By Shalini Ramachandran

Comcast Corp. reported better-than-expected financial results

and added video customers again in the first quarter, extending a

strong streak for the cable industry in a weak overall pay-TV

market.

Comcast Chief Executive Brian Roberts said the company's

addition of net video subscribers over the past 12 months is "an

important milestone that has eluded us for nearly a decade."

Speaking on the company's earnings conference call Wednesday,

Mr. Roberts and other Comcast executives attributed the growth to

reduced customer cancellations, known as churn, thanks to better

video products like its X1 set-top box and voice-enabled remote, as

well as heightened investment in customer service. Nearly 35% of

Comcast's video base now has X1 boxes, the company said.

Comcast added 53,000 video customers, compared with a loss of

8,000 in the prior-year quarter. Its quarterly profit rose to $2.13

billion, or 87 cents a share, up from $2.06 billion, or 81 cents a

share, a year ago.

Excluding certain gains and costs, adjusted profit per share for

the latest quarter was 84 cents. Revenue grew 5.3% to $18.79

billion. Both figures exceeded estimates from analysts, who were

projecting adjusted earnings of 79 cents a share on $18.6 billion

in revenue, according to Thomson Reuters.

Since its Time Warner Cable Inc. deal fell apart last year amid

regulatory opposition, Comcast has been on the lookout for new

deals, investing in digital media companies and theme parks. The

company is now in talks to buy DreamWorks Animation SKG Inc. for

more than $3 billion, The Wall Street Journal reported late

Tuesday. Adding the animation studio to its arsenal could help

Comcast become a more formidable rival to Walt Disney Co. in family

entertainment and allow it to use DreamWorks franchises like

"Shrek" and "Kung Fu Panda" to build out its consumer products and

theme parks businesses, which Wall Street is beginning to view as a

key growth driver.

"Theme Parks must now be viewed as a foundational element of the

Comcast story, and no doubt is a big part of their interest in

DreamWorks," MoffettNathanson analyst Craig Moffett wrote in a

research note Wednesday. Revenue at the theme parks segment grew

58% to $1 billion in the first quarter, thanks to the inclusion of

Universal Studios Japan, which Comcast bought control of last

September.

On the call, Comcast executives declined to comment on the deal

reports. But NBCUniversal Chief Executive Steve Burke emphasized

the value of the film studio's movie franchises, which include

animated hits like "Minions."

"We are doing everything we can to make sure that the franchises

we have are as strong as possible," he said. Mr. Burke said that

during the film group's five-year plan review meeting Tuesday "we

spent half the time talking about how to take care of franchises,

make sure that they stay fresh, create new ones, [and] make sure

they are fully monetized in consumer products and around the

world."

Class A shares of Comcast, up 13% over the past three months,

were flat at $61.05 in late morning trading. DreamWorks Animation

shares increased 14% to $31.

Comcast's results add to the cable industry's comeback after

years of losing video subscribers to satellite and phone companies.

Cable companies are benefiting from pouring more investment into

their cable TV products and bundling that alongside fast broadband,

as well as offering cheaper, slimmed-down bundles of programming

for more cost-conscious consumers.

Comcast has been among cable companies in recent quarters to

bolster its cable-TV customers even as the overall pay TV industry

continues to experience "cord-cutting" and "cord-shaving," when

people disconnect their subscriptions or opt for cheaper, skinnier

packages.

Comcast's broadband and business services divisions posted

strong sales growth in the first quarter, lifting overall revenue

at the cable business -- which accounts for the bulk of Comcast's

top line -- by 6.7% to $12.2 billion.

Broadband revenue increased 7.6% to $3.3 billion, while voice

revenue fell 1.1% to $896 million. Video revenue grew 3.9% to $5.5

billion. Business-services revenue jumped 17.5% to $1.3

billion.

The cable giant added 438,000 broadband customers in the quarter

compared with 407,000 a year earlier.

At NBCUniversal, revenue grew 3.9% to $6.9 billion, as its cable

networks and theme parks businesses offset revenue declines at

filmed entertainment and broadcast TV. Excluding the year-ago boost

from the 2015 Super Bowl, NBCU's revenue increased 10.2%. Operating

cash flow at NBCU increased 10% to $1.6 billion.

Revenue grew 4% at the unit that includes the company's cable TV

networks, and operating cash flow grew 6.4% to $956 million. Higher

pay-TV carriage fees from distributors offset a decline in the NBCU

cable networks' subscribers, who come from any pay TV provider, not

just Comcast's cable service.

Mr. Burke said the decline isn't a "major change" and reiterated

that the cable-network business, while still a "good business" is

"not going to grow the way it did 10 years ago." Still, Mr. Burke

struck an upbeat note looking forward to the Summer Olympics that

will be broadcast on NBC, and he predicted a "strong upfront"

market, when marketers commit to spending ad dollars on TV ahead of

the fall season.

Revenue at the broadcast-TV segment, which includes the flagship

NBC network, declined 7.3%. Excluding the impact of the Super Bowl

last year, it would have grown 11.4%.

Coming off a blockbuster year, filmed entertainment saw a drop

in revenues and operating cash flow because of a decline in home

entertainment and theatrical revenues.

Write to Shalini Ramachandran at

shalini.ramachandran@wsj.com

(END) Dow Jones Newswires

April 27, 2016 11:30 ET (15:30 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

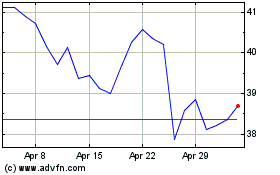

Comcast (NASDAQ:CMCSA)

Historical Stock Chart

From Mar 2024 to Apr 2024

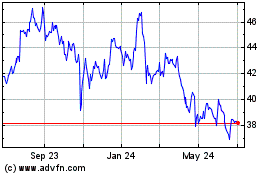

Comcast (NASDAQ:CMCSA)

Historical Stock Chart

From Apr 2023 to Apr 2024