UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 29, 2014

CLEAN ENERGY FUELS CORP.

(Exact Name of Registrant as Specified in Charter)

|

Delaware |

|

001-33480 |

|

33-0968580 |

|

(State or Other Jurisdiction of

Incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

|

4675 MacArthur Court, Suite 800, Newport Beach,

California |

|

92660 |

|

(Address of Principal Executive Offices) |

|

Zip Code |

(949) 437-1000

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 1.01 Entry into a Material Definitive Agreement.

Sale of Interest in Dallas Clean Energy, LLC

On December 29, 2014 (the “Closing Date”), Mavrix, LLC (“Mavrix”), a wholly owned subsidiary of Clean Energy Fuels Corp. (“Clean Energy”), entered into a Membership Interest Purchase Agreement (the “Agreement”) with Cambrian Energy McCommas Bluff III LLC (“Cambrian”), pursuant to which Clean Energy, through Mavrix, sold its entire 51% interest in Dallas Clean Energy, LLC (“DCE”) to Cambrian. DCE owns all of the equity interests in Dallas Clean Energy McCommas Bluff, LLC, which owns a renewable natural gas extraction and processing project at the McCommas Bluff landfill in Dallas, Texas (the “Project”). As consideration for the sale of DCE, Clean Energy, through Mavrix, received $40.6 million in cash on the Closing Date and may receive up to an additional $3.0 million in cash on or before August 14, 2015, subject to the results of certain performance tests to be performed at the Project on or before August 1, 2015 in accordance the terms of the Agreement. Prior to the Closing Date, Cambrian owned the remaining 49% interest in DCE. Clean Energy will continue to have the right to market and sell biomethane produced at the McCommas Bluff project under its Redeem renewable natural gas vehicle fuel brand.

Also on the Closing Date, Mavrix delivered $13.6 million of the cash proceeds paid to it under the Agreement to Massachusetts Mutual Life Insurance Company as payment in full of all outstanding indebtedness under the Note Purchase Agreement dated as of April 25, 2013 (the “NPA”) and a related secured promissory note (the “Note”). Such amount includes approximately $750,000 as payment of an early termination fee required pursuant to the terms of the NPA and the Note. Concurrently with such payment, the Note Purchase Agreement, the Note and all other documents related thereto were terminated in full.

The foregoing description of the Agreement and the Note Purchase Agreement do not purport to be complete and are qualified in their entirety by the complete text of each such document, copies of which are attached as Exhibit 2.10 to this Current Report on Form 8-K and Exhibit 10.82 to Clean Energy’s Current Report on Form 8-K filed with the Securities and Exchange Commission on April 26, 2013, respectively, and are incorporated herein by reference. The Agreement contains customary representations and warranties by the parties thereto, which were made only for the purposes of the Agreement as of specific dates, may have been qualified by certain disclosures between the parties, are subject to a contractual standard of materiality different from those generally applicable to stockholders, among other limitations, and should not be relied upon as a disclosure of factual information. Clean Energy issued a press release on January 5, 2015 regarding the Agreement, a copy of which is attached as Exhibit 99.1 to this Current Report on Form 8-K.

Amendment to GE Credit Agreement

On November 7, 2012, Clean Energy, through two wholly owned subsidiaries (the “Borrowers”), entered into a Credit Agreement (“Credit Agreement”) with General Electric Capital Corporation (“GE”). Pursuant to the Credit Agreement, GE agreed to loan to the Borrowers up to an aggregate of $200 million to finance the development, construction and operation of two liquefied natural gas (“LNG”) production facilities (individually a “Project” and together the “Projects”), each with an expected production capacity of approximately 250,000 LNG gallons per day.

On December 29, 2014, the Borrowers and GE entered into an Amendment to the Credit Agreement (the “Credit Agreement Amendment”) providing, among other things, that (i) the Credit Agreement will terminate if the initial loans under the Credit Agreement (collectively, “Loans” and, with respect to each Project “Tranche A Loans” and “Tranche B Loans”) for the Projects are not made prior to December 31, 2016 (rather than December 31, 2014, as the Credit Agreement originally provided), (ii) each Project must be completed by the earlier of (a) the date that is thirty months after the funding of the initial Loans with respect to such Project and (b) December 31, 2018 (rather than December 31, 2016, as the Credit Agreement originally provided), and (iii) prior to the funding of the Loans, the Borrowers will be required to enter into agreements with GE Oil & Gas, Inc. relating to the purchase of equipment for the Projects. Except as expressly provided in the Credit Agreement Amendment, all terms of the Credit Agreement remain unchanged and in full force and effect in accordance with their original terms, including, without limitation, the conditions to the Borrowers’ ability to obtain the Loans from GE under the Credit Agreement.

1

Also on December 29, 2014, Clean Energy and GE entered into an amendment to a warrant (the “Warrants Amendment”) that was originally issued to GE concurrently and in connection with the execution of the Credit Agreement (such warrant, the “Warrant”). The Warrant entitles GE to purchase up to an aggregate of five million shares of Clean Energy’s common stock, par value $0.0001 per share (“Shares”), at a price per share of $0.01. The Shares subject to the Warrant, as originally issued, were to become exercisable pursuant to the following schedule: (i) 500,000 Shares were immediately exercisable (the “Commitment Fee Shares”), (ii) an additional 1,250,000 shares were to become exercisable at the time that the first Tranche A Loan is made under the Credit Agreement, (iii) an additional 1,250,000 shares were to become exercisable at the time that the first Tranche B Loan is made under the Credit Agreement, (iv) an additional 1,000,000 shares were to become exercisable at the time that Tranche A Loans in aggregate principal amount of at least $15 million have been made under the Credit Agreement, and (v) the remaining 1,000,000 shares were to become exercisable at the time that Tranche B Loans in aggregate principal amount of at least $15 million have been made under the Credit Agreement; provided, however, that if no Loans were made as contemplated by (ii) through (v) above pursuant to the Credit Agreement, an additional 500,000 Shares (the “Termination Shares”) were to become exercisable. The Warrants Amendment amends the Warrant to provide that the Shares subject to the Warrant become exercisable pursuant to the following schedule: (i) the Commitment Fee Shares continue to be immediately exercisable, (ii) the Termination Shares become exercisable at any time (during the term of the Warrant) on or after December 31, 2014, (iii) an additional 1,250,000 shares become exercisable at the time that the first Tranche A Loan is made under the Credit Agreement, (iv) an additional 1,250,000 shares become exercisable at the time that the first Tranche B Loan is made under the Credit Agreement, (v) an additional 750,000 shares become exercisable at the time that Tranche A Loans in aggregate principal amount of at least $15 million have been made under the Credit Agreement, and (vi) the remaining 750,000 shares become exercisable at the time that Tranche B Loans in aggregate principal amount of at least $15 million have been made under the Credit Agreement. Except as expressly provided in the Warrants Amendment, all terms of the Warrant remain unchanged and in full force and effect in accordance with their original terms.

