UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): July 14, 2015

Career Education Corporation

(Exact Name of Registrant as Specified in Charter)

|

|

|

|

|

| Delaware |

|

0-23245 |

|

36-3932190 |

| (State or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

|

|

|

| 231 North Martingale Road Schaumburg, IL |

|

60173 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (847) 781-3600

Not Applicable

(Former

Name or Former Address, if Changed Since Last Report.)

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 5.02. |

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

On July 14, 2015, the Compensation Committee (the “Committee”) of the Board of Directors of Career Education Corporation (the

“Company”) approved the Amended and Restated 2015 Annual Incentive Award Program (the “Revised AIP”) pursuant to the Career Education Corporation 2008 Incentive Compensation Plan (the “2008 Plan”).

The terms and conditions of the 2015 Annual Incentive Award Program approved by the Committee on March 2, 2015 (and disclosed in a Current Report on Form 8-K dated March 2, 2015 (the “March 2nd 8-K”) ) shall have no further force and effect and are replaced by the terms and conditions of the Revised AIP.

The Revised AIP aligns the Company’s annual incentive program with the Company’s May 2015 strategic decision to exit the Company’s Career

Colleges business, to right-size its corporate overhead and to streamline its University operations in order to focus the Company’s resources and attention on its University business. The Committee believes that it is necessary and important to

realign the performance measures and payout opportunities to the Company’s revised operating plan to provide clear incentives and performance expectations. The Revised AIP maintains an EBITDA performance component (80% weighting) and an

individual goals performance component (20% weighting) for the most senior level participants. The EBITDA performance component is based solely on a company-wide EBITDA performance measure which has been revised to reflect the Company’s

strategic decision and related actions. Achievement of the target level of performance for the EBITDA performance component results in a payout factor of 100% reflecting expectations for improved consolidated EBITDA performance as a result of the

strategic changes to the Company’s business and to provide greater incentive to participants to achieve the anticipated benefits of the business changes. In addition, the payout opportunity for the individual goals performance component will

also vary based on the level of achievement of the EBITDA performance component to further support the achievement of the anticipated benefits of the business changes. Threshold EBITDA performance levels of at least 60% must be achieved for any

payments under the Revised AIP, and payments are capped at 200% of a participant’s AIP target value.

The Company’s current executive officers

(other than the Interim CEO and Interim CFO) participate in the 2015 Annual Incentive Award Program for Key Executives pursuant to the 2008 Plan (the “Key Executive AIP”). The incentive compensation arrangements for the

Company’s Interim CEO, Ronald McCray, are discussed below. As previously announced, compensation for the services of the Company’s Interim CFO, David Rawden, is provided pursuant to an agreement with an affiliate of AlixPartners;

Mr. Rawden is not directly compensated by the Company. As noted in the March 2nd 8-K, the Key Executive AIP (i) establishes the maximum amount payable to each identified participant

based on achievement of a revenue performance measure and (ii) is designed to qualify amounts earned under the Key Executive AIP as “performance-based” compensation for purposes of Section 162(m) of the Internal Revenue Code of

1986, as amended from time to time. The March 2nd 8-K also noted the Committee’s intention to exercise its negative discretion under the Key Executive AIP to establish payments

thereunder in accordance with the 2015 Annual Incentive Plan, consistent with its practice in recent years. In light of the adoption of the Revised AIP, the Committee will exercise its negative discretion under the Key Executive AIP to establish

payments thereunder in accordance with the Revised AIP.

