The Cheesecake Factory Incorporated (NASDAQ: CAKE) today

reported financial results for the fourth quarter of fiscal 2016,

which ended on January 3, 2017.

Total revenues were $603.1 million in the fourth quarter of

fiscal 2016 as compared to $526.8 million in the fourth quarter of

fiscal 2015. The fourth quarter of fiscal 2016 included 14 weeks

compared to 13 weeks in the fourth quarter of fiscal 2015; the

additional week in fiscal 2016 contributed approximately $54.7

million of sales. Net income and diluted net income per share were

$32.4 million and $0.66, respectively, in the fourth quarter of

fiscal 2016.

The Company recorded a pre-tax, non-cash charge of $0.1 million

during the fourth quarter of fiscal 2016 related to the planned

relocation of one The Cheesecake Factory restaurant. Excluding this

item, net income and diluted net income per share were $32.4

million and $0.67, respectively.

Comparable restaurant sales at The Cheesecake Factory

restaurants increased 1.1% in the fourth quarter of fiscal 2016 (14

weeks vs. 14 weeks).

“We delivered our 28th consecutive quarter of positive

comparable sales, marking seven years of strong financial

performance and meaningful shareholder value creation,” said David

Overton, Chairman and Chief Executive Officer. “We significantly

outperformed the casual dining industry again during the fourth

quarter as we continued to take market share.”

Overton concluded, “We delivered on all of our objectives in

2016, including producing solid comparable sales performance,

achieving our domestic unit growth goal, expanding our

international presence to a total of 15 locations and increasing

operating margins, all of which contributed to approximately 20%

earnings per share growth. By maintaining our differentiated

positioning and commitment to operational excellence, we believe we

will uphold our leadership position in the casual dining industry

in 2017 and beyond.”

Development

The Company opened five The Cheesecake Factory restaurants and

one Grand Lux Cafe during the fourth quarter of fiscal 2016,

meeting its objective to open as many as eight Company-owned

restaurants domestically in fiscal 2016.

Internationally, two The Cheesecake Factory restaurants opened

in the fourth quarter of fiscal 2016, including the first location

in Qatar and the third location in Mexico, for a total of four

locations opened under licensing agreements during the year, as

expected.

Capital Allocation

The Company’s Board of Directors declared a quarterly cash

dividend of $0.24 per share on the Company’s common stock. The

dividend is payable on March 21, 2017 to shareholders of record at

the close of business on March 8, 2017.

During the fourth quarter of fiscal 2016, the Company

repurchased 0.5 million shares of its common stock at a cost of

$27.5 million. The Company repurchased a total of 2.9 million

shares of its common stock at a cost of $146.5 million during

fiscal 2016.

The Company continues to expect that it will return its free

cash flow to shareholders in fiscal 2017 in the form of dividends

and share repurchases.

Conference Call and Webcast

The Company will hold a conference call to review its results

for the fourth quarter of fiscal 2016 today at 2:00 p.m. Pacific

Time. The conference call will be webcast live on the Company’s

website at investors.thecheesecakefactory.com and a replay of the

webcast will be available through March 24, 2017.

About The Cheesecake Factory Incorporated

The Cheesecake Factory Incorporated created the upscale casual

dining segment in 1978 with the introduction of its namesake

concept. The Company, through its subsidiaries, owns and operates

208 full-service, casual dining restaurants throughout the U.S.A.

and Puerto Rico, including 194 restaurants under The Cheesecake

Factory® mark; 13 restaurants under the Grand Lux Cafe® mark; and

one restaurant under the Rock Sugar Pan Asian Kitchen® mark

(rebranding to RockSugar Southeast Asian Kitchen™).

Internationally, 15 The Cheesecake Factory® restaurants operate

under licensing agreements. The Company’s bakery division operates

two bakery production facilities, in Calabasas Hills, CA and Rocky

Mount, NC, that produce quality cheesecakes and other baked

products for its restaurants, international licensees and

third-party bakery customers. In 2016, the Company was named to the

FORTUNE Magazine “100 Best Companies to Work For®” list for the

third consecutive year. To learn more about the Company, visit

www.thecheesecakefactory.com.

FORTUNE and 100 Best Companies to Work For® are registered

trademarks of Time Inc. and are used under license. From FORTUNE

Magazine, March 3, 2016 ©2016 Time Inc. FORTUNE and Time Inc. are

not affiliated with, and do not endorse products or services of,

The Cheesecake Factory Incorporated.