The foregoing description of the Credit Agreement, the Credit Agreement Amendment, the Warrant and the Warrants Amendment is only a summary of the terms of each such agreement and is qualified by reference to the full text of each document. The Warrants Amendment and the Credit Agreement Amendment are filed as Exhibits 4.15 and 10.97, respectively, to this Current Report on Form 8-K and are incorporated herein by reference. The Credit Agreement and the Warrant are described in and filed as Exhibits 10.70 and 10.73, respectively, to Clean Energy’s Current Report on Form 8-K filed with the Securities and Exchange Commission on November 13, 2012, which documents and descriptions are incorporated herein by reference.

Item 1.02 Termination of a Material Definitive Agreement.

The information set forth in Item 1.01 of this Current Report regarding the termination of the NPA and the Note is incorporated by reference into this Item 1.02.

Item 2.01 Completion of Acquisition or Disposition of Assets.

The information set forth in Item 1.01 of this Current Report regarding the Agreement is incorporated by reference into this Item 2.01.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet. Arrangement.

The information set forth in Item 1.01 of this Current Report on Form 8-K regarding the Credit Agreement and the Credit Agreement Amendment is incorporated by reference into this Item 2.03.

Item 3.02 Unregistered Sales of Equity Securities.

The information set forth in Item 1.01 of this Current Report on Form 8-K regarding the Warrant and the Warrant Amendment is incorporated by reference into this Item 3.02.

2

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

|

Exhibit |

|

Description |

|

2.10 |

|

Membership Interest Purchase Agreement dated December 29, 2014, between Mavrix, LLC and Cambrian Energy McCommas Bluff III LLC* |

|

|

|

|

|

4.15 |

|

Warrants Amendment dated December 29, 2014, by and among Clean Energy Fuels Corp., General Electric Company and GPFS Securities Inc. |

|

|

|

|

|

10.97 |

|

Amendment to Credit Agreement dated December 29, 2014, by and among Clean Energy Tranche A LNG Plant, LLC, Clean Energy Tranche B LNG Plant, LLC and General Electric Capital Corporation. |

|

|

|

|

|

99.1 |

|

Press Release issued by Clean Energy, dated January 5, 2015. |

* Schedules and exhibits have been omitted pursuant to Item 601(b)(2) of Regulation S-K. A copy of any omitted schedule or exhibit will be furnished supplementally to the Securities and Exchange Commission upon request; provided, however, that Clean Energy may request confidential treatment pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended, for any schedule or exhibit so furnished.

Forward-Looking Statements

This Form 8-K, including the exhibits filed herewith, contains certain forward-looking statements regarding the disposition of DCE to Cambrian, including, without limitation, statements regarding the potential amount of contingent consideration that may be paid to Clean Energy in the future. Actual events or results may differ materially from those contained in these forward-looking statements. Among the important factors that could cause future events or results to vary from those addressed in the forward-looking statements include, without limitation, the results of certain performance tests to be performed at the Project on or before August 1, 2015 in accordance the terms of the Agreement. The Company is under no duty to update any of the forward-looking statements after the date of this Current Report on Form 8-K to conform to actual results.

3

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

Date: January 5, 2015 |

|

Clean Energy Fuels Corp. |

|

|

|

|

|

|

By: |

/s/ Andrew J. Littlefair |

|

|

|

Name: Andrew J. Littlefair |

|

|

|

Title: President and Chief Executive Officer |

4

Exhibit 2.10

MEMBERSHIP INTEREST PURCHASE AGREEMENT

THIS MEMBERSHIP INTEREST PURCHASE AGREEMENT (this “Agreement”) is entered into as of December 29, 2014 (the “Effective Date”) by and among Cambrian Energy McCommas Bluff III LLC (the “Purchaser”) and Mavrix, LLC (the “Seller”).

R E C I T A L S

A. Seller and Purchaser are parties to that certain Limited Liability Company Agreement dated August 15, 2008 (“LLC Agreement”) of Dallas Clean Energy LLC (“DCE” and f/k/a CE Dallas Renewables LLC).

B. Seller owns 51% of the outstanding membership interests of DCE, representing a 51% share of DCE’s profits, losses and distributions (the “Transferred Membership Interests”).

C. On September 4, 2014, Purchaser delivered to Seller a Buy/Sell Notice pursuant to the LLC Agreement.

D. Purchaser and Seller desire to enter this Agreement to facilitate the sale of all of the Transferred Membership Interests to Purchaser pursuant to the Buy/Sell Notice and the LLC Agreement.

AGREEMENT

NOW, THEREFORE, in consideration of the promises and the respective representations, warranties, covenants, agreements and conditions hereinafter set forth, and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto hereby agree as follows:

ARTICLE 1

DEFINITIONS

1.1 Capitalized terms used in this Agreement and not otherwise defined herein have the meanings given to such terms in the LLC Agreement.

ARTICLE 2

PURCHASE AND SALE OF THE TRANSFERRED INTEREST

2.1 Purchase and Sale. Concurrently herewith:

(a) Seller, by its execution hereof, hereby sells and assigns to Purchaser all of the Transferred Membership Interests;

(b) Purchaser has delivered to Seller payment, by wire transfer to a bank account designated in writing by Seller, immediately available funds in an amount equal to $40,587,749.59 (the “Purchase Price”), which amount includes $15,198,749.59 of the “Additional Stated Value” payments available to the Seller on the Effective Date as described in Exhibit A to the Buy/Sell Notice;

1

(c) Additional consideration maybe payable by Purchaser to Seller pursuant to Section 2.2;

(d) Purchaser confirms that the terms and conditions set forth in Exhibit B to the Buy/Sell Notice have been satisfied and remain satisfied as of the Effective Date;

(e) Purchaser, Seller, DCE and Dallas Clean Energy McCommas Bluff LLC (“DCEMB”) have entered the Joint Interest Agreement attached hereto as Exhibit A; and

(f) Seller has delivered written resignations of directors, managers and officers of DCE and DCEMB listed on Schedule 2.1.

