Table of Contents

Filed Pursuant to Rule 424(b)(5)

Registration No. 333-192640

CALCULATION OF REGISTRATION FEE

|

Title of each class of securities

to be registered

|

|

Maximum

aggregate offering

price

|

|

Amount of

registration fee(1)

|

|

|

Common Stock, par value $0.001 per share

|

|

$

|

60,000,000

|

|

$

|

6,042

|

|

|

|

|

|

|

|

|

|

|

(1) This filing fee is calculated in accordance with Rule 457(r) under the Securities Act of 1933, as amended. This “Calculation of Registration Fee” table shall be deemed to update the “Calculation of Registration Fee” table in the registrant’s Registration Statement on Form S-3 (File No. 333-192640) in accordance with Rules 456(b) and 457(r) under the Securities Act of 1933, as amended.

PROSPECTUS SUPPLEMENT

(To prospectus dated December 3, 2013)

Up to $60,000,000

Common Stock

We have entered into a Controlled Equity Offering

SM

Sales Agreement, or sales agreement, with Cantor Fitzgerald & Co., or Cantor Fitzgerald, relating to shares of our common stock offered by this prospectus supplement and the accompanying prospectus. In accordance with the terms of the sales agreement, we may offer and sell shares of our common stock having an aggregate offering price of up to $60 million from time to time through Cantor Fitzgerald acting as sales agent.

Our common stock is traded on the NASDAQ Global Market, or NASDAQ, under the symbol “CLDX”. On May 18, 2016, the last reported sales price of our common stock on NASDAQ was $3.93 per share.

Sales of our common stock, if any, under this prospectus supplement and the accompanying prospectus may be made in sales deemed to be “at-the-market” offerings as defined in Rule 415 promulgated under the Securities Act of 1933, as amended, or the Securities Act, including sales made directly on or through NASDAQ, the existing trading market for our common stock, sales made to or through a market maker other than on an exchange or otherwise, in negotiated transactions at market prices prevailing at the time of sale or at prices related to such prevailing market prices, and/or any other method permitted by law, including in privately negotiated transactions with our prior consent. Cantor Fitzgerald is not required to sell any specific number or dollar amount of securities, but will act as a sales agent using commercially reasonable efforts consistent with its normal trading and sales practices, on mutually agreed terms between Cantor Fitzgerald and us. There is no arrangement for funds to be received in any escrow, trust or similar arrangement.

Cantor Fitzgerald will be entitled to compensation at a fixed commission rate equal to 3.0% of the gross sales price per share sold. In connection with the sale of our common stock on our behalf, Cantor Fitzgerald will be deemed to be an “underwriter” within the meaning of the Securities Act and the compensation of Cantor Fitzgerald will be deemed to be underwriting commissions or discounts.

Investing in our common stock involves risks. Before buying any shares, you should read the discussion of material risks of investing in our common stock in “

Risk Factors

” beginning on page S-8 of this prospectus supplement, and in the risks discussed in the documents incorporated by reference in this prospectus supplement and accompanying prospectus, as they may be amended, updated or modified periodically in our reports filed with the Securities and Exchange Commission.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus supplement and accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus supplement is May 19, 2016.

Table of Contents

ABOUT THIS PROSPECTUS SUPPLEMENT

In this prospectus supplement, “Celldex,” “we,” “us,” “our” or “ours” refer to Celldex Therapeutics, Inc. and its consolidated subsidiary.

This prospectus supplement and the accompanying prospectus relate to the offering of shares of our common stock. Before buying any of the shares of common stock offered hereby, we urge you to carefully read this prospectus supplement and the accompanying prospectus, together with the information incorporated herein by reference as described under the headings “Where You Can Find More Information” and “Incorporation of Documents by Reference.” These documents contain important information that you should consider when making your investment decision. This prospectus supplement contains information about the common stock offered hereby and may add, update or change information in the accompanying prospectus.

You should rely only on the information that we have provided or incorporated by reference in this prospectus supplement and the accompanying prospectus. We have not authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it.

We are not making offers to sell or solicitations to buy our common stock in any jurisdiction in which an offer or solicitation is not authorized or in which the person making that offer or solicitation is not qualified to do so or to anyone to whom it is unlawful to make an offer or solicitation. You should assume that the information in this prospectus supplement and the accompanying prospectus or any related free writing prospectus is accurate only as of the date on the front of the document and that any information that we have incorporated by reference is accurate only as of the date of the document incorporated by reference, regardless of the time of delivery of this prospectus supplement, the accompanying prospectus or any related free writing prospectus, or any sale of a security.

This document is in two parts. The first part is this prospectus supplement, which adds to and updates information contained in the accompanying prospectus. The second part, the prospectus, provides more general information, some of which may not apply to this offering. Generally, when we refer to this prospectus, we are referring to both parts of this document combined. To the extent there is a conflict between the information contained in this prospectus supplement and the information contained in the accompanying prospectus, you should rely on the information in this prospectus supplement.

This prospectus supplement and the accompanying prospectus contain summaries of certain provisions contained in some of the documents described herein, but reference is made to the actual documents for complete information. All of the summaries are qualified in their entirety by the actual documents. Copies of some of the documents referred to herein have been or will be filed as exhibits to the registration statement of which this prospectus is a part or as exhibits to documents incorporated by reference herein, and you may obtain copies of those documents as described below under the headings “Where You Can Find More Information” and “Incorporation of Documents by Reference.”

S-

1

Table of Contents

PROSPECTUS SUPPLEMENT SUMMARY

The following summary of our business highlights some of the information contained elsewhere in or incorporated by reference into this prospectus supplement. Because this is only a summary, however, it does not contain all of the information that may be important to you. You should carefully read this prospectus supplement and the accompanying prospectus, including the documents incorporated by reference, which are described under “Incorporation of Documents by Reference” and “Where You Can Find More Information” in this prospectus supplement. You should also carefully consider the matters discussed in the section titled “Risk Factors” in this prospectus supplement and in the accompanying prospectus and in other periodic reports incorporated by reference herein.

Our Company

We are a biopharmaceutical company focused on the development and commercialization of several immunotherapy technologies for the treatment of cancer and other difficult-to-treat diseases. Our drug candidates are derived from a broad set of complementary technologies which have the ability to utilize the human immune system and enable the creation of therapeutic agents. We are using these technologies to develop targeted immunotherapeutics comprised of protein-based molecules such as vaccines, antibodies and antibody-drug conjugates that are used to treat specific types of cancer or other diseases.

Our latest stage drug candidate, glembatumumab vedotin (also referred to as CDX-011) is a targeted antibody-drug conjugate in a randomized, Phase 2b study for the treatment of triple negative breast cancer and a Phase 2 study for the treatment of metastatic melanoma. Varlilumab (also referred to as CDX-1127) is an immune modulating antibody that is designed to enhance a patient’s immune response against their cancer. We established proof of concept in a Phase 1 study with varlilumab, which has allowed several combination studies to begin in various indications. We also have a number of earlier stage drug candidates in clinical development, including CDX-1401, a targeted immunotherapeutic aimed at antigen presenting cells, or APCs, for cancer indications, CDX-301, an immune cell mobilizing agent and dendritic cell growth factor, and CDX-014, an antibody drug conjugate targeting TIM-1. Our drug candidates address market opportunities for which we believe current therapies are inadequate or non-existent.

We are building a fully integrated, commercial-stage biopharmaceutical company that develops important therapies for patients with unmet medical needs. Our program assets provide us with the strategic options to either retain full economic rights to our innovative therapies or seek favorable economic terms through advantageous commercial partnerships. This approach allows us to maximize the overall value of our technology and product portfolio while best ensuring the expeditious development of each individual product.

