Groupon Works to Win Back Investors

August 15 2016 - 8:30AM

Dow Jones News

Groupon Inc. is slowly winning back the kind of bargain hunter

it has sorely missed during the past three years: investors.

Months after newly appointed Chief Executive Rich Williams

lamented that Wall Street "misunderstood" the online discounter's

business model, Groupon's stock has rebounded. Its shares are up

nearly 90% this year and got a boost when its active users

surpassed 50 million globally in the recent quarter. Shares closed

at $5.73 on Friday in New York.

The Chicago company acts as a marketing outlet for restaurants,

beauty salons and other local businesses by selling discounted

services on their behalf. The company is projected to book revenue

of $3 billion this year, but until recently its market value was

half that. Rivals have struggled and Amazon.com Inc. last year shut

its Groupon competitor.

Groupon this year has gone on an offensive to try to recast the

company as one of the few online players able to succeed in local

markets. It also has owned its past mistakes and blames itself for

poorly communicating the company's story.

Mr. Williams, a former Amazon executive who has worked at

Groupon since before its 2011 IPO, says the company now has a more

straightforward game plan. It has retrenched globally, shedding

offices in 21 countries and cutting 2,000 jobs, or 20% of its

workforce. It is spending more money on customer service for the

U.S. market, which contributes two-thirds of its revenue.

"We've been simplifying the strategy and being consistent in

what we say," the 41-year-old CEO said in an interview. "How we

discuss the strategy internally is how we discuss the strategy

externally."

It also has succeeded in convincing some big investors to take

the risk. Chinese e-commerce giant Alibaba Group Holding Ltd.

revealed a 5.6% stake in February, when the company's stock was

near an all-time low. Atairos Management LP, an investment fund

launched by cable giant Comcast Corp., followed in April, buying

convertible bonds worth up to 7.5% of the company for $250 million.

At the time, Atairos said it hoped Comcast would work with Groupon

to expand its reach to more customers.

Ruth Ann Francis, a 41-year-old aerospace engineer from Fort

Worth, Texas, is the kind of sporadic customer Groupon would like

to get spending more. She said she uses about one or two deals a

year, usually for activities she wants do to anyway, like Segway

tours and minigolf. "This year I've used two already, so we're on

track to be a little higher," she said.

To attract new investors, Groupon has shifted its focus to

driving profitability from each deal it sells and avoiding "empty

calories" from deals such as electronics or high-end apparel sold

through its shopping site. The plan also rests on adding users more

quickly, even if doing so weighs on near-term results.

The company has posted losses in four straight quarters.

Marketing spending of $92 million in the latest quarter was at its

highest level since the first quarter of 2012, and a 61% increase

from a year ago. By comparison, revenue in the quarter rose just

2.4%.

"We obviously would love all this stuff to move faster, but

we're happy with the basics of how customer use is changing over

time," Mr. Williams said.

The company's cash position also is down. At the end of March,

Groupon had its lowest cash balance since it went public, with

$688.5 million in cash and equivalents. At the end of June, that

rose to $780 million, compared with the $1.1 billion on hand at the

same point last year. A Groupon spokesman said many of the expenses

that hit the company's cash flow earlier this year were

temporary.

Launched in 2008, Groupon once was considered among the

internet's hottest startups targeting local businesses, a

notoriously tough market for Web companies to pierce. It sported a

$16 billion market value shortly after its 2011 initial public

offering. Shareholders soured on the stock almost immediately as

losses ballooned and "deal fatigue" set in among its user base.

Changes to Gmail and other email programs made it more difficult

for Groupon's daily messages to get noticed, choking off a major

source of new business. The company also earned a reputation for

surprising the market with big losses, and its use of exotic

financial metrics that came under regulatory scrutiny.

Groupon plans to keep spending. It already has kicked off new TV

ads and is in talks with Comcast about expanding its marketing

campaign. Groupon also uses push notifications and ads on Google

and Facebook to remind users about restaurant deals and spa

promotions.

It appeared to be an also-ran, ready to join the ranks of

Myspace and Foursquare. In February, when its shares fell to an

all-time low, it was worth only $1.3 billion. That was a week

before Alibaba disclosed its investment.

Groupon faces a challenge convincing more skeptical customers

its discount offers are worthwhile. Macquarie analyst Tom White

said the service has made strides expanding its supply of local

businesses but has yet to reach its more ambitious audience goals.

"As far as driving that day-in, day-out usage, it's not going to be

easy," he said.

Write to Drew FitzGerald at andrew.fitzgerald@wsj.com

(END) Dow Jones Newswires

August 15, 2016 08:15 ET (12:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

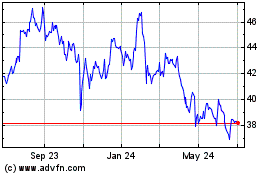

Comcast (NASDAQ:CMCSA)

Historical Stock Chart

From Mar 2024 to Apr 2024

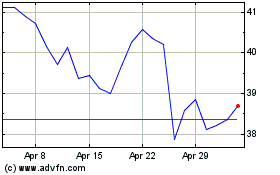

Comcast (NASDAQ:CMCSA)

Historical Stock Chart

From Apr 2023 to Apr 2024