2.2 Additional Payments.

(a) Seller and Purchaser acknowledge that (i) $5,340,749.93 of the Purchase Price is attributable to the “H2S Removal System Performance Payment,” as defined and discussed in the Buy/Sell Notice and the Exhibits and Annexes thereto, and that the test conducted pursuant to Annex A to the Buy/Sell Notice determined the removal efficiency of the hydrogen sulfide removal system (the “H2S System”) to be 70.5% (the “Base Efficiency”); and (ii) the H2S System achieved an operating availability in excess of 98% as required by and in accordance with Annex A to the Buy/Sell Notice. At Seller’s option, Purchaser and Seller will cause an additional test of the H2S System to be performed no later than August 1, 2015 (the “Subsequent Test”). Such test shall be conducted in accordance with Annex A to the Buy/Sell Notice and overseen by an independent engineer agreed to by Seller and Purchaser. Within 10 business days of the completion of the Subsequent Test, Purchaser will pay to Seller an additional $75,755.32 for each 1% increase in operating efficiency of the H2S System over the Base Efficiency (up to a maximum of $1,780,250.02). For the avoidance of doubt, Seller shall not be required to return any portion of the Purchase Price to Purchaser if the operating efficiency of the H2S System as demonstrated by the Subsequent Test is less than the Base Efficiency.

(b) At a time mutually agreed to by Seller and Purchaser, the Train 2 PSA System (as defined in the Buy/Sell notice and the Exhibits and Annexes thereto) shall undergo a 3 day continuous performance test conducted pursuant to Annex I and overseen by an independent engineer mutually acceptable to Seller and Purchaser to determine the processing capacity and efficiency of the Train 2 PSA System. Such test shall be completed on or before August 1, 2015. Provided that the foregoing test demonstrates that the Train 2 PSA System has a capacity in excess of its nominal inlet processing capacity of 5.5 million standard cubic feet of landfill gas per day, Purchaser will pay to Seller addition consideration, determined in accordance with Schedule 2.2(b), based on the demonstrated capacity and efficiency of the Train 2 PSA System. Such additional consideration shall be paid within 10 business days of the completion of the test contemplated by this Section 2.2(b).

2

2.3 Books and Records. Seller will deliver all books and records of DCE and DCEMB, copies of which are not in the possession of Purchaser as of the Effective Date, on or before March 31, 2015;

ARTICLE 3

REPRESENTATIONS AND WARRANTIES

3.1 Representations and Warranties Regarding Seller and the Transferred Membership Interests. Seller hereby represents and warrants to the Purchaser on the Effective Date as follows:

(a) Title; Capitalization.

(i) Seller has good and marketable title to one hundred percent (100%) of the Transferred Membership Interests and owns the same free and clear of any liens, claims, security interests and encumbrances (other than pursuant to the LLC Agreement) (“Claims”), except for Claims that will be discharged in connection with the consummation of the transactions contemplated by this Agreement.

(ii) The purchase and sale of the Transferred Membership Interests as contemplated herein will pass title to such Transferred Membership Interests to the Purchaser, free and clear of all Claims.

(b) Authority. Seller is an entity duly organized, validly existing and in good standing under the laws of the jurisdiction of its organization with full right, corporate, partnership or other applicable power and authority to enter into and to consummate the transactions contemplated by this Agreement and otherwise to carry out its obligations hereunder, and the execution, delivery and performance by Seller of the transactions contemplated by this Agreement have been duly authorized by all necessary corporate or similar action on the part of Seller. This Agreement, when executed and delivered by Seller, will constitute a valid and legally binding obligation of Seller, enforceable against Seller in accordance with its terms, except (a) as limited by applicable bankruptcy, insolvency, reorganization, moratorium, fraudulent conveyance, and any other laws of general application affecting enforcement of creditors’ rights generally or (b) as limited by laws relating to the availability of specific performance, injunctive relief, or other equitable remedies.

3.2 Representations and Warranties Regarding Purchaser. Purchaser hereby represents and warrants to Seller as follows:

(a) Authority. Purchaser is an entity duly organized, validly existing and in good standing under the laws of the jurisdiction of its organization with full right, corporate, partnership or other applicable power and authority to enter into and to consummate the transactions contemplated by this Agreement and otherwise to carry out its obligations hereunder, and the execution, delivery and performance by Purchaser of the transactions contemplated by this Agreement have been duly authorized by all necessary corporate or similar action on the part of Purchaser. This Agreement, when executed and delivered by Purchaser, will constitute a valid and legally binding obligation of Purchaser, enforceable against Purchaser

3

in accordance with its terms, except (a) as limited by applicable bankruptcy, insolvency, reorganization, moratorium, fraudulent conveyance, and any other laws of general application affecting enforcement of creditors’ rights generally or (b) as limited by laws relating to the availability of specific performance, injunctive relief, or other equitable remedies.

3.3 No Other Representations. Except for the representations and warranties contained in Sections 3.1 and 3.2, none of Seller, Purchaser or any other Person has made or makes any other express or implied representation or warranty, either written or oral, with respect to DCE, DCEMB, the Transferred Membership Interests, or any other subject matter.

ARTICLE 4

TAX MATTERS

4.1 Tax Covenants.

(a) All transfer, documentary, sales, use, stamp, registration, value added and other such Taxes and fees (including any penalties and interest) incurred in connection with this Agreement shall be borne and paid by Seller when due. Seller shall, at its own expense, timely file any Tax Return or other document with respect to such Taxes or fees (and Purchaser shall cooperate with respect thereto as necessary).

(b) Purchaser shall prepare, or cause to be prepared, all Tax Returns required to be filed by DCE or DCEMB after the Effective Date with respect to a tax period prior to the Effective Date. Any such Tax Return shall be prepared in a manner consistent with past practice (unless otherwise required by Applicable Law) and without a change of any election or any accounting method which has an adverse impact to Seller and shall be submitted by Purchaser to Seller (together with schedules, statements and, to the extent requested by Seller, supporting documentation) at least 30 days prior to the due date (including extensions) of such Tax Return. If Seller objects to any item on any such Tax Return, it shall, within ten (10) days after delivery of such Tax Return, notify Purchaser in writing that it so objects, specifying with particularity any such item and stating the specific factual or legal basis for any such objection. If a notice of objection shall be duly delivered, Purchaser and Seller shall negotiate in good faith and use their reasonable best efforts to resolve such items. If Purchaser and Seller are unable to reach such agreement within ten (10) days after receipt by Purchaser of such notice, the disputed items shall be resolved by Accounting Firm and any determination by the Accounting Firm shall be final. The Accounting Firm shall resolve any disputed items within thirty days of having the item referred to it pursuant to such procedures as it may require. If the Accounting Firm is unable to resolve any disputed items before the due date for such Tax Return, the Tax Return shall be filed as prepared by Purchaser and then amended to reflect the Accounting Firm’s resolution. The reasonable and documented costs, fees and expenses of the Accounting Firm shall be borne equally by Purchaser and Seller. The preparation and filing of any Tax Return of DCE or DCEMB that does not relate to a tax period prior to the Effective Date shall be exclusively within the control of Purchaser.