The following table reflects our current clinical pipeline.

|

Product (generic)

|

|

Indication/Field

|

|

Status

|

|

Glembatumumab vedotin

|

|

Triple Negative Breast Cancer

|

|

Phase 2b

|

|

Glembatumumab vedotin

|

|

Metastatic melanoma

|

|

Phase 2

|

|

Varlilumab

|

|

Multiple solid tumors (with nivolumab)

|

|

Phase 2

|

|

Varlilumab

|

|

Metastatic melanoma (with ipilimumab)

|

|

Phase 1

|

|

Varlilumab

|

|

Renal cell carcinoma (with sunitinib)

|

|

Phase 1

|

|

Varlilumab

|

|

Multiple solid tumors (with atezolizumab)

|

|

Phase 1

|

|

CDX-1401

|

|

Multiple solid tumors

|

|

Phase 2

|

|

CDX-301

|

|

Multiple indications

|

|

Phase 1

|

|

CDX-014

|

|

Renal cell carcinoma

|

|

Phase 1

|

Glembatumumab Vedotin

Glembatumumab vedotin is an antibody-drug conjugate, or ADC, that consists of a fully human monoclonal antibody, CR011, linked to a potent cell-killing drug, monomethyl-auristatin E, or MMAE. The CR011 antibody specifically targets glycoprotein NMB, referred to as gpNMB, that is over-expressed in a variety of cancers including breast cancer, melanoma, non-small cell lung cancer, uveal melanoma and osteosarcoma, among others. The ADC technology, comprised of MMAE and a stable linker system for attaching it to CR011, was licensed from Seattle Genetics, Inc. and is the same as that used in the marketed product Adcetris

®. The ADC is designed to be stable in the bloodstream. Following intravenous administration, glembatumumab vedotin targets and binds to gpNMB, and upon internalization into the targeted cell, glembatumumab vedotin is designed to release MMAE from CR011 to produce a cell-killing effect. The FDA has granted Fast Track designation to glembatumumab vedotin for the treatment of advanced, refractory/resistant gpNMB-expressing breast cancer. A companion diagnostic is in development for certain indications and we expect that, if necessary, such a companion diagnostic must be approved by the FDA or certain other foreign regulatory agencies before glembatumumab vedotin may be commercialized in those indications.

S-

2

Table of Contents

Treatment of Metastatic Breast Cancer:

The Phase 1/2 study of glembatumumab vedotin administered intravenously once every three weeks evaluated patients with locally advanced or metastatic breast cancer who had received prior therapy (median of seven prior regimens). Results were published in the

Journal of Clinical Oncology

in September 2014. The study began with a bridging phase to confirm the maximum tolerated dose, or MTD, and then expanded into a Phase 2 open-label, multi-center study. The study confirmed the safety of glembatumumab vedotin at the pre-defined maximum dose level (1.88 mg/kg) in 6 patients. An additional 28 patients were enrolled in an expanded Phase 2 cohort (for a total of 34 treated patients at 1.88 mg/kg, the Phase 2 dose) to evaluate the progression-free survival (PFS) rate at 12 weeks. The 1.88 mg/kg dose was well tolerated in this patient population with the most common adverse events of rash, neuropathy and fatigue. The primary activity endpoint, which called for at least 5 of 25 (20%) patients in the Phase 2 study portion to be progression-free at 12 weeks, was met as 9 of 27 (33%) evaluable patients were progression-free at 12 weeks. For all patients treated at the maximum dose level, median PFS was 9.1 weeks.

A subset of 10 patients had “triple negative disease,” a more aggressive breast cancer subtype that carries a high risk of relapse and reduced survival as well as limited therapeutic options due to lack of over-expression of HER2/neu, estrogen and progesterone receptors. In these patients, 12-week PFS rate was 60% (6/10), and median PFS was 17.9 weeks. Tumor samples from a subset of patients across all dose groups were analyzed for gpNMB expression. The tumor samples from most patients showed evidence of stromal and/or tumor cell expression of gpNMB.

The EMERGE study was a randomized, multi-center Phase 2b study of glembatumumab vedotin in 124 patients with heavily pre-treated, advanced, gpNMB-positive breast cancer. Results from EMERGE were published in the

Journal of Clinical Oncology

in April 2015. Patients were randomized (2:1) to receive either glembatumumab vedotin or single-agent Investigator’s Choice, or IC, chemotherapy. Patients randomized to receive IC were allowed to cross over to receive glembatumumab vedotin following disease progression. Activity endpoints included response rate, PFS and overall survival (OS). The final results, as shown below, suggested that glembatumumab vedotin induces significant response rates compared to currently available therapies in patient subsets with advanced, refractory breast cancers with high gpNMB expression (expression in at least 25% of tumor cells) and in patients with triple negative breast cancer. The OS and PFS of patients treated with glembatumumab vedotin was also observed to be greatest in patients with triple negative breast cancer who also have high gpNMB expression and all patients with high gpNMB expression.

EMERGE: Overall Response Rate and Disease Control Data (Intent-to-Treat Population)

|

|

|

High gpNMB Expression

|

|

Triple Negative and

gpNMB Over-Expression

|

|

|

|

|

glembatumumab

vedotin

|

|

Investigator

Choice

|

|

glembatumumab

vedotin

|

|

Investigator

Choice

|

|

|

|

|

(n=23)

|

|

(n=11)

|

|

(n=10)

|

|

(n=6)

|

|

|

Response

|

|

30

|

%

|

9

|

%

|

40

|

%

|

0

|

%

|

|

Disease Control Rate

|

|

65

|

%

|

27

|

%

|

90

|

%

|

17

|

%

|

Responses per RECIST 1.1; IC = Investigator’s Choice;

EMERGE: Progression Free Survival (PFS) and Overall Survival (OS) Data

|

|

|

High gpNMB Expression

|

|

Triple Negative and

gpNMB Over-Expression

|

|

|

|

|

glembatumumab

vedotin

|

|

Investigator

Choice

|

|

glembatumumab

vedotin

|

|

Investigator

Choice

|

|

|

Median PFS (months)

|

|

2.8

|

|

1.5

|

|

3.5

|

|

1.5

|

|

|

|

|

p=0.18

|

|

|

|

p=0.0017

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Median OS (months)

|

|

10.0

|

|

5.7

|

|

10.0

|

|

5.5

|

|

|

|

|

p=0.31

|

|

|

|

p=0.003

|

|

|

|

In December 2013, we initiated METRIC, a randomized, controlled Phase 2b study of glembatumumab vedotin in patients with triple negative breast cancer that over-express gpNMB. Clinical trial sites are open to enrollment across the U.S., Canada, Australia and the European Union. The METRIC protocol was amended in late 2014 based on feedback from clinical investigators conducting the study that the eligibility criteria for study entry were limiting their ability to enroll patients they felt were clinically appropriate. In addition, we had spoken to country-specific members of the European Medicines Agency, or EMA, and believed a significant opportunity existed to expand the study into the EU. The amendment expanded patient entry criteria to position it for full marketing approval with global regulators, including the EMA, and to support improved enrollment in the study. The primary endpoint of the study is PFS as PFS is an established endpoint for full approval registration studies in this patient population in both the U.S. and the EU. The sample size (n=300) and the secondary endpoint of OS remained unchanged. We implemented these changes in parallel to regulatory discussions to maintain momentum at open clinical trial sites. Since implementation, both the FDA and central European regulatory

S-

3

Table of Contents

authorities have reviewed the protocol design, and we believe the METRIC study could support marketing approval in both the U.S. and Europe dependent upon data review. Our goal is to complete enrollment by year end 2016.

