By Shalini Ramachandran And Lukas I. Alpert

Steve Burke, chief executive of Comcast Corp.'s NBCUniversal,

stood in front of his senior executive team earlier this year and

gave them a directive: the media giant needs to go where the

eyeballs are going, he said, and get more "digital" into its

DNA.

A few months later NBCUniversal has made some headway in

realizing those ambitions. The company on Tuesday said it agreed to

invest $200 million in BuzzFeed in a deal that people familiar with

the situation say values the new-media company at $1.5 billion. The

pact comes a week after NBCUniversal said it would invest the same

amount in BuzzFeed competitor Vox Media.

The deals give NBCUniversal more exposure to sites that offer a

combination of news, lists and advertiser-sponsored content, and

specialize in reaching the young audiences that are increasingly

fleeing traditional TV. NBCUniversal sees potential to partner with

BuzzFeed and Vox on everything from advertising to creating

television programming to appeal to younger viewers, people

familiar with the deal say.

For BuzzFeed, the investment would allow the company "to grow

and invest without pressure to chase short-term revenue or rush an

IPO," Chief Executive Jonah Peretti said in a memo to staff. In

2014, the company said it had taken in over $100 million in

revenue.

In an interview, Mr. Peretti said there could be many potential

strategic partnerships for the companies, including allowing

marketers to promote across NBCUniversal properties and BuzzFeed.

And he said the resources will help BuzzFeed expand into television

and film, which he estimates will only make up about 10% to 20% of

BuzzFeed's business long term but require bigger content

investments than online media.

"The cost structure of traditional media is much higher--the

cost to make a movie or show is higher," he said, adding that even

though BuzzFeed aims to improve on the efficiency of Hollywood's

traditional model, "it's still going to take significant

investment."

On Monday, BuzzFeed also announced that it had signed a joint

venture deal with Yahoo Japan to create a local Japanese-language

version of the site. Japan would be the ninth foreign market

BuzzFeed has expanded into and the company says it now gets 45% of

its traffic from abroad.

Many media industry observers have been expecting for the past

year to see big mergers among TV channel owners to deal with

mounting pressures in the pay TV world. But so far no such

blockbuster transactions have happened. Instead, several media

companies appear to be directing their capital--at least for the

moment--into digital media companies that hold the promise of

powering future growth.

Unlike the venture investments traditional giants have made for

years, these are sizable bets. Time Warner Inc.'s Turner cable unit

paid nearly $200 million for a majority stake in Web TV tech vendor

iStreamPlanet, saying the deal could help expand Turner's online

video products. 21st Century Fox in July invested $150 million in

sports fantasy startup DraftKings Inc., which is attracting the

coveted demographic of young men.

Last year, A+E Networks, which is jointly owned by Walt Disney

Co. and Hearst Corp., invested $250 million in Vice Media and has

since sought to rebrand one of its channels as a Vice channel.

As for Comcast, the company in April abandoned a $45.2 billion

bid to buy Time Warner Cable after strong pushback in Washington.

Since then, its entertainment arm, NBCUniversal, has been actively

scouting for digital media deals, including with Vice Media, AOL's

Huffington Post, BuzzFeed and Vox Media, people familiar with the

situation say. The company decided to move ahead with the

investments in BuzzFeed and Vox.

NBCUniversal, which owns channels such as USA, Bravo, E! and

MSNBC, has struggled like other media companies to maintain a

connection with young viewers, who have increasingly dropped their

cable connections in favor of watching video online. According to a

Horizon Media analysis of Nielsen data, only about a quarter of

people ages 18 to 34 watch prime-time TV, compared with 53.1% of

those over 55.

More than half of BuzzFeed's 82.4 million unique visitors in

July were between the ages of 18 and 34, according to comScore Inc.

Vox Media, which is made up of eight websites focused on sports,

politics, food, fashion and technology, had a combined 54.4 million

unique visitors in July, with more than 40% between the ages of 18

and 34.

One potential area of partnership with BuzzFeed is the Olympics,

which NBC telecasts. For a big television feature on a key Olympic

swimmer, for example, BuzzFeed could create promotional videos of

younger Olympic swimmers that could help generate interest among

younger viewers for the television broadcast and bring in ad

dollars, the person familiar with NBCU's thinking said. In

addition, some popular BuzzFeed shows such as "The Try Guys" --a

show where a few men try outlandish acts such as walking a mile

with fake pregnant bellies--could get picked up as a television

show or segment on an NBCU channel, the person said.

In advertising, NBCU could join forces with Vox and BuzzFeed to

package together younger audiences for advertisers to target. NBCU

could offer a marketer a chance to buy ads across its cable

channels Bravo and E! as well as BuzzFeed and Vox to reach a

particular demographic, for instance, the person said. NBCU's news

properties also hope to learn from BuzzFeed's expertise in making

stories and videos go viral.

Before the NBCUniversal investment, BuzzFeed had raised $96.3

million in five investment rounds. Last year, it raised $50 million

from venture-capital firm Andreessen Horowitz, valuing the company

at $850 million.

As part of the deals, NBCU will likely have a seat on the boards

of each company, according to a person familiar with the

transactions, which will give the media giant a voice in the

startups' strategic direction.

Amol Sharma contributed to this article.

Write to Shalini Ramachandran at shalini.ramachandran@wsj.com

and Lukas I. Alpert at lukas.alpert@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

August 18, 2015 16:05 ET (20:05 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

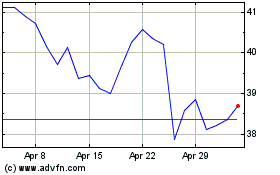

Comcast (NASDAQ:CMCSA)

Historical Stock Chart

From Mar 2024 to Apr 2024

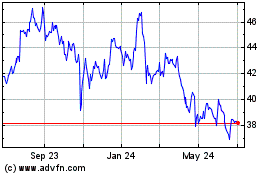

Comcast (NASDAQ:CMCSA)

Historical Stock Chart

From Apr 2023 to Apr 2024