US Education Dept Softens Final Rule On Vocational Programs

June 02 2011 - 12:31AM

Dow Jones News

The U.S. Department of Education on Thursday will release the

final version of its much-awaited "gainful employment" rule that

punishes career-training programs for graduating students with

heavy debt loads.

The rule, one of the most controversial to come out of that

office in years, is an effort to ensure the programs are preparing

students for legitimate jobs. This final version is less severe

than a draft released last summer, giving programs more

opportunities to right themselves if they run afoul of the

measure.

To qualify to receive federal student aid, a program now must

pass one of three tests: at least 35% of former students are paying

down their loan balances by at least $1, or a typical graduate's

loan payment doesn't exceed 30% of his or her discretionary income

or 12% of total earnings. The rule applies to most for-profit

programs and certificate programs at non-profit and public

institutions.

Previously, the department proposed a three-tier system.

Programs were safe with a repayment rate above 45%. They fell into

a danger zone with rates between 35% and 45%, and either graduate

debt burdens above 8% of total income or above 20% of discretionary

income. They would lose eligibility entirely if they had repayment

rates below 35%, graduate debt payments above 12% of total income

and above 30% of discretionary income.

The new criteria will go into effect July 1, 2012. Programs must

fail the debt measures three times in four years before losing

access to the funds, meaning no programs would lose eligibility

before 2015.

"We're giving career colleges every opportunity to reform

themselves but we're not letting them off the hook, because too

many vulnerable students are being hurt," Education Secretary Arne

Duncan said.

The final rule is being released after a months-long delay, amid

strong opposition from the for-profit college industry. The

Education Department received more than 90,000 comments on last

year's draft proposal.

Many for-profit college companies, such as University of Phoenix

operator Apollo Group Inc. (APOL) and ITT Educational Services Inc.

(ESI), derive upwards of 80% of their revenue from students'

federally guaranteed financial aid. Programs with low tuition, such

as those offered by American Public Education Inc. (APEI) are

expected to fare better than those that require students to take on

significant debt. Schools that offer programs in subjects like

culinary arts and design, many of which lead to low-paying jobs,

may also suffer.

"We're asking companies that get up to 90% of their profits from

taxpayer dollars to be at least 35% effective," Duncan said.

For-profit colleges have faced heightened criticism in the past

year regarding their academic value, as program graduates default

on their loans at alarming rates. While 12% of all students attend

for-profit colleges, their graduates contribute more than 40% of

all defaulted federal loans.

According to Department of Education calculations, 18% of

for-profit programs are expected to fail the debt tests at some

point, with 5% ultimately losing eligibility. Across all

institutions, those figures are 8% and 2%, respectively.

Though scheduled to take effect next summer, the rule likely

won't be instituted without a fight. Schools have aggressively

opposed the measure, with lobbyists alleging the Education

Department was unjustly swayed by short-sellers with a financial

interest in seeing the publicly traded school operators suffer.

They also say the rule will limit access to higher education,

particularly for minorities. A handful of lawsuits are currently

pending on issues related to the rule.

The Education Department in October released the majority of a

rules package governing higher education, addressing issues such as

the measure of a credit hour and incentive compensation for

recruiters. Those rules take effect July 1. Parts of the gainful

employment rule, related to the disclosure of graduation rates and

information about student debt loads, will go into effect then as

well.

Stocks of some for-profit colleges rose late yesterday in

anticipation of the new rule, which, if not softer than the earlier

proposal, was expected at least to give some certainty to the

sector. Shares of Career Education Corp. (CECO) closed up 6.4%, to

$22.87, while Apollo Group rose 2.6%, to $42.19.

-By Melissa Korn, Dow Jones Newswires; 212-416-2271;

melissa.korn@dowjones.com

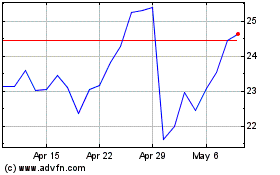

CECO Environmental (NASDAQ:CECO)

Historical Stock Chart

From Mar 2024 to Apr 2024

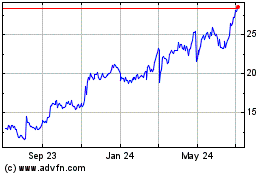

CECO Environmental (NASDAQ:CECO)

Historical Stock Chart

From Apr 2023 to Apr 2024