Treatment of Metastatic Melanoma:

The Phase 1/2 open-label, multi-center, dose escalation study evaluated the safety, tolerability and pharmacokinetics of glembatumumab vedotin in 117 patients with unresectable stage III or IV melanoma who had failed no more than one prior line of cytotoxic therapy. The MTD was determined to be 1.88 mg/kg administered intravenously once every three weeks. The study achieved its primary activity objective with an overall response rate (ORR) in the Phase 2 cohort of 15% (5/34). Median PFS was 3.3 months for patients treated with the Phase 2 MTD. Glembatumumab vedotin was generally well tolerated, with the most frequent treatment-related adverse events being rash, fatigue, alopecia, pruritus, diarrhea and nausea. A nonsignificant trend toward prolonged PFS was seen for patients with tumors expressing higher levels of gpNMB. The development of rash, which may be associated with the presence of gpNMB in the skin, also seemed to correlate with greater PFS.

In December 2014, we initiated a single arm, single-agent, open label Phase 2 study of glembatumumab vedotin in patients with unresectable stage III or IV melanoma (n=60) and enrollment has been completed. The Company is currently amending the protocol to add a second cohort of patients to a glembatumumab vedotin and varlilumab combination arm to assess the potential clinical benefit of the combination and to explore varlilumab’s potential biologic and immunologic effect when combined with an antibody drug conjugate. The primary endpoint of each cohort is ORR. Secondary endpoints include analyses of PFS, duration of response, OS, retrospective investigation of whether the anticancer activity of glembatumumab vedotin is dependent upon the degree of gpNMB expression in tumor tissue and safety of both the monotherapy and combination regimen. The Company expects to present data from the single-agent cohort at an appropriate medical meeting in the second half of 2016.

Treatment of Other Indications:

We have entered into a collaborative relationship with PrECOG, LLC, which represents a research network established by the Eastern Cooperative Oncology Group (ECOG), under which PrECOG, LLC, is conducting an open-label Phase 1/2 study in patients with unresectable stage IIIB or IV, gpNMB-expressing, advanced or metastatic squamous cell cancer (SCC) of the lung, who have progressed on prior platinum-based chemotherapy. This study opened to enrollment in April 2016. The study will include a dose-escalation phase followed by a two-stage Phase 2 portion (Simon two-stage design). The Phase 1, dose-escalation portion of the study will assess the safety and tolerability of glembatumumab vedotin at the current dose of 1.9 mg/kg and then 2.2 mg/kg in order to determine whether higher dosing is feasible in this population. The first stage of the Phase 2 portion will enroll approximately 20 patients, and if at least two patients achieve a partial response or complete response, a second stage may enroll an additional 15 patients. The primary objective of the Phase 2 portion of the study is to assess the anti-tumor efficacy of glembatumumab vedotin in squamous cell lung cancer as measured by ORR. Secondary objectives of the study include analyses of safety and tolerability and further assessment of anti-tumor activity across a broad range of endpoints.

We have also entered into a Cooperative Research and Development Agreement, or CRADA, with the National Cancer Institute, or NCI, under which NCI is sponsoring two studies of glembatumumab vedotin—one in uveal melanoma and one in pediatric osteosarcoma. Both studies are currently open to enrollment. The uveal melanoma study is a single arm, open label study in patients with locally recurrent or metastatic uveal melanoma. The primary outcome measure is ORR. Secondary outcome measures include change in gpNMB expression on tumor tissue via immunohistochemistry, safety, OS and PFS. The osteosarcoma study is a single arm, open label, evaluation of adolescent and adult patients with recurrent or refractory osteosarcoma. The co-primary objectives are to determine whether glembatumumab vedotin therapy either increases the disease control rate at 4 months in patients with recurrent measurable osteosarcoma as compared to historical experience and/or whether glembatumumab vedotin therapy produces an objective response rate greater than 20% in patients without previous eribulin (eribulin mesylate) treatment. Secondary outcome measures include safety, pharmacokinetics and the relation of gpNMB expression as measured by immunohistochemistry to clinical response.

Varlilumab

Varlilumab, a fully human monoclonal agonist antibody, binds and activates CD27, a critical co-stimulatory molecule in the immune activation cascade, primarily by stimulating T cells to attack cancer cells. Restricted expression and regulation of CD27 enables varlilumab specifically to activate T cells, resulting in an enhanced immune response with a favorable safety profile. Varlilumab has also been shown to directly kill or inhibit the growth of CD27 expressing lymphomas and leukemias

in vitro

and

in vivo

. We have entered into license agreements with the University of Southampton, UK for intellectual property to use anti-CD27 antibodies and with Medarex (now a subsidiary of the Bristol-Myers Squibb Company, or BMS) for access to the UltiMab technology to develop and commercialize human antibodies to CD27.

Patient treatment is complete in the open label Phase 1 study of varlilumab in patients with selected malignant solid tumors or hematologic cancers at multiple clinical sites in the U.S. Initial dose escalation cohorts were conducted to determine an optimal dose for future study, and no maximum tolerated dose was reached. The lymphoid malignancies dose escalation arm completed enrollment (n=24), and a new cohort was added to include evaluation of T cell malignancies. An expansion cohort was also added at 0.3 mg/kg dosed once every three weeks in patients with Hodgkin lymphoma (n= up to 15). The solid tumor arm, which included patients with various solid tumors, completed dose escalation in 2013. Two expansion cohorts were subsequently added at 3 mg/kg dosed weekly in

S-

4

Table of Contents

metastatic melanoma (n=16) and renal cell carcinoma, or RCC, (n=15) to better characterize clinical activity and further define the safety profile in preparation for combination studies.

We presented updated data from this Phase 1 study in November 2014. Varlilumab was very well tolerated and induced immunologic activity in patients that is consistent with both its mechanism of action and preclinical models. A total of 90 patients have been dosed in the study. 56 patients have been dosed in dose escalation cohorts (various solid and hematologic B-cell tumors), and 34 patients have been dosed in the expansion cohorts (melanoma and RCC) at 3 mg/kg. In both the solid tumor and hematologic dose-escalations, the pre-specified maximum dose level (10 mg/kg) was reached without identification of a maximum tolerated dose. The majority of adverse events, or AEs, related to treatment have been mild to moderate (Grade 1/2) in severity, with only three serious AEs related to treatment reported. No significant immune-mediated adverse events (colitis, hepatitis, etc.) typically associated with checkpoint blockade have been observed. Two patients experienced significant objective responses including a complete response in Hodgkin lymphoma (continues at 33.1+ months) and a partial response in renal cell carcinoma of 24.7+ months. Thirteen patients experienced stable disease with a range of 3-41.4+ months (as of April 2016) to-date. Based on the results observed in hematologic malignancies, an expansion cohort in up to 15 patients with Hodgkin lymphoma, and an abbreviated dose escalation in T cell hematologic malignancies were added and are now closed to enrollment. Any incremental data updates from this study will be included in future scientific presentations/publications.

In May 2014, we entered into a clinical trial collaboration with Bristol-Myers Squibb to evaluate the safety, tolerability and preliminary efficacy of varlilumab and Opdivo

®, Bristol-Myers Squibb’s PD-1 immune checkpoint inhibitor, in a Phase 1/2 study. Under the terms of this clinical trial collaboration, Bristol-Myers Squibb made a one-time payment to us of $5.0 million, and the companies amended the terms of our existing license agreement with Medarex (a subsidiary of Bristol-Myers Squibb) related to our CD27 program whereby certain future milestone payments were waived and future royalty rates were reduced that may have been due from us to Medarex. In return, Bristol-Myers Squibb was granted a time-limited right of first negotiation if we wish to out-license varlilumab. The companies also agreed to work exclusively with each other to explore anti-PD-1 antagonist antibody and anti-CD27 agonist antibody combination regimens. The clinical trial collaboration provides that the companies will share development costs and that we will be responsible for conducting the Phase 1/2 study.