As previously disclosed, on March 6, 2015 the Committee granted the following to Ronald

McCray in accordance with the compensation arrangements established for Mr. McCray in connection with his employment as the Company’s Interim President and Chief Executive Officer: (i) 250,000 stock-settled restricted stock units

under the 2008 Plan, and (ii) 11,324 cash-settled restricted stock units outside of the 2008 Plan. As described in the March 2nd 8-K, Mr. McCray’s restricted stock unit awards

vest on March 14, 2016 based on the level of achievement of company-wide 2015 EBITDA, as defined for purposes of the Company’s 2015 Annual Incentive Program, and the number of restricted stock units eligible for vesting will be based on

the length of Mr. McCray’s tenure in his role as Interim President and Chief Executive Officer of the Company, with 25% being eligible for vesting as of the grant date and an additional 25% eligible for vesting on each of April 1,

2015, July 1, 2015 and October 1, 2015. In light of the adoption of the Revised AIP, the performance vesting criteria of Mr. McCray’s restricted stock units is now based on the level of achievement of company-wide EBITDA as

defined for purposes of the Revised AIP. The scale for determining the number of restricted stock units eligible for vesting based on achievement of the above-referenced EBITDA performance measure has been revised to conform to the payout scale

under the Revised AIP in

2

accordance with the rationale discussed above relating to the design of the Revised AIP. The revised scale is set forth in the Amendment to Restricted Stock Unit Agreements attached as Exhibit

10.2.

| Item 9.01. |

Financial Statements and Exhibits. |

|

|

|

| Exhibit

Number |

|

Description of Exhibits |

|

|

| 10.1 |

|

Amended and Restated 2015 Annual Incentive Award Program pursuant to the Career Education Corporation 2008 Incentive Compensation Plan (the “2008 Plan”) |

|

|

| 10.2 |

|

Amendment to Restricted Stock Unit Agreements between Career Education Corporation and Ronald McCray dated July 17, 2015 |

3

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

|

|

| CAREER EDUCATION CORPORATION |

|

|

| By: |

|

/s/ Jeffrey D. Ayers |

|

|

Jeffrey D. Ayers |

|

|

Senior Vice President, General Counsel and

Corporate Secretary |

|

| Date: July 20, 2015 |

4

Exhibit Index

|

|

|

| Exhibit

Number |

|

Description of Exhibits |

|

|

| 10.1 |

|

Amended and Restated 2015 Annual Incentive Award Program pursuant to the Career Education Corporation 2008 Incentive Compensation Plan (the “2008 Plan”) |

|

|

| 10.2 |

|

Amendment to Restricted Stock Unit Agreements between Career Education Corporation and Ronald McCray dated July 17, 2015 |

5

Exhibit 10.1

Final

Career Education Corporation

Amended and Restated

2015 Annual Incentive Award Program

pursuant to the

2008

Incentive Compensation Plan

ARTICLE 1

PURPOSE AND PERFORMANCE PERIOD

1.1

Purpose. This document is created to set forth the amended and restated terms and conditions for certain Grantees who have been selected to participate in the Annual Incentive Award portion of the Plan for calendar year 2015. The terms

and conditions of the 2015 Annual Incentive Award Program approved by the Committee on March 2, 2015 shall have no further force or effect and are hereby replaced by the terms and conditions set forth in this document. To the extent that there

is any conflict between the terms of this document and the terms of the Plan, the Plan shall control.

1.2 Performance Period. This document

is effective for certain Annual Incentive Awards calculated for Grantees under the Plan relating to calendar year 2015. The 2015 Annual Incentive Awards earned pursuant to this Program shall be paid no later than March 15, 2016.

1.3 No Misconduct. If at any time prior to the date the 2015 Annual Incentive Award is paid by the Company or an Affiliate, a Grantee is

determined by the Administrator to have engaged in Misconduct, then no such Annual Incentive Award shall be paid to such Grantee.

ARTICLE 2

DEFINITIONS

Capitalized terms used but not otherwise defined herein shall have the meanings ascribed to such terms in the Plan. The following

words and phrases shall have the following meanings:

2.1 “Administrator” means a committee consisting of the Chief Financial

Officer, the General Counsel and the Chief Human Resources Officer (or their respective designees), and/or any other executive officer as determined by the Committee.

2.2 “Affiliate” means any corporation, campus, or other entity that, directly or indirectly through one or more intermediaries, is

owned by the Company.

2.3 “Covered Management Position” means a position within the Company which the Company has determined to

be covered under 34 C.F.R. Section 668.14(b)(22)(iii)(C).

