Current Report Filing (8-k)

December 08 2015 - 4:17PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): December 7, 2015

Career Education Corporation

(Exact Name of Registrant as Specified in Charter)

|

|

|

|

|

| Delaware |

|

0-23245 |

|

36-3932190 |

| (State or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

|

|

|

| 231 N. Martingale Rd., Schaumburg, IL |

|

60173 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (847) 781-3600

Not applicable

(Former

Name or Former Address, if Changed Since Last Report)

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 2.05. |

Costs Associated With Exit or Disposal Activities. |

In May 2015, Career Education Corporation (the

“Company”) announced its strategic decision to focus its resources and attention on its universities – Colorado Technical University (CTU) and American InterContinental University (AIU). In connection with that decision, the

Board of Directors of the Company approved the pursuit of divestiture options for several of the Company’s Career College campuses, including Briarcliffe College, with those campuses to be taught out if a sale was not successful. In accordance

with this strategy, on December 7, 2015, the teach-out of the Company’s Briarcliffe College campuses was announced. These campuses will remain open to offer current students the reasonable opportunity to complete their course of study.

Briarcliffe College consists of two ground-based campuses and one online satellite campus and contributed $19.4 million and $32.2 million of revenue and ($7.0) million and ($2.6) million of operating losses for the nine months ended

September 30, 2015 and for the year ended December 31, 2014, respectively.

The Company expects to record approximately $6 million to $8 million

of restructuring charges related to the teach-out of the Briarcliffe College campuses. These estimated charges are based on the timing of campus teach-outs, and are subject to change. These costs primarily relate to severance charges (approximately

$2 million - $3 million) and costs associated with exiting lease obligations (approximately $4 million - $5 million). The severance and related charges will primarily be recorded during the fourth quarter of 2015 and the lease charges will be

recorded at the time each facility is vacated, which is expected to be during 2018. These amounts will result in actual cash outlay through 2018 for severance related charges and from the teach-out date through 2019 for lease obligations. The

estimated charges and cash outlay associated with exiting lease obligations could be reduced if any sublease agreements are entered into.

Cautionary

Statement Regarding Forward-Looking Statements

This current report on Form 8-K contains forward-looking statements, including statements about the

expected timing and effects of the teach-out of Briarcliffe College. These forward-looking statements are subject to a number of risks and uncertainties that could cause actual results to differ materially from those anticipated, including, but not

limited to, uncertainties regarding the timing and future costs associated with the Company’s teach out and restructuring activities and the factors described in the Company’s reports filed with the Securities and Exchange Commission from

time to time. Except to the extent required by law, the Company disclaims any obligations to update any forward-looking statements.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

| CAREER EDUCATION CORPORATION |

|

|

| By: |

|

/s/ David Rawden |

|

|

David Rawden |

|

|

Interim Chief Financial Officer |

Date: December 8, 2015

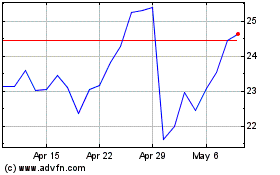

CECO Environmental (NASDAQ:CECO)

Historical Stock Chart

From Mar 2024 to Apr 2024

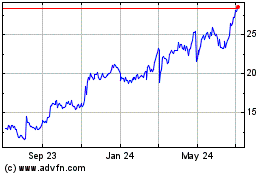

CECO Environmental (NASDAQ:CECO)

Historical Stock Chart

From Apr 2023 to Apr 2024