The Phase 1/2 study was initiated in January 2015 and is being conducted in adult patients with multiple solid tumors to assess the safety and tolerability of varlilumab at varying doses when administered with Opdivo followed by a Phase 2 expansion to evaluate the activity of the combination in disease specific cohorts. The Phase 1 dose escalation portion of the study, conducted in patients with solid tumors, has completed enrollment (n=36) and primarily enrolled patients with colorectal and ovarian cancer.

Data was presented from the Phase 1 portion of the varlilumab and nivolumab study in a poster at the American Association for Cancer Research (AACR) Annual Meeting 2016 in April. The primary objective of the Phase 1 portion of the study was to evaluate the safety and tolerability of the combination. The combination showed acceptable tolerability and safety across all dose levels without any evidence of increased autoimmunity or inappropriate immune activation. Marked changes in the tumor microenvironment including increased infiltrating CD8+ T cells and increased PD-L1 expression, which have been shown to correlate with a greater magnitude of treatment effect from checkpoint inhibitors in other clinical studies were observed. Additional favorable immune biomarkers, such as increase in inflammatory chemokines and decrease in T regulatory cells, were also noted. In a subset of patients (n=17) on study who had both pre- and post-tumor biopsies available, preliminary evidence suggest a correlation between biomarker data and stable disease or better in seven of these patients (4 ovarian cancer, 2 colorectal cancer, 1 squamous cell carcinoma of the head and neck). All dose levels of the combination therapy showed acceptable tolerability and safety, without identification of a maximum tolerated dose. In the Phase 2 portion of the study, varlilumab will be administered at 3 mg/kg, which is based upon cumulative data across multiple studies.

The Phase 2 portion of the study opened to enrollment in April 2016 and includes cohorts in advanced non-small cell lung cancer (n=35), colorectal cancer (n=18), ovarian cancer (n=18), head and neck squamous cell carcinoma (n=18), renal cell carcinoma (n=25) and glioblastoma (n=20). The primary objective of the Phase 2 cohorts will be ORR, except glioblastoma, where the primary objective is the rate of 12-month overall survival. Secondary objectives include pharmacokinetics assessments, determining the immunogenicity of varlilumab when given in combination with Opdivo and further assessing the anti-tumor activity of combination treatment.

In March 2015, we entered into a clinical trial collaboration with Roche to evaluate the safety, tolerability and preliminary efficacy of varlilumab and atezolizumab (anti-PDL1), Roche’s investigational cancer immunotherapy, in a Phase 1/2 study. The Phase 1 portion of the study is being conducted in multiple tumor types, and the primary outcome is safety and tolerability. The Phase 2 portion of the study will be conducted in RCC, and the primary outcome is ORR. Secondary outcome measures include safety and tolerability, pharmacokinetics, immunogenicity and further assessment of anti-tumor activity across a broad range of endpoints. Under the terms of this agreement, Roche will provide study drug, and we will be responsible for conducting and funding the study, which opened to enrollment in December 2015.

In April 2015, we initiated a Phase 1/2 safety pilot and expansion study examining the combination of varlilumab and Yervoy

®

in patients with stage III or IV metastatic melanoma. In the Phase 2 portion of the study, patients with tumors that express NY-ESO-1

S-

5

Table of Contents

will also receive CDX-1401. The Phase 1 portion of the study will assess the safety and tolerability of varlilumab at varying doses when administered with Yervoy to identify a recommended dose for the Phase 2 portion of the study. The Phase 2 study will include two cohorts—one comprised of patients who are NY-ESO-1 positive and one comprised of patients who are NY-ESO-1 negative. Patients who are NY-ESO-1 positive will also receive CDX-1401 (with poly-ICLC at 2 mg given as an adjuvant) in addition to varlilumab and Yervoy. The primary objective for both cohorts is objective response rate up to 24 weeks. Secondary objectives for the Phase 2 study include safety and tolerability, immunogenicity, pharmacokinetics and further assessment of anti-tumor activity across a broad range of endpoints.

In May 2015, we initiated a Phase 1/2 safety and tolerability study examining the combination of varlilumab and sunitinib (Sutent

®

) in patients with metastatic clear cell renal cell carcinoma. The Phase 1 portion of the study will assess the safety and tolerability of varlilumab at varying doses when administered with sunitinib to identify a recommended dose for the Phase 2 portion of the study. The primary objective of the Phase 2 portion of the study is to assess the preliminary anti-tumor efficacy of the varlilumab/sunitinib combination measured by the overall response rate. Secondary objectives include safety and tolerability, pharmacokinetics, immunogenicity and further assessment of anti-tumor activity across a broad range of endpoints.

In addition to our sponsored studies and clinical trial collaborations, we anticipate that varlilumab’s potential activity will also be explored in investigator sponsored studies at various academic institutions.

Rintega

®

On March 7, 2016, we announced that our Phase 3 study of Rintega

® in patients with newly diagnosed EGFRvIII-positive glioblastoma was being discontinued. This decision was made based on the outcome of a preplanned interim analysis conducted by an independent Data Safety and Monitoring Board (DSMB). The DSMB determined that continuation of the study would not result in reaching statistical significance for the primary endpoint of the study, overall survival in patients with minimal residual disease, as both the Rintega arm and the control arm were performing on par with each other. In the ACT IV study, Rintega performed consistently with prior Phase 2 studies but the control arm significantly outperformed expectations (Hazard ratio = 0.99; median OS: Rintega 20.4 months vs. control 21.1 months). Based on this recommendation, we discontinued the study and do not anticipate incurring substantial additional costs related to Rintega at this time. All patients on the Rintega arm of the ACT IV study, prior Phase 2 studies and existing compassionate use recipients were offered ongoing access to Rintega on a compassionate use basis. We are in the process of conducting a thorough analysis of the data. It is our goal to share this information either through scientific publication or at a medical meeting in the future.

Corporate Information

We are a Delaware corporation organized in 1983. Our principal executive offices are located at Perryville III Building, 53 Frontage Road, Suite 220, Hampton, New Jersey 08827 and our telephone number is (908) 200-7500. Our corporate website is

www.celldex.com

. The information on our website is not incorporated by reference into this prospectus.

S-

6

Table of Contents

The Offering

|

Common stock offered by us

|

|

Shares of our common stock having an aggregate offering price of up to $60 million.

|

|

|

|

|

|

Common stock to be outstanding after this offering

|

|

Up to 113,985,660 shares, assuming sales at a price of $3.93 per share, which was the closing price of our common stock on The NASDAQ Global Market, or NASDAQ, on May 18, 2016. The actual number of shares issued will vary depending on the sales price under this offering.

|

|

|

|

|

|

Manner of offering

|

|

“At-the-market” offering that may be made from time to time through our sales agent, Cantor Fitzgerald & Co. See “Plan of Distribution” beginning on page S-15 of this prospectus supplement.

|

|

|

|

|

|

Use of Proceeds

|

|

We currently intend to use the net proceeds from this offering for working capital and other general corporate purposes. See “Use of Proceeds” on page S-12 of this prospectus supplement.

|

|

|

|

|

|

Risk Factors

|

|

Investing in our common stock involves a high degree of risk. See “Risk Factors” beginning on page S-8 of this prospectus supplement and under similar headings in the other documents that are filed after the date hereof and incorporated by reference in this prospectus supplement for a discussion of factors to consider before deciding to purchase shares of our common stock.

|

|

|

|

|

|

NASDAQ Global Market symbol

|

|

“CLDX”

|

The total number of shares of common stock to be outstanding immediately after this offering is based on 98,718,484 shares of common stock issued and outstanding as of March 31, 2016, which does not include the following, all as of March 31, 2016:

·

8,157,550 shares issuable upon the exercise of outstanding stock options with a weighted-average exercise price of $13.04 per share; and

·

5,727,572 shares available for future issuance under our equity compensation plans.