4

4.2 Straddle Period. In the case of Taxes that are payable with respect to a taxable period that begins before and ends after the Effective Date (each such period, a “Straddle Period”), the portion of any such Taxes shall be treated for purposes of this Agreement as follows:

(a) in the case of Taxes based upon, or related to, income or receipts, deemed equal to the amount which would be payable if the taxable year ended with the Effective Date; and

(b) in the case of other Taxes, deemed to be the amount of such Taxes for the entire period multiplied by a fraction the numerator of which is the number of days in the period ending on the Effective Date and the denominator of which is the number of days in the entire period.

4.3 Cooperation and Exchange of Information. Seller and Purchaser shall provide each other with such cooperation and information as either of them reasonably may request of the other in filing any Tax Return pursuant to this Article 4 or in connection with any audit or other proceeding in respect of Taxes of DCE and DCEMB. Such cooperation and information shall include providing copies of relevant Tax Returns or portions thereof, together with accompanying schedules, related work papers and documents relating to rulings or other determinations by tax authorities. Each of Seller and Purchaser shall retain all Tax Returns, schedules and work papers, records and other documents in its possession relating to Tax matters of DCE and DCEMB for any taxable period beginning before the Effective Date until the expiration of the statute of limitations of the taxable periods to which such Tax Returns and other documents relate, without regard to extensions except to the extent notified by the other party in writing of such extensions for the respective Tax periods. Prior to transferring, destroying or discarding any Tax Returns, schedules and work papers, records and other documents in its possession relating to Tax matters of DCE and DCEMB for any taxable period beginning before the Effective Date, Seller or Purchaser (as the case may be) shall provide the other party with reasonable written notice and offer the other party the opportunity to take custody of such materials.

4.4 Survival. Notwithstanding anything in this Agreement to the contrary, the provisions of this Article 4 shall survive for the full period of all applicable statutes of limitations (giving effect to any waiver, mitigation or extension thereof) plus 60 days.

For the purposes of this Article 4, the term “Tax Return” means any return, declaration, report, claim for refund, information return or statement or other document relating to Taxes, including any schedule or attachment thereto, and including any amendment thereof.

ARTICLE 5

GENERAL PROVISIONS

5.1 Expenses. Except as otherwise expressly provided herein, notwithstanding any provision of the LLC Agreement to the contrary, all costs and expenses, including, without limitation, fees and disbursements of counsel, financial advisors and accountants, incurred in connection with this Agreement and the transactions contemplated hereby shall be paid by the party incurring such costs and expenses.

5

5.2 LLC Agreement; No Dissolution. Purchaser hereby consents to the transactions contemplated hereunder in satisfaction of all requirements under the LLC Agreement. Purchaser and Seller agree that this Agreement satisfies, or otherwise each such party waives, all of the obligations of either Purchaser or Seller with respect to the transactions contemplated under this Agreement, including but not limited to those obligations and conditions set forth in Section 13.9 of the LLC Agreement. None of the transactions contemplated by this Agreement shall give rise to a dissolution or termination of DCE under Article XV of the LLC Agreement. Seller hereby acknowledges and agrees that as of the Effective Date the LLC Agreement shall be superseded in its entirety by an amended and restated limited liability company agreement of DCE, which such agreement shall govern DCE. Seller acknowledges and agrees that as of the Effective Date it is no longer a member of DCE or a party to the LLC Agreement.

5.3 Notices. All notices, requests or consents required or permitted under this Agreement shall be made in writing and shall be given to the other parties by personal delivery, registered or certified mail (with return receipt), overnight air courier (with receipt signature) or facsimile transmission (with “answerback” confirmation of transmission), sent to such party’s addresses or telecopy numbers as are set forth below such party’s signatures to this Agreement, or such other addresses or telecopy numbers of which the parties have given notice pursuant to this Section 5.3. Each such notice, request or consent shall be deemed effective upon the date of actual receipt, receipt signature or confirmation of transmission, as applicable.

5.4 Severability. If any term or provision of this Agreement or the application thereof to any circumstance shall, in any jurisdiction and to any extent, be invalid or unenforceable, such term or provision shall be ineffective as to such jurisdiction to the extent of such invalidity or unenforceability without invalidating or rendering unenforceable such term or provision in any other jurisdiction, the remaining terms and provisions of this Agreement or the application of such terms and provisions to circumstances other than those as to which it is held invalid or enforceable.

5.5 Entire Agreement. This Agreement contains the entire understanding of the parties hereto in respect of its subject matter and supersedes all prior and contemporaneous agreements and understandings, oral and written, between the parties with respect to such subject matter.

5.6 Successors and Assigns. This Agreement shall be binding upon and inure to the benefit of Purchaser and Seller and respective successors and permitted assigns. Neither party may assign its rights or obligations hereunder without the prior written consent of the other party, which consent shall not be unreasonably withheld or delayed. No assignment shall relieve the assigning party of any of its obligations hereunder.

5.7 Counterparts. This Agreement may be executed in one or more counterparts, each of which shall be deemed an original, but all such counterparts together shall constitute but one and the same Agreement.

6

5.8 Construction. The article, section and subsection headings used herein are inserted for reference purposes only and shall not in any way affect the meaning or interpretation of this Agreement. As used in this Agreement, the masculine, feminine or neuter gender, and the singular or plural, shall be deemed to include the others whenever and wherever the context so requires.

5.9 GOVERNING LAW; Submission to Jurisdiction; WAIVER OF JURY TRIAL.

(a) THIS AGREEMENT SHALL BE GOVERNED BY AND CONSTRUED IN ACCORDANCE WITH THE INTERNAL LAWS (AND NOT THE LAW OF CONFLICTS) OF THE STATE OF DELAWARE.

(b) Each party hereto hereby irrevocably and unconditionally submits, for itself and its respective property, to the exclusive jurisdiction of any of (i) the Superior Court of the State of California sitting in Los Angeles County, California, or the United States District Court for Central District of California, (ii) the Supreme Court of the State of New York sitting in New York County, Borough of Manhattan, or the United States District Court for the Southern District of New York, (iii) the District Courts of the State of Texas sitting in Dallas County, Texas, or the United States District Court for the Northern District of Texas, (iv) the Delaware Court of Chancery, and (v) any appellate court from any thereof, in any action or proceeding arising out of or relating to this Agreement, or for recognition or enforcement of any judgment, and each of the parties hereby irrevocably and unconditionally agrees that all claims in respect of any such action or proceeding may be heard and determined in the above-referenced courts, to the extent permitted by law. Each party agrees that a final judgment in any such action or proceeding shall be conclusive and may be enforced in other jurisdictions by suit on the judgment or in any other manner provided by law.

