Google parent Alphabet Inc. is rethinking its high-speed

internet business after initial rollouts proved more expensive and

time consuming than anticipated, a stark contrast to the fanfare

that greeted its launch six years ago.

Alphabet's internet provider, Google Fiber, has spent hundreds

of millions dollars digging up streets and laying fiber-optic

cables in a handful of cities to offer web connections roughly 30

times faster than the U.S. average.

Now the company is hoping to use wireless technology to connect

homes, rather than cables, in about a dozen new metro areas,

including Los Angeles, Chicago and Dallas, according to people

familiar with the company's plans. As a result Alphabet has

suspended projects in San Jose, Calif., and Portland, Ore.

Meanwhile, the company is trying to cut costs and accelerate its

expansion elsewhere by leasing existing fiber or asking cities or

power companies to build the networks instead of building its

own.

Google's announcement in 2010 of its Fiber project sparked high

expectations at a time when telephone companies were perceived as

moving slowly in rolling out faster broadband service. More than

1,000 cities applied and Google began service in the Kansas City

area in November 2012. The following month, Google Executive

Chairman Eric Schmidt told a conference that Fiber "isn't just an

experiment, it's a real business and we're trying to decide where

to expand next."

Today, Google Fiber has reached just six metro areas, the latest

example of the challenges facing digital companies seeking to move

into more traditional lines of business.

"If you're in the telecommunications industry for 150 years,

there are no surprises here," said Jonathan Reichental, chief

technology officer of the city of Palo Alto, Calif. "But if you're

a software company getting into the business for the first time,

this is a completely new world."

Mr. Reichental said Google Fiber executives recently told him

that plans to bring the service to Palo Alto and nearby cities are

on hold for at least six months.

In a written statement, Alphabet said, "We're continuing to work

with city leaders to explore the possibility of bringing Google

Fiber to many cities. This means deploying the latest technologies

in alignment with our product road map, while understanding local

considerations and challenges, which takes time."

The delays in Alphabet's fiber plans follow stumbles in other

arenas outside the company's core internet search and advertising

business. Alphabet stopped selling the first version of its Glass

wearable computer early last year amid privacy concerns; it has

distributed a revised version to some workplaces but hasn't

revealed an updated consumer model.

The company doesn't disclose financial results for the Fiber

unit, but consolidates them with other nonsearch businesses in its

"Other Bets" unit. That unit reported revenue of $185 million in

the latest quarter, primarily driven by Fiber, home-automation firm

Nest and life-sciences firm Verily, and an operating loss of $859

million. Fiber accounted for most of the unit's quarterly capital

expenditures of $280 million.

Alphabet hopes the investment in Google Fiber will eventually

pay off with subscriber fees and, indirectly, more clicks on its

search ads. Fiber costs $70 a month for the fastest internet

connection and an additional $60 a month for TV. Analysts estimate

a one-time cost for Alphabet of more than $500 for each home the

network reaches, not all of which subscribe.

Alphabet declined to disclose its number of subscribers. Based

on numbers reported to the U.S. Copyright Office, research firm

MoffettNathanson said in March the TV service had 53,000

subscribers total as of December.

There likely are many more subscribers for the internet service,

the firm said, but "one can't help but feel that all of this has

the flavor of a junior science fair."

Google Fiber has begun construction in five new metro areas and

announced plans to reach another dozen cities in the next few

years. Now, those dozen cities will be the test bed for a push into

wireless technology.

Google Fiber last month bought Webpass Inc., a company that

beams internet service from a fiber-connected antenna to another

antenna mounted on an apartment building. The company serves

roughly 820 buildings in five cities.

Webpass Chief Executive Charles Barr, now an Alphabet employee,

said wireless offers an opportunity to overcome the challenging

economics of building fiber networks from scratch. "Everyone who

has done fiber to the home has given up because it costs way too

much money and takes way too much time," he said.

In Kansas City, Alphabet also is testing a wireless technology

that delivers connections from antennas on street lamps. And the

company recently applied to the Federal Communications Commission

to test "experimental transmitters" for wireless connections in 24

U.S. locations during the next two years.

Google Fiber is planning a system that would use fiber for the

central network and antennas to connect each home wirelessly to

that network, according to a person familiar with the plans.

Alphabet Chairman Eric Schmidt said at the company's shareholder

meeting in June that wireless connections can be "cheaper than

digging up your garden" to lay fiber.

AT&T Inc. and Verizon Communications Inc. also have

discussed using wireless technology for the "last-mile" connection

to homes, but neither has deployed it widely.

Google Fiber is also trying other strategies to aid its

expansion In San Francisco.

In San Francisco and parts of Atlanta, the company is leasing

existing underused fiber and connecting apartment buildings rather

than single-family homes. It chose Huntsville, Ala., in part

because the city agreed to build a fiber network for Google.

In Tampa, Google Fiber is in talks with a power company to build

the fiber network. It is working with real-estate firm Irvine Co.

to pre-install fiber in new properties near Irvine, Calif., and it

hopes to strike similar deals with other builders.

The new strategies are in response to the headaches of building

a fiber network. In Kansas City, homeowners complained about

destroyed lawns and ruptured gas lines. In Nashville, Tenn., and

Louisville, Ky., competing telecom firms are blocking the company

from stringing fiber on their utility poles.

Some analysts have long suspected that Alphabet's primary goal

was to prod other broadband firms to increase their speeds.

AT&T, Comcast Corp. and Time Warner Cable, which recently was

acquired by Charter Communications Inc., have done so in some

competing markets.

Alphabet says Google Fiber is a real business. "We continue to

see Fiber as a huge market opportunity," Chief Financial Officer

Ruth Porat told investors last month. "We're being thoughtful and

deliberate in our execution path."

Shalini Ramachandran contributed to this article.

Write to Jack Nicas at jack.nicas@wsj.com

(END) Dow Jones Newswires

August 14, 2016 21:45 ET (01:45 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

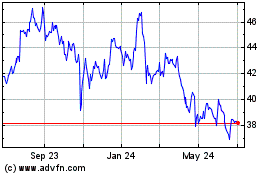

Comcast (NASDAQ:CMCSA)

Historical Stock Chart

From Mar 2024 to Apr 2024

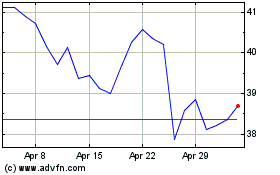

Comcast (NASDAQ:CMCSA)

Historical Stock Chart

From Apr 2023 to Apr 2024