Unless otherwise stated, all information in this prospectus supplement:

·

assumes no exercise of outstanding options to purchase common stock and no issuance of shares available for future issuance under our equity compensation plans; and

·

reflects all currency in U.S. dollars.

S-

7

Table of Contents

RISK FACTORS

An investment in our securities involves a high degree of risk. You should carefully consider the risks described under “Risk Factors” in the accompanying prospectus and our Annual Report on Form 10-K/A for the year ended December 31, 2015, respectively, as updated by any other document that we subsequently file with the Securities and Exchange Commission and that is incorporated by reference into this prospectus supplement and the accompanying prospectus, as well as the risks described below and all of the other information contained in this prospectus supplement and the accompanying prospectus, and incorporated by reference into this prospectus supplement and the accompanying prospectus, including our financial statements and related notes, before investing in our securities. These risks and uncertainties are not the only ones facing us and there may be additional matters that we are unaware of or that we currently consider immaterial. All of these could adversely affect our business, business prospects, cash flow, results of operations and financial condition. In such case, the trading price of our common stock could decline, and you could lose all or part of your investment in our common stock.

Risks Related to this Offering

Management will have broad discretion as to the use of the proceeds from this offering, and we may not use the proceeds effectively.

Because we have not designated the amount of net proceeds received by us from this offering to be used for any particular purpose, our management will have broad discretion as to the application of the net proceeds from this offering and could use them for purposes other than those contemplated at the time of the offering. Our management may use the net proceeds for corporate purposes that may not improve our financial condition or market value.

You may experience immediate and substantial dilution in the book value per share of the common stock you purchase.

Because the price per share of our common stock being offered may be higher than the book value per share of our common stock, you may suffer substantial dilution in the net tangible book value of the common stock you purchase in this offering. See the section entitled “Dilution” below for a more detailed discussion of the dilution you will incur if you purchase common stock in this offering. In addition, we have a significant number of options and restricted stock outstanding. If the holders of these securities exercise them or become vested in them, as applicable, you may incur further dilution.

You may experience future dilution as a result of future equity offerings.

To raise additional capital, we may in the future offer additional shares of our common stock or other securities convertible into or exchangeable for our common stock at prices that may not be the same as the price per share in this offering. We may sell shares or other securities in any other offering at a price per share that is less than the price per share paid by investors in this offering, and investors purchasing shares or other securities in the future could have rights superior to existing stockholders. The price per share at which we sell additional shares of our common stock, or securities convertible or exchangeable into common stock, in future transactions may be higher or lower than the price per share paid by investors in this offering.

Sales of a significant number of shares of our common stock in the public markets, or the perception that such sales could occur, could depress the market price of our common stock.

Sales of a substantial number of shares of our common stock in the public markets, or the perception that such sales could occur, could depress the market price of our common stock and impair our ability to raise capital through the sale of additional equity securities. We have agreed, without the prior written consent of Cantor Fitzgerald & Co. and subject to certain exceptions set forth in the sales agreement, not to sell or otherwise dispose of any common stock or securities convertible into or exchangeable for shares of common stock, warrants or any rights to purchase or acquire common stock during the period beginning on the fifth trading day immediately prior to the delivery of any placement notice delivered by us to Cantor Fitzgerald & Co. and ending on the fifth trading day immediately following the final settlement date with respect to the shares sold pursuant to such notice. We have further agreed, subject to certain exceptions set forth in the sales agreement, not to sell or otherwise dispose of any common stock or securities convertible into or exchangeable for shares of common stock, warrants or any rights to purchase or acquire common stock in any other “at-the-market” or continuous equity transaction prior to the termination of the sales agreement with Cantor Fitzgerald & Co. Therefore, it is possible that we could issue and sell additional shares of our common stock in the public markets. We cannot predict the effect that future sales of our common stock would have on the market price of our common stock

.

Our share price has been and could remain volatile.

The market price of our common stock has historically experienced and may continue to experience significant volatility. From January 2014 through March 31, 2016, the market price of our common stock has fluctuated from a high of $33.33 per share in the first quarter of 2014, to a low of $2.96 per share in the first quarter of 2016. Our progress in developing and commercializing our

S-

8

Table of Contents

products, the impact of government regulations on our products and industry, the potential sale of a large volume of our common stock by stockholders, our quarterly operating results, changes in general conditions in the economy or the financial markets and other developments affecting us or our competitors could cause the market price of our common stock to fluctuate substantially with significant market losses. If our stockholders sell a substantial number of shares of common stock, especially if those sales are made during a short period of time, those sales could adversely affect the market price of our common stock and could impair our ability to raise capital. In addition, in recent years, the stock market has experienced significant price and volume fluctuations. This volatility has affected the market prices of securities issued by many companies for reasons unrelated to their operating performance and may adversely affect the price of our common stock. In addition, we could be subject to a securities class action litigation as a result of volatility in the price of our stock, which could result in substantial costs and diversion of management’s attention and resources and could harm our stock price, business, prospects, results of operations and financial condition.

Because we do not intend to declare cash dividends on our shares of common stock in the foreseeable future, stockholders must rely on appreciation of the value of our common stock for any return on their investment.

We have never declared or paid cash dividends on our common stock. We currently anticipate that we will retain future earnings for the development, operation and expansion of our business and do not anticipate declaring or paying any cash dividends in the foreseeable future. In addition, the terms of any existing or future debt agreements may preclude us from paying dividends. As a result, we expect that only appreciation of the price of our common stock, if any, will provide a return to investors in this offering for the foreseeable future.

S-

9

Table of Contents

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein contain forward-looking statements made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements represent our management’s judgment regarding future events. In many cases, you can identify forward- looking statements by terminology such as “may,” “will,” “should,” “plan,” “expect,” “anticipate,” “estimate,” “predict,” “intend,” “potential” or “continue” or the negative of these terms or other words of similar import, although some forward-looking statements are expressed differently. All statements other than statements of historical fact included in this prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein regarding our financial position, business strategy and plans or objectives for future operations are forward-looking statements. Without limiting the broader description of forward-looking statements above, we specifically note that statements regarding potential drug candidates, their potential therapeutic effect, the possibility of obtaining regulatory approval, our expected timing for completing clinical trials and clinical trial milestones for our drug candidates, our ability or the ability of our collaborators to manufacture and sell any products, market acceptance or our ability to earn a profit from sales or licenses of any drug candidate or to discover new drugs in the future are all forward-looking in nature. We cannot guarantee the accuracy of forward-looking statements, and you should be aware that results and events could differ materially and adversely from those described in the forward-looking statements due to a number of factors, including:

There are a number of important factors that could cause the actual results to differ materially from those expressed in any forward-looking statement made by us. These factors include, but are not limited to:

·

our ability to successfully complete research and further development, including animal, preclinical and clinical studies, and, if we obtain regulatory approval, commercialization of glembatumumab vedotin and other drug candidates and the growth of the markets for those drug candidates;

·

our ability to raise sufficient capital to fund our clinical studies and to meet our long-term liquidity needs, on terms acceptable to us, or at all. If we are unable to raise the funds necessary to meet our long-term liquidity needs, we may have to delay or discontinue the development of one or more programs, discontinue or delay on-going or anticipated clinical trials, license out programs earlier than expected, raise funds at significant discount or on other unfavorable terms, if at all, or sell all or part of our business;