(c) The parties hereby irrevocably and unconditionally waive, to the fullest extent such party may legally and effectively do so, any objection which such party may now or hereafter have to the laying of venue of any suit, action or proceeding arising out of or relating to this Agreement in any court referred to in paragraph (b) of this Section. Each party hereto hereby irrevocably waives, to the fullest extent permitted by law, the defense of an inconvenient forum to the maintenance of such action or proceeding in any such court.

(d) Each party to this Agreement irrevocably consents to service of process in the manner provided for notices in Section 5.3 of this Agreement. Nothing in this Agreement will affect the right of any party to this Agreement to serve process in any other manner permitted by law.

(e) EACH PARTY HERETO HEREBY WAIVES, TO THE FULLEST EXTENT PERMITTED BY APPLICABLE LAW, ANY RIGHT IT MAY HAVE TO A TRIAL BY JURY IN ANY LEGAL PROCEEDING DIRECTLY OR INDIRECTLY ARISING OUT OF OR RELATING TO THIS AGREEMENT OR THE TRANSACTIONS CONTEMPLATED HEREBY (WHETHER BASED ON CONTRACT, TORT OR ANY OTHER THEORY). EACH PARTY HERETO (A) CERTIFIES THAT NO REPRESENTATIVE, AGENT OR ATTORNEY OF ANY OTHER PARTY HAS REPRESENTED, EXPRESSLY OR OTHERWISE, THAT SUCH OTHER PARTY

7

WOULD NOT, IN THE EVENT OF LITIGATION, SEEK TO ENFORCE THE FOREGOING WAIVER AND (B) ACKNOWLEDGES THAT IT AND THE OTHER PARTIES HAVE BEEN INDUCED TO ENTER INTO THIS AGREEMENT BY, AMONG OTHER THINGS, THE MUTUAL WAIVERS AND CERTIFICATIONS IN THIS SECTION 5.9(e).

5.10 Amendment. This Agreement may be amended at any time by a written instrument executed by each of the parties hereto.

5.11 Waiver. Any term or provision of this Agreement may be waived in writing at any time by the party or parties entitled to the benefits thereof. Any waiver effected pursuant to this Section 5.11 shall be binding upon all parties hereto. No failure to exercise, and no delay in exercising, any right, power or privilege shall operate as a waiver thereof, nor shall any single or partial exercise of any right, power or privilege preclude the exercise of any other right, power or privilege. No waiver of any breach of any covenant or agreement hereunder shall be deemed a waiver of any preceding or subsequent breach of the same or of any other covenant or agreement. The rights and remedies of each party under this Agreement are in addition to all other rights and remedies, at law or in equity, that such party may have against the other parties.

5.12 Further Assurances. Subject to the terms and conditions of this Agreement, each of the parties hereto agrees to use all reasonable efforts to take, or cause to be taken, all action, and to do, or cause to be done, all things necessary, proper or advisable to consummate and make effective the transactions contemplated by this Agreement.

[Remainder of Page Intentionally Blank]

8

IN WITNESS WHEREOF, each of the parties hereto has executed this Agreement, or has caused this Agreement to be executed on its behalf by a representative duly authorized, all as of the date first above set forth.

|

PURCHASER: |

CAMBRIAN ENERGY MCCOMMAS BLUFF III LLC |

|

|

|

|

|

|

|

|

|

By: |

/s/ Evan Williams |

|

|

|

|

Name: |

Evan Williams |

|

|

|

Title: |

Primary Manager |

|

|

|

|

|

|

Address: |

c/o Cambrian Energy Management LLC |

|

|

|

624 So. Grand Ave., #2425 |

|

|

|

Los Angeles, California 90017-3335 |

|

|

|

|

|

|

Facsimile No.: (213) 488-9890 |

|

|

|

|

|

|

MIPA

|

SELLER: |

MAVRIX, LLC |

|

|

|

|

|

|

|

|

|

|

By: |

/s/ Harrison S. Clay |

|

|

|

|

Name: |

Harrison S. Clay |

|

|

|

Title: |

President |

|

|

|

|

|

|

Address: |

c/o Clean Energy Renewable Fuels, LLC |

|

|

|

4675 MacArthur Court, Suite 800 |

|

|

|

Newport Beach, California 92660 |

|

|

|

|

|

|

Facsimile No.: (949) 434-8293 |

|

|

|

|

|

|

|

MIPA

Exhibit 4.15

EXECUTION VERSION

WARRANTS AMENDMENT

This WARRANTS AMENDMENT (the “Amendment”), dated as of December 29, 2014, is by and among General Electric Company, a Delaware corporation (“GEC”), GPFS Securities Inc., a Delaware corporation (“GPFS”), and Clean Energy Fuels Corp., a Delaware corporation (the “Issuer”).

WHEREAS, the Issuer and GE Energy Financial Services, Inc., a Delaware corporation (“GEEFS”), entered into the Warrant Agreement (the “Warrant Agreement”) dated November 7, 2012, pursuant to which GEEFS is issued a warrant (the “GEEFS Warrant”) to purchase up to 5,000,000 shares of Common Stock (as defined in the Warrant Agreement) of the Issuer;

WHEREAS, pursuant to the Assignment and Assumption Agreement dated May 23, 2013, by and among GEEFS, GEC and GPFS, GEEFS assigned and transferred (a) the GEEFS Warrant to each of GEC and GPFS (collectively, the “Warrants”), and (b) its rights under the Warrant Agreement to each of GEC and GPFS;

NOW, THEREFORE, the Issuer, GEC and GPFS hereby agree to amend each of the Warrants as set forth below.

1. Section 2.1 of each of the Warrants is hereby amended and replaced in its entirety by the following:

“2.1 General. At any time and from time to time after the Closing Date and until 5:00 p.m., New York time, on the tenth (10th) anniversary of the Closing Date or such earlier date as provided in Section 4.2 below (the “Exercise Period”), the Holder may exercise this Warrant, on any Business Day, for all or any part of such number of Shares, at the state Exercise Price, equal to the sum of:

(a) 10% of the aggregate number of Shares purchasable hereunder as an upfront commitment fee, plus

(b) as of December 31, 2014, 10% of the aggregate number of Shares purchasable hereunder, plus

(c)

(i) after the first Tranche A Loan (as defined in the Credit Agreement) is made, 25% of the aggregate number of Shares purchasable hereunder,

(ii) after the first Tranche B Loan (as defined in the Credit Agreement) is made, 25% of the aggregate number of Shares purchasable hereunder,

(iii) after Tranche A Loans in aggregate principal amount of at least $15,000,000 have been made, 15% of the aggregate number of Shares purchasable hereunder, and

(iv) after Tranche B Loans in aggregate principal amount of at least $15,000,000 have been made, 15% of the aggregate number of Shares purchasable hereunder.

