Thanks to Michael Phelps, Katie Ledecky and Simone Biles, the

U.S. is on pace to take home the most gold medals at the 2016

Summer Olympics. When it comes to television ratings, however, NBC

may have to settle for a bronze.

Although the Rio Games are dominating everything else on

television, the performance is significantly below the 2012 Summer

Games held in London, according to Nielsen. Through Saturday,

Comcast Corp.'s NBC is averaging 27.9 million for the first nine

nights, down about 15.5% from the London Olympics, which finished

with an average of 33 million viewers. The Games are also off from

the 34.2 million viewers the 2008 Summer Olympics in Beijing

averaged.

So far, NBC isn't delivering the audience it promised

advertisers who spent more than $1.2 billion for commercials during

the 17-day event. Of particular concern is a roughly 30% drop among

viewers age 18-34, a demographic advertisers pay a premium to

reach.

The lower-than-expected ratings show that even an institution as

big as the Olympics isn't immune to changing media consumption

habits and the abundance of choice viewers have on television and

online.

"It's not that we're watching less, it's that we're watching

more than three channels," said Victor Matheson, a professor who

specializes in sports economics at the College of the Holy

Cross.

NBC has said it is unreasonable to expect ratings as high as

London with such swift changes to viewing habits. But it is taking

advantage of the plethora of platforms by putting Olympic events on

its cable networks as well as streaming every competition live.

Through Thursday, NBC's Olympics live streaming reached 1.28

billion minutes, passing the combined total of the London and Sochi

Games.

Combined, the streaming and cable coverage is adding about 2

million viewers a night—still not enough to overtake London.

Heading into the Olympics, headlines focused largely on Brazil's

struggle to prepare, with Zika virus concerns, political turmoil

and pollution. NBC's ability to promote the Games may have been

even more hindered by the bitter U.S. race for president between

Donald Trump and Hillary Clinton.

"There were more distractions than usual," said NBC Sports Group

Chairman Mark Lazarus. "The country is so hideously divided I think

it took people a little bit of time to get together and rally

behind the athletes."

While the first few days were down sharply from London including

a 35% drop for the opening ceremony, the gap has tightened as

compelling story lines emerged. Mr. Phelps collected his 23rd gold

medal in what may be his last Olympics, the U.S. gymnastics team

dominated and Ms. Ledecky swept events in the pool.

Despite the ratings decline from four years ago, NBC executives

and advertisers aren't upset.

"This will be our most economically successful Games in

history," said Mr. Lazarus. "We are extremely pleased with where we

are going to end up." Since the Games began, NBC has raked in an

additional $30 million in ad sales, he said.

NBC has enough inventory remaining in the Games to fulfill any

ratings shortfalls, he added.

Last month, NBCUniversal Chief Executive Steve Burke told

analysts the Rio Olympics will "make a lot more" than the

approximately $120 million profit from London.

The rights to the Rio Olympics were part of a $4.38 billion deal

NBCU struck in 2011 for the 2014 Games through 2020. NBC followed

that deal up in 2014 with a $7.65 billion pact to lock up the rest

of the Games through 2032.

Those large gambles don't intimidate Mr. Lazarus, even with all

the uncertainty surrounding traditional media. He notes that NBCU

has rights for all platforms and is free to experiment and create

new revenue streams that will allow the event to remain

profitable.

"Consumption patterns are changing but a company like ours is

part of facilitating that change," Mr. Lazarus said. "The set of

rights that we hold allows us to be part of whatever is happening

today and what's ahead."

Hypothetically, he said, that could even include selling the

Games directly to consumers.

Lee Berke, a sports media consultant, said NBCU made a good bet

despite the traditional ratings dip this year. NBCU is ahead of the

game by embracing streaming and putting more events on more

channels.

"You could see them have dedicated channels going forward for

every Olympic sport," he said. "There are going to be more dollars

down the road."

Ad buyers point out that any ratings shortfall won't damp future

interest in the Olympics because the audience is still a rarity in

the TV business.

"If you look at the numbers and compare them to the ratings for

an average program, the Olympics are far superior," said Rino

Scanzoni, chief investment officer of WPP PLC's GroupM, the world's

largest ad-buying firm.

Indeed, NBC's rivals are ready to concede more than just a

participation trophy.

"Relative to all other television, the Olympics are stronger

than ever," said David Poltrack, chief research officer for CBS

Corp.

Write to Joe Flint at joe.flint@wsj.com and Suzanne Vranica at

suzanne.vranica@wsj.com

(END) Dow Jones Newswires

August 14, 2016 21:45 ET (01:45 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

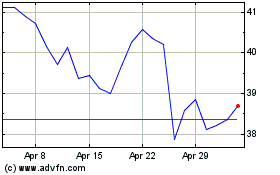

Comcast (NASDAQ:CMCSA)

Historical Stock Chart

From Mar 2024 to Apr 2024

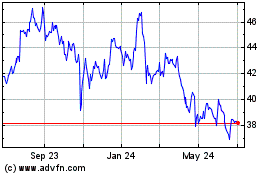

Comcast (NASDAQ:CMCSA)

Historical Stock Chart

From Apr 2023 to Apr 2024