·

our ability to manage multiple clinical trials for a variety of drug candidates at different stages of development;

·

the cost, timing, scope and results of ongoing safety and efficacy trials of glembatumumab vedotin, and other preclinical and clinical testing;

·

the cost, timing, and uncertainty of obtaining regulatory approvals for our drug candidates;

·

the availability, cost, delivery and quality of clinical management services provided by our clinical research organization partners;

·

the availability, cost, delivery and quality of clinical and commercial grade materials produced by our own manufacturing facility or supplied by contract manufacturers, suppliers and partners, who may be the sole source of supply;

·

our ability to develop and commercialize products before competitors that are superior to the alternatives developed by such competitors;

·

our ability to negotiate strategic partnerships, where appropriate, for our programs, which may include, glembatumumab vedotin and varlilumab;

·

our ability to develop technological capabilities, including identification of novel and clinically important targets, exploiting our existing technology platforms to develop new product candidates and expand our focus to broader markets for our existing targeted immunotherapeutics;

·

our ability to adapt our proprietary antibody-targeted technology, or APC Targeting Technology™, to develop new, safe and effective therapeutics for oncology and infectious disease indications; and

·

our ability to protect our intellectual property rights, including the ability to successfully defend patent oppositions filed against a European patent related to technology we use in varlilumab, and our ability to avoid intellectual property litigation, which can be costly and divert management time and attention.

S-

10

Table of Contents

You should also consider carefully the statements set forth in the section entitled “Risk Factors” in this prospectus supplement and in our Annual Report on Form 10-K/A for the year ended December 31, 2015, respectively, as updated by any other document that we subsequently filed with the Securities and Exchange Commission and that is incorporated by reference into this prospectus supplement, which address various factors that could cause results or events to differ from those described in the forward-looking statements. All subsequent written and oral forward-looking statements attributable to us or to persons acting on our behalf are expressly qualified in their entirety by the applicable cautionary statements. We have no plans to update these forward-looking statements.

S-

11

Table of Contents

USE OF PROCEEDS

The amount of proceeds from this offering will depend upon the number of shares of our common stock sold and the market price at which they are sold. There can be no assurance that we will be able to sell any shares under or fully utilize the sales agreement with Cantor Fitzgerald as a source of financing. We currently expect to use the net proceeds from this offering for working capital and other general corporate purposes. Until we use the net proceeds of this offering, we intend to invest the funds in short-term, investment grade, interest-bearing securities.

The amount and timing of actual expenditures for the purposes set forth above may vary based on several factors, and our management will retain broad discretion as to the ultimate allocation of the proceeds.

S-

12

Table of Contents

MARKET PRICE FOR OUR COMMON STOCK

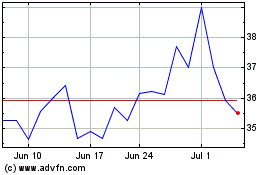

Our common stock currently trades on NASDAQ under the symbol “CLDX”. The following table sets forth for the periods indicated the high and low sale prices per share for our common stock, as reported by NASDAQ.

|

Fiscal Period

|

|

High

|

|

Low

|

|

|

Year Ending December 31, 2016

|

|

|

|

|

|

|

First Quarter

|

|

$

|

15.61

|

|

2.96

|

|

|

Second Quarter (through May 18, 2016)

|

|

4.97

|

|

3.40

|

|

|

Year Ended December 31, 2015

|

|

|

|

|

|

|

First Quarter

|

|

$

|

32.82

|

|

$

|

17.81

|

|

|

Second Quarter

|

|

30.28

|

|

23.62

|

|

|

Third Quarter

|

|

28.08

|

|

10.11

|

|

|

Fourth Quarter

|

|

18.62

|

|

10.15

|

|

|

Year Ended December 31, 2014

|

|

|

|

|

|

|

First Quarter

|

|

$

|

33.33

|

|

$

|

16.58

|

|

|

Second Quarter

|

|

18.52

|

|

10.76

|

|

|

Third Quarter

|

|

18.30

|

|

11.93

|

|

|

Fourth Quarter

|

|

21.70

|

|

12.11

|

|

On May 18, 2016 the closing price of our common stock, as reported by NASDAQ, was $3.93 per share. We have not paid any dividends on our common stock since our inception and do not intend to pay any dividends in the foreseeable future.

S-

13

Table of Contents

DILUTION

If you invest in our common stock in this offering, your ownership interest will be diluted to the extent of the difference between the price per share you pay in this offering and our pro forma net tangible book value per share after this offering. We calculate net tangible book value per share by dividing our net tangible book value, which is tangible assets less total liabilities, by the number of outstanding shares of our common stock.

Our net tangible book value as of March 31, 2016 was approximately $230.5 million, or $2.34 per share. Net tangible book value per share after this offering gives effect to the sale of $60.0 million of common stock in this offering at an assumed offering price of $3.93 per share, which was the closing price of our common stock as reported on NASDAQ on May 18, 2016, after deducting offering commissions and estimated expenses payable by us. Our net tangible book value as of March 31, 2016, after giving effect to this offering as described above, would have been approximately $288.6 million, or $2.53 per share of common stock. This represents an immediate increase in pro forma net tangible book value of $0.19 per share to existing stockholders and an immediate dilution of $1.40 per share to new investors purchasing our common stock in this offering. The following table illustrates the per share dilution:

|

Assumed offering price per share

|

|

|

|

$

|

3.93

|

|

|

Net tangible book value per share as of March 31, 2016

|

|

$

|

2.34

|

|

|

|

|

Increase in net tangible book value per share attributable to new investors

|

|

$

|

0.19

|

|

|

|

|

Pro forma net tangible book value per share as of March 31, 2016, after giving effect to this offering

|

|

|

|

$

|

2.53

|

|

|

Dilution per share to new investors in this offering

|

|

|

|

$

|

1.40

|

|

The above table is based on 98,718,484 shares of our common stock issued and outstanding as of March 31, 2016, which does not include the following:

·

8,157,550 shares issuable upon the exercise of outstanding stock options with a weighted-average exercise price of $13.04 per share; and

·

5,727,572 shares available for future issuance under our equity compensation plans.

S-

14

Table of Contents

PLAN OF DISTRIBUTION

We have entered into a Controlled Equity Offering

SM

sales agreement with Cantor Fitzgerald & Co., or Cantor, pursuant to which we may offer and sell up to $60 million of shares of our common stock, $0.001 par value per share, from time to time through Cantor acting as agent. This summary of the material provisions of the sales agreement does not purport to be a complete statement of its terms and conditions. A copy of the sales agreement has been filed as an exhibit to a Current Report on Form 8-K under the Exchange Act and is incorporated by reference into the registration statement of which this prospectus supplement is a part. See “Where You Can Find More Information” below.

Upon delivery of a placement notice and subject to the terms and conditions of the sales agreement, Cantor may sell our common stock by any method permitted by law deemed to be an “at the market offering” as defined in Rule 415 promulgated under the Securities Act, including sales made directly on NASDAQ, on any other existing trading market for our common stock or to or through a market maker. Cantor may also sell our common stock by any other method permitted by law, including in privately negotiated transactions with our prior consent. We or Cantor may suspend or terminate the offering of our common stock upon notice and subject to other conditions.

We will pay Cantor in cash, upon each sale of our common stock pursuant to the sales agreement, a commission in an amount equal to 3.0% of the aggregate gross proceeds from each sale of our common stock. Because there is no minimum offering amount required as a condition to this offering, the actual total public offering amount, commissions and proceeds to us, if any, are not determinable at this time. We have agreed to reimburse a portion of Cantor’s expenses, including legal fees, in connection with this offering up to a maximum of $50,000. We estimate that the total expenses for the offering, excluding compensation and expense reimbursement payable to Cantor under the terms of the sales agreement, will be approximately $110,000.

