Some Relief, But For-Profit Colleges Still Face Challenges

June 09 2011 - 1:46PM

Dow Jones News

Investors in for-profit colleges breathed a collective sigh of

relief last week when the U.S. Department of Education released a

softer-than-expected regulation addressing concerns about student

loan rates.

But the schools aren't out of the woods yet. They still face the

looming expiration of an allowance to get more revenue from federal

student aid sources. Continued pressure to improve admissions

standards and graduation and loan-repayment rates are also expected

to hurt earnings for some time to come.

Last week, the Department of Education issued the final version

of its so-called "gainful employment" rule, intended to ensure

vocational programs actually prepare students for jobs. Programs

could lose eligibility for federal financial aid if their students'

debt burdens prove too high. Shares of the schools, including

Education Management Corp. (EDMC), Strayer Education Inc. (STRA)

and Corinthian Colleges Inc. (COCO), moved sharply higher the day

the rule was released, as they stand less chance of losing access

to the funds.

Still, the stocks remain well below their 52-week highs. Given

the continued pressures, some say multiples may not return any time

soon.

The next major test for the industry will come on July 1, when a

hard ceiling on how much of their revenue the schools can derive

from Title IV federal aid--90%--is reinstituted. When federal loan

limits were increased in 2008, Congress provided an exemption that

allowed them not to count that additional money toward the 90%.

Sen. Tom Harkin (D., Iowa), who heads the Senate Committee on

Health, Education, Labor and Pensions, is in favor of letting the

exemption expire and is angling to count military-education

benefits toward the 90% in future calculations. Schools are

lobbying hard for an extension.

"It's tough to see how the stalemate breaks," said Jarrel Price,

an analyst at Height Analytics in Washington, D.C. If it does,

though, "the question is what the industry will have to give up to

get that relief."

Schools that rely significantly on Title IV funding and

military-funded aid--including Corinthian, American Public

Education Inc. (APEI), Bridgepoint Education Inc. (BPI), Apollo

Group Inc. (APOL) and Washington Post Co.'s (WPO) Kaplan--stand to

suffer most, Price said.

The Education Department will begin an experiment soon allowing

schools to limit the federal aid their students accept, but it will

be "nowhere near large enough to have an effect on one of these big

schools' bottom-line 90/10 ratio," said Deputy Undersecretary James

Kvaal.

Meanwhile, schools could lose access to other federal aid

through no action of their own. The fiscal 2012 budget may include

cuts to the under-funded Pell Grant program, reserved for the

neediest students. The Obama administration has fought hard to keep

the maximum grant at $5,550, but some in Congress expect the limit

to be lowered.

Corinthian derived nearly 29% of revenue from Pell grants in the

2009-2010 year, while Bridgepoint brought in 27.5% of its revenue

from that source, according to Price. Lincoln Educational Services

Inc. (LINC), Universal Technical Institutes Inc. (UTI), Kaplan and

Apollo also rely heavily on Pell funds.

Even if student funding is kept intact, the number of students

enrolling is declining. For-profit colleges have reported falling

new-student start rates as the schools tighten admissions standards

to comply with additional Department of Education rules.

Schools can expect more oversight by accrediting agencies, too,

after those groups were criticized for shirking their

responsibilities. An accreditation oversight group is expected to

issue a series of recommendations later this year.

Also, attorneys general in Florida, Kentucky, New York,

Massachusetts and elsewhere have launched investigations into the

business practices at campuses operated by companies including

Washington Post, Apollo Group and Corinthian Colleges.

-By Melissa Korn, Dow Jones Newswires; 212-416-2271;

melissa.korn@dowjones.com

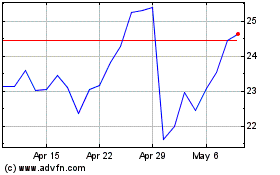

CECO Environmental (NASDAQ:CECO)

Historical Stock Chart

From Mar 2024 to Apr 2024

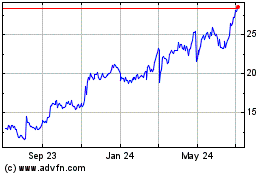

CECO Environmental (NASDAQ:CECO)

Historical Stock Chart

From Apr 2023 to Apr 2024