Safe Harbor Statement

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. These statements involve known and unknown risks,

uncertainties and other factors that may cause the actual results,

performance or achievements of the Company to be materially

different from any future results, performance or achievements

expressed or implied by forward-looking statements, including

uncertainties related to: the Company’s ability to deliver

consistent and dependable comparable sales results over a sustained

period of time; the Company’s ability to deliver increases in guest

traffic; the strength of the Company’s brand; the Company’s ability

to provide a differentiated experience to guests; the Company’s

ability to outperform the casual dining industry and increase its

market share; the Company’s ability to leverage sales increases and

manage flow through; the Company’s ability to increase margins; the

Company’s ability to grow earnings; the Company’s ability to remain

relevant to consumers; the Company’s ability to increase

shareholder value; the Company’s ability to expand its concepts

domestically and work with its licensees to expand its concept

internationally; the Company’s ability to support the growth of

North Italia and Flower Child restaurants; the Company’s ability to

develop a fast casual concept; the Company’s ability to utilize its

capital effectively and continue to repurchase its shares; factors

outside of the Company’s control that impact consumer confidence

and spending; current and future macroeconomic conditions;

acceptance and success of The Cheesecake Factory in international

markets; changes in unemployment rates; the economic health of the

Company’s landlords and other tenants in retail centers in which

its restaurants are located; the economic health of suppliers,

licensees, vendors and other third parties providing goods or

services to the Company; adverse weather conditions in regions in

which the Company’s restaurants are located; factors that are under

the control of government agencies, landlords and other third

parties; and other risks and uncertainties detailed from time to

time in the Company’s filings with the Securities and Exchange

Commission (“SEC”). Investors are cautioned that forward-looking

statements are not guarantees of future performance and that undue

reliance should not be placed on such statements. Forward-looking

statements speak only as of the dates on which they are made and

the Company undertakes no obligation to publicly update or revise

any forward-looking statements or to make any other forward-looking

statements, whether as a result of new information, future events

or otherwise, unless required to do so by securities laws.

Investors are referred to the full discussion of risks and

uncertainties associated with forward-looking statements and the

discussion of risk factors contained in the Company’s latest Annual

Report on Form 10-K, Quarterly Reports on Form 10-Q and Current

Reports on Form 8-K as filed with the SEC, which are available at

www.sec.gov.

The Cheesecake Factory Incorporated and Subsidiaries

Condensed Consolidated Financial Statements (unaudited;

in thousands, except per share and statistical data)