2.4 “EBITDA” means the consolidated earnings of the Company (and

its Affiliates) from both continuing and discontinued operations, determined before interest, taxes, depreciation and amortization, and before amounts paid under this Program, the Key Executive Program and any other annual cash bonus program of the

Company or any Affiliate. EBITDA shall be calculated using the earnings and other amounts as reported on the Company’s Form 10-K for the year ending on December 31, 2015 (which is prepared in accordance with the generally accepted

accounting principles in the U.S.), excluding intra-Company management fees and amounts paid pursuant to this Program, the Key Executive Program and any other annual cash bonus program of the Company or any Affiliate, and including such adjustment,

if any, as may be made by the Committee pursuant to Section 5.1. For 2015, these adjustments may include items such as neutralizing for legal expenses (including legal settlements), certain occupancy costs, impairment charges, retention costs,

and the impact of certain accounting changes, as well as certain severance and related cost savings. To the extent the information reported on the Form 10-K is not sufficiently specific to provide data for a specific amount, the data will be

obtained from the Company’s Finance Department and will be based on the data upon which information in the Form 10-K is based.

2.5

“EBITDA Performance Factor” means a percentage (expressed to the second decimal place) determined pursuant to the table set forth in the applicable memorandum from the Company setting forth the criteria for a Grantee’s

Award. The EBITDA Performance Factor may not be less than 0% nor more than 200%.

|

|

|

| Program Effective January 1, 2015 |

|

Page 2 of 6 |

2.6 “Eligible Earned Wages”

means compensation for services performed in an incentive-eligible position (as determined pursuant to Article 3) that is eligible for inclusion when determining a Grantee’s Annual Incentive Award. Eligible Earned Wages are based on base

earnings during the Performance Period only and exclude any other payments made during the Performance Period (i.e., teach pay, allowances, reimbursements, equity grants, bonuses, incentive payments, short-term disability payments, long-term

disability payments, etc.). For the avoidance of doubt, Eligible Earned Wages for the Performance Period shall be determined consistent with Article 3 and any Grantee who is not eligible for an award or payment pursuant to Article 3 shall have no

Eligible Earned Wages for the Performance Period.

2.7 “Individual Goals Performance Factor” means, with respect to each Grantee,

the Grantee’s achievement (expressed as a percentage and as determined by the Grantee’s manager) of the individual performance goals, and weighting of such goals, established by the Grantee’s manager or department head, as applicable,

and recorded in the Company’s performance management system as the Grantee’s goals for the Performance Period. The Individual Goals Performance Factor may not be less than 0% nor more than 200%.

2.8 “Key Executive Program” means the Career Education Corporation 2015 Annual Incentive Award Program for Key Executives.

2.9 “Misconduct” means any one of the following in which a Grantee may engage prior to or during the Performance Period or any time

thereafter, but prior to the date the 2015 Annual Incentive Award is paid: (a) any act of intentional misconduct, dishonesty, gross negligence, conscious abandonment, or neglect of duty; (b) any violation of the Company’s Code of

Conduct, policies on maintaining confidentiality of proprietary information, Code of Ethics or non-discrimination or anti-harassment policy; (c) any commission of a criminal activity, fraud, or embezzlement; (d) any failure to reasonably

cooperate in any investigation or proceeding concerning the Company or any of its Affiliates; (e) any unauthorized disclosure or use of confidential information or trade secrets; (f) any violation of any enforceable restrictive covenant,

such as a non-compete, non-solicit, or non-disclosure agreement between the Grantee and the Company or an Affiliate; or (g) any conduct that causes the Grantee to be ineligible for benefits pursuant the applicable Company severance plan.

2.10 “Performance Period” means the calendar year ending December 31, 2015.

2.11 “Plan” means the Career Education Corporation 2008 Incentive Compensation Plan, as amended.

2.12 “Program” means this Amended and Restated 2015 Annual Incentive Award Program which is established under the Plan.

2.13 “Target Incentive Percentage” means a Grantee’s target Annual Incentive Award percentage of Eligible Earned Wages as

communicated to the Grantee.