Settlement for sales of common stock will occur on the third business day following the date on which any sales are made, or on some other date that is agreed upon by us and Cantor in connection with a particular transaction, in return for payment of the net proceeds to us. There is no arrangement for funds to be received in an escrow, trust or similar arrangement. Sales of our common stock as contemplated in this prospectus will be settled through the facilities of The Depository Trust Company or by such other means as we and Cantor may agree upon.

Cantor will act as sales agent on a commercially reasonable efforts basis consistent with its normal trading and sales practices and applicable state and federal laws, rules and regulations and the rules of NASDAQ. In connection with the sale of the common stock on our behalf, Cantor will be deemed to be an “underwriter” within the meaning of the Securities Act and the compensation of Cantor will be deemed to be underwriting commissions or discounts. We have agreed to provide indemnification and contribution to Cantor against certain civil liabilities, including liabilities under the Securities Act.

The offering of our common stock pursuant to the sales agreement will terminate as permitted therein. We or Cantor may terminate the sales agreement at any time upon ten (10) days’ prior notice.

Cantor and its affiliates may in the future provide various investment banking, commercial banking and other financial services for us and our affiliates, for which services they may in the future receive customary fees. To the extent required by Regulation M, Cantor will not engage in any market making activities involving our common stock while the offering is ongoing under this prospectus.

This prospectus in electronic format may be made available on a website maintained by Cantor and Cantor may distribute this prospectus electronically.

S-

15

Table of Contents

LEGAL MATTERS

Lowenstein Sandler LLP, Roseland, New Jersey, will provide us with an opinion as to the validity of the shares of common stock offered by this prospectus supplement and the accompanying prospectus. Cantor is being represented in connection with this offering by Cooley LLP, New York, New York.

EXPERTS

The financial statements and management’s assessment of the effectiveness of internal control over financial reporting (which is included in Management’s Report on Internal Control over Financial Reporting) incorporated in this prospectus supplement by reference to the Annual Report on Form 10-K/A for the year ended December 31, 2015 have been so incorporated in reliance on the report of PricewaterhouseCoopers LLP, an independent registered public accounting firm, given on the authority of said firm as experts in auditing and accounting.

WHERE YOU CAN FIND MORE INFORMATION

We file annual, quarterly and current reports, proxy statements and other information with the SEC. We have also filed a registration statement on Form S-3, including exhibits, under the Securities Act with respect to the securities offered by this prospectus supplement and the accompanying prospectus. This prospectus supplement and the accompanying prospectus are a part of the registration statement but do not contain all of the information included in the registration statement or the exhibits. You may read and copy the registration statement and any other document that we file at the SEC’s public reference room at 100 F Street, N.E., Room 1580, Washington D.C. 20549. You can call the SEC at 1-800-SEC-0330 for further information on the operation of the public reference room. You can also find our public filings with the SEC on the Internet at a web site maintained by the SEC located at

http://www.sec.gov

.

INCORPORATION OF DOCUMENTS BY REFERENCE

The SEC allows us to “incorporate by reference” into this prospectus supplement and the accompanying prospectus certain information. This means that we can disclose important information to you by referring you to those documents that contain the information. The information we incorporate by reference is considered a part of this prospectus supplement and the accompanying prospectus, and later information we file with the SEC will automatically update and supersede this information. We incorporate by reference the documents listed below and any future filings we make with the SEC under Section 13(a), 13(c), 14 or 15(d) of the Exchange Act, on or after the date of this prospectus supplement (other than information “furnished” under Items 2.02 or 7.01 (or corresponding information furnished under Item 9.01 or included as an exhibit)) of any Current Report on Form 8-K or otherwise “furnished” to the SEC, unless otherwise stated) until this offering is completed:

·

Our Annual Report on Form 10-K/A for the fiscal year ended December 31, 2015, filed on February 25, 2016;

·

Our Quarterly Report on Form 10-Q for the quarter ended March 31, 2016, filed on May 5, 2016;

·

Our Current Reports on Form 8-K filed on February 23, 2016, February 25, 2016, March 7, 2016, May 5, 2016 and May 19, 2016 (other than information “furnished” under Items 2.02 or 7.01 (or corresponding information furnished under Item 9.01 or included as an exhibit));

·

Our Definitive Proxy Statement on Schedule 14A, filed with the SEC on April 21, 2016 (other than the portions thereof which are furnished and not filed); and

·

The description of our common stock contained in our Registration Statement on Form 8-A, filed on November 8, 2004, as amended by Form 8-A/A filed on October 22, 2007 and March 7, 2008.

You may request a copy of these filings, at no cost, by writing to or telephoning us at the following address:

Corporate Secretary

Celldex Therapeutics, Inc.

Perryville III Building, 53 Frontage Road, Suite 220,

Hampton, New Jersey 08827

(908) 200-7500

Any statement contained in this prospectus supplement or in a document incorporated or deemed to be incorporated by reference into this prospectus supplement will be deemed to be modified or superseded for purposes of this prospectus supplement to the extent that a statement contained in this prospectus supplement or any other subsequently filed document that is deemed to be incorporated by reference into this prospectus supplement modifies or supersedes the statement. Any statement so modified or superseded will not be deemed, except as so modified or superseded, to constitute a part of this prospectus supplement.

You should rely only on information contained in, or incorporated by reference into, this prospectus supplement and the accompanying prospectus. We have not authorized anyone to provide you with information different from that contained in this prospectus supplement and the accompanying prospectus or incorporated by reference in this prospectus supplement and the accompanying prospectus. We are not making offers to sell the securities in any jurisdiction in which such an offer or solicitation is not authorized or in which the person making such offer or solicitation is not qualified to do so or to anyone to whom it is unlawful to make such offer or solicitation.

S-

16

Table of Contents

PROSPECTUS

CELLDEX THERAPEUTICS, INC.

Common Stock

Preferred Stock

Warrants

Depositary Shares

Units

Celldex Therapeutics, Inc. or any selling securityholders may offer, issue and sell from time to time, together or separately, in one or more offerings, any combination of:

·

our common stock,

·

our preferred stock, which we may issue in one or more series,

·

warrants,

·

depositary shares, and

·

units.

This prospectus provides a general description of the securities we may offer. Each time we or any selling securityholders sell securities, we will provide specific terms of the securities offered in a supplement to this prospectus. The prospectus supplement may also add, update or change information contained in this prospectus. You should read this prospectus and the accompanying prospectus supplement, as well as the documents incorporated or deemed incorporated by reference in this prospectus, carefully before you make your investment decision. Our common stock is traded on the NASDAQ Global Market under the symbol “CLDX.” On November 29, 2013, the last reported sale price of our common stock on the NASDAQ Global Market was $27.76 per share. You are urged to obtain current market quotations of the common stock. Each prospectus supplement will indicate if the securities offered thereby will be listed on any securities exchange.

This prospectus may not be used to sell securities unless accompanied by a prospectus supplement.

We or any selling securityholders may offer to sell these securities on a continuous or delayed basis, through agents, dealers or underwriters, or directly to purchasers. The prospectus supplement for each offering of securities will describe in detail the plan of distribution for that offering. If our agents or any dealers or underwriters are involved in the sale of the securities, the applicable prospectus supplement will set forth the names of the agents, dealers or underwriters and any applicable commissions or discounts. Our net proceeds from the sale of securities will also be set forth in the applicable prospectus supplement. For general information about the distribution of securities offered, please see “Plan of Distribution” in this prospectus.