14 Weeks

Ended 13 Weeks Ended 53 Weeks Ended 52 Weeks

Ended Consolidated Statement of Operations January 3,

2017 December 29, 2015 January 3, 2017

December 29, 2015 Amount Percent of

Revenues

Amount Percent of

Revenues

Amount Percent of

Revenues

Amount Percent of

Revenues

Revenues $ 603,146 100.0 % $ 526,841 100.0 % $ 2,275,719 100.0 % $

2,100,609 100.0 % Costs and expenses: Cost of sales 140,084 23.2 %

125,191 23.8 % 526,628 23.2 % 504,031 24.0 % Labor expenses 202,562

33.6 % 173,053 32.8 % 759,998 33.4 % 684,818 32.6 % Other operating

costs and expenses 143,951 23.9 % 125,103 23.7 % 540,365 23.7 %

500,640 23.8 % General and administrative expenses 38,863 6.4 %

35,705 6.8 % 146,042 6.4 % 137,402 6.5 % Depreciation and

amortization expenses 23,451 3.9 % 21,911 4.2 % 88,010 3.9 % 85,563

4.1 % Impairment of assets and lease terminations 114 0.0 % - 0.0 %

114 0.0 % 6,011 0.3 % Preopening costs 6,975

1.2 % 7,083 1.3 % 13,569 0.6 %

16,898 0.8 % Total costs and expenses 556,000

92.2 % 488,046 92.6 %

2,074,726 91.2 % 1,935,363 92.1 % Income from

operations 47,146 7.8 % 38,795 7.4 % 200,993 8.8 % 165,246 7.9 %

Interest and other expense, net (2,263 ) (0.4 )%

(1,845 ) (0.4 )% (9,225 ) (0.4 )%

(5,894 ) (0.3 )% Income before income taxes 44,883 7.4 % 36,950 7.0

% 191,768 8.4 % 159,352 7.6 % Income tax provision 12,502

2.0 % 9,750 1.8 % 52,274

2.3 % 42,829 2.1 % Net income $ 32,381

5.4 % $ 27,200 5.2 % $ 139,494 6.1 % $

116,523 5.5 % Basic net income per share $ 0.68

$ 0.56 $ 2.91 $ 2.39 Basic weighted

average shares outstanding 47,403 48,808

47,981 48,833 Diluted net

income per share $ 0.66 $ 0.54 $ 2.83 $ 2.30

Diluted weighted average shares outstanding 48,795

50,470 49,372 50,605

Selected Segment Information Revenues: The

Cheesecake Factory restaurants $ 547,809 $ 476,580 $ 2,078,083 $

1,913,758 Other 55,337 50,261

197,636 186,851 $ 603,146 $ 526,841

$ 2,275,719 $ 2,100,609 Income from

operations: The Cheesecake Factory restaurants $ 74,673 $ 64,220 $

308,058 $ 275,686 Other (1) 8,189 7,446 27,623 18,047 Corporate

(35,716 ) (32,871 ) (134,688 ) (128,487

) $ 47,146 $ 38,795 $ 200,993 $ 165,246

(1) Includes $0.1 million of accelerated depreciation

expense related to the planned relocation of one The Cheesecake

Factory restaurant in the fourteen and fifty-three weeks ended

January 3, 2017 and $6.0 million of impairment expense related to

Rock Sugar Pan Asian Kitchen in the fifty-two weeks ended December

29, 2015.

Selected Consolidated Balance Sheet

Information January 3, 2017 December 29, 2015

Cash and cash equivalents $ 53,839 $ 43,854 Total assets 1,293,319

1,233,346 Total liabilities 690,112 644,807 Stockholders' equity

603,207 588,539

14 Weeks Ended 13 Weeks

Ended 53 Weeks Ended 52 Weeks Ended The

Cheesecake Factory Supplemental Information January 3,

2017 December 29, 2015 January 3, 2017

December 29, 2015 Comparable restaurant sales 1.1 % 1.1 %

1.2 % 2.6 % Restaurants opened during period 5 6 7 10 Restaurants

open at period-end 194 187 194 187 Restaurant operating weeks 2,690

2,394 10,031 9,341

Reconciliation of Non-GAAP Results to GAAP Results

In addition to the results provided in accordance with Generally

Accepted Accounting Principles (“GAAP”) in this press release, the

Company is providing non-GAAP measurements which present net income

and diluted net income per share excluding the impact of certain

items.

The non-GAAP measurements are intended to supplement the

presentation of the Company’s financial results in accordance with

GAAP. The Company believes that the presentation of these items

provides additional information to facilitate the comparison of

past and present financial results.

The Cheesecake Factory Incorporated and Subsidiaries

Reconciliation of Non-GAAP Financial Measures (unaudited;

in thousands, except per share data)

14 Weeks Ended

13 Weeks Ended 53 Weeks Ended 52 Weeks Ended

January 3, 2017 December 29, 2015 January 3,

2017 December 29, 2015 Net Income (GAAP) $ 32,381

$ 27,200 $ 139,494 $ 116,523 After-tax impact from: - Impairment of

assets and lease terminations (1) 68 -

68 3,607 Net Income (non-GAAP) $

32,449 $ 27,200 $ 139,562 $ 120,130

Diluted net income per share (GAAP) $ 0.66 $ 0.54 $ 2.83 $ 2.30

After-tax impact from: - Impairment of assets and lease

terminations 0.00 - 0.00

0.07 Diluted net income per share (non-GAAP) (2)

$ 0.67 $ 0.54 $ 2.83 $ 2.37 (1)

The pre-tax amount associated with these items in fiscal 2016 and

2015 were $114 and $6,011, and were recorded in impairment of

assets and lease terminations. (2) Adjusted diluted net income per

share may not add due to rounding.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170222006286/en/

The Cheesecake Factory IncorporatedStacy Feit,

818-871-3000investorrelations@thecheesecakefactory.com

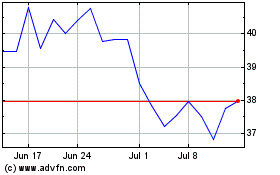

Cheesecake Factory (NASDAQ:CAKE)

Historical Stock Chart

From Mar 2024 to Apr 2024

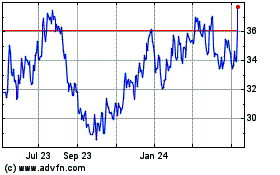

Cheesecake Factory (NASDAQ:CAKE)

Historical Stock Chart

From Apr 2023 to Apr 2024