Comcast to Launch Wireless Service by Mid-2017--2nd Update

September 20 2016 - 4:16PM

Dow Jones News

By Shalini Ramachandran and Ryan Knutson

Comcast Corp. Chief Executive Brian Roberts said Tuesday the

cable giant is aiming to launch a wireless service by mid-2017,

creating a new line of business that could help the company better

retain cable customers in a fiercely competitive pay-TV market.

Speaking at a Goldman Sachs investor conference, Mr. Roberts

said the product will take advantage of Comcast's 15 million Wi-Fi

hot spots and use airwaves leased from Verizon Communications

Inc.

Comcast has a deal with Verizon dating back to 2011 that allows

the cable company to sell wireless service using the telecom

carrier's network at set terms and pricing.

Mr. Roberts said because Comcast is essentially renting

Verizon's network, "we won't have to make the kind of investment"

needed otherwise, such as cell towers and other infrastructure.

"We believe there will be a big payback with reduced churn, more

stickiness and better satisfaction," Mr. Roberts said.

Comcast will market the wireless service inside its footprint,

to existing and potential Comcast cable customers, as opposed to

nationwide. The company is interested in up-selling customers to a

bigger bundle of services, Mr. Roberts said.

Comcast declined to offer any further details about the service,

including pricing and which phones will be supported.

Comcast, like all U.S. cable companies, is increasingly leaning

on its broadband business as the overall pay-TV business stagnates

and consumers cut the cord or trade down to discounted packages. In

search of new revenue streams, the cable giant has been seriously

weighing its wireless options for at least a year, engaging in

discussions with Verizon and testing potential services.

But it will be stepping into a competitive U.S. wireless market,

which has four national players who already have more than 100%

penetration in the U.S. -- meaning there are more active cellphones

in use than people in the U.S. As a result, wireless revenue growth

is slowing and carriers are locked in a price war over a finite

amount of existing subscribers.

Comcast could reduce its infrastructure costs by integrating its

Wi-Fi network so that calls and data could be routed through its

Wi-Fi hot spots instead of cell towers, whenever possible. New

Street Research analyst Jonathan Chaplin said a cable company could

"easily steer more than 75% of data traffic to Wi-Fi."

"We believe this will mark a turning point for the U.S.

communications landscape," said Mr. Chaplin, who is bullish on

cable's prospects to steal away some market share from wireless

incumbents. He estimated that the wireless business could be worth

at least $6 a share of upside for Comcast's stock, translating into

over $14 billion of market value.

Comcast's ability to bundle wireless service with cable TV and

home broadband will also give it other advantages not easily

matched by wireless carriers. T-Mobile and Sprint Corp. don't have

home broadband or TV offers. Verizon has Fios high-speed internet

service, but its footprint is relatively small and the carrier has

avoided aggressively bundling Fios with wireless. AT&T Inc.

acquired DirecTV last year, giving it a huge foothold in video, but

AT&T's home internet speeds are relatively slow in much of its

footprint because of a continued reliance on copper wires.

For Verizon, Comcast's entry into wireless brings rewards as

well as potential risks. If Comcast is able to steal customers from

any of its three rivals, then Verizon wins by getting incremental

revenue. Even if customers switch from Verizon to Comcast, Verizon

is still able to make money off those connections.

One risk is that Comcast could get more ambitious, and that the

initial offer is just the first step in a bigger plan to compete.

Comcast is currently participating in a government auction of

wireless airwaves, which could be used to build a network.

Also at the Tuesday conference, Mr. Roberts introduced Comcast's

newly integrated Netflix experience on its next-generation X1

set-top box and guide. He said that working through that deal

brought the two companies, who have often fought bitterly, "a lot

closer."

Comcast is in discussions with several other video streaming

providers to integrate their services into the X1 box, Mr. Roberts

said.

Write to Shalini Ramachandran at shalini.ramachandran@wsj.com

and Ryan Knutson at ryan.knutson@wsj.com

(END) Dow Jones Newswires

September 20, 2016 16:01 ET (20:01 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

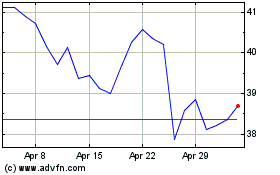

Comcast (NASDAQ:CMCSA)

Historical Stock Chart

From Mar 2024 to Apr 2024

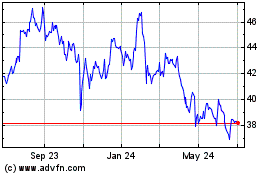

Comcast (NASDAQ:CMCSA)

Historical Stock Chart

From Apr 2023 to Apr 2024