Upon the occurrence of any of the events described in the foregoing clause (c), the Issuer shall deliver written notice thereof to Holder.”

2. This Amendment will be governed by, and interpreted in accordance with, the laws of the State of Delaware, without giving effect to any conflict of law provision.

3. This Amendment will be binding upon, and will inure to the benefit of, the parties hereto and their respective successors and assigns.

4. This Amendment may be executed in multiple counterparts, each of which will be deemed an original, but all of which will constitute one and the same instrument.

[Signature Page Follows]

2

IN WITNESS WHEREOF, the parties hereto have caused this Amendment to be executed with effect from the date first above written.

|

|

CLEAN ENERGY FUELS CORP. |

|

|

|

|

|

|

|

|

By: |

/s/ Andrew J. Littlefair |

|

|

Name: Andrew J. Littlefair |

|

|

Title: President & Chief Executive Officer |

|

|

|

|

|

|

|

|

GENERAL ELECTRIC COMPANY |

|

|

|

|

|

|

|

|

By: |

/s/ Tyson Yates |

|

|

Name: Tyson Yates |

|

|

Title: Managing Director |

|

|

|

|

|

|

|

|

GPFS SECURITIES INC. |

|

|

|

|

|

|

|

|

By: |

/s/ Tyson Yates |

|

|

Name: Tyson Yates |

|

|

Title: Managing Director |

SIGNATURE PAGE TO

WARRANTS AMENDMENT

Exhibit 10.97

EXECUTION VERSION

AMENDMENT TO CREDIT AGREEMENT

This Amendment (“Amendment”), dated as of December 29, 2014, is entered into by and among (i) Clean Energy Tranche A LNG Plant, LLC (the “Tranche A Borrower”), (ii) Clean Energy Tranche B LNG Plant, LLC (the “Tranche B Borrower” and, together with the Tranche A Borrower, collectively the “Borrowers”), (iii) the financial institutions from time to time party to the Credit Agreement referred to below as Lenders (the “Lenders”) and (iv) General Electric Capital Corporation, as Administrative Agent (in such capacity, the “Administrative Agent”) and Collateral Agent (in such capacity, the “Collateral Agent”). Capitalized terms used but not defined herein shall have the meanings ascribed to such terms in the Credit Agreement referred to below.

RECITALS

WHEREAS, reference is made to that certain Credit Agreement, dated as of November 7, 2012, by and among the Borrowers, the Lenders, the Administrative Agent and the Collateral Agent (as amended, restated, supplemented or otherwise modified from time to time, the “Credit Agreement”); and

WHEREAS, the Borrowers, the Lenders, the Administrative Agent and the Collateral Agent now wish to amend the Credit Agreement on the terms and conditions set forth herein.

NOW, THEREFORE, in consideration of the covenants and obligations of the parties herein contained, and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, each of the parties hereto hereby agrees as follows:

AMENDMENT

1. Amendments to Section 1.1 of the Credit Agreement. Section 1.1 of the Credit Agreement is amended as follows:

(a) The definition of “Construction Agreements” is deleted in its entirety and replaced with the following:

““Construction Agreements” shall mean, collectively, (i) any GE Equipment Supply Agreement and (ii) any other agreement to which any Finance Party or any Affiliate of any Finance Party is now or hereafter becomes a party providing for the design, development, construction, testing or start-up of the Projects.”

(b) The definition of “Contractors” is deleted in its entirety and replaced with the following:

““Contractors” shall mean, collectively, any GE Equipment Supplier and each other party to a Construction Agreement (other than a Borrower).”

(c) The definitions of “Facility A Date Certain” and “Facility B Date Certain” are amended by replacing “2016” in both such definitions with “2018”.

1

(d) The definitions of “GE Contractor” and “GE EPC Contracts” are deleted in their entirety.

(e) The following definitions are added in alphabetical order:

““GE Equipment Supplier” shall mean GE Oil & Gas, Inc. or any Affiliate thereof, in each case to the extent a party to a GE Equipment Supply Agreement.”

““GE Equipment Supply Agreement” shall mean any contract or agreement relating to the purchase, sale, supply, construction, testing, operation, servicing, maintenance, repair, financing or use of any equipment or products supplied, or other services rendered in relation thereto, to the Projects by GE Oil & Gas, Inc. or any Affiliate thereof.”

2. Amendment to Section 2.13 of the Credit Agreement. Section 2.13 of the Credit Agreement is amended by replacing “2014” in each of Section 2.13(c) of the Credit Agreement and Section 2.13(d) of the Credit Agreement with “2016”.

3. Amendments to Section 3.2 of the Credit Agreement. Section 3.2 of the Credit Agreement is amended as follows:

(a) Section 3.2(j), clause (i) of the Credit Agreement is deleted in its entirety and replaced with the following:

“(i) one or more GE Equipment Supply Agreements with minimum supply and down payment terms satisfactory to the Administrative Agent, one or more engineering, procurement and construction contracts, and such other Construction Agreements, in each case, as are determined by the Project Engineer and the Administrative Agent in their reasonable discretion to be necessary or desirable to complete the design, development, construction, testing and start-up of the applicable Project,”

(b) Section 3.2(l) of the Credit Agreement is deleted in its entirety and replaced with the following:

“(l) Equity. The Administrative Agent shall have received either (i) the original Tranche A Equity Letters of Credit or the Tranche B Equity Letters of Credit, as applicable (as such terms are defined in the Equity Contribution Agreement) or (ii) satisfactory evidence that Equity Contributions have been deposited in the Tranche A Construction Account or the Tranche B Construction Account, as applicable, in an aggregate amount equal to one-third (1/3) of the Tranche A Construction Loan Commitments or the Tranche B Construction Loan Commitments, as applicable; provided, however, that for the purposes of this clause (ii), Equity Contributions for each Tranche shall include the allocable portion of all Project Costs directly paid by the Sponsor in connection with the Projects prior to the applicable Initial Funding Date (including without limitation any payments made by the Sponsor with respect to any letter of credit or the issuance thereof in connection with the Projects) to the extent the same have been approved by the Administrative Agent in its reasonable discretion.”

2

(c) A new Section 3.2(o) is added to the Credit Agreement as follows:

“(o) Market Feasibility. The Administrative Agent shall have received evidence, in form and substance satisfactory to each Lender in its sole discretion, demonstrating the economic and market feasibility of the applicable Project, which evidence may be in the form of a satisfactory market report from a consultant appointed by the Required Lenders and reasonably acceptable to such Borrower.”