2.14 “Targeted EBITDA” means the targeted EBITDA for the Performance Period as approved by the

Committee, which shall be consistent with the Company’s revised 2015 operating plan approved by the Board of Directors of the Company on June 23, 2015.

ARTICLE 3

ELIGIBILITY

3.1 General Eligibility Requirements. The Grantees for the Performance Period are employees who are not in a Covered Management

Position and are classified by the Company as (a) Grade E55 or higher, or (b)

|

|

|

| Program Effective January 1, 2015 |

|

Page 3 of 6 |

Grade T09, T10 or T12. Grantees are separately notified of their eligibility to participate in the Program. Employees who participate in the Key Executive Program are not eligible Grantees for

purposes of this Program. If an individual is in a Covered Management Position at any point during the Performance Period, then such individual will not be eligible for an award or payment under this Program.

3.2 Campuses in Teach Out. Individuals classified as Transitional Group employees relating to a campus in teach out will not be eligible

for an award or payment under this Program, unless otherwise determined by the Committee. Notwithstanding the foregoing, and subject to Section 1.3 hereof, if a Grantee pursuant to this Program becomes a Transitional Group employee relating to

a campus in teach out on or after October 1, 2015, then such Grantee shall remain eligible to receive an Annual Incentive Award pursuant to this Program and such Grantee’s Eligible Earned Wages earned during the Performance Period prior to

his or her classification as a Transitional Group employee relating to a campus in teach out shall continue to be Eligible Earned Wages for purposes of this Program.

3.3 Employment Changes. To the extent an individual is newly hired by the Company or any of its Affiliates or first moves into an

incentive-eligible position on or after October 1, 2015, such individual shall not be eligible to receive an Annual Incentive Award pursuant to this Program. Subject to Section 1.3 hereof and unless otherwise determined by the Committee, a

Grantee must be employed by the Company or an Affiliate on the last day of the Performance Period in order to be eligible to receive an Annual Incentive Award payment hereunder. Notwithstanding the foregoing, and subject to Section 1.3 hereof,

if a Grantee’s employment with the Company is terminated by the Company without Cause as part of a reduction in force on or after October 1, 2015, then such Grantee shall remain eligible to receive an Annual Incentive Award pursuant to

this Program and such Grantee’s Eligible Earned Wages earned during the Performance Period prior to his or her termination shall continue to be Eligible Earned Wages for purposes of this Program; provided that, unless otherwise determined by

the Committee, such Grantee shall not be eligible for a payment hereunder to the extent such Grantee received a severance package in connection with such termination and such severance package contained a payment related to or otherwise based on

annual bonus. In all cases, to the extent a Grantee is no longer employed by the Company or an Affiliate on the date the Annual Incentive Award becomes payable pursuant to this Program (a “Separated Grantee”), then the Annual

Incentive Amount shall only be paid to such Separated Grantee to the extent the Separated Grantee has executed a release of claims against the Company and its Affiliates, which release must be in a form satisfactory to the Administrator, prior to

the payment date for such Annual Incentive Award. In addition, if applicable law requires that any such release be subject to a revocation period in order to become fully effective, payment of the Annual Incentive Award to a Separated Grantee shall

only be required if, prior to the payment date for the Annual Incentive Award, the applicable revocation period for the release has lapsed without any such revocation occurring.

ARTICLE 4

AWARD AMOUNT

4.1 Annual Incentive Award Weightings. The following table identifies the Annual Incentive Award element weightings based on the

performance components and Grantee classification. Grantee classification will be determined by the Administrator and communicated to the Grantee.

|

|

|

|

|

|

|

| Grantee Classification |

|

EBITDA |

|

Individual

Goals |

|

Total |

| E61 and Above |

|

80% |

|

20% |

|

100% |

| E58 - E60, T12 |

|

70% |

|

30% |

|

100% |

| E55 – E57, T09, T10 |

|

60% |

|

40% |

|

100% |

For Grantees performing services during the Performance Period in multiple Grantee classifications, the percentages set forth

in the tables above may be subject to proration pursuant to Section 5.2 hereof.

