast Corp. and Charter Communications Inc. both

discussed plans to begin reselling Verizon Wireless service as

early as next year. But the Verizon contract only allows the

companies to sell cellphone service as part of a bundle, not as a

stand-alone product, according to people familiar with the

agreement.

That means consumers won't be able to switch to Comcast or

Charter for cellular service without also buying either cable

television or home internet, too.

Comcast CEO Brian Roberts said Tuesday its primary objective in

offering wireless service is to discourage people from switching or

dropping their cable connection. Mr. Roberts said 70% to 80% of

Comcast customers buy a bundle, such as internet and TV, and by

offering cellphones "we can sell them more products."

"We believe there will be a big payback with reduced churn, with

more stickiness, with better satisfaction," he said Tuesday at a

Goldman Sachs investor conference.

Comcast, along with other cable companies, obtained rights to

resell Verizon Wireless service in 2011, as part of a broader $3.6

billion spectrum deal. Charter inherited the agreement earlier this

year after completing a deal to buy Time Warner Cable and Bright

House Networks.

The deal was struck at a time when most cellular plans were

still centered on voice and text messages, not data. So the

wholesale prices the cable companies pay for data might not align

well with today's competitive market.

"I am not worried," Verizon finance chief Fran Shammo said at

the conference Thursday. "If we were to walk in a room today we'd

do the exact same agreement."

Mr. Shammo said that such wholesale agreements are "extremely

profitable" because the company doesn't have to deal with retail

and marketing costs to get the connections.

Still, Charter and Comcast pass tens of millions of households,

and the companies could offer a bundle of internet and cellphone

service that is cheap enough to appeal to the growing number of

cord-cutters. And cable companies could reduce the amount they pay

to Verizon by shifting wireless traffic to the millions of Wi-Fi

hot spots installed around the country.

Cable operators have emphasized that they will deploy even more

secondary Wi-Fi hot spots inside customers' homes and business to

bolster a potential mobile service. They have also noted that they

are far more interested in hawking wireless as an attractive add-on

to their existing bundle of services than as a stand-alone

product.

Offering wireless service could also help cable companies fend

off future competition. AT&T Inc. is preparing to launch a

streaming version of its DirecTV service and has started bundling

its wireless plans with traditional DirecTV.

Wireless carriers are also working on next-generation network

technology, known as 5G, that could be fast enough to allow

customers to buy all their high speed internet -- including inside

the home -- from a cellphone carrier.

"5G fixed wireless would be a competitor to cable or any

broadband connection," Mr. Shammo said. Verizon is planning market

trials in 2017.

Write to Ryan Knutson at ryan.knutson@wsj.com and Shalini

Ramachandran at shalini.ramachandran@wsj.com

(END) Dow Jones Newswires

September 22, 2016 17:38 ET (21:38 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

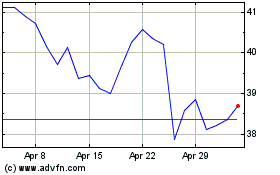

Comcast (NASDAQ:CMCSA)

Historical Stock Chart

From Mar 2024 to Apr 2024

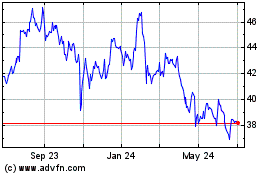

Comcast (NASDAQ:CMCSA)

Historical Stock Chart

From Apr 2023 to Apr 2024