4. Amendments to Section 3.3 of the Credit Agreement. Section 3.3 of the Credit Agreement is amended by deleting Section 3.3(g) of the Credit Agreement in its entirety and replacing it with the following:

“(g) Construction Budget; Drawdown Schedule; Payments to GE Equipment Supplier. Such Construction Loan shall be in accordance with the applicable Construction Budget and the applicable Drawdown Schedule. The Administrative Agent shall have received evidence (which may be in the form of a Construction Account Withdrawal Certificate (as defined in the Collateral Account Agreement) pursuant to and in accordance with Section 4.1(c) of the Collateral Account Agreement) demonstrating that any payments of Project Costs to be made from such Construction Loan (and previously made from Construction Loans) shall be (and have been) applied (x) first, to the payments of any amounts due and payable to any GE Equipment Supplier and (y) second, to the payment of other Project Costs.”

5. Amendments to Section 3.4(g) of the Credit Agreement. Section 3.4(g) of the Credit Agreement is amended as follows:

(a) “1.25” is deleted from the sixth (6th) line and replaced with “1.15”.

(b) “twenty percent (20%)” is deleted from the seventh (7th) line and replaced with “thirty percent (30%)”.

6. Amendment to Annex III to the Credit Agreement. The Credit Agreement is amended by deleting in its entirety Annex III thereto and replacing it with the Annex III attached hereto.

7. Effectiveness. This Amendment shall become effective only upon (i) the receipt by the Administrative Agent of counterpart signature pages to this Amendment duly executed by the Borrowers and each of the Required Lenders and (ii) payment by or on behalf of the Borrowers of all reasonable fees and expenses of counsel to the Administrative Agent incurred in connection with this Amendment (the “Effective Date”).

8. Representations and Warranties. In order to induce the Lenders to enter into this Amendment, the Borrowers represent and warrant to the Administrative Agent and each Lender that the following statements are true and correct in all material respects as of the Effective Date:

a. Power and Authority. Each Borrower has all requisite power and authority to enter into this Amendment and to carry out the transactions contemplated hereby.

3

b. Authorization of Agreements. The execution and delivery of this Amendment by each Borrower has been duly authorized by all necessary action on the part of such Borrower.

c. Binding Obligation. This Amendment has been duly executed and delivered by each Borrower and is the legally valid and binding obligation of such Borrower, enforceable against such Borrower in accordance with its terms, except as may be limited by bankruptcy, insolvency, reorganization, moratorium or similar laws relating to or limiting creditors’ rights generally or by equitable principles relating to enforceability.

d. Absence of Default. No event has occurred and is continuing that would constitute an Event of Default or a Default.

e. Incorporation of Representations and Warranties from Credit Agreement. The representations and warranties contained in Article IV of the Credit Agreement are and will be true and correct in all material respects (provided that those representations and warranties that are qualified by materiality or “Material Adverse Effect” shall be true and correct in all respects) on and as of the Effective Date to the same extent as though made on and as of that date, except to the extent such representations and warranties specifically relate to an earlier date, in which case they were true and correct in all material respects on and as of such earlier date.

9. Change to Borrowers’ Notice Address. In accordance with Section 11.3 of the Credit Agreement, each Borrower designates the applicable address set forth on the signature page hereto as the address, facsimile number or email address for Communications to such Borrower.

10. Direction. By its signature below, each Lender hereby instructs the Administrative Agent to enter into and agree to the terms of this Amendment.

11. Terms and Conditions of the Credit Agreement. On and after the Effective Date, each reference in the Credit Agreement to “this Agreement”, “hereunder”, “hereof”, “herein” or words of like import referring to the Credit Agreement, and each reference in the other Finance Documents to the “Credit Agreement”, “thereunder”, “thereof” or words of like import referring to the Credit Agreement shall mean and be a reference to the Credit Agreement as amended hereby. Other than as expressly set forth in this Amendment, all of the terms and conditions of the Credit Agreement shall remain in full force and effect and shall apply to this Amendment; provided that to the extent there is a conflict between the terms of this Amendment and the terms of the Credit Agreement, the terms of this Amendment shall control to the extent of such conflict.

12. Finance Document. This Amendment shall constitute a Finance Document.

13. No Waiver or Release. This Amendment shall not constitute a waiver, release, amendment or modification by the Lenders or any other party hereto of any covenant, right, remedy, Collateral, Default or Event of Default under the Credit Agreement or any of the other Finance Documents, except to the extent of the amendment expressly set forth herein, and all

4

such provisions and requirements of the Credit Agreement and the other Finance Documents shall remain unmodified and in full force and effect. The Lenders hereby reserve all rights, remedies, privileges and powers available to them under the Credit Agreement, the other Finance Documents, applicable Law or otherwise. No failure on the part of the Lenders to exercise, and no delay in exercising, any right, remedy or power hereunder shall operate as a waiver thereof, nor shall any single or partial exercise of any right, remedy or power hereunder preclude any other or future exercise of any right, remedy or power. Each and every right, remedy and power allowed to the Lenders by Law or under the Finance Documents or other agreement shall be cumulative and not exclusive of any other, and may be exercised by the Lenders from time to time.

14. Headings. Section and Subsection headings in this Amendment are included herein for convenience of reference only and shall not constitute a part of this Amendment for any other purpose or be given any substantive effect.

15. Governing Law. THIS AMENDMENT SHALL BE GOVERNED BY, AND CONSTRUED IN ACCORDANCE WITH, THE LAWS OF THE STATE OF NEW YORK.

16. Counterparts. This Amendment may be executed in any number of counterparts and by the different parties hereto on separate counterparts, each of which when so executed and delivered shall be an original, but all of which together constitute one and the same instrument.

17. Entire Agreement. This Amendment and any agreement, document, instrument, schedule or exhibit referred to herein integrate all the terms and conditions mentioned herein or incidental hereto and supersede all oral negotiations and prior writings in respect of the subject matter hereof.

* * *

5

IN WITNESS WHEREOF, the parties hereto have caused their duly authorized officers to execute and deliver this Amendment as of the date first above written.

|

Notice Address: |

CLEAN ENERGY TRANCHE A LNG PLANT, LLC, as Borrower |

|

|

|

|

Address: Clean Energy Tranche A LNG

Plant, LLC

c/o Clean Energy Fuels Corp.

4675 MacArthur Court, Suite 800

Newport Beach, CA 92660 |

|

|

Attention: Nate Jensen |

|

|

Telephone No.: (949) 437-1000 |

By: |

/s/ Andrew J. Littlefair |

|

Telecopier No.: (949) 424-8285 |

|

Name: |

Andrew J. Littlefair |

|

Email: njensen@cleanenergyfuels.com |

|

Title: |

President & Chief Executive Officer |

|

Notice Address: |

CLEAN ENERGY TRANCHE B LNG PLANT, LLC, as Borrower |

|

|

|

|

Address: Clean Energy Tranche B LNG

Plant, LLC

c/o Clean Energy Fuels Corp.