|

|

|

| Program Effective January 1, 2015 |

|

Page 4 of 6 |

4.2 EBITDA Performance Component. In

respect of the EBITDA performance component, each Grantee will be eligible to receive a payment equal to the result of applying the following formula to such Grantee:

A x B x C x D:

Where:

| |

“A” |

equals such Grantee’s Eligible Earned Wages; |

| |

“B” |

equals such Grantee’s Target Incentive Percentage; |

| |

“C” |

equals the percentage set forth in the applicable box set forth in the “EBITDA” column in the table in Section 4.1 hereof; and |

| |

“D” |

equals the applicable EBITDA Performance Factor. |

4.3 Individual Goals Performance Component. In

respect of the individual goals performance component, each Grantee will be eligible to receive a payment equal to the result of applying the following formula to such Grantee:

A x B x Y x D x Z:

Where:

| |

“A” |

equals such Grantee’s Eligible Earned Wages; |

| |

“B” |

equals such Grantee’s Target Incentive Percentage; |

| |

“D” |

equals the applicable EBITDA Performance Factor; |

| |

“Y” |

equals the percentage set forth in the applicable box set forth in the “Individual Goals” column in the table in Section 4.1 hereof; and |

| |

“Z” |

equals the applicable Individual Goals Performance Factor. |

Notwithstanding the foregoing, the product of D x

Z may not be greater than 200%, and any payment pursuant to this Section 4.3 shall be adjusted accordingly to implement a 200% payout cap with respect to the individual goals performance component.

4.4 Adjustment. The individual goals performance component of each Grantee’s Annual Incentive Award (determined without application of this

Section 4.4) is subject to adjustment by managers. Such adjustment may be negative for those Grantees who do not achieve the applicable goals, and positive for those Grantees who demonstrate outstanding accomplishments. For purposes of applying

this Section 4.4, any positive adjustment made to the individual goals performance component of the Annual Incentive Award of one Grantee must result in a dollar-for-dollar negative adjustment to the individual goals performance component of

the Annual Incentive Award of one or more other Grantees so that, in the aggregate, the application of the adjustment described in this Section 4.4 to all the Grantees shall not result in any additional cost to the Company and its Affiliates

for the group of Grantees over which a particular manager retains authority.

ARTICLE 5

MISCELLANEOUS

5.1

Miscellaneous. The Committee may modify or terminate this Program at any time and for any reason, effective at such date as the Committee may determine, without the approval of the Grantees or stockholders of the Company. Without

limiting the foregoing, the Committee reserves the right to adjust EBITDA, the EBITDA Performance Factor, Targeted EBITDA, the Target Incentive Percentage and the applicable individual goals, and to adjust, make or interpret any other determination

or classification, for any or all Grantees for any reason, including if, in the Committee’s sole discretion, any unforeseen or unplanned event results in a positive or negative impact on the performance of the Company (or its Affiliates) during

the Performance Period or its overall financial position. All such modifications, terminations, adjustments, determinations and interpretations relating to this Program shall be binding on all Grantees.

|

|

|

| Program Effective January 1, 2015 |

|

Page 5 of 6 |

5.2 Proration. If a Grantee’s

move between two or more incentive-eligible positions during the Performance Period impacts Grantee classification for purposes of Section 4.1, then a proration may be applied to determine the amount due to such Grantee pursuant to Article 4

hereof. To the extent it applies, such proration shall be determined in the discretion of the Administrator, and shall be based on relevant factors, which may include, but shall not be limited to (a) the relative time spent by such Grantee

working at each level, and (b) the extent to which corporate or an education group was charged for the services of such Grantee. Unless otherwise determined by the Administrator, such proration will be based on whole months (rather than a

day-by-day basis), and for purposes of such proration, actions taken prior to the fifteenth day of any month will be deemed to have happened on the first day of that month, while action taken on or after the fifteenth day of any month will be deemed

to have happened on the first day of the following month.