Investing in our securities involves risks. Before making an investment decisions, you should carefully review the information contained in this prospectus under the heading “Risk Factors” beginning on page 6 of this prospectus.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION OR REGULATORY BODY HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR DETERMINED IF THIS PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The date of this prospectus is December 3, 2013.

Table of Contents

ABOUT THIS PROSPECTUS

This prospectus is a part of a registration statement that we filed with the Securities and Exchange Commission, or the SEC, utilizing a “shelf” registration process. Under this shelf registration process, we or any selling securityholders may, from time to time, sell any combination of the securities described in this prospectus in one or more offerings.

The registration statement containing this prospectus, including the exhibits to the registration statement, provides additional information about us and the securities offered under this prospectus. You should read the registration statement and the accompanying exhibits for further information. The registration statement, including the exhibits and the documents incorporated or deemed incorporated herein by reference, can be read and are available to the public over the Internet at the SEC’s website at

http://www.sec.gov

as described under the heading “Where You Can Find More Information.”

This prospectus provides you with a general description of the securities we or any selling securityholders may offer. Each time we or any selling securityholders sell securities pursuant to this prospectus, we will provide a prospectus supplement containing specific information about the terms of a particular offering by us or any selling securityholders. That prospectus supplement may include a discussion of any risk factors or other special considerations that apply to those securities. The prospectus supplement may add, update or change information in this prospectus. If the information in the prospectus is inconsistent with a prospectus supplement, you should rely on the information in that prospectus supplement. You should read both this prospectus and, if applicable, any prospectus supplement. See “Where You Can Find More Information” for more information.

You should rely only on the information incorporated by reference or provided in this prospectus. We have not authorized any dealer, salesman or other person to give any information or to make any representation other than those contained or incorporated by reference in this prospectus or any prospectus supplement. You must not rely upon any information or representation not contained or incorporated by reference in this prospectus or any prospectus supplement. This prospectus and any prospectus supplement do not constitute an offer to sell or the solicitation of an offer to buy any securities other than the registered securities to which they relate, nor do this prospectus and any prospectus supplement constitute an offer to sell or the solicitation of an offer to buy securities in any jurisdiction to any person to whom it is unlawful to make such offer or solicitation in such jurisdiction. You should not assume that the information contained in this prospectus or any prospectus supplement is accurate on any date subsequent to the date set forth on the front of such document or that any information we have incorporated by reference is correct on any date subsequent to the date of the document incorporated by reference, even though this prospectus and any prospectus supplement is delivered or securities are sold on a later date.

Unless this prospectus indicates otherwise or the context otherwise requires, the terms “we,” “our,” “us,” “Celldex” or the “Company” as used in this prospectus refer to Celldex Therapeutics, Inc. and its subsidiaries, except that such terms refer to only Celldex Therapeutics, Inc. and not its subsidiaries in the sections entitled “Description of Common Stock,” “Description of Preferred Stock,” “Description of Warrants,” “Description of Depositary Shares,” and “Description of Units.”

1

Table of Contents

PROSPECTUS SUMMARY

Company Overview

We are a biopharmaceutical company focused on the development and commercialization of several immunotherapy technologies for the treatment of cancer and other difficult-to-treat diseases. Our lead drug candidates include rindopepimut (CDX-110), an immunotherapeutic vaccine in a pivotal Phase 3 study for the treatment of front-line glioblastoma and a Phase 2 study for the treatment of recurrent glioblastoma, and CDX-011, an antibody-drug conjugate for which we initiated an accelerated approval study in December 2013 for the treatment of advanced breast cancer. We also have a number of earlier stage candidates in clinical development, including CDX-1127, a therapeutic fully human monoclonal antibody in a Phase 1 study for cancer indications, CDX-1135, a molecule that inhibits a part of the immune system called the complement system, CDX-301, an immune cell mobilizing agent and dendritic cell growth factor and CDX-1401, an APC Targeting Technology™ program in a Phase 1 study for cancer indications. Our drug candidates address market opportunities for which we believe current therapies are inadequate or non-existent.

We are building a fully integrated, commercial-stage biopharmaceutical company that develops important therapies for patients with unmet medical needs. Our program assets provide us with the strategic options to either retain full economic rights to our innovative therapies or seek favorable economic terms through advantageous commercial partnerships. This approach allows us to maximize the overall value of our technology and product portfolio while best ensuring the expeditious development of each individual product.

Rindopepimut (CDX-110)

Rindopepimut is an experimental immunotherapeutic drug that targets the tumor-specific molecule, epidermal growth factor receptor variant III, or EGFRvIII. EGFRvIII is a mutated form of the epidermal growth factor receptor, or EGFR, that is only expressed in cancer cells and not in normal tissue and can directly contribute to cancer cell growth. EGFRvIII is expressed in approximately 30% of glioblastoma, or GB, tumors, the most common and aggressive form of brain cancer. The rindopepimut vaccine is composed of the EGFRvIII peptide linked to a carrier protein called Keyhole Limpet Hemocyanin, or KLH, and administered together with the adjuvant GM-CSF. The Food and Drug Administration, or FDA, and the European Medicines Agency, or EMA, have both granted orphan drug designation for rindopepimut for the treatment of EGFRvIII expressing GB and the FDA has also granted Fast Track designation.

Glembatumumab Vedotin (CDX-011)

CDX-011 is an antibody-drug conjugate, or ADC, for the treatment of patients with glycoprotein NMB, or gpNMB, expressing advanced, refractory breast cancer. CDX-011 consists of a fully-human monoclonal antibody, CR011, linked to a potent cell-killing drug, monomethyl-auristatin E, or MMAE. CDX-011 targets the protein gpNMB, which is over-expressed in a variety of cancers, including breast cancer and melanoma. The ADC technology, comprised of MMAE and a stable linker system for attaching it to CR011, was licensed from Seattle Genetics, Inc. The FDA has granted Fast Track designation to CDX-011 for the treatment of advanced, refractory/resistant gpNMB-expressing breast cancer.

In connection with our acquisition of CuraGen Corporation, we assumed the license agreement between CuraGen and Seattle Genetics, whereby CuraGen acquired the rights to proprietary ADC technology, with the right to sublicense, for use with its proprietary antibodies for the potential treatment of cancer. Under the terms of the agreement, we have the responsibility of using commercially reasonable efforts to develop, commercialize and market such treatment. In furtherance of these responsibilities, technical assistance from Seattle Genetics is available to us as necessary. We may be required to pay milestones of up to $7.5 million upon obtaining first approval for commercial sale in a first indication and royalty payments in the mid-single digits on any net product sales to Seattle Genetics with respect to development and commercialization of the ADC technology, including our CDX-011 program. The term of the agreement varies country to country and may be until the later of the expiration of the last relevant patent or the 10

th

anniversary of the first commercial sale. The agreement allows us to terminate with prior written notice, with both parties being able to terminate the agreement for an uncured material breach or insolvency of the other party.

The patent rights licensed from Seattle Genetics include issued patents and pending applications in Australia, Canada, Europe, the U.S. and Japan which include composition of matter claims relating to the toxin and conjugation technology. If maintained to full term in due course, the main Seattle Genetics patent rights would have estimated patent expiry dates ranging from 2023 in Europe to 2026 in the U.S.

CDX-1127

CDX-1127 is a human monoclonal antibody that targets CD27, a potentially important target for immunotherapy of various cancers. CD27 acts downstream from CD40 and may provide a novel way to regulate the immune responses. CD27 is a co-stimulatory molecule on T cells and is over-expressed in certain lymphomas and leukemias. CDX-1127 is an agonist antibody designed to have two potential therapeutic mechanisms. CDX-1127 has been shown to activate immune cells that can target and eliminate cancerous

2

Table of Contents