By Shalini Ramachandran

Comcast Corp. is fending off the cord-cutting trend.

The nation's largest cable company added video customers in the

fourth quarter, capping off its best year in almost a decade as

cable providers gain market share in a contracting pay-TV

market.

The company added 89,000 video customers, compared with 6,000 in

the prior-year quarter, contributing to a boost in quarterly

profit. Comcast only lost 36,000 video customers in 2015, the

company's best result in nine years.

Comcast's results illustrate the strength of cable operators,

who for years lost video subscribers to satellite and phone

companies but have lately clawed back share. Cable companies are

benefiting from investments in their cable-TV products and bundling

those alongside fast broadband, as well as offering cheaper,

slimmed-down bundles of programming for more cost-conscious

consumers.

"Amidst pay TV's worst year ever, cable just enjoyed its best

year in the past decade," MoffettNathanson analyst Craig Moffett

wrote in a research note Wednesday.

Shares of Comcast, down 13% over the past three months, rose

2.4% to $55.92 in morning trading as the company also announced

plans to increase its dividend and its stock-buyback plan.

Comcast is beginning to benefit from the aggressive rollout of

its souped-up X1 Internet-connected set-top box and guide, which it

has said increases customers' time spent watching TV and makes them

more likely to stick with Comcast. The company said that more than

60% of its new customers were X1 subscribers.

Chief Executive Brian Roberts also credited Comcast's recent

investments in customer service for helping to retain customers.

The company last year budgeted $300 million to turning around its

customer operations, including building an Uber-like app to allow

customers to track and rate their technicians, after some

embarrassing episodes of poor customer interactions went viral.

The overall pay-TV industry is trying to combat "cord-cutting"

and "cord-shaving," as people disconnect their subscriptions and

opt for cheaper, skinnier packages. Mr. Moffett estimates the

industry is contracting at a rate of 0.9% a year, despite an

increase in new household formation.

But Comcast said that 75% of its new video customers in the

fourth quarter signed up for big TV packages. The big bundle "is

going to continue to be a very good business for a long time," said

NBCUniversal Chief Executive Steve Burke, who oversees the

company's TV networks.

Given the broader trends, Comcast said it is seriously exploring

a new growth opportunity in wireless. Comcast said it plans to file

to participate in the coming government auction of wireless

spectrum, which will enable the cable operator to potentially buy

wireless airwaves to be used for offering mobile service.

"We are going to evaluate, consider and may purchase, but only

if we consider the price is right," Chief Financial Officer Michael

Cavanagh said on the call.

Comcast's fourth-quarter profit grew 2.4% to $1.97 billion, or

79 cents a share, up from $1.93 billion, or 74 cents a share, a

year ago.

Excluding certain gains and costs, adjusted profit for the

latest quarter was 82 cents a share. Revenue rose 8.5% to $19.2

billion. Analysts were projecting adjusted earnings of 82 cents a

share on $18.8 billion in revenue, according to estimates from

Thomson Reuters.

Almost two years since it attempted to buy Time Warner Cable,

speculation on Wall Street has picked up about Comcast's next big

deal. On the call, Mr. Roberts said he doesn't "feel that we need

to go and change the face of our company," but "we are always

looking to see if there are ways we can grow shareholder value." He

said that the company's new fund run by former CFO Michael

Angelakis is "scouring the globe for smart investments."

Comcast's broadband and business-services divisions posted

strong revenue growth in the fourth quarter, offsetting softness in

the voice and cable advertising units. Video revenue grew 4.4% to

$5.4 billion. Broadband revenue increased 9.8% to $3.2 billion, and

business-services revenue jumped 18.9% to $1.3 billion. Overall, at

the cable business, which accounts for the bulk of the top line at

Comcast, revenue rose 5.9% to $11.98 billion.

The cable giant added 460,000 broadband customers in the quarter

compared with 375,000 a year earlier. Voice customer additions grew

to 139,000, compared with 123,000.

Excluding certain one-time items like the 2015 Super Bowl and

the acquisition of a majority stake in Universal Studios Japan last

year, NBCUniversal revenue increased 10.5% to $7.3 billion, powered

by growth at the filmed entertainment and theme parks divisions.

Operating cash flow grew 4.7% to $1.5 billion.

Revenue grew 3.4% at the unit that includes the company's cable

TV networks, despite ongoing ratings pressures, but operating cash

flow--a measure of profitability--declined 1.9% because of

increased programming expenses from the licensing of Nascar rights.

Revenue at the broadcast-TV segment, which includes the flagship

NBC network, grew 7%, while operating cash flow declined 5.6% to

$217 million because of higher expenses.

Filmed entertainment continued to profit from its blockbuster

year, increasing operating cash flow 85% to $143 million. Operating

cash flow at the theme parks segment grew 37% to $452 million,

though it only grew 12% excluding the Universal Studios Japan

deal.

The company said it was boosting its quarterly dividend 10% to

$1.10 per share a year. It also increased its share-repurchase

program to $10 billion, with $5 billion to be repurchased this

year.

Write to Shalini Ramachandran at

shalini.ramachandran@wsj.com

(END) Dow Jones Newswires

February 03, 2016 11:58 ET (16:58 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

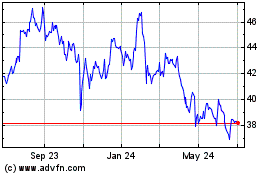

Comcast (NASDAQ:CMCSA)

Historical Stock Chart

From Mar 2024 to Apr 2024

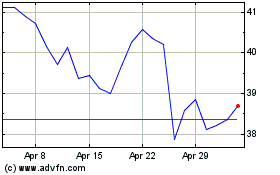

Comcast (NASDAQ:CMCSA)

Historical Stock Chart

From Apr 2023 to Apr 2024