5.3 Compliance With Laws. This Program was created to comply with the

“incentive compensation” provisions of the Higher Education Act, 20 U.S.C.§ 1094(a)(20), and with the implementing regulations of the U.S. Department of Education (“ED”), located at 34

C.F.R.§ 668.14(b)(22). The Company is aware that the ED regulations changed, effective July 1, 2011, and this Program has been created to comply with changed regulations that took effect July 1, 2011. All provisions of this

Program will be interpreted and applied so as to be consistent with that statute and those regulations. If at any time the Committee determines that any potential compensation action would, or in the Committee’s sole discretion might, violate

that statute or those regulations, the Committee may in its sole discretion elect not to pay such compensation. If the statute or regulations change or if ED provides guidance that changes the Committee’s understanding of how the statute and

regulations will be applied, the Committee will make appropriate changes to this Program, or may terminate this Program, in its sole discretion, with or without advance notice to the Grantees. The Committee reserves the right to modify any element

of this Program, to decline to make any payments under this Program, or to terminate this Program in its entirety, at any time for any reason, in its sole discretion, with or without advance notice to the Grantees.

|

|

|

| Program Effective January 1, 2015 |

|

Page 6 of 6 |

Exhibit 10.2

AMENDMENT TO

RESTRICTED STOCK UNIT AGREEMENTS

This AMENDMENT TO RESTRICTED STOCK UNIT AGREEMENTS (this “Amendment”) dated July 17, 2015 is by and between Career

Education Corporation, a Delaware corporation (the “Company”), and Ronald McCray (the “Grantee”).

The

Company and the Grantee are parties to (i) a Restricted Stock Unit Agreement dated March 6, 2015 relating to an award of 250,000 stock-settled restricted stock units granted pursuant to the Career Education Corporation 2008 Incentive

Compensation Plan, as amended (the “Plan”), and (ii) a Restricted Stock Unit Agreement dated March 6, 2015 relating to an award of 11,324 cash-settled restricted stock units granted outside of the Plan (collectively, the

“McCray Award Agreements”).

The Company and the Grantee hereby amend the McCray Award Agreements by deleting the Exhibit

A attached thereto in the entirety and replacing such deleted exhibits with the Exhibit A attached to this Amendment.

IN WITNESS

WHEREOF, this Amendment has been duly executed as of the day and year first written above.

|

| CAREER EDUCATION CORPORATION |

|

| /s/ Jeffrey D. Ayers |

| Jeffrey D. Ayers |

| Senior Vice President, General Counsel and

Corporate Secretary |

|

| GRANTEE |

|

| /s/ Ronald McCray |

| Ronald McCray |

Exhibit 10.2

Exhibit A

Performance Criteria and Payout Scale

|

|

|

| Actual 2015 EBITDA as a percentage of

Targeted EBITDA(1) |

|

Percent of Eligible RSUs to become

Vested Shares pursuant to Section 3(b) |

| 100% |

|

100% |

| 80% |

|

60% |

| 60% |

|

30% |

| <60% |

|

0% |

Straight line interpolation between points.

(1) “Actual 2015 EBITDA” shall be the EBITDA at the corporate organizational level determined in accordance with, and used for purposes of

determining the EBITDA Performance Factor under, the Amended and Restated 2015 Annual Incentive Award Program pursuant to the Plan (the “AIP”). “Targeted EBITDA” shall have the meaning set forth in the AIP with

respect to the Company (and its affiliates).

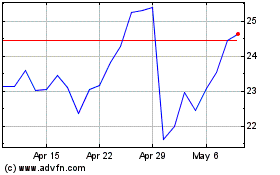

CECO Environmental (NASDAQ:CECO)

Historical Stock Chart

From Mar 2024 to Apr 2024

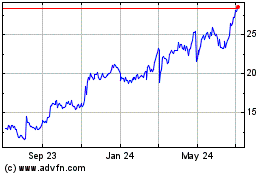

CECO Environmental (NASDAQ:CECO)

Historical Stock Chart

From Apr 2023 to Apr 2024