4675 MacArthur Court, Suite 800

Newport Beach, CA 92660 |

|

|

Attention: Nate Jensen |

|

|

Telephone No.: (949) 437-1000 |

By: |

/s/ Andrew J. Littlefair |

|

Telecopier No.: (949) 424-8285 |

|

Name: |

Andrew J. Littlefair |

|

Email: njensen@cleanenergyfuels.com |

|

Title: |

President & Chief Executive Officer |

Signature Page to Amendment to Credit Agreement

|

|

GENERAL ELECTRIC CAPITAL CORPORATION, as Administrative Agent and Collateral Agent |

|

|

|

|

|

By: |

/s/ Tyson Yates |

|

|

|

Name: |

Tyson Yates |

|

|

|

Title: |

Managing Director |

|

|

GENERAL ELECTRIC CAPITAL CORPORATION, as Lender |

|

|

|

|

|

By: |

/s/ Tyson Yates |

|

|

|

Name: |

Tyson Yates |

|

|

|

Title: |

Managing Director |

Signature Page to Amendment to Credit Agreement

Annex III

TERM LOAN AMORTIZATION

|

Quarterly Dates

following the

applicable

Conversion Date |

|

Percentage

Amortization |

|

1 |

|

0.46% |

|

2 |

|

0.47% |

|

3 |

|

0.47% |

|

4 |

|

0.47% |

|

5 |

|

0.47% |

|

6 |

|

0.47% |

|

7 |

|

0.47% |

|

8 |

|

2.78% |

|

9 |

|

2.78% |

|

10 |

|

2.78% |

|

11 |

|

2.78% |

|

12 |

|

2.78% |

|

13 |

|

2.78% |

|

14 |

|

2.78% |

|

15 |

|

2.78% |

|

16 |

|

2.78% |

|

17 |

|

2.78% |

|

18 |

|

2.78% |

|

19 |

|

2.78% |

|

20 |

|

2.78% |

|

21 |

|

2.78% |

|

22 |

|

2.78% |

|

23 |

|

2.78% |

|

24 |

|

2.78% |

|

25 |

|

2.78% |

|

26 |

|

2.78% |

|

27 |

|

2.78% |

|

28 |

|

2.78% |

|

29 |

|

2.78% |

|

30 |

|

2.78% |

|

31 |

|

2.78% |

|

Maturity Date Payment |

|

30.00% |

Exhibit 99.1

Clean Energy Sells Interest in McCommas Bluff Biomethane Production Facility to Project Partner Cambrian Energy; Adds 12 Additional Biomethane Sources for Redeem

NEWPORT BEACH, Calif. (January 5, 2015) — Clean Energy Fuels Corp. (NASDAQ: CLNE) today announced the sale of Clean Energy’s majority interest in its McCommas Bluff biomethane production facility located in Dallas, Texas, to minority interest owner Cambrian Energy for approximately $40.6 million with approximately $3.0 million in additional compensation pending further performance tests of the McCommas facility to be completed in early 2015. Clean Energy will continue to have the right to market and sell biomethane produced at the facility under its Redeem renewable natural gas (RNG) vehicle fuel brand. Cambrian Energy has been Clean Energy’s partner since Clean Energy bought into the McCommas project in August 2008.

“Buying the McCommas biomethane facility allowed Clean Energy to gain a valuable foothold in the renewable natural gas business. We are extremely proud of what we have accomplished at the project over the past six years, quintupling biomethane sales and providing for the long term financial stability that the project had historically lacked. We have successfully leveraged our success at McCommas into a greater knowledge of the entire supply chain and established a leadership position in the RNG fuel market. With McCommas remaining a RNG supplier, we will be able to focus our RNG business on Clean Energy Renewables’ core strength—marketing and selling alternative fuels,” said Harrison Clay, president of Clean Energy Renewables, a division of Clean Energy.

Clean Energy commenced production at its new biomethane facility in North Shelby, Tenn., this year and added an additional 12 third-party-owned biomethane production sources to its portfolio of RNG supply.

The U.S. Environmental Protection Agency underscored the potential of biomethane in the renewable fuel landscape when it recently reclassified biomethane as a cellulosic biofuel under the Federal Renewable Fuel Standard.

Redeem renewable natural gas is currently available throughout Clean Energy’s public natural gas fueling stations in California. Biomethane is the only fuel commercially available today at a discount to diesel prices that achieves a 90% reduction in greenhouse gas emissions and can meet 100% of the fueling requirements of an 18-wheeler.

Media Contacts:

|

Clean Energy Media Contact:

Gary Foster

949-437-1113

gfoster@cleanenergyfuels.com |

|

Clean Energy Investor Contact:

Tony Kritzer

949-437-1403

tkritzer@cleanenergyfuels.com |

About Clean Energy

Clean Energy Fuels Corp. (Nasdaq: CLNE) is the leading provider of natural gas fuel for transportation in North America. We build and operate compressed natural gas (CNG) and liquefied natural gas (LNG) fueling stations; manufacture CNG and LNG equipment and technologies for ourselves and other companies; develop renewable natural gas (RNG) production facilities; and deliver more CNG, LNG and Redeem RNG fuel than any other company in the U.S. For more information, visit www.cleanenergyfuels.com.

Forward-Looking Statements

This Press Release contains certain forward-looking statements regarding the disposition of Clean Energy’s interest in the McCommas Bluff facility to Cambrian Energy, including, without limitation, statements regarding the potential amount of contingent consideration that may be paid to Clean Energy in the future. Actual events or results may differ materially from those contained in these forward-looking statements. Among the important factors that could cause future events or results to vary from those addressed in the forward-looking statements include, without limitation, the results of certain performance tests to be performed at the Project on or before August 1, 2015 in accordance the terms of the Agreement. The Company is under no duty to update any of the forward-looking statements after the date of this press release to conform to actual results.

# # #

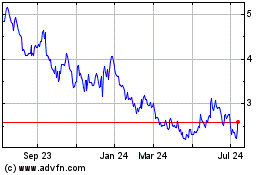

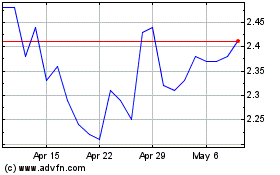

Clean Energy Fuels (NASDAQ:CLNE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Clean Energy Fuels (NASDAQ:CLNE)

Historical Stock Chart

From Apr 